On the earth of inflation, the final six months have been extra eventful than the previous six years. After a decade of persistently below-target inflation, the US economic system has witnessed value development method above the central financial institution’s goal, fuelled by sturdy client demand, provide constraints, and backlogs in logistics (Ball et al. 2021).

The controversy over how the Federal Reserve ought to reply has hinged on the implementation of the brand new versatile common inflation concentrating on (AIT) framework introduced in August 2020 (Powell 2020) and on the persistence of the inflationary spike. How can the Fed reconcile a dedication to make up for inflation shortfalls with the chance that persistent low charges may take them too removed from their goal? On this column, we make clear a number of vital items of this puzzle.

The AIT framework implies that if inflation falls beneath the two% goal in a given 12 months, the Federal Reserve ought to enable inflation to run above 2% within the following intervals, in order to hit the goal on common over time. Key questions for an AIT framework due to this fact concern (i) the time window over which inflation is averaged; and (ii) the burden this inflation common receives relative to some measure of output deviations from pattern.

In a latest paper (Eggertsson et al. 2021), we doc that the implied common inflation window, per the Fed’s present and introduced coverage, is between three and 5 years, assuming the Fed begins to lift charges within the second quarter of this 12 months. We additionally discover that two different make-up methods – a history-dependent nominal GDP goal (HD-NGDPT) and a symmetric dual-objective concentrating on rule (SDTR) – would indicate nominal charges equally caught on the zero decrease certain. In distinction to AIT, these coverage methods explicitly take account of previous shortfalls in each inflation and output.

A key conclusion from our train is {that a} lift-off of the Federal funds charge from zero within the first half of 2022 is per the AIT framework outlined by the Fed, supplied the averaging is over a interval of round three to 5 years and that the Fed is giving equal weight to output deviations relative to common inflation.

These conclusions are derived solely utilizing information and forecasts, and assuming the Fed follows the desired guidelines from 2022 onwards. Clearly, had these guidelines been applied pre-pandemic, the information and projections would look very completely different, because the expectations of market individuals would mirror the completely different plan of action taken by the central financial institution. We due to this fact flip to a easy New Keynesian mannequin to construct counterfactual eventualities for a handful of coverage methods.

We discover that the introduced AIT technique considerably mitigated (-40%) the recession that in any other case could have occurred below normal inflation concentrating on (i.e. the Taylor rule). Our extra dovish guidelines that take express account of previous misses of inflation and output targets would have supplied even bigger features, mitigating the recession by 75%. Lastly, we discover that the anticipated lift-off of nominal charges doesn’t appear to rely upon the persistence of inflationary forces in the event that they originate from shortcomings on the availability facet. As well as, we discover that being over-stimulative with respect to AIT introduces a trade-off, with output features coming at the price of greater inflation.

Regardless of its limitations in capturing all of the aspects of the recession regarding Covid-19, distributional penalties, or unconventional financial coverage resembling quantitative easing, it is a helpful baseline evaluation for the forces at play when the economic system is constrained by a zero decrease certain on nominal rates of interest.

The window of common inflation

The Fed launched the AIT framework in August 2020, making clear that they weren’t “tying [themselves] to a selected mathematical formulation that defines the common” (Powell 2020). We due to this fact posit that, behind the scenes, the Fed has a versatile rule that accounts for deviations of common inflation from its goal but additionally takes its employment-output mandate into consideration.

Given realised inflation and output in 2021 and central financial institution projections (Federal Reserve Board of Governors 2021), we receive the implied rate of interest lift-off dates for various time home windows for common inflation and completely different weights for the twin mandate, proven in Determine 1. Take into account, for instance, the yellow line, for which there’s equal weight on output and common inflation (which we contemplate an inexpensive description of the Fed’s behaviour). If charges are lifted within the second quarter of this 12 months – because it was believable to imagine as of the December 2021 coverage assembly – the Fed is aiming at averaging inflation over a window of between three and 5 years.1 If lift-off falls within the third quarter of 2022, then the Fed is utilizing an inflation window past six years. A window of three to 5 years is in the direction of the decrease finish of the ideas of Fed officers in 2021 (Buiter 2021). Nevertheless, if the hole in output performs no position and the Fed solely targets common inflation, the implied time window can be above eight years, as below narrower home windows the Fed would have already got elevated the coverage charge. This means that the US central financial institution will not be following a pure common inflation concentrating on technique.

