Emmanuel Wong/Getty Images Entertainment

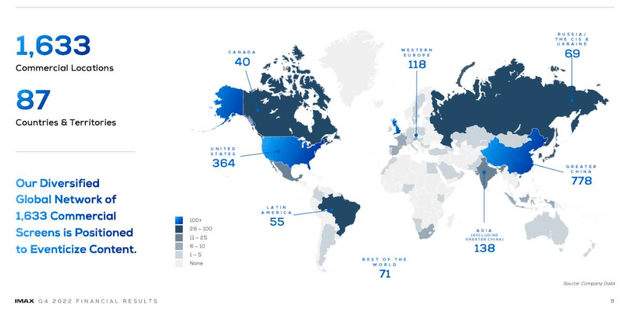

IMAX Corporation (NYSE:IMAX) is a small-cap cinema stock with a market cap of $1.07 billion and a FWD price-to-earnings ratio of 24.49, lower than some of its direct cinema stock peers. It distinguishes itself from other movie stocks through its technology-first approach and investments into international markets through its local language box office offerings. Over the last year, the stock has rewarded investors with returns of 13.46%.

One-year stock trend (SeekingAlpha.com)

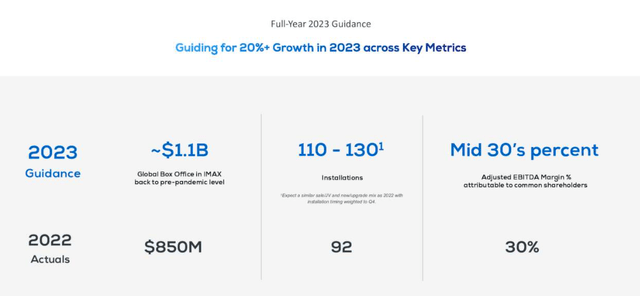

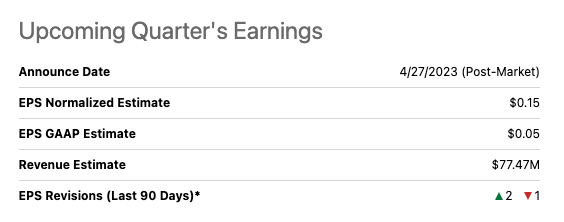

Although IMAX has yet to reach 2019 performance numbers, it has recently recorded a global box office record for Q1 2023. Going into FY2023, the company is benefiting from tailwinds of China reopening, the release of several significant blockbusters on its screens, and strong market growth through its local language box office offerings globally, with robust results in India. For the soon-to-be-released Q1 2023 Earnings report, analysts predict positive normalised EPS of $0.15 and revenue of $77.47 million. While cautious of the growing competition from streaming alternatives and a looming recession, there is significant momentum across its international markets going into Q1 to set an upward performance trend for the rest of the financial year. Therefore investors may want to take a bullish stance on this stock.

IMAX Q1 2023 expectations

Whilst movie theatre revenue is growing, box office numbers are still below pre-pandemic numbers due to the lower number of movie releases, the rise in streaming platforms and the COVID concern that continues to hang over extensive group activities in enclosed environments. However, IMAX is faring better than its peers AMC Entertainment Holdings Inc. (AMC) and Cinemark Holdings Inc. (CNK) due to the Chinese market reopening, the Chinese New Year boost in sales and a mix of Hollywood and local language box office offerings increasing sales across its global market.

IMAX global reach (Investor presentation 2023)

Although we should be cautious that IMAX has missed EPS expectations for the last four quarters, this upcoming quarter has a normalised EPS estimate of $0.15 compared to a loss of $0.13 one year prior, and revenue could rise to $77.47 million from $60 million one year earlier.

