Kinwun

Investment Thesis

The company, run by Howard Jonas and his son Shmuel Jonas, has become a spin-off incubator. This is because they have a core business that is neither growing nor interesting but generates sufficient cash flows to develop new companies. Later, they take these companies public on the stock market as independent entities, thus creating value for shareholders, which the core business cannot provide.

I believe the opportunity exists because if you are not familiar with IDT’s history and you only examine the financial statements, you might consider leaving. Sales have shown little growth in recent years, and EBIT margin is minimal and not interesting at first glance.

In this article, we will discuss the three businesses currently under development within the company, any of which could become the subject of a spin-off at any time. Also, I will also perform a valuation to estimate the potential value the company could have if each business were valued individually.

Business Overview

IDT Corporation (NYSE:IDT) is a telecommunications company based in the United States. Its core business lies in traditional communication services, such as prepaid international calling services or wholesale carriers of international long-distance minutes. This segment of the business represented 91% of sales in FY2022, but is in secular decline because the consumer is moving towards internet-based calling applications such as WhatsApp and even video calls like Skype. However, IDT’s appeal lies not in its traditional communications business, but rather in the companies it has developed ‘at home,’ taking advantage of the cash flows generated by this segment. The company currently has three main businesses in ‘incubation,’ which are as follows:

net2phone

This company is a UCaaS (Unified Communications as a Service, also known as Unified Communications in the Cloud) provider, which involves integrating various communication tools on a single platform. This integration allows users to access multiple communication services, including IP Voice, contact center, video, email, instant messaging, and real-time collaboration, from a single platform, anytime, anywhere, and on any device. This business is particularly intriguing because its revenue source is a monthly subscription fee based on the number of seats on the platform. In other words, net2phone clients, typically businesses (making net2phone a B2B business), pay a subscription fee for each employee they wish to grant access to the unified communication network. This model generates predictable revenues with minimal incremental costs for adding new users.

Solutions like these are essential in the modern digital workplace as they enable quick and efficient collaboration with colleagues and clients, enhancing productivity in communication and collaboration. It’s not surprising that this market is experiencing double-digit growth rates in the US and is expected to maintain this trend for the next decade.

