This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

Donald Trump will turn himself in to New York prosecutors next Tuesday after his history-making indictment in a hush money case. Here’s our explainer on the four separate investigations and mountain of litigation facing the former US president.

The UK economy grew 0.1 per cent in the final quarter of 2022, rather than the initial estimate of flatlining. Business investment however was worse than previously thought.

The Biden administration offered limited relief to carmakers worried about being frozen out of new US tax credits for electric vehicles, proposing rules on battery minerals that would expand access to the subsidies.

For up-to-the-minute news updates, visit our live blog

Good evening.

Falls in inflation on both sides of the Atlantic today give some hope to central bankers that their programmes of interest rate rises, even against the backdrop of turmoil in the banking sector, are starting to bear fruit.

In the US, the core personal consumption expenditures price index — the Federal Reserve’s preferred inflation gauge — slowed more than expected to 0.3 per cent in February, from 0.5 per cent the previous month, making the annual rate 4.6 per cent, down from 4.7 per cent. Headline inflation fell to 5 per cent from 5.3 per cent.

Eurozone data this morning showed inflation falling sharply from 8.5 per cent to 6.9 per cent in the year to March, its lowest level in a year, thanks to plunging energy costs.

Although the headline fall was steeper than expected, analysts believe the increase in core inflation, which excludes volatile energy and food costs, to a new high of 5.7 per cent, will make the ECB plump for further increases in rates.

The pattern in individual states was mixed. Inflation fell sharply in France and Spain but Germany, the bloc’s biggest economy, reported a smaller decrease to 7.8 per cent, from 9.3 per cent the previous month. Annual inflation fell in 18 of the 20 eurozone countries, rising in just Slovenia and holding steady in Malta.

The UK is somewhat of an outlier, last week reporting an unexpected acceleration to 10.4 per cent in February from 10.1 per cent the previous month, a level referred to by chancellor Jeremy Hunt as “dangerously high”. The Bank of England in response raised rates for the 11th month in a row to 4.25 per cent, followed by warnings from governor Andrew Bailey that banking upheavals would not stand in the way of its mission to control inflation.

There was also further evidence of the country’s acute cost of living crisis as new data showed supermarket prices rose a record 17.5 per cent in March, adding £837 to the average household’s annual bill.

Central banks are turning their attention to companies using high inflation as an excuse for price gouging.

Profit margins of US companies last year hit their highest level since the second world war, while eurozone businesses over the past two years have enjoyed their biggest expansion in profitability since the 2008 financial crisis.

This surge in profits, in the face of stiff headwinds from the pandemic and the war in Ukraine, with associated problems in energy and supply chains, is causing a new word to catch on among policymakers, economists, and, increasingly, the public: greedflation.

Need to know: UK and Europe economy

UK prime minister Rishi Sunak hailed the country’s accession to the CPTPP Asia-Pacific trade bloc as a significant post-Brexit opportunity, making exports for products such as cars, machinery, cheese and chocolate eligible for zero tariffs. The government estimated the deal would increase UK GDP by just 0.08 per cent, but said that could rise if Thailand and South Korea later joined the group.

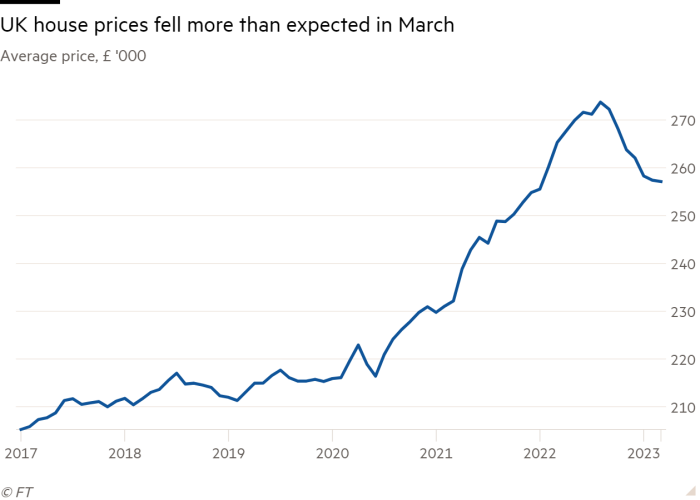

UK house prices fell by a more-than-expected 3.1 per cent in March, the largest year-on-year drop since 2009.

The EU agreed a compromise on renewable energy targets after making an exception for nuclear power in certain sectors following pressure from France. The bloc’s overall binding target for energy from renewables will now be 42.5 per cent by 2030, up from 32 per cent. In the UK, the government admitted its new net zero strategy would fail to cut emissions enough to hit its own targets.

The EU said it needed “new defensive tools” for sectors such as quantum computing and artificial intelligence to tighten oversight of trade in the face of an increasingly assertive China.

