alberto clemares expósito/iStock via Getty Images

I think that we are at the start of a major technology-driven bull market that will rival the “dotcom” bull market. In this piece, I make the case for a new tech-driven bull market that will rival the 1990’s dotcom bull.

All major bull markets require three conditions:

- a disruptive technology,

- funding (money) to release the real-resources, and

- fear (incredulity) in the herd of investors.

In the 1990s, there was:

- the new communication technology of the internet,

- bank-credit funding of the economy, and

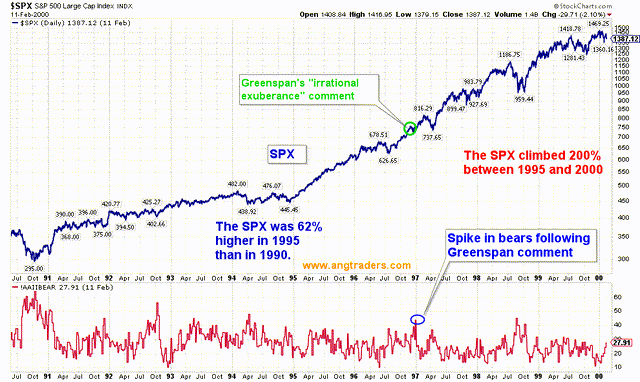

- fear (incredulity) in the herd. (Greenspan’s infamous “irrational exuberance” comment in 1996 personified the belief that the top was near, after which the market climbed 100% over the next three years.)

Dotcom fear and incredulity (ANG Traders, stockcharts.com)

Now, we have:

- a disruptive technology (artificial intelligence), the impact of which could rival the invention of computers,

- the investing-herd is terrified of inflation, higher interest rates, recession, the Federal Government “debt”, and the very AI technology that will drive the economy forward.

- and most importantly, government fund-flows (deficit-spending) that can release the technology into the economy. [Note: in the 1990s, Clinton had a budget surplus, which means funds were removed from the economy on a net-basis (private-deficit) and had to be compensated for with private bank credit].

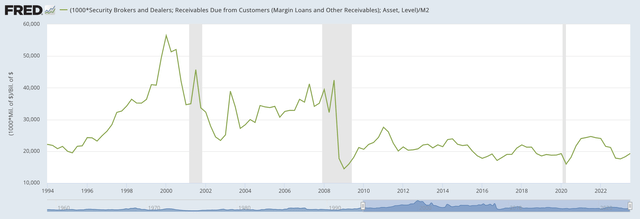

The chart below shows the explosion of margin debt during the late 1990s; the dotcom bull was funded through private debt.

Margin debt (FRED)

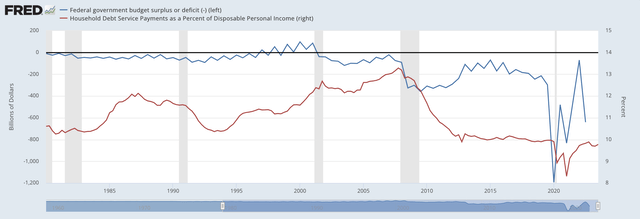

The chart below shows how Clinton delivered a budget surplus between 1996 and 2001 (blue line). A government surplus means that more money is taxed out of private bank accounts than was spent into them. A government surplus is a private-sector deficit; money is net-drained from private bank accounts. The Clinton private-sector deficit was compensated for by increasing bank credit; the red line below shows how household debt burden increased along with government surpluses.

Budget surplus/deficit and private debt (FRED)

Unlike the 1990s, currently there is a healthy government deficit (private surplus) and a low private debt-level which could fund a bull market capable of making the 1990s bull look like a baby calf by comparison.

