This text is an on-site model of our Unhedged e-newsletter. Premium subscribers can enroll right here to get the e-newsletter delivered each weekday. Normal subscribers can improve to Premium right here, or discover all FT newsletters

Good morning. Yesterday in our evaluate of US client corporations’ outcomes, we concluded that the composite image was “decidedly not of a rustic sliding in the direction of recession”. We must always have been extra emphatic. Quickly after we revealed, the July retail gross sales report confirmed the strongest month-to-month development since January of final yr, and the Walmart CEO mentioned “we aren’t experiencing a weaker client”. Bear in mind the recession scare final week? Yeah, we don’t both. E-mail us: [email protected] and [email protected].

Friday interview: Jason Furman

Jason Furman is a professor of economics at Harvard College and a fellow on the Peterson Institute for Worldwide Economics. He served because the chair of the Council of Financial Advisers in the course of the Obama administration. He spoke with us concerning the financial stimulus, immigration, AI and rather more.

Unhedged: Financial indicators are all around the map. Horrible manufacturing surveys, for instance, whereas the job market seems strong. Is that this an unusually laborious economic system to analyse?

Furman: I agree that we’ve a specific amount of bizarre weirdness within the economic system proper now. A few of that’s measurement. There was an enormous enhance in immigration, which could be very poorly tracked in the actual time knowledge. It’s affecting issues like the connection between GDP and GDI, and family and payroll employment surveys.

The second issue is that the macro coverage stance is kind of uncommon, in that it is rather strongly expansionary on the fiscal aspect and really strongly contractionary on the financial aspect. These two instruments have an effect on completely different elements of the economic system in another way. So that you see manufacturing constructions rising and residential housing falling, and that’s precisely what you’d anticipate if fiscal coverage was subsidising manufacturing constructions, and the Fed’s excessive rates of interest had been crippling the housing sector.

Unhedged: Is it unhealthy to have fiscal coverage doing one factor and financial coverage one other?

Furman: I believe it’s unlucky that we’ve the expansionary fiscal coverage that we at the moment have. The US has the biggest deficit of any of the superior economies. The markets truly appear fairly relaxed about this. Rates of interest are greater than they had been 5 years in the past, however within the grand scheme, that’s nonetheless on the low aspect. And if something, a part of why US short- time period rates of interest are greater than many different superior economies is that the Fed has extra fiscal coverage that it’s combating towards. You don’t see any such fiscal growth within the UK or the Euro space.

Unhedged: Over the past main inflationary bout, within the late Nineteen Seventies and early 80s, inflation would fall, then come again. The Fed was repeatedly compelled to backtrack on charge cuts. How frightened ought to buyers and the Fed be about an inflation resurgence?

Furman: The individuals who hold saying that that is going to be just like the 70s and 80s are all going to be mistaken. The rationale they’re all going to be mistaken is exactly as a result of they hold saying it. It’s a self-unfulfilling prophecy.

Our financial policymakers have realized lots, and so they’re rather more credible now. Throughout this complete episode, medium-term inflation expectations have been just about anchored. So central banks got here into this with lots of credibility. And take a look at what they’ve achieved: inflation has come down by two share factors over the previous yr, and the Fed has stored rates of interest the identical. They’re erring, as they need to, on the inflation aspect of the mandate. It’s solely with the final two jobs prints and the final two inflation prints that they’re shifting in the direction of the employment aspect of the mandate.

Unhedged: What are you on the lookout for within the subsequent jobs report?

