VladK213

Impala Platinum Holdings Limited (OTCQX:IMPUY), a platinum group metals (PGMs) mining giant, has been hit hard by plummeting palladium and rhodium prices and load curtailments due to South Africa’s energy crisis. The company, however, is well positioned to absorb the hit and continue growing profitably while generating cash flow, largely due to an adept deployment of capital to boost/stabilize margins and output. The headwinds are fierce, for sure, but the stock has clearly dipped into the buy zone.

Key Metrics & Performance

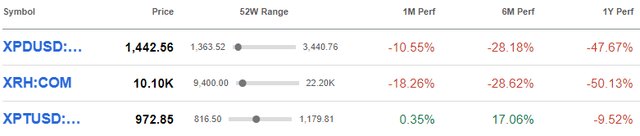

Impala’s stock is down nearly 50% in the past 12 months, now trading a mere 5% above its 52-week low. The stock collapse correlates with the plunge in palladium and rhodium prices. Palladium last March broke the 3,000 mark – a metal that traded around $500/oz in 2016 – and rhodium soared north of $22,000 due to supply constraints brought on by the war in Ukraine. Although both have dropped to less than 10% above their 52-week lows, platinum has shown signs of recovery, down almost 10% in the past year but up 15% in the previous six months.

PGM Metals Price Performance (Seeking Alpha)

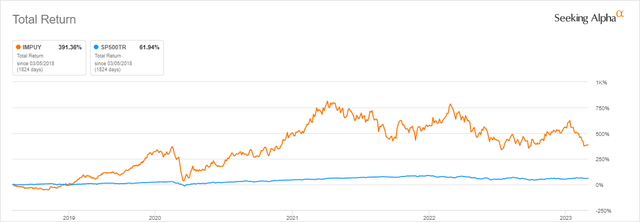

It is worth mentioning that the stock over the long run has returned significant value to shareholders – including nearly 400% over the past five years in total returns, far surpassing the S&P 500.

IMPUY 5Y Total Return vs. Market (Seeking Alpha)

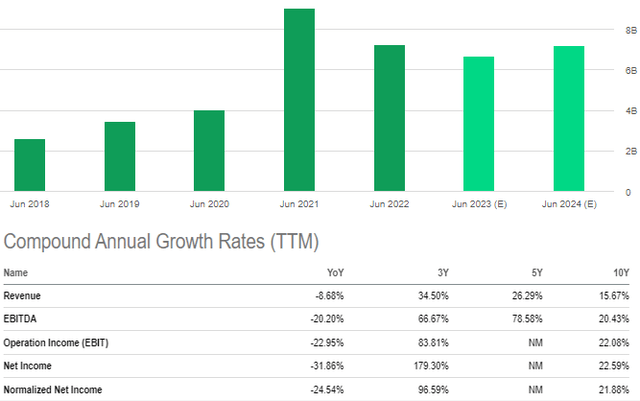

From 2013-2022, the company grew revenue at a compound annual growth rate of 15% and by 26% in the past five years. And prior to the 2021 price surge sparked by the supply chain crisis, the CAGR was 4%. Point being, the firm has shown consistent growth in a very cyclical industry.

Impala Platinum Annual Growth Metrics (Seeking Alpha)

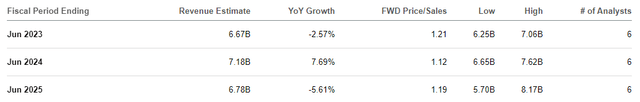

Analysts project Impala sales will drop 8% this fiscal year before bouncing back by eight percent in FY2024.