Determine 1 Implied time window for common inflation below three completely different assumptions on the welfare weight of output

Word: Blue dotted line implies no weight on output in any respect (strict common inflation concentrating on); Yellow strong line implies equal weights on deviations of inflation from goal and the output hole, whereas crimson dashed line takes on an intermediate place. Projections for inflation and output begin in 2022:Q1.

Supply: US Bureau of Financial Evaluation, Abstract of Financial Projections, December 15, 2021, Federal Reserve Board of Governors, authors’ calculations.

Make-up

The brand new coverage of AIT was meant to sign dedication to creating up for previous shortfalls,2 following a decade of realised inflation persistently failing to hit the two% goal. In Eggertsson et al. (2021), we recommend two different indices to measure the extent of previous misses: a cumulative shortfall of nominal GDP from its pattern (what we name the Gamma index), and a abstract of how each inflation and actual output deviate from pattern (the D index). The associated coverage guidelines (HD-NGDPT and SDTR, respectively) indicate substantial lodging even within the face of a powerful restoration. We additionally present that they’d have been more practical than AIT in mitigating the Nice Recession (Eggertsson et al. 2020). Determine 2 (backside proper and centre panels) updates the evaluation with the newest information launch and means that, if the Fed began to observe both of our two methods, lift-off would occur no sooner than 2024. We additionally contemplate a extra standard nominal GDP goal, which solely considers deviations of present nominal GDP from its pattern. Beneath this rule, lift-off would have already got occurred within the second quarter of 2021 (bottom-left panel).

Determine 2 Knowledge (strong line) and projections (dashed line) for chosen macroeconomic variables

Word: Projections begin in 2022:Q1. Actual GDP is linearly detrended from 2012– 2019 output information.

Supply: US Bureau of Financial Evaluation, Abstract of Financial Projections, December 15, 2021, Federal Reserve Board of Governors, authors’ calculations.

What if?

To this point, we’ve taken the trail of the US economic system as given by the information. To evaluate what would have occurred below a unique coverage stance of the Fed in the course of the pandemic, we have to construct a correct counterfactual situation, and for that we flip to a structural mannequin.

To maintain issues easy and intuitive, we make use of the canonical three-equation New Keynesian mannequin (Galì 2008). We mannequin the disaster as an unanticipated fall within the pure charge of curiosity, with some likelihood of reversal to the regular state (as in our toolkit paper referenced above). This can be a handy technique to seize the mixture uncertainty surrounding the tip of the Covid-19 pandemic, whereas retaining long-run inflation expectations anchored. As well as, to include the noticed value will increase, we additionally hit the economic system with a deterministic cost-push shock that fades out over time following an AR(1) course of.

The sizes of the shocks are calibrated in order that the mannequin replicates the realised path of inflation and actual output from the outset of Covid-19 (2020:Q1) till the newest information launch (2021:This autumn), assuming the Fed has been following a four-year AIT rule all through.3 We contemplate 4 different coverage methods: a normal Taylor Rule truncated on the zero decrease certain (TTR), a nominal GDP goal (NGDPT), and the beforehand talked about HD-NGDPT and SDTR.