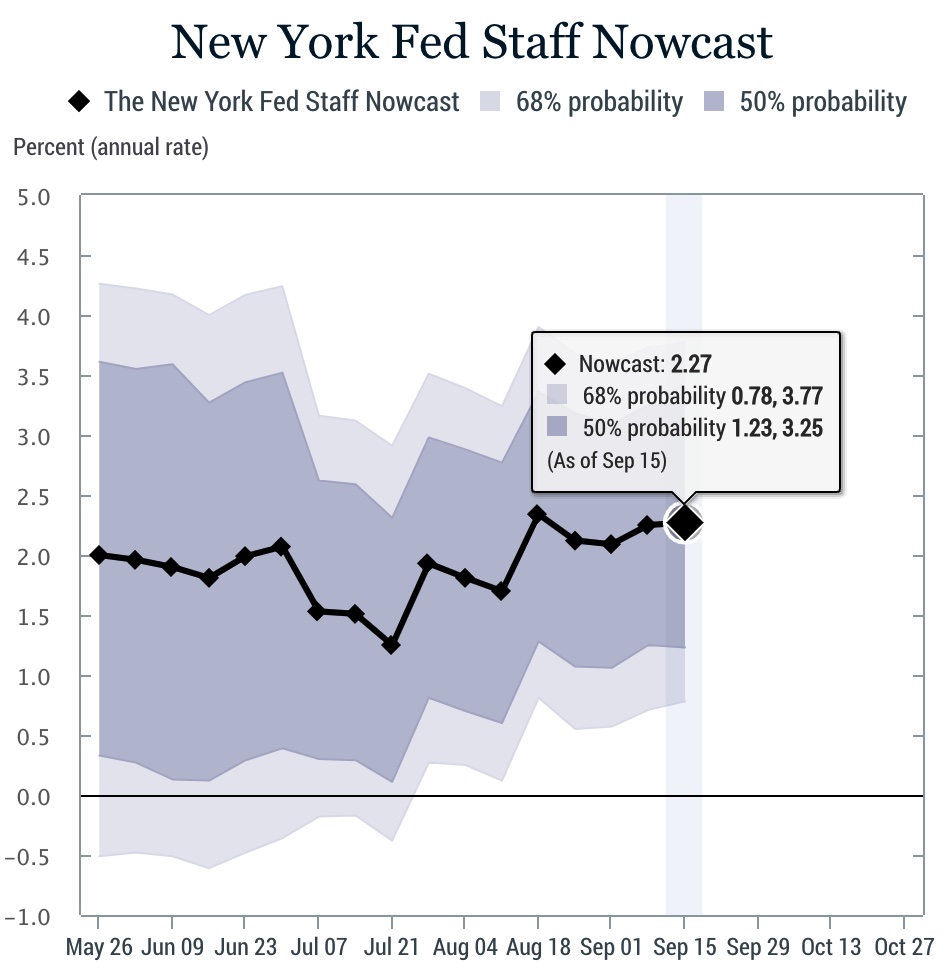

Furman: Largely on the family survey [which generates the unemployment rate] as a result of we don’t know what break-even payroll development is. If you happen to see a payroll variety of 150,000 [in the establishment survey], you don’t know if that’s good or unhealthy, as a result of what number of immigrants we’re getting, that has an enormous impact on break-even job development. Whereas we do know what a better or decrease unemployment charge means. It’s simply so simple as, is it going up or is it taking place? If the unemployment charge stays at 4.3 per cent, the concept [the disappointing July jobs reports] was simply from momentary lay-offs or Hurricane Beryl is mistaken. And I might absolutely anticipate that the Fed goes to learn the information the identical method, and minimize by 50 foundation factors and sign that it’ll do extra 50s in the event that they’re wanted. However, if the unemployment charge falls again to 4.1, it is going to appear like final month was only a fluke, we’ll breathe a sigh of aid. However I don’t assume there’s any knowledge at this level that would cease the Fed from reducing in September.

Unhedged: Do we all know sufficient concerning the fiscal strategy of both presidential candidate to say something of use?

Furman: Unified Republican management can be probably the most fiscally expansionary consequence. The Republican enthusiasm for tax cuts far outstrips the Republican enthusiasm for spending cuts.

Left to their very own units, Democrats don’t care very a lot concerning the deficit lately. However they do have lots of urge for food for tax will increase on excessive incomes, and in consequence, they in all probability may find yourself paying for lots of the brand new spending they might doubtless push by. Some folks won’t like that fiscal combine, nevertheless it wouldn’t be very expansionary.

A giant wild card in all of that is the markets. When will the markets pressure Washington to take this problem extra severely? If the 10-year yield went above 5 per cent, I believe it could get the eye of whoever was president. They don’t have any alternative however to have interaction severely on the fiscal points. In any other case the subsequent president has lots of room, and so they’ll in all probability use it.

Unhedged: We loved your paper on the financial impacts of AI. How do you assume AI will have an effect on the economic system?

Furman: Predictions about AI should have a very large confidence interval. We’re to date outstripping the place any of us thought AI can be within the yr 2024, however most companies haven’t but discovered learn how to use it. So within the brief run, I believe we’re getting demand for issues like knowledge centres, however we aren’t getting “provide” by way of elevated productiveness. If something, it’s a short-run headwind to productiveness as a result of we’re hiring so many individuals to determine learn how to use AI earlier than we’ve deployed it. However I believe all of these investments will finally repay.

One chance is that generative AI seems to be an innovation that reduces inequality, quite than rising it. It’s a bit like spell examine: it’s extra helpful if you happen to’re a nasty speller. If that’s the case, that may assist hold AI politically viable, so long as we’re ensuring that governments don’t get in the best way. On the query of job alternative, I are usually sanguine. But when AI begins changing massive numbers of staff in numerous areas concurrently, that may be a problem. However that may be a very good downside to have, as it could doubtless be a problem in a world wherein AI has helped make us so wealthy that we will afford options.

Unhedged: Are corporations and governments doing sufficient to anticipate these potential challenges?