IMPUY Analyst Estimates (Seeking Alpha)

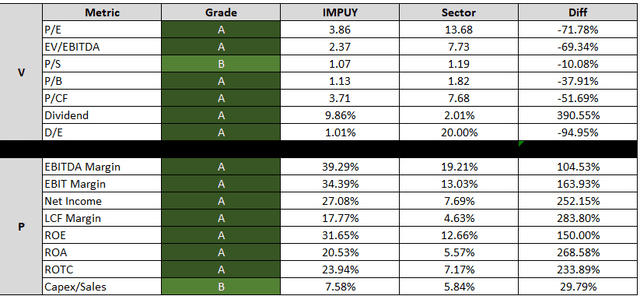

Impala far outperforms sector valuation and profitability averages, and would likely garner A grades nearly across the board if awarded quant scores. The high reinvestment and return on capital rates are very good signs that will yield EBIT growth and, at a minimum, help maintain/support profit levels if lower selling prices pressure margins.

IMPUY Relative Profitability and Valuation Grades (Data: Seeking Alpha)

Despite load curtailment headwinds that cost Impala 9,000 6E ounces of mined volumes and 38,000 of refined production in the first six months of the 2023 fiscal year (H123), which ended in December, the company saw revenue grow by around 4% and EBITDA by over 2 percent versus the same 6-month period in the prior year. CEO Nico Muller attributed the ability to counter macro-economic headwinds and power constraints to Impala’s geographically diverse production footprint – which is spread across South Africa, Zimbabwe, and Canada – and contributions from growth projects.

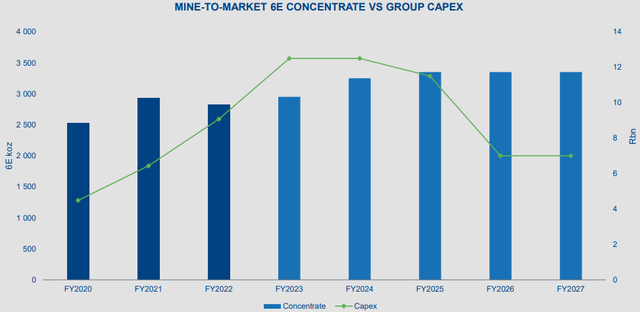

In terms of future growth, during its most recent earnings call, Impala referenced guidance provided at the end of fiscal year 2022 that shows capital expenditure investments and expected production levels. Impala is looking to grow annual 6E output to 3.4 million oz by 2025, about 13% above the 2023 target of around 3 million oz. I am willing to bet, based on its track record, that Impala will find ways to exploit the 268 million ounces+ of 6E reserves they are sitting to continue growing beyond 2025.

Impala Platinum Production Forecast 2023-2027 (Impala Platinum YE2022 Investor Presentation)

PGM Outlook

Despite the company’s internal strength, however, they cannot control metal price speculation – they are by definition price takers – and at the mercy of interpretations how their most critical end markets are expected to perform.

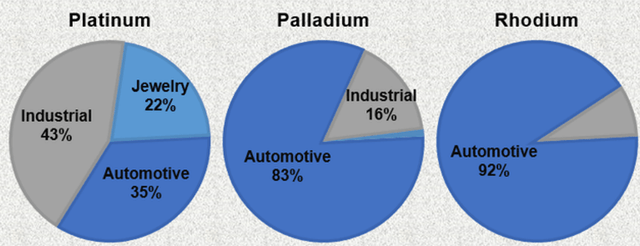

Palladium and rhodium combined accounted for almost 70% of Impala’s sales in the first six months of the current fiscal year. Over 80% of palladium and 90% of rhodium demand comes from autocatalysts, while platinum demand is diversified across industrial, jewelry, and automotive end markets.