Upcoming Earnings Expectations Q1 2023 (SeekingAlpha.com)

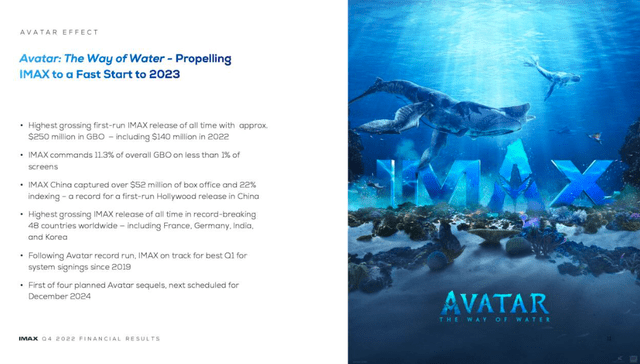

These numbers are still below the first quarter of 2019. However, there are some major growth catalysts if we consider that the Chinese market opened and is recovering exceptionally quickly, and the company is majorly benefiting from local language box office releases in markets such as India. Furthermore, the company has major top blockbuster releases such as Avatar 2, the highest-grossing IMAX release of all time, as seen below creating strong tailwinds.

Strong momentum into 2023 (Investor presentation 2023)

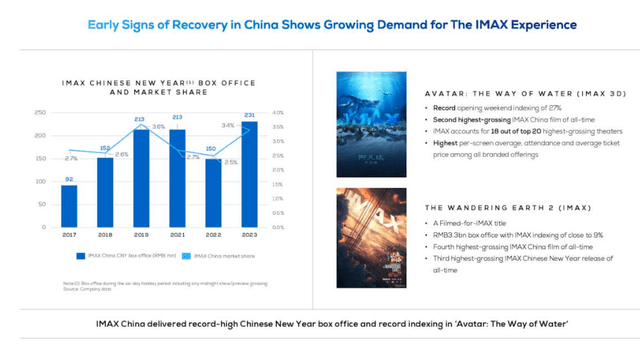

Growth catalyst: Return of the Chinese market

China represents a massive market for IMAX, making up one-third of the revenue in 2019. Until December 2022, more than one-third of IMAX locations were closed. However, the turnaround while the market is still recovering is apparent. We saw Chinese New Year, typically the company’s peak movie-going period set a new record generating $34 million. The six-day holiday period in January 2023 was an increase of 54% YoY, and it beat the previous record set in 2021 by 3%. The Chinese market has generated $1.2 billion in box office sales year to date, compared to $513 million for North America for the same period.

China market recovery (Investor Presentation 2022)

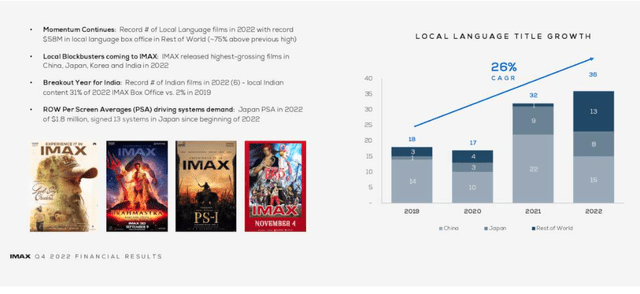

Growth Catalyst: Local language offerings, particularly in India

The impact of local language offerings is often underlooked compared to the Hollywood box office hits by investors. IMAX delivered a record $86.3 million in box office for regional language films in the first quarter of 2023, accounting for 31% of the Company’s overall global box office. YoY, these are growing in their contributions to overall sales. In FY2022, IMAX experienced one of its top-performing years in India post-2019. The box office collection increased by 41% in 2022 compared to 2019.

