BlackJack3D

Investment Thesis

Innodata (NASDAQ:INOD) is not the type of high-quality AI company one should invest their hard-earned capital into.

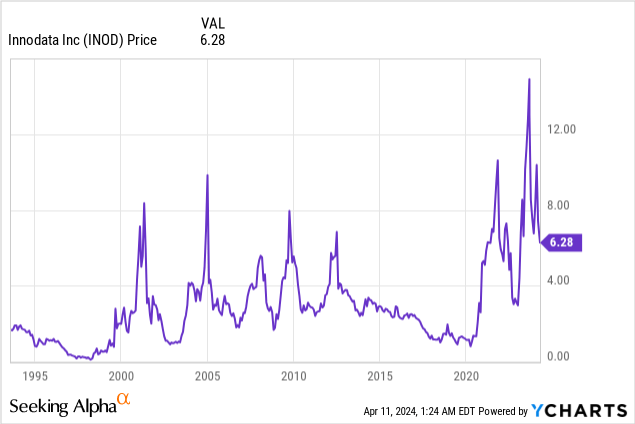

The business has the occasional strong period, as you can see below.

But in the grand scheme of things, it’s just a business that often promises jam tomorrow, but tomorrow never comes.

On the other hand, the stock doesn’t appear expensive. After all, it’s priced at approximately 13x forward EBITDA.

And that’s part of the bull case. The stock appears like a cheaply valued AI play. But it’s not cheap. On the contrary, I argue that this stock is a value trap.

Rapid Recap

Back in August, I said,

Innodata, a data engineering company, has seen its share price soar numerous times over the past two decades, only to subsequently and unexpectedly drop once again.

Presently, it’s again jumping to all-time highs. That being said, recently the company has made tremendous progress, and in the past couple of quarters, Innodata has succeeded in signing up a large Big Five customer. Needless to say, for a company with a sub $1 billion market cap to sign up such a large customer is undoubtedly a very positive development.

But as I dig into the financials, I remain skeptical that this investment is such a bargain valuation.

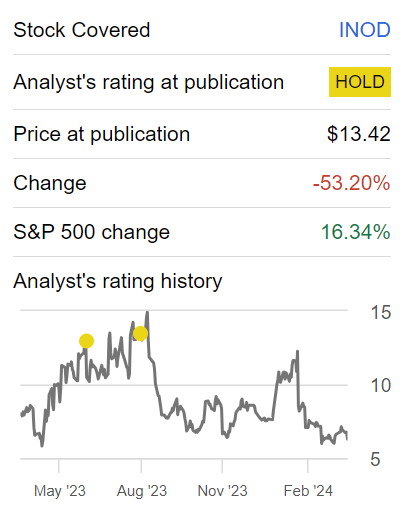

Author’s work on INOD

As I look back in hindsight, my timing was impeccable. INOD is down 50% compared with the S&P 500 which is up 16%.

Innodata’s Prospects Discussed

Innodata strives to help businesses harness AI to improve their operations and products. They specialize in providing services like creating data sets to train AI models, fine-tuning these models for specific tasks, and ensuring they meet performance and regulatory standards.

Essentially, they help businesses leverage AI technology to enhance efficiency, innovate their processes, and stay competitive in today’s rapidly evolving digital landscape.

Despite its promising prospects, Innodata faces a key challenge. Innodata relies on a few major customers. What’s more, these top customers are not the same in 2022 and 2023 (page 15).

Additionally, while its recent signing of a three-year deal with a major customer is a positive development, the potential for early termination or reduced spending under the contract introduces uncertainty in extrapolating its revenue growth too far.

Given this background, let’s now dig into its financials.

Revenue Growth Rates Are Choppy

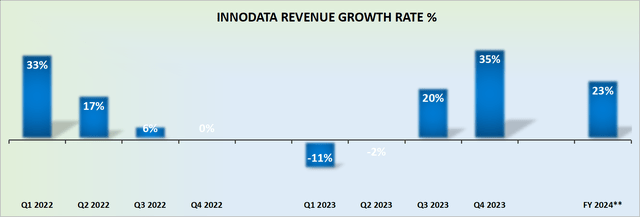

INOD revenue growth rates

Innodata ended Q4 up strongly at 35% y/y growth. However, management is quick to remark that if you remove the loss of its large customer in Q4 of the prior year, its normalized Q4 revenue growth rates would have actually been up 39% y/y.

And while that’s undoubtedly a terrific figure, the fact remains that the only reason why Innodata’s revenue growth was so strong in Q4 was because the prior year quarter delivered no topline growth.

Put more simply, this is not a secular winning AI play. This is akin to a consulting business that has the odd “flash in the pan” quarter, and investors should not over eagerly extrapolate its growth too far into the future.

That being said, Innodata positively asserts that looking out to full year 2024, the business should minimally deliver a 20% CAGR. And again, I have to stress that this growth only presents itself as alluring since the comparables with the prior year, particularly H1 2023, are so easy.

Given this context, let’s now delve into its valuation.

INOD Stock Valuation — 13x Forward EBITDA

When it comes to buying into an AI momentum stock, you need to know that the company’s balance sheet holds sufficient cash so that the business can invest in its research and sales teams.

Innodata has approximately $16 million of cash if we include the $2.4 million of cash from a receivable that got paid after Q4 ended. Against this, Innodata holds approximately $8 million of net debt, meaning that its net cash position is approximately $8 million.

For a business that ended 2023 at practically breakeven on its free cash flow line, this is a reminder that Innodata’s financial position is precarious.

To address this concern, management wrote in its Q4 earnings report,

Several investors have asked whether we currently anticipate needing to raise additional equity.

The answer is no, we do not currently anticipate needing to raise additional equity.

[…] We anticipate generating enough cash from operations in 2024 to fund our capital needs without having to draw down on the Wells Fargo facility.

And even though management states that they don’t need to raise further capital to go after the hottest technology in the market right now, I remain skeptical.

Indeed, the market is flush with startups that are hungry and highly incentivized with ample financial backing to chase the same opportunities that Innodata is striving for.

In fact, as you know, software and product development teams don’t come cheap. These tech engineers don’t work for free. Moreover, as a reference point, Innodata made $10 million of EBITDA in 2023. But of that $10 million, approximately 40% was in the form of stock-based compensation.

Put another way, even if Innodata were to grow its EBITDA in 2024 by 50%, this would still leave this stock priced at 13x forward EBITDA. Nonetheless, I firmly believe that this EBITDA figure would be heavy on adjustments and light on free cash flow.

The Bottom Line

In conclusion, despite occasional spurts of growth and promising developments, I would advise against investing in INOD.

While the company may tout its AI-driven prospects and recent customer signings, its over-reliance on a few major clients and the potential for revenue disruption due to contract uncertainties raise significant red flags.

Moreover, the company’s financial position, is precarious with meaningful reliance on stock-based compensation, which casts doubts on its ability to sustainably capitalize on market opportunities.

Therefore, considering the uncertainties surrounding its revenue growth, its financial stability, and valuation metrics, I charge that readers should avoid INOD.