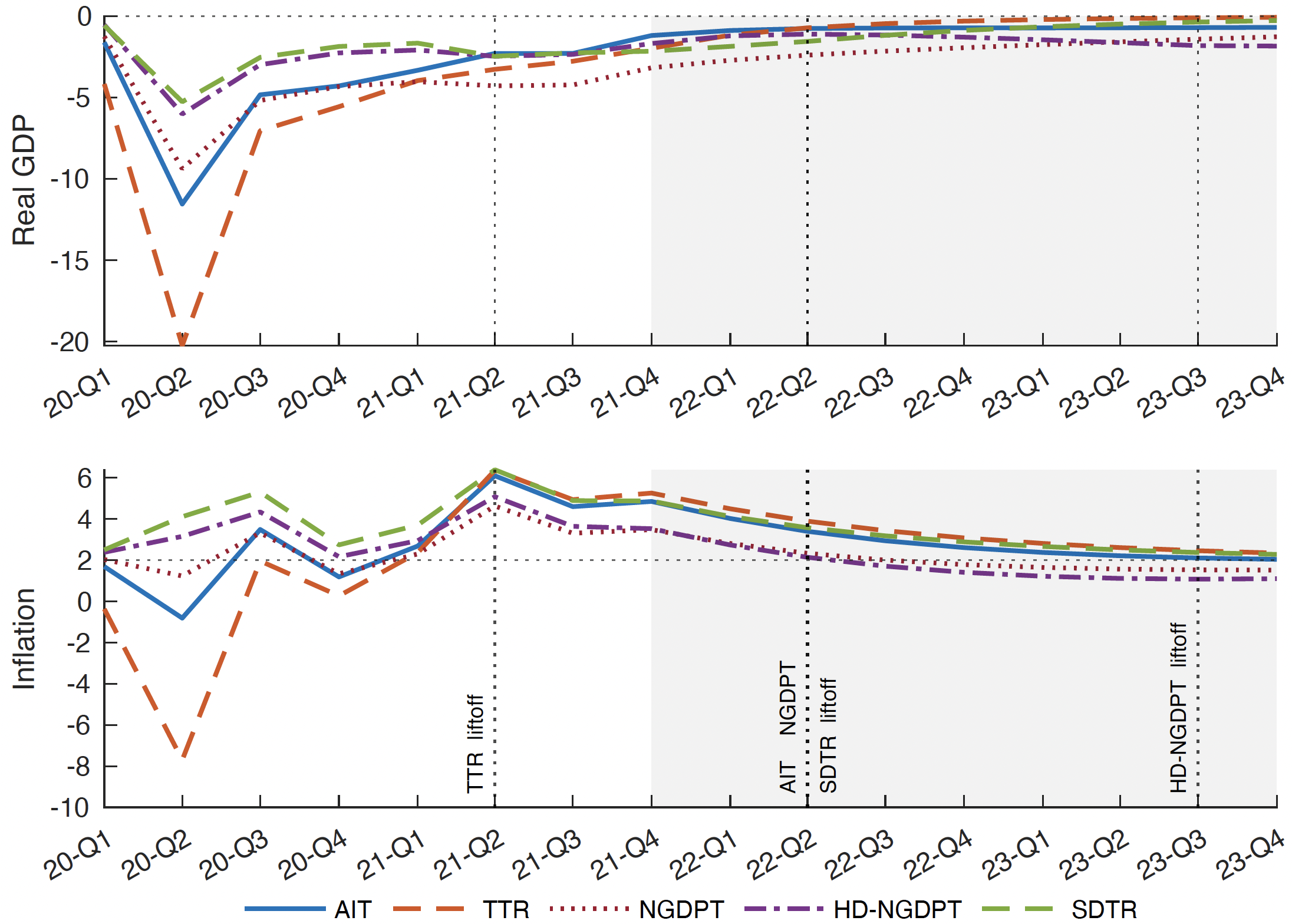

Determine 3 exhibits the response of actual GDP and inflation to the 2 Covid-19 shocks. Had the Fed adopted a Taylor rule, the output loss would have been rather more extreme (-20.2% with respect to pattern, versus the realised -11.5% contraction). Nevertheless, the Fed would have finished higher to observe our two proposed guidelines or a nominal GDP goal, specifically as a result of they indicate a stronger make-up part. The vertical bars in Determine 3 denote the anticipated date of lift-off of nominal rates of interest as sociated with every coverage rule. Unsurprisingly, the Taylor rule would have led to a elevate in rates of interest in 2021. Beneath all different guidelines, lift-off falls someday this 12 months or later.

Determine 3 Counterfactual paths for actual GDP and inflation below different Fed coverage guidelines

Word: Common Inflation Concentrating on (AIT, blue strong), Taylor Rule (TTR, orange dashed), Nominal GDP Concentrating on (NGDPT, crimson dotted), Historical past-Dependent Nominal GDP Concentrating on (HD-NGDPT, purple dash-dotted), Symmetric Twin-Concentrating on Rule (SDTR, inexperienced dashed). Shaded space denotes forecast. Vertical strains correspond to the anticipated date at which nominal rates of interest are raised above zero.

