islander11

When you go through Informatica’s (NYSE:INFA) profile page on SA, you will see a wide range of activities around data, in addition to the usual AI and cloud services.

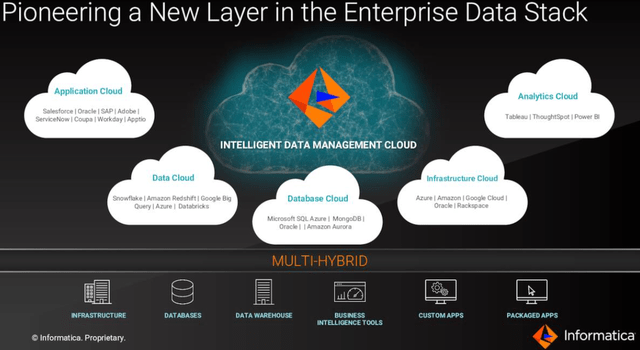

What is different from others is that instead of just talking about the cloud, its focus is more to provide its services in a Data-as-a-Service fashion using its IDMC or Intelligent Data Management Cloud for enterprises as pictured below.

IDMC (seekingalpha.com)

Another subject of interest is its elaborate ecosystem of partnerships. Hence, my focus with this thesis is to show how this approach can help generate ARR (Annual Recurring Revenues) which represents a more stable source of sales in a deteriorating economic environment as high inflation grinds in corporate disposable income. I will also look at the sustainability of the operating model by looking at the Capex and cash flow ratios.

I start by providing insights as to why firms need data management services in the first place.

Data-as-a-Service and Informatica’s Partnerships

With the development of a multitude of technologies, there is no shortage of applications to help employees perform various functions like marketing or accounting, but the challenge is now how to take care of the underlying data, including capturing, storing, searching, and analyzing.

In this connection, while technology including big data have overcome some of the technical issues in analyzing data there are other challenges remaining in the industry like how to rapidly integrate data from different sources for decision-making purposes. In this respect, the company’s IDMC is designed to help businesses process and gain actionable insights out of their data on any platform, be it multi-cloud, or hybrid. Together with the ease of buying a subscription as opposed to the complexity of having to install software, this approach is termed as Data-as-a-Service.

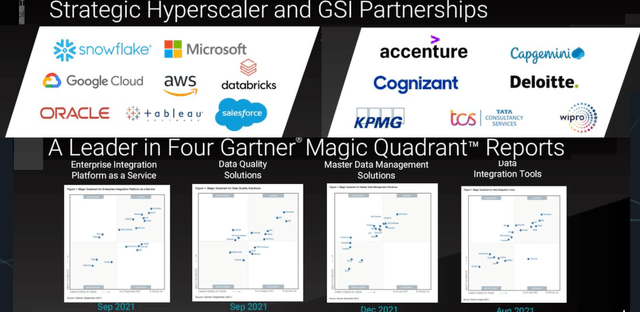

Looking at the industry, there are literally tons of companies offering data integration services, but, one thing which clearly distinguishes Informatica is its ability to have forged strategic partnerships with all the major cloud providers like Microsoft’s (NASDAQ:MSFT) Azure, Amazon’s (NASDAQ:AMZN) AWS, Google’s (NASDAQ:GOOG) (GOOGL) GCP and Oracle (ORCL). In addition, it has partnered with global system integrators like Accenture (ACN) which enables Informatica to co-sell solutions to customers.

Partnerships and Gartner Magic Quadrants (www.seekingalpha.com)

Consequently, with its differentiated product offering, it has been awarded leadership positions by Gartner in four categories all related to data as shown above.

Looking deeper, one of the factors which have enabled it to achieve such a competitive moat is vendor neutrality for technology. This is an often overlooked aspect, but the key to ensuring that all customer data migration decisions pertaining to moving IT workloads from on-premise data centers to the cloud are done solely based on the actual requirements, not biased by the technology to be used. This is also the reason Informatica’s IDMC can be used by customers already subscribed to service providers like Snowflake (SNOW) and Databricks.

Partnerships have translated into more co-selling opportunities or a 105% increase over the last year.

Revenue Mix and Headwinds

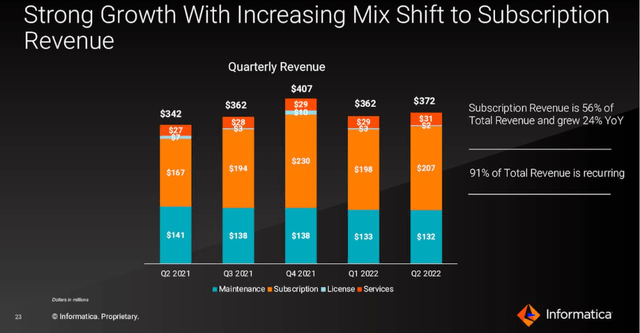

Coming to the results for the second quarter of 2022 (Q2), The uptake in Data-as-a-Service is reflected by subscription revenues increasing to constitute 56% of total sales compared to 49% a year ago. Moreover, 94% of subscribers renewed their plans compared to 93% before.

Revenue Mix (www.seekingalpha.com)

As seen in the above chart, in addition to subscription (in orange), there is also migration (in blue) whereby the company performs maintenance-related works for companies shifting their workloads to the cloud before turning them into subscribers for its IDMC. Since subscription follows migration and it normally takes 9-12 months between the two, it is possible to have an idea of the future subscriber revenues just by looking at the above chart.