Need to know: Global economy

China has started to flesh out its new foreign policy aim of creating alternative structures for international co-operation, particularly with the developing world, in the biggest challenge to the US-led world order since the cold war. China’s envoy to the EU warned of the “peril” of following US trade restrictions, while Japan joined in the chip war, restricting semiconductor tool exports.

Meanwhile new survey data highlighted the uneven nature of China’s recovery, as services activity expanded at the fastest rate in 12 years, while manufacturing growth slowed.

More than a quarter of emerging market economies have found themselves locked out of international bond markets as recent banking sector chaos prompts investors to shy away from riskier assets.

The World Bank warned that tech decoupling and trade restrictions from the US-China cold war were having an impact on knowledge generation and innovation and posed a long-term threat to growth across Asia.

Need to know: business

The transatlantic banking panic has fuelled the continuing downturn in global dealmaking. The value of mergers and acquisitions dropped 45 per cent year-on-year in the first quarter.

Our Lex Big Read considers the question: how safe are America’s regional banks? This explainer details how rising interest rates are exposing bank weaknesses. And spare a thought for the bankers on Wall Street: their bonuses plunged 26 per cent last year as dealmaking slumped.

Passengers flying from London’s Heathrow airport face potential disruption over Easter because of a strike by security staff. European airlines separately warned of strike disruption from French air traffic controllers, who are responsible for planes flying over their airspace as well as those using French airports.

Austrian lender Raiffeisen is in talks to sell its Russian banking arm. A Swiss court found bankers at Gazprombank guilty of helping to launder tens of millions of francs linked to Russian president Vladimir Putin.

The UK risks becoming a “haven for fraudsters”, according to a parliamentary report. It comes a day after the government announced its plan to tackle economic crime, which drew strong criticism from anti-corruption organisations.

Science round up

Genomic data around Covid-19 has been made available again to researchers looking into the potential animal link to the original outbreak in China in 2019.

China has become a prolific producer of academic research with “paper mills” churning out fabricated scientific studies. But, as our Big Read explains, fraudulent reports risk serious real-world consequences,

The UK’s Royal Institution, the London-based organisation founded more than 200 years ago to promote scientific research and education, is relaunching with a new five-year strategy as a “home for science where everyone will feel welcome”.

The tech boom in consumer products might be over, but we could be on the verge of a golden era of digital innovation and investment in industry, writes columnist Rana Foroohar.

The Tech Tonic podcast series on the quantum revolution continues with a look at how the technology is helping solve bottlenecks at the Port of Los Angeles.

And finally, the idea that there could be “another me”, a doppelgänger or identical copy of oneself, has long had a powerful hold on the popular imagination. A new book, Virtual You, explains how science is beginning to bring the concept into reality.

Something for the weekend

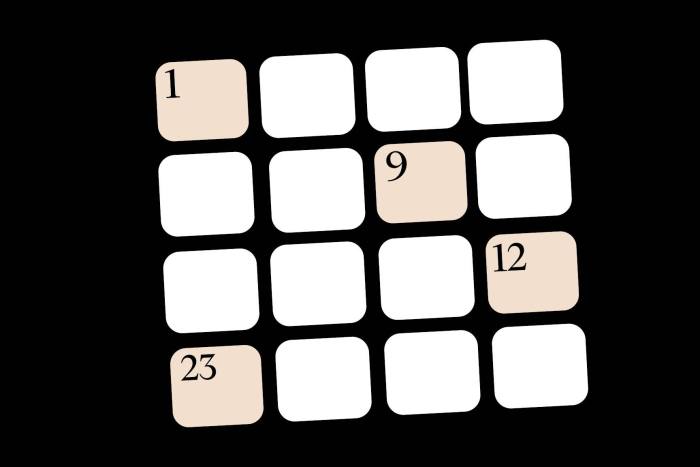

The FT Weekend interactive crossword will be published here on Saturday, but in the meantime why not try today’s cryptic crossword?

Interactive crosswords on the FT app

Subscribers can now solve the FT’s Daily Cryptic, Polymath and FT Weekend crosswords on the iOS and Android apps

Some good news

Four cheetah cubs have been born in an Indian national park, the first since the animals were declared extinct in the country in 1952.

From bad news yesterday to renewed hope for #ProjectCheetah this morning. Female cheetah Siyaya gave birth to four healthy cubs. Today, CCF Conservation Biologist Eli Walker confirmed and made visual contact (they’re ~5 days old) in the nest. He took the first photos/videos. pic.twitter.com/gagpTRIxfv

— Cheetah Conservation Fund (@CCFCheetah) March 29, 2023

Recommended newsletters

Working it — Discover the big ideas shaping today’s workplaces with a weekly newsletter from work & careers editor Isabel Berwick. Sign up here

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at [email protected]. Thank you