PGM Demand by Industry (Data: Johnson Matthey 2022 PGM Market Report)

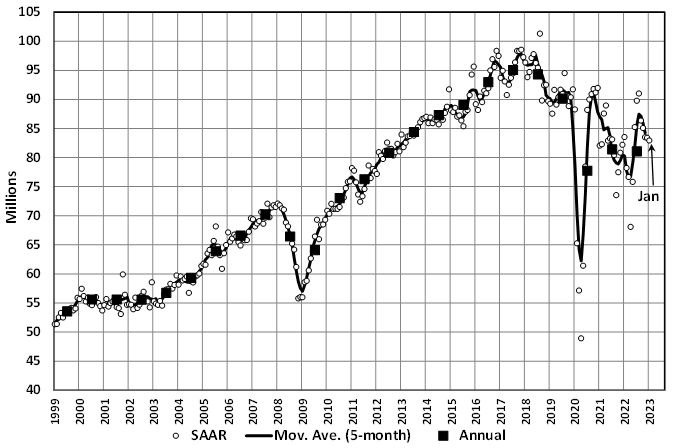

Market prices have come down significantly compared to those Impala reported in H123 results. However, since the plummet from the Ukraine war premium and China lockdowns, the direction prices are continuing to take are not reflective of supply/demand realities and end market trends. The auto market may not be booming, for example, but it certainly is not in retreat. LMC reported that January’s global light vehicle selling rate stood at 83 million units per year, in line with the previous month.

January’s Global Light Vehicle (LV) selling rate (LMC)

Impala in its H123 booklet, citing Global Insight, said auto sales could grow 6.3% to 85.7 million units this year and 6% in 2024 to 90.8 million units. Although sales in China plunged 38% in January, the second-largest autocatalyst market, that being the United States, saw car sales rise over 6% year-over-year. India, meanwhile, is seeing a boom in auto sales and is projected to grow by 9-10% in fiscal year 2024, according to Crisil Ratings.

One interesting development is that global palladium-backed funds increased by 37koz over the last three months, the first period of net holdings growth since last March, according to Heraeus. Most buying came in January as the price sank below the $1,650 per ounce mark. Heraeus suggested that there is a possibility palladium is being seen as “oversold” compared to platinum.

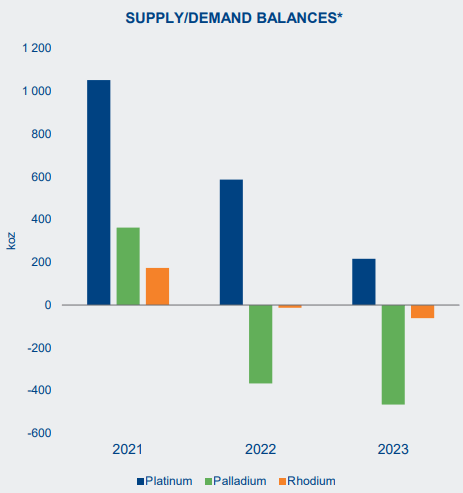

Impala itself projects deficits to continue next year in both palladium and rhodium markets. In 2022, Pd recorded a deficit of 800koz, Rh 62koz, and Pt a surplus of 300koz. The company says PGM markets are expected to tighten in 2023 as auto production recovers, China moves away from its zero-covid policy, and industrial demand remains resilient.

PGM Supply/Demand Forecast (IMPUY H1FY23 Results Presentation)

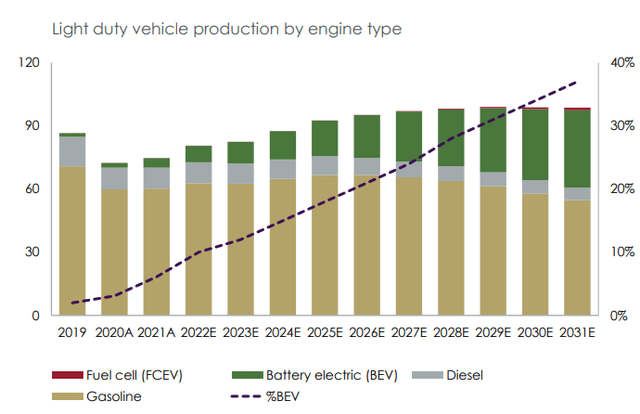

Sibanye Stillwater Limited (SBSW) has forecasted light duty vehicle sales to rise this year and also projected that EV sales will continually gobble market share, estimating penetration of nearly 40% by 2031. Despite losing market share, gas and diesel vehicle production will – in terms of total units – remain constant with slight year-to-year growth before declining in 2026.

