Tarun Gupta/iStock via Getty Images

The India Fund overview

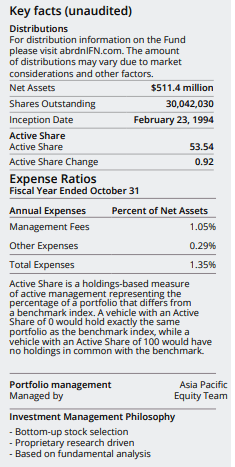

The India Fund (NYSE:IFN) is a closed end fund focused solely on listed Indian equities. It has a very long-established history dating back to 1994 and has good sized scale with AUMs above $500 million. The expense ratio of around 1.3% is reasonable, as is their overall performance over the long term. Whilst the fund’s distribution late last year was very high, that is not at a level that is sustainable in the future. Investors should be prepared for inconsistency with the distributions they receive.

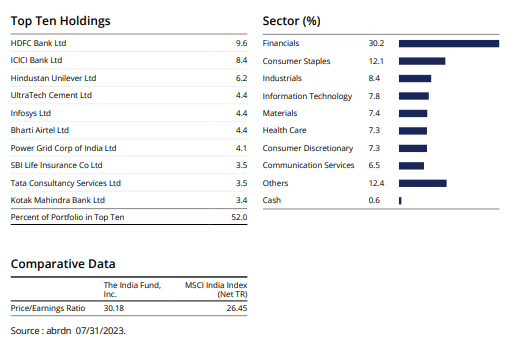

The India Fund factsheet July 31, 2023.

They are not afraid to deviate from their benchmark and actively manage the portfolio. At times this has proved successful, although I note no meaningful edge in their NAV returns over their benchmark in the long run.

Performance over the last 5 years has been given an extra boost because of the market price closing the discount to the NAV. This may present one of various signs that Indian equities are overbought, making them vulnerable to any unexpected negative news.

The India Fund past performance

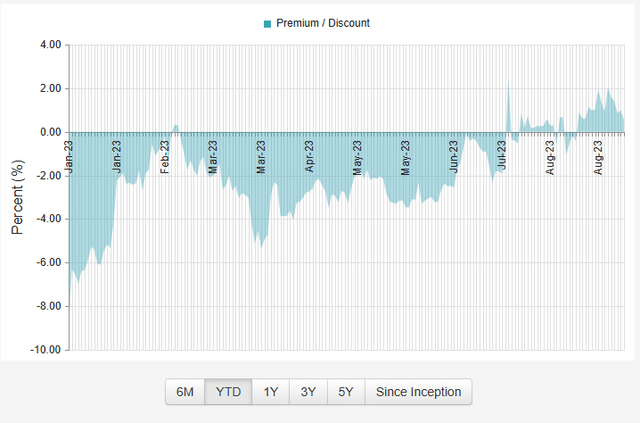

Investors in the India Fund this year should be very pleased with the YTD returns of circa 20%. That is based off the price traded and some distributions received until August 31. Longer term returns are illustrated in the table below. Note the latest factsheet there supplied contains data until July 31.

The India Fund factsheet July 31, 2023.

Investors should however acknowledge the rare factors at play with returns achieved thus far this year. Firstly, the fund in 2023 has seen solid active outperformance versus the listed benchmark in NAV terms. As mentioned earlier, this has not been consistently observed over the history of the fund.

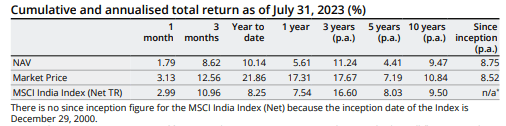

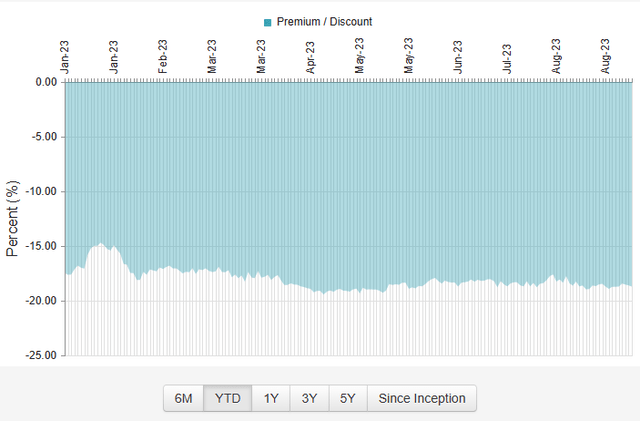

Secondly, the magnitude of the market price closing the discount to NAV this year has been quite pronounced.

CEF Fund Connect – The India Fund YTD premium / discount chart at September 1, 2023.