Shifting to profitability, non-GAAP Gross margins for Q2 were at 81% which translates into 79.2% of GAAP gross margins. Also, these have reduced from the 82.2% obtained in the same period last year. Now, as a result of total operating expenses going up by 3.41% in Q2 compared to 2021, Informatica has suffered from an operating margin loss of -3.26% compared to a profit margin of 4.22% during the same period last year.

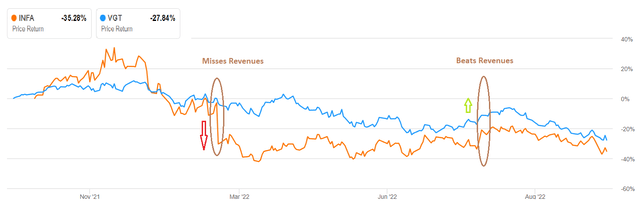

Now, given current financial conditions where investors are increasingly focused on profitability metrics, the ability of Informatica to deliver profitability is vital, but, for this to happen, it must deliver a consistent top line, or risk being punished by investors. Thus, when it missed analysts’ forecast by $1.32 million for its first quarter results, it suffered from an above 20% downside (as indicated by the red arrow in the chart below), and this, despite recording an 8.6% Y/Y growth. I have also included the Vanguard Information Technology ETF (VGT) in blue which includes many IT stocks for comparison purposes.

Price Performance (www.seekingalpha.com)

Conversely, as shown by the green arrow, when Informatica beat revenue expectations by $7.36M at the end of July, it was rewarded by an upside.

At that time, ARR had increased by 31% to $896 million, with the cloud component (cloud ARR) increasing by 42% to $373 million. Thus, the 40% in cloud ARR expected for Q3 and for the full year represents a decrease. This is due to currency headwinds as a result of the strong greenback, which also explains why the total revenue guidance for 2022 has been brought down by $45 million to $1.55 billion (midpoint) with free cash flow (unlevered) guidance also cut by $33 million to $300 million (midpoint). According to the CEO, the company has started “to see some customers delay payments”.

Now, with the dollar having already appreciated by more than 7.5% since July and the Federal Reserve prioritizing hiking interest rates to bring down high inflation, there is a high probability that the company could miss its revenue guidance in the third quarter with results to be announced on October 26.

However, there are positives too.

Valuations, Cashflow-to-Capex and Conclusion

First, in case customers who have deferred payments perform the same in the fourth quarter, the company could see additional revenues, possibly prompting a revenue beat. Second, Informatica’s operating income guidance for fiscal 2022 is maintained as a significant portion of expenses is made in foreign currency, not in dollars. This has helped to mitigate the effect of higher costs in America.

As for valuations, despite its above 35% downside in the last year, at a price to sales of 3.65x, the data management play remains overvalued with respect to the median for the IT sector by nearly 40%. Therefore, this stock does not constitute an opportunistic buy.

Thinking aloud, the company has some advantages, but a lot will depend on the way it is able to drive revenues. For this purpose, it has significantly expanded its market size as a result of its strong partnership ecosystem as it has access to vast collections of customer data sets to market its Data-as-a-Service offerings.

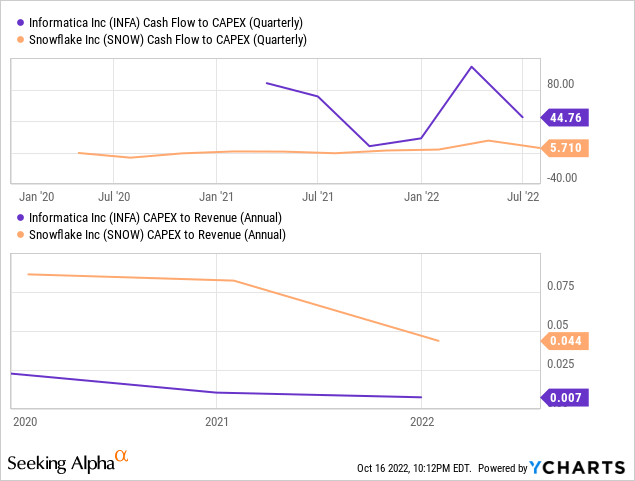

This operating model has generated a higher operating cash flow relative to Capex spent than Snowflake as shown in the chart below.

Moreover, its annual Capex to Revenue ratio remains much lower than Snowflake too, signifying that it does not need to take on additional debt to finance the business in order to generate growth. In this respect, the balance sheet shows that the IDMC company has been able to reduce debt while increasing cash during the last four years.

Pursuing further, with its Data-as-a-Service approach, possessing an intelligent platform as a growth engine, and a strong ecosystem of partnerships, the company should continue delivering more subscription ARR. However, it is not immune to a further downside in case it misses revenue forecasts during the Q3 earnings call on October 26. In this regard, the strengthening dollar just increases the probability of another downside next week in case there is a revenue miss with respect to expectations. This may constitute an opportunity to buy the stock for long-term positioning.

Finally, I am optimistic for the longer term as Informatica has a whole range of data management products that allow customers to play around with their applications in order to meet business requirements, as digital transformation is now a secular trend.