Local language content growth (Investor presentation 2022)

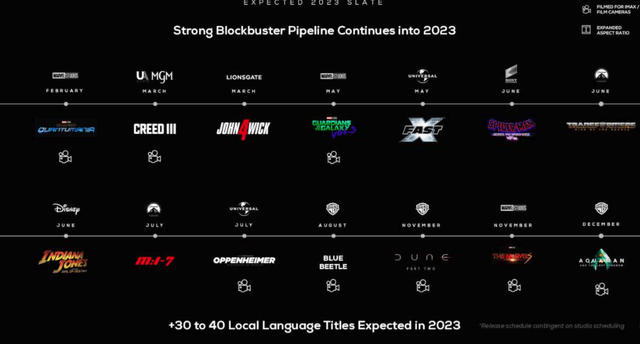

Growth catalysts: Pipeline of Blockbuster for the next two years

IMAX is connected to solid blockbusters. Avatar gave the company a strong year finish and a continued tailwind going into 2023. The movies attract crowds with the company’s technological strengths and premium watching facilities, which are hard to replicate in at-home cinemas through streaming alternatives. IMAX has a pipeline full of Hollywood blockbusters for the next two years, which should significantly impact the company’s performance.

Blockbuster pipeline 2023 (Investor Presentation 2023)

Valuation

IMAX has an average target price of $21.27, which is under the current stock price and has a BUY consensus on MarketScreener. Analysts’ recommendations are mixed on the stock, with a Sell rating by Goldman Sachs and an Outperform by Barrington. On the market, IMAX is faring better than its direct peers, CNK and AMC, if we compare their price returns over the last year. IMAX has rewarded investors with 13.46% of returns, whereas CNK and AMC have lost value over the previous year.

One-year price return trend (SeekingAlpha.com)

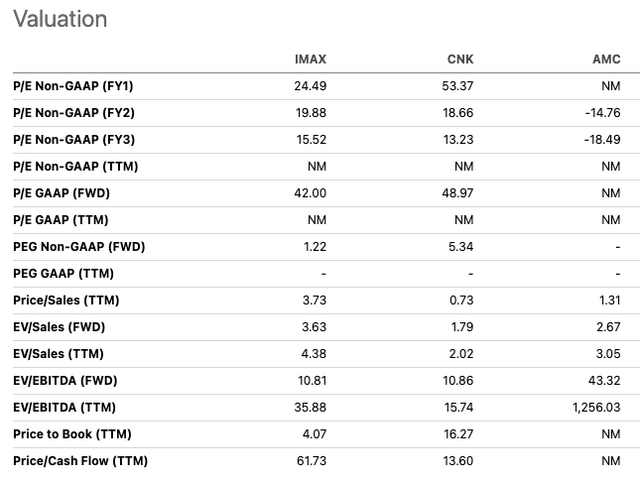

We can see that IMAX has a more attractive valuation with a price-to-earnings of 24.49 versus 53.37 for CNK and AMC with negative earnings. However, we can see that the price-to-sales ratio is high at 3.73 compared to CNK, for which investors are paying less than a dollar for every dollar generated. IMAX has yet to return to its normalised revenue generation, for which the reopening of the Chinese market will play an essential role in FY 2023.

Relative peer valuation (SeekingAlpha.com)

Risks

Cinema stocks have yet to recover to their 2019 highs, and with the increase in streaming platform offerings, it may be hard for these companies to reach the exact attendance numbers. Streaming platforms are entering the movie space to diversify content to increase subscriber growth. Apple Inc. (AAPL) plans to spend over $1 billion on movies for theatre release, and Amazon Inc. (AMZN) was considering purchasing AMC. This could impact the company’s future performance.

Final thoughts

IMAX is riding high off of the opening of the Chinese market and successful blockbuster hits, in addition to a growing number of local language films on offer across exciting markets such as India which saw tremendous growth in 2022. Although the company has not yet reached the highs of 2019, the development and strong forecast for FY2023 are promising. With the release of the Q1 2023 Earnings report just around the corner and strong tailwinds indicating a potentially financially solid quarter, investors may want to take a bullish stance on this stock that relies on its technology to give customers a screening experience that is difficult to replicate elsewhere.

FY2023 Forecast (Investor presentation 2023)