Whereas SDTR implies an anticipated lift-off date just like that of AIT (2022:Q2), HD-NGDPT delays it till as late because the second half of 2023. The instinct above is thus confirmed: lift-off dates – and due to this fact financial stabilisation – largely rely upon the coverage rule adopted, and extra dovish insurance policies that postpone the return to constructive rates of interest appear more practical at stabilising inflation and output.

How persistent? It doesn’t matter

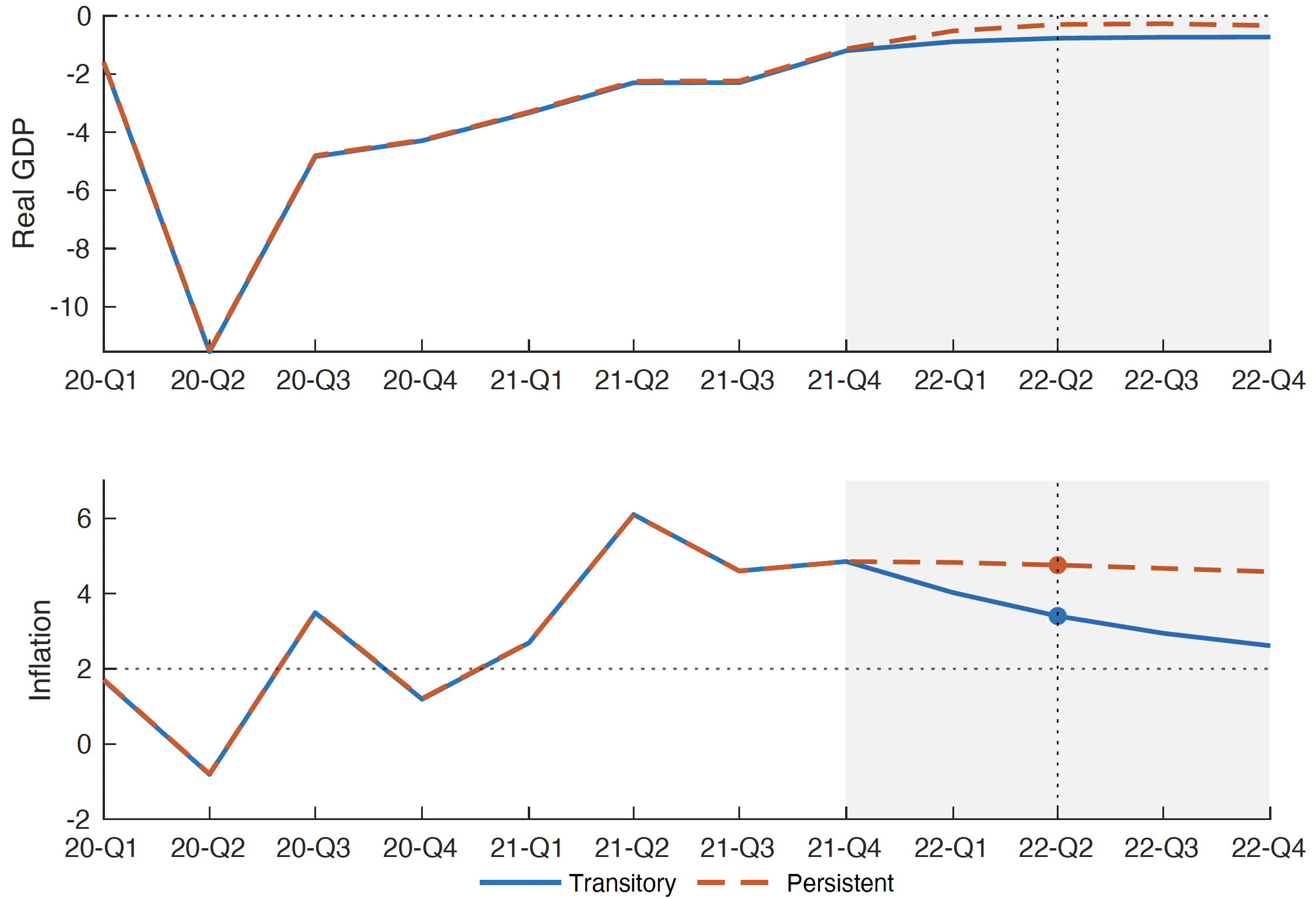

We additional analyse the potential of extreme dovishness below AIT within the face of the present inflationary pressures (D’Acunto and Weber 2021). In Determine 4, we offer some proof that with the present coverage technique, the anticipated lift-off is unaffected by the persistence of inflation. Particularly, we evaluate the implied outcomes within the baseline economic system below AIT, the place the cost-push shock is about to peter out by 70% inside a 12 months, in opposition to the identical economic system through which the persistence of the shock implies that it might nonetheless be at 95% of its present dimension after a 12 months. Provided that the mannequin should match the identical realised information between the onset of Covid-19 and 2021year finish, the implied shocks are characterised by a smaller – however extra persistent – price push and a extra extreme drop in demand. Within the simulation, it seems that the added inflation persistence doesn’t add sufficient value strain to lift charges sooner than the baseline. It ought to be famous that the idea of a really persistent cost-push shock would indicate, on common, a core inflation charge above 4% for no less than three years into the long run. This prediction is inconsistent with most present forecasts, suggesting that the present inflationary episode ought to be thought of as transitory.

Determine 4 Knowledge (2020:Q1-2021:This autumn) and predicted paths (shaded space) for actual GDP and inflation

Notes: Persistent situation implies that the price push shock has persistence of 0.988. Shock dimension calibrated to match the identical information below the 2 eventualities. Colored markers point out anticipated lift-off dates.

Heating up: Not so simple as it appears to be like