Furman: If I had been the federal government, the primary factor I’d be making an attempt to do is work out how we will have extra AI. A few of that may be streamlining the allowing and funding analysis. I do fear that lots of the analysis has migrated into the businesses, which don’t share it, and so we’re shedding out on the optimistic spillovers. By way of regulation, I fear extra that the federal government goes to do an excessive amount of and do it too stupidly, quite than too little. I don’t need an AI tremendous regulator — I need the Freeway Administration, the SEC and the FDA to have experience in AI to allow them to perceive the way it’s used of their completely different domains, however regulate it identical to they regulate auto security or medical machine security.

Unhedged: Your feedback elevate a normal query concerning the technological economic system. There’s a line of thought that claims the final couple of rounds of innovation have led to a small variety of corporations and people reaping all of the rewards, whereas the remainder of us are overlooked. And people are the very corporations which have all of the analysis muscle in AI. Do you agree?

Furman: Firms develop partially as a result of they make wonderful issues, and we must always need that. I don’t assume that Europe is sitting there feeling nice that it doesn’t have any massive tech corporations so it doesn’t have to fret about monopolists. However however, some corporations have grown by aggressive mergers and anti-competitive behaviours, and people are unhealthy for customers. I believe at present’s digital giants are giants partially as a result of they’re wonderful, and partially as a result of they’ve achieved a set of aggressive issues. And what we have to do is get the correct stability of stopping the aggressive issues, whereas conserving every thing that’s good about them. Within the EU, I believe they’re going a bit too far on curbing monopolists. And right here within the US, we’re in all probability not doing sufficient. However we’ll see what the cures are in a few of the upcoming trials.

Unhedged: You will have achieved lots of work on healthcare reform. Do you assume non-public insurers are a barrier or part of the answer?

Furman: Among the innovation of insurance coverage corporations is terrific. They’ve give you issues like tiered drug formularies, slim networks, HMOs and value sharing which, whereas they aren’t essentially standard, have saved some huge cash whereas not hurting anybody’s well being. We don’t know the reply on learn how to management well being prices. That reply, like every thing else within the economic system, is one thing that’s greatest discovered by corporations in competitors with one another. However what you need to do is be sure that the medical insurance corporations aren’t competing with one another in a nasty method; for instance, insuring solely the wholesome folks and dumping the sick folks. The Inexpensive Care Act did lots to cease that adverse competitors, however there’s nonetheless a few of it — there’s much more of it in Medicare Benefit, the non-public medical insurance plans for seniors. There are steps the federal government may take there.

Unhedged: Sentiments concerning the economic system have remained very adverse, whilst issues have gotten higher. Is there a notion downside?

Furman: Objectively, I may inform a narrative wherein folks can be considerably adverse concerning the economic system. Wages have grown sooner than costs, however solely by a bit by a bit, and development has not been as quick because it was previous to the pandemic. And the unemployment charge is now rising. So I believe there’s some purpose to be a bit bit adverse.

What is way tougher to clarify is the magnitude of the negativity. Whereas it has diminished some as inflation has fallen, it’s nonetheless very persistent. So I believe there’s a mixture there: a few of it was seeded by precise financial improvement, nevertheless it has been dramatically magnified by non-economic occasions.

Within the FT ballot that got here out lately, individuals are rather more optimistic about how Kamala Harris would deal with the economic system relative to Trump than they’re about Biden relative to Trump. I don’t assume anybody ought to actually have a distinct opinion there. If you happen to hate or love Biden, you need to hate or love Harris, too. However lots of people have modified their thoughts concerning the economic system primarily based on which one is the candidate.

Unhedged: You talked about that one of many issues complicating measurements proper now could be immigration. How are you viewing the impression of immigration?

Furman: Immigration has been an important issue within the US economic system within the final couple of years. It’s the rationale we’re including jobs quite than subtracting jobs, and the rationale we’re capable of develop at 3 per cent whereas inflation falls. The US has two issues that no different nation on this planet has together. One is it’s a really engaging vacation spot for immigrants; the second is the immigrants that come right here work. Employment charges for immigrants in Europe are a lot decrease than they’re within the US.

A number of it, although, has been towards our legal guidelines. And I’m fairly uncomfortable saying that we must always nullify our legal guidelines simply because I like an consequence. We have to change our legal guidelines in a method that understands that we want each high-skilled and low-skilled immigration. As a result of proper now if you happen to absolutely implement our legal guidelines, our economic system would come aside. When you create legal guidelines that help extra folks to return legally, then I believe then you may actually begin to implement your border and employment restrictions.

One good learn

OK, perhaps working from house has gotten uncontrolled.

FT Unhedged podcast

Can’t get sufficient of Unhedged? Hearken to our new podcast, for a 15-minute dive into the newest markets information and monetary headlines, twice every week. Atone for previous editions of the e-newsletter right here.

Advisable newsletters for you

Swamp Notes — Skilled perception on the intersection of cash and energy in US politics. Join right here

Chris Giles on Central Banks — Very important information and views on what central banks are pondering, inflation, rates of interest and cash. Join right here