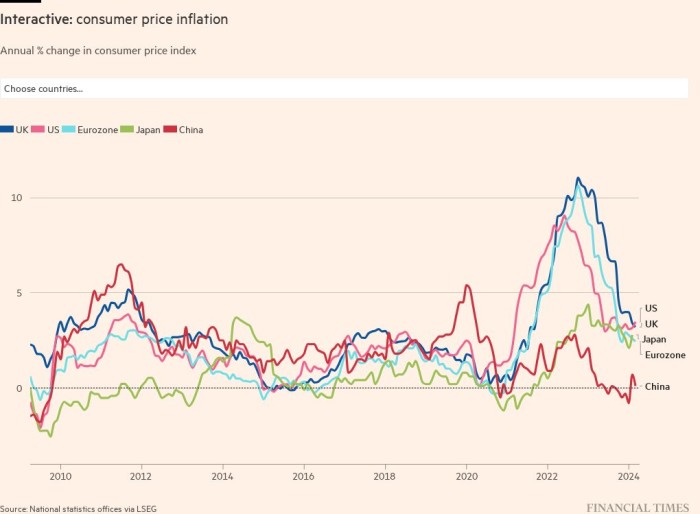

Inflation has hit its highest degree in a long time for a lot of nations, with the Ukraine battle including upward strain on power costs and squeezing households’ actual incomes.

Russia’s invasion of its neighbour has pushed up power and meals costs at a time when many nations had been already registering near-record charges of client value progress, main some economists to worry a basic return to the persistent inflation of the Seventies. Excessive inflation is geographically broad-based even when East Asia has largely been an exception to the worldwide sample.

This web page offers a frequently up to date visible narrative of client value inflation world wide, together with economists’ expectations for the long run.

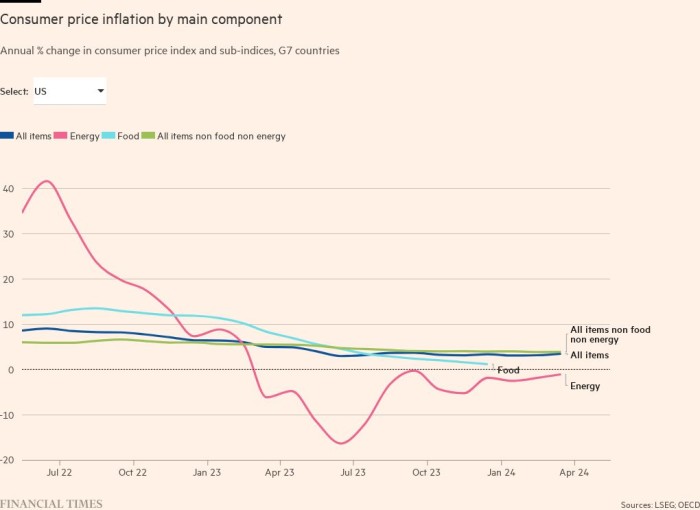

It separates inflation into its primary parts, and exhibits what larger meals costs imply for shoppers and the place buyers suppose inflation is heading over the medium time period. It additionally tracks home costs.

The rise in power costs drove inflation in lots of nations even earlier than Russia invaded Ukraine. Every day knowledge present how the strain has not too long ago elevated on oil, fuel and electrical energy.

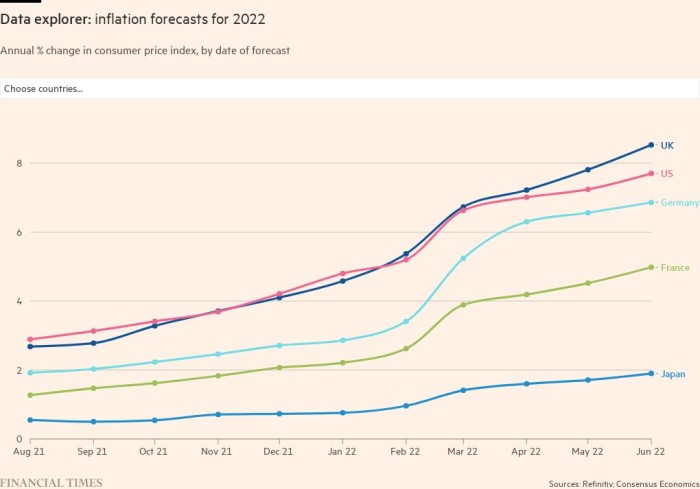

Consequently, main forecasters polled by Consensus Economics have steadily revised up their anticipated inflation figures for 2022 and 2023.