A second suspect for elevated inflation is just a extra dovish Fed. Utilizing the identical structural mannequin, in Determine 5 we consider the prices of over-stimulating with respect to the AIT prescriptions on nominal rates of interest. Suppose that, from the tip of 2021 onwards, the Fed retains rates of interest at zero for 4 quarters past what the usual AIT rule would prescribe, below any attainable future state of the world. The consequences of this over-stimulation are elevated output at the price of greater inflation on common. Assessing the desirability of a extra dovish coverage due to this fact is dependent upon how one views the trade-off between a stronger restoration and elevated inflation.

Determine 5 Knowledge (2020:Q1-2021:This autumn) and predicted paths (shaded space) for actual GDP and inflation

Notes: Overstimulate situation implies the Fed retains nominal charges at zero for 4 further quarters in comparison with what AIT prescribes in every state of the world. Vertical strains correspond to the anticipated date at which nominal rates of interest are raised above zero.

Authors’ word: The views expressed herein are these of the authors and don’t essentially characterize the views of the Financial institution of Italy, the IMF, their respective administration or Govt Boards.

References

Ball L, G Gopinath, D Leigh, P Mishra and A Spilimbergo (2021), “US inflation: Set for take-off?”, VoxEU.org, 7 Might.

Buiter, W (2021), “The Fed should abandon common inflation concentrating on”, Monetary Instances, November 14.

D’Acunto, F and M Weber (2021), “Rising inflation is worrisome. However not for the explanations you assume”, VoxEU.org, 4 January.

Eggertsson, G B, S Ok Egiev, A Lin, J Platzer and L Riva (2020), “The Fed’s new coverage framework: A significant enchancment however extra could be finished”, VoxEU.org, 21 October.

Eggertsson, G B, S Ok Egiev, A Lin, J Platzer and L Riva (2021), “A toolkit for fixing fashions with a decrease certain on rates of interest of stochastic period”, Evaluate of Financial Dynamics 41: 121-173.

Federal Reserve Board of Governors (2021), Abstract of Financial Projections, December 15.

Galì, J (2008), The Fundamental New Keynesian Mannequin in Financial coverage, inflation, and the enterprise cycle: an introduction to the brand new Keynesian framework and its purposes, Princeton College Press.

Powell, J H (2020), “Opening Remarks: New Financial Challenges and the Fed’s Financial Coverage Evaluate”.