Such a move in the closing of the discount to NAV in this emerging market CEF is not a trend I have observed across other similar funds.

For example, refer to below for the MS India Investment Fund (IIF). This is a smaller India CEF with approximately $300 million AUMs.

Cef Fund Connect – The MS India Investment Fund YTD premium / discount chart at September 1, 2023.

As a result of these couple of unusual factors, about an extra 10% has therefore been added to the returns of the India Fund this year.

This development, plus signs of overvaluations in Indian equities in general this year, make for an opportune time to lighten exposure to this fund.

Are Indian stocks expensive?

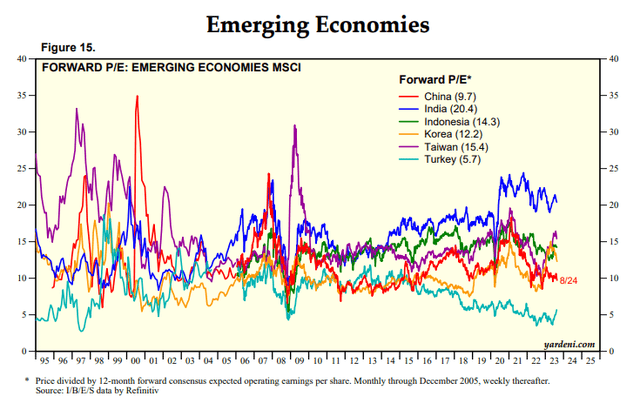

I do acknowledge here that Indian stocks generally trade on higher earnings multiples compared to most other markets, particularly other emerging stock markets.

yardeni.com,via Refinitiv data, to August 30, 2023.

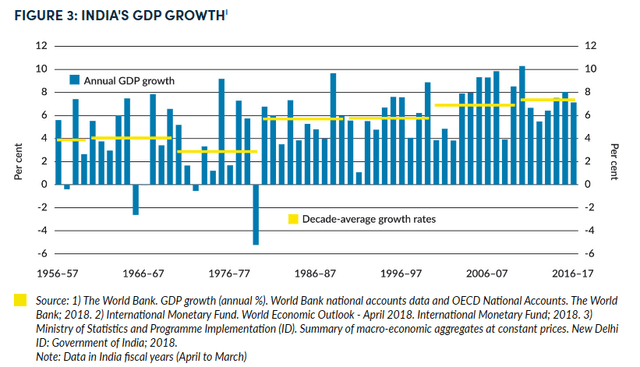

In this respect though, investors often have short memories. The above chart begins in the mid-90s, which is also the time when India’s GDP gained solid consistent momentum. Structural economic reforms accelerated from 1991, where soon after suddenly GDP of 6 to 7% became more normal without much interruption.

dfat.gov.au, via World Bank / IMF / Govt of India

Even though for the last three decades India has been considered a popular successful emerging market story, the volatility in P/E ratios has been large.

Indian forward P/E ratios have suffered major negative moves during the global economic slumps of the early 2000s, then in 2008.

As shown in the emerging market P/E chart earlier, the forward P/E of the Indian market slumped from the mid-20s to single digits on both occasions.

Indian stocks deserving of a premium P/E rating but to what degree?

Let’s acknowledge many reasons that do explain the relatively higher forward P/E ratios that Indian stocks often trade on. Fundamentally there is a lot to like, however over the last year the positives have been given a lot of attention.

I suspect Indian stocks have been given an extra boost in this period, due to stocks in China widely being described as “uninvestable”. In the last few months again in particular, the media has been quite negative on China. This is not without valid reason, yet it’s quite possible it has led to Indian stocks being overvalued.

Sometimes the easy call by fund managers is to manage their “career risk”, and to flock to the market that has obvious positive fundamentals, regardless of valuations. An emerging market manager for instance, might feel safe about reducing Chinese exposure in preference for Indian stocks. After all, if this move proves to be wrong, they will probably keep their job anyway as everyone else was doing the same!

Positive economic fundamentals of India

Amongst the factors that draw investors to the Indian stock market in recent times would be the following:

- Favorable demographics, with a young and well educated workforce and large population.

- Consistently strong annual GDP of circa 7%.

- Relatively well regarded and stable political leadership and central bank.

- Strong technology sector.

- Positioned well for positive FDI flows compared to others, including the “China plus one” thematic.

- A strong domestic economic story in terms of consumption and infrastructure growth.

I would not debate such positive arguments for India, but query if these positives can carry the weight of paying high earnings multiples for their stocks. Some of these arguments have not enabled India to escape significant stock market valuation declines in the past when global growth is under pressure.

Are Indian equities “priced for perfection”?

You don’t have to search too long to find stories on why Indian stocks are the place to be right now.

India has become the logical favorite emerging stock market for emerging stock market fund managers. High profile stockbrokers are recommending India as their top pick , and upgrading the market to “overweight”.