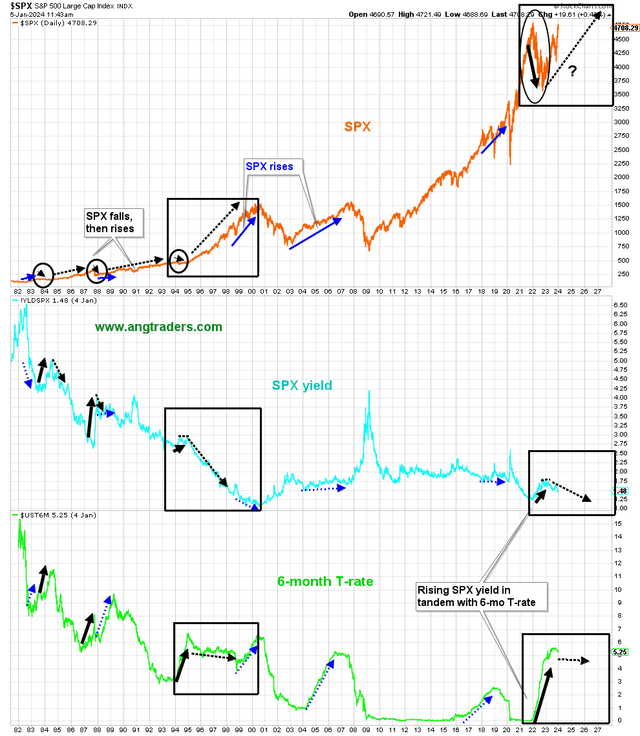

For the past two-years, I have pointed out that rising interest rates are good for the stock market. After the initial shock (black-ovals below), the stock market tends to rally hard (black and blue arrows below). The current situation is eerily similar to the late 1990s when the last major tech bull market took place (black-rectangles below).

Bullish rate hikes (ANG Traders, stockcharts.com)

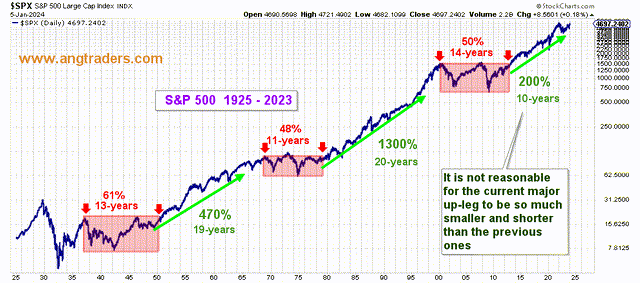

The very long term picture of the stock market is in a solid bullish primary trend. The chart below shows that the last 100-years of the stock market have been a “step-like” ascension of stock prices. There have been three major trading-range periods (“steps”) which lasted an average of 12-years and were separated by two major up-legs (“risers”) that lasted about 20-years each. The market is only 10-years into the current major up-leg, which implies that there could be as much as 10-years left in the current cyclical bull market.

100-year stock market (ANG Traders, stockcharts.com)

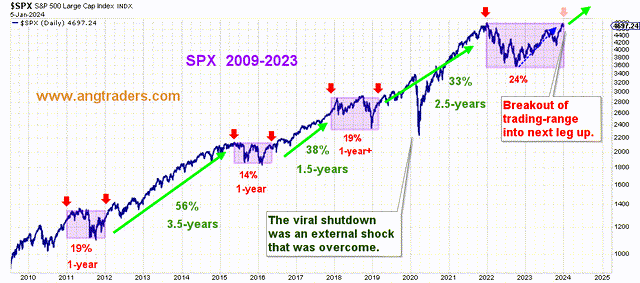

The chart below shows the fractal nature of the current major up-leg; there is a similar (fractal) pattern of “step-like” movement higher in stock prices. The SPX is on the verge of breaking out into the next short-term up-leg which could last up to 3-years before the next short-term trading-range develops.

Current fractal pattern (ANG Traders, stockcharts.com)

In conclusion, the fundamental conditions required for a major bull market resembling (and rivaling) the 1990s dotcom bull are in place.

“It is probably the only report of its type on the planet when you think about it.“

“ I am SO VERY thankful for the discovery of this site, and the wisdom and knowledge I have gained ... “

” I have not seen this type of analysis anywhere else. Please keep up the awesome work! – James “

“ Happy ANG subscriber here. I believe them to be the best broad market analysts on seeking alpha. “

” Best here in seeking alpha…@ANG Traders . Best of the best! “

Take advantage of our14-day free trial and stay on the right side of the market and Away From the Herd.