Endnotes

1 Most up-to-date communication by the FOMC factors to the potential of a primary charge hike in the direction of the tip of the primary quarter of 2022. It is very important word that our evaluation is carried out from the perspective of the newest obtainable public launch, which incorporates information as much as December 2021.

2 The ECB additionally introduced its new coverage technique in July 2021, to formally incorporate unconventional instruments and to think about new challenges resembling local weather change. Their technique differs from the Fed’s primarily as a result of it’s primarily based on a symmetric inflation goal.

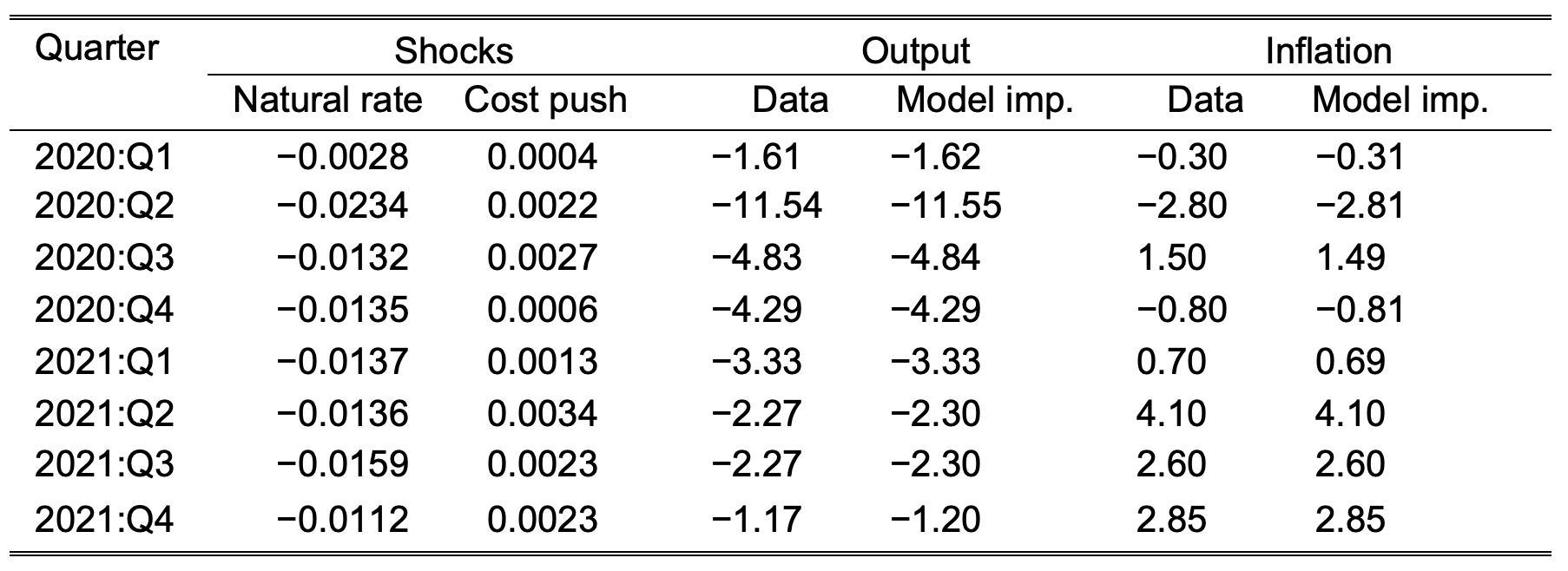

3 To mannequin altering expectations on the period of the recession, we set the likelihood of exit from the disaster to a unique worth in every quarter, in order that on common brokers count on the disaster to revert in 2022:Q2. We report the estimated shocks within the desk beneath. Outcomes are sturdy to utilizing a three- or five-year window for common inflation.

Word: Calibration of 3-equation New Keynesian mannequin assuming the central financial institution follows a modified AIT. Shock course of follows a 2-state martingale for rnand a deterministic AR(1) course of for the price push shock ut. β = 0.99875, µ modifications each quarter (implied anticipated liftoff in 2022:Q2). Output information are share deviations from linear pattern 2012:Q1-2019:This autumn.

Supply: U.S. Bureau of Financial Evaluation, authors’ calculations.