tadamichi

Investing in fixed-income securities, particularly corporate bonds, is an essential part of diversifying one’s investment portfolio. And it becomes a lot easier when the Fed isn’t raising rates. That’s one reason the iShares 5-10 Year Investment Grade Corporate Bond ETF (IGIB) is worth a look.

IGIB is an exchange-traded fund that primarily invests in U.S. investment-grade corporate bonds with maturities ranging between 5 and 10 years. Managed by BlackRock’s iShares ETF group, IGIB has amassed over $12B in assets and over 2,600 securities, making it a substantial player in the corporate bond market.

The ETF aims to track the performance of the ICE® BofA® 5-10 Year US Corporate Index, providing exposure to the mid-duration segment of the U.S. investment grade corporate bond market. The fund’s holdings primarily consist of bonds from reputable companies that display high solvency and cash generation capabilities.

A Dive into IGIB’s Holdings

IGIB’s portfolio composition is quite diversified, with a significant portion of its holdings spread across various sectors and industries. The top individual positions in IGIB’s portfolio are all Financials, and include:

- Bank of America Corporation: This entity stands as a global powerhouse in investment banking and financial services, marking its position as one of the foremost banking entities within the United States.

- JPMorgan Chase & Company: Recognized as a premier institution in the realm of global financial services, JPMorgan Chase & Company commands a significant presence as a top-tier banking authority in the U.S.

- Morgan Stanley: Operating on a global scale, Morgan Stanley excels in offering a diverse array of financial services, including investment banking, securities, wealth management, and investment management solutions.

- Citigroup Incorporated: With its headquarters anchored in New York City, Citigroup Incorporated operates as a global leader in investment banking and financial services.

- Wells Fargo & Company: Headquartered in San Francisco, Wells Fargo & Company is a widely recognized multinational financial services firm with a broad international presence.

Sector Composition and Weightings

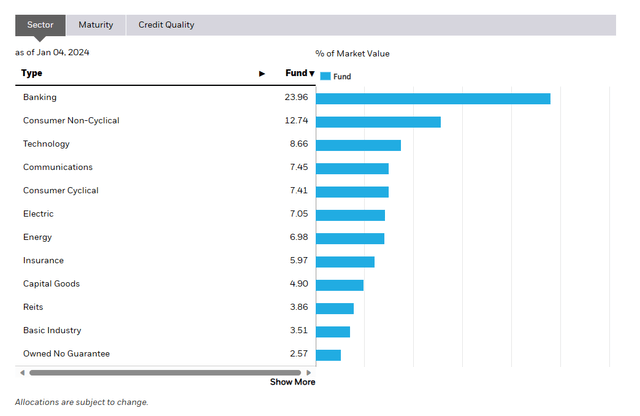

A closer look at IGIB’s sector composition reveals that the fund heavily invests in the Banking sector, followed by the Consumer Non-Cyclical and Technology sectors.

ishares.com

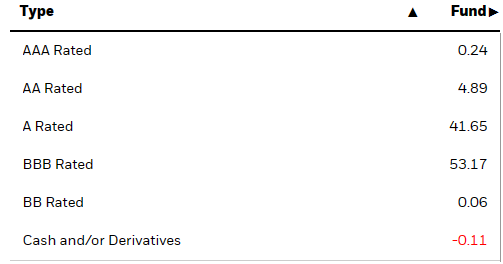

Credit quality is primarily in the A to BBB range.

ishares.com

Peer Comparison

When compared to similar ETFs, IGIB stands out due to its balanced approach to fixed-income investing. For instance, the iShares 10+ Year Investment Grade Corporate Bond ETF (IGLB) holds bonds with a longer duration, making it more sensitive to interest rate changes. On the other hand, the iShares 1-5 Year Investment Grade Corporate Bond ETF (IGSB) invests in bonds with a shorter duration, offering lower yields but also lower sensitivity to interest rate fluctuations.

Pros and Cons of IGIB

Like any investment, IGIB comes with its own set of advantages and disadvantages. One of its key strengths is its focus on investment-grade bonds, which offer a reliable stream of income and stability during market downturns. Additionally, IGIB’s intermediate-term maturity profile strategically positions it within the yield curve, balancing income generation and interest rate risk management.

However, IGIB also faces risks associated with potential economic recessions and interest rate hikes. These factors can impact the bond market, causing bond prices to decline and affecting IGIB’s performance. While these are largely high quality funds, we can’t disregard credit risk which could adversely impact performance.

Conclusion: To Invest or Not to Invest?

Investing in IGIB presents an opportunity to earn consistent income through regular coupon payments and enjoy potential capital appreciation in the long run. However, the potential risks associated with economic downturns and interest rate changes warrant caution should credit spreads widen as I have been warning about for several months now. It’s a good core bond fund though without much duration risk relative to other options out there, and extremely well diversified across corporate credit.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).