Larger inflation is spreading past power to many different client gadgets, particularly in nations the place demand is robust sufficient for companies to move on larger prices.

Rising client costs current a problem for central banks, not least these in G7 nations which have a value stability goal of about 2 per cent. To achieve that aim, central banks can modify financial coverage to curb demand.

However such instruments are much less efficient in tackling inflation created by provide shortages. Because the governor of the Financial institution of England, Andrew Bailey, has stated, financial coverage “doesn’t get extra fuel, extra pc chips, extra lorry drivers”.

Rising costs restrict what households can spend on items and providers. For the much less well-off, that would result in a wrestle to afford primary wants, resembling meals and shelter.

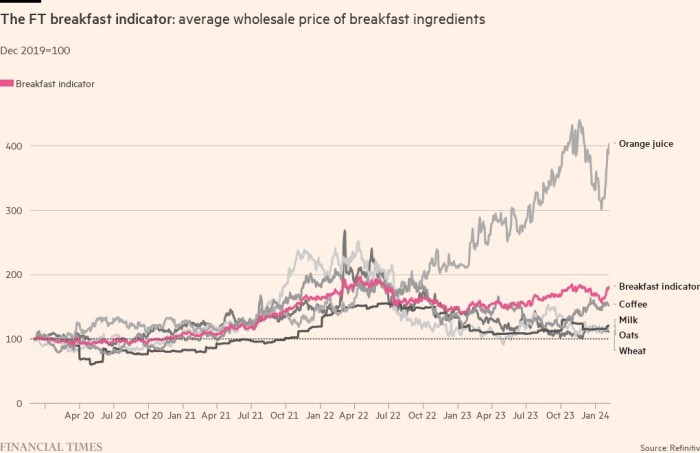

Every day knowledge on staple items, such because the wholesale value of breakfast substances, present an up-to-date indicator of the pressures confronted by shoppers. In creating nations, the wholesale value of those substances has a bigger affect on remaining meals costs; meals additionally accounts for a bigger share of family spending.

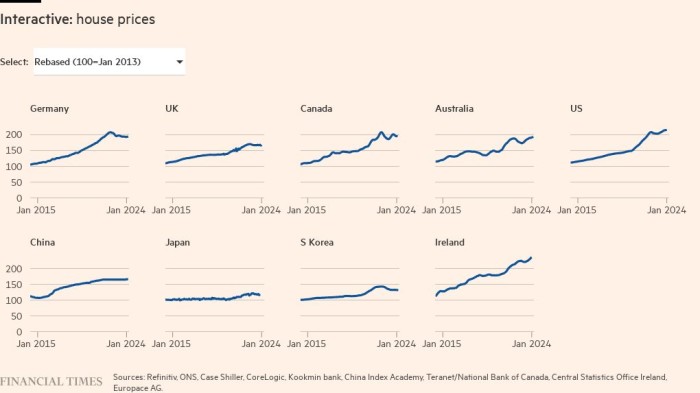

One other level of concern is asset costs, particularly for homes.

These soared in lots of nations through the pandemic, boosted by extremely unfastened financial coverage, homeworkers’ need for more room and authorities income-support schemes.

The important thing debate amongst policymakers and economists is how lengthy excessive inflation will final. Whereas supporters of “workforce transitory” imagine the price pressures ensuing from provide chain disruptions are anticipated to fade, supporters of “workforce everlasting” worry larger costs might turn out to be embedded within the wider economic system.

The warfare provides a number of uncertainty to that debate, however markets’ expectations for inflation over the following 5 years are typically rising.