jetcityimage

The iShares Lengthy-Time period Company Bond ETF (NYSEARCA:IGLB) has traded down meaningfully and deservedly so. Whereas shopping for bond ETFs makes a whole lot of sense, particularly as it’s costly to purchase bonds straight from the broker-dealer networks that commerce them, you must watch out about what you are doing. Sure, there’s a fixed money circulation and that may be interesting, however period issues loads for capital appreciation and the depth of abrasion of financial return from a coupon. IGLB has actually excessive period bonds. Whereas credit score threat shouldn’t be an element, and YTMs are fairly good, we simply do not see the explanation to speculate now with extra fee hikes coming in and the financial atmosphere being so unsure.

IGLB Breakdown

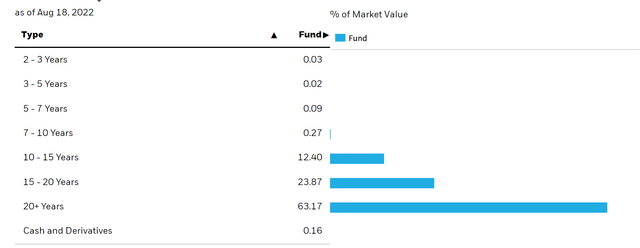

The IGLB actually earns its identify as a result of durations are actually lengthy.

Breakdown (iShares.com)

Trying on the detailed holdings information, the weighted common period of the portfolio is 13.4 years. Indicatively that signifies that for each 1% enhance in charges, the value ought to decline by 13.4%. Once more, that is indicative, however it exhibits the potential sensitivity.

Credit score qualities are technically somewhat good, actually funding grade, however in our opinion as fairness buyers, the shares which have issued debt that this ETF holds are all terribly protected. The riskiest is perhaps AT&T (T) however even they we might contemplate very sturdy. Different issuers embody Apple (AAPL), different telco corporations, nicely capitalised monetary establishments, and Oracle (ORCL) and Microsoft (MSFT).

Conclusions

At present, the weighted common YTM on the bonds is sort of 5%. Which may really feel interesting, however not like the dividend on a nicely chosen fairness, this is not going to develop. The typical worth is 94, which means they’re on common buying and selling beneath par and coupons have gotten more and more dwarfed. Because of the excessive period, if charges proceed to rise, which is probably going on condition that unemployment stays terribly low and core inflation stays excessive, additional worth declines are seemingly, and a weak unfold between the coupons between 4 and 5% and the reference fee, quickly approaching 3%, demonstrates the anti-economy within the funding. Greater charges are probably the brand new regular with capability crimps and provide chain issues more likely to partially persist resulting from rising financial disintegration. So it’s each a long-term and quick concern with increased charges additionally seemingly so as to add to the already substantial 20% YTD decline.

If buyers need to contemplate bonds as a method of parking cash throughout the present uncertainty, low maturity company bonds is perhaps the best way to guarantee some earnings, whereas additionally having coherence between the potential horizon of a downturn and the maturity of the bond portfolio. A period of most 2 years, which might signify a bear market on the longer facet, is sensible, given the uncertainty across the present financial atmosphere, together with latent declines in company spending reflecting already observable declines in client spending.

Whereas we do not usually do macroeconomic opinions, we do sometimes on our market service right here on Looking for Alpha, The Worth Lab. We give attention to long-only worth concepts, the place we attempt to discover worldwide mispriced equities and goal a portfolio yield of about 4%. We have completed very well for ourselves during the last 5 years, however it took getting our arms soiled in worldwide markets. If you’re a value-investor, critical about defending your wealth, us on the Worth Lab is perhaps of inspiration. Give our no-strings-attached free trial a attempt to see if it is for you.