Other little worrying signals that are not necessarily signs to rush out and sell Indian stocks, but collectively are a cause for concern, are appearing. For example, the increased flow of funds from both global investors, and from local retail traders might be a sign of an imminent correction.

In August, foreigners were snapping up Indian stocks, and rushing out of their Chinese equities exposures. Do such trends of flows indicate these foreign investors made such moves because they have high conviction of Indian stocks in the long term? I see some risk that it may be more of a sign that the first consideration here is simply to exit Chinese stocks. I question therefore if such funds will have “strong hands” if we see more volatility in the Indian stock market later this year.

Another recent positive article about Indian stocks referenced the positive flows not only from foreign institutions, but also local retail investors. “But recently there has been a “confluence of positive flows” from both domestic retail and foreign institutional investors due to an “amazing allocation towards equity investments,” Peeyush Mittal, portfolio manager at Matthews Asia, told CNBC.

Complacency in sentiment for Indian stocks

Overall, I sense some complacency in such articles.

Likewise with the fact I pointed to earlier, with the India Fund now moving to trading at a premium to NAV. If anything, such changes are more associated with market tops. Whereas with emerging market bottoms you often see widespread disinterest in the country’s stock market from domestic retail investors and foreign institutions. You may also see large discounts to the country’s CEFs and maybe them and ETFs being closed down.

The political environment for India looks comparatively favorable compared to many other countries. Is that also a sign however to consider lightning positions in an emerging market? After all, EM stock markets are very volatile and renowned for political risks. If something left field comes out to unsettle the relative calm, then often by then it is too late to sell.

The Modi government is tipped to win another term in 2024 which should satisfy the market bulls. One criticism of the emerging success story of India though is a widening gap between the rich and the poor. This could provide some backdrop to some profit taking in the future as an election date looms ahead.

On the geopolitical front India is also seen as a relatively sound place to invest compared to many other emerging markets. The recent BRICS summit however, might lead to more discussion globally about the future surrounding potential risks for the Indian economy.

High economic growth rates do not guarantee good stock market returns

Those drawn to Indian stocks primarily because of the higher economic growth rates should at least be mindful of the myth of the economy driving the stock market. The correlations overall over the long run are perhaps weaker than many first imagine.

Also, as my earlier chart showed on long term EM forward P/E ratios, India was clearly affected by global slumps in 2000, 2008 and 2020. This leads me to be quite cautious on the common narrative around about India being a safe haven destination to invest in.

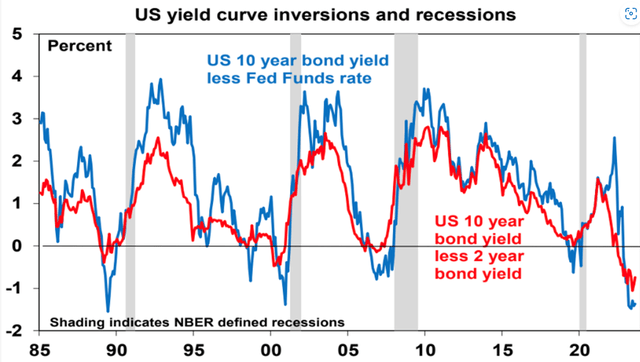

Like in those periods of global economic slumps just mentioned, global leading indicators are not looking too great right now.

One being the much-discussed inversion of the US yield curve.

Bloomberg, AMP.

The India Fund portfolio characteristics

The India Fund factsheet July 31, 2023.

The India Fund has a higher P/E ratio than its benchmark, and one above 30 times.

Conclusion

I considered placing a “hold” rather than a “sell” on the India Fund, reflecting on my general agreement with the longer term positive economic story.

Should investors be sitting on large gains from quite a few years back, it might be better to always keep a strategic position in India and avoid unnecessary turnover and taxes. That is an easier strategy for the more passive investor.

In conclusion though, I placed a “sell” on the India Fund. This reflects more my opinion of bullish sentiment being overly high, at the time of valuations being on the upper side of historical ranges. I see the market being vulnerable in the short term to any slight disappointment. This may come from unexpected global shocks that India is not immune from. Possibilities include recession in other major global economies and potentially negative geopolitical developments.

Also influencing my opinion were perhaps other investments that could be more relatively attractive for EM exposures. Possibly switching to the MS India Investment Fund I briefly mentioned earlier could make sense. It trades at near a 20% discount to NAV as opposed to a premium with the India Fund.

Or if one wanted to diversify their bets on other markets with favorable GDP and demographic stories, the Indonesia and Vietnam markets could be worth consideration. In these cases, forward P/E ratios are around 14 times rather than above 20. These markets seem more “under the radar” in terms of attention from global investors right now.