Car Demand Forecast by Engine Type (Sibanye Stillwater)

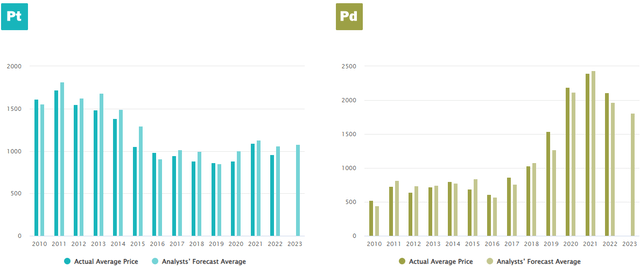

The average analysts’ forecast in an LBMA survey has palladium finishing the calendar year at $1,800/oz and platinum at $1,080/oz. Considering palladium is hovering at about $1,440 currently, the forecast seems divorced from reality. In the experts’ defense, however, the forecast deadline was January 18, a day palladium closed at $1,708/oz.

Analysts’ Pt/Pd Forecast (as 1/18/23) (LBMA 2023 Precious Metals Forecast Survey)

(Note: For a convincing argument as to why PGM prices should rebound see Pearl Grey Equity and Research’s recent analysis).

In the end, I see no reason to believe PGM demand will weaken significantly anytime soon, despite the EV hype, to a degree that will justify a continuance in the price freefall.

Valuation

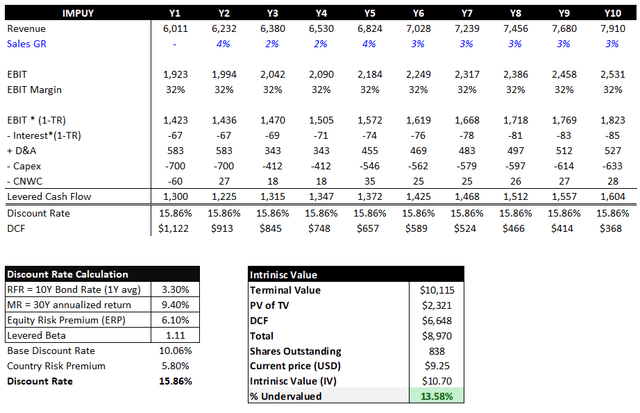

For the purposes of the DCF calculation I did not want to attempt guessing metal price cycles, and hoped to normalize as much as possible within reason by falling back on historical averages. For the theoretical “year one” of the model I plugged in current market prices and then gradually pushed the prices toward – very selective – historical averages. For platinum I used the ten-year historical average (~$1,000/oz), for palladium the 8-year historical average ($1,453), and for rhodium the seven-year historical average ($8,042).

For year one production I used 3.15 million oz, roughly 2% over the 2023 guidance, then assumed 5-6% growth rates through year 5, before slowing growth to 3% in years 6-10. The revenue does not follow the same growth line as volumes due to the net shift in pricing. When the smoke cleared, I concluded that Impala Platinum is trading at least 13% below its intrinsic value, based on my DCF model.

IMPUY DCF Results (MH Analytics)

(The stock is extremely undervalued if you think the country risk premium is an absurdity – and some do with valid arguments).

Concluding, then. The falling PGM prices, Eskom load curtailments, and the EV threat are all legitimate risks that investors must consider as they assess Impala Platinum’s stock. However, in the end the company is highly focused on boosting 6E output through strategic investments that will drive growth, which is a good sign for shareholders. Its products are still in high demand and will continue to be for years. The company is a highly-profitable cash-flow generating machine that is trading at less than 4x earnings. Hence, I bestow it a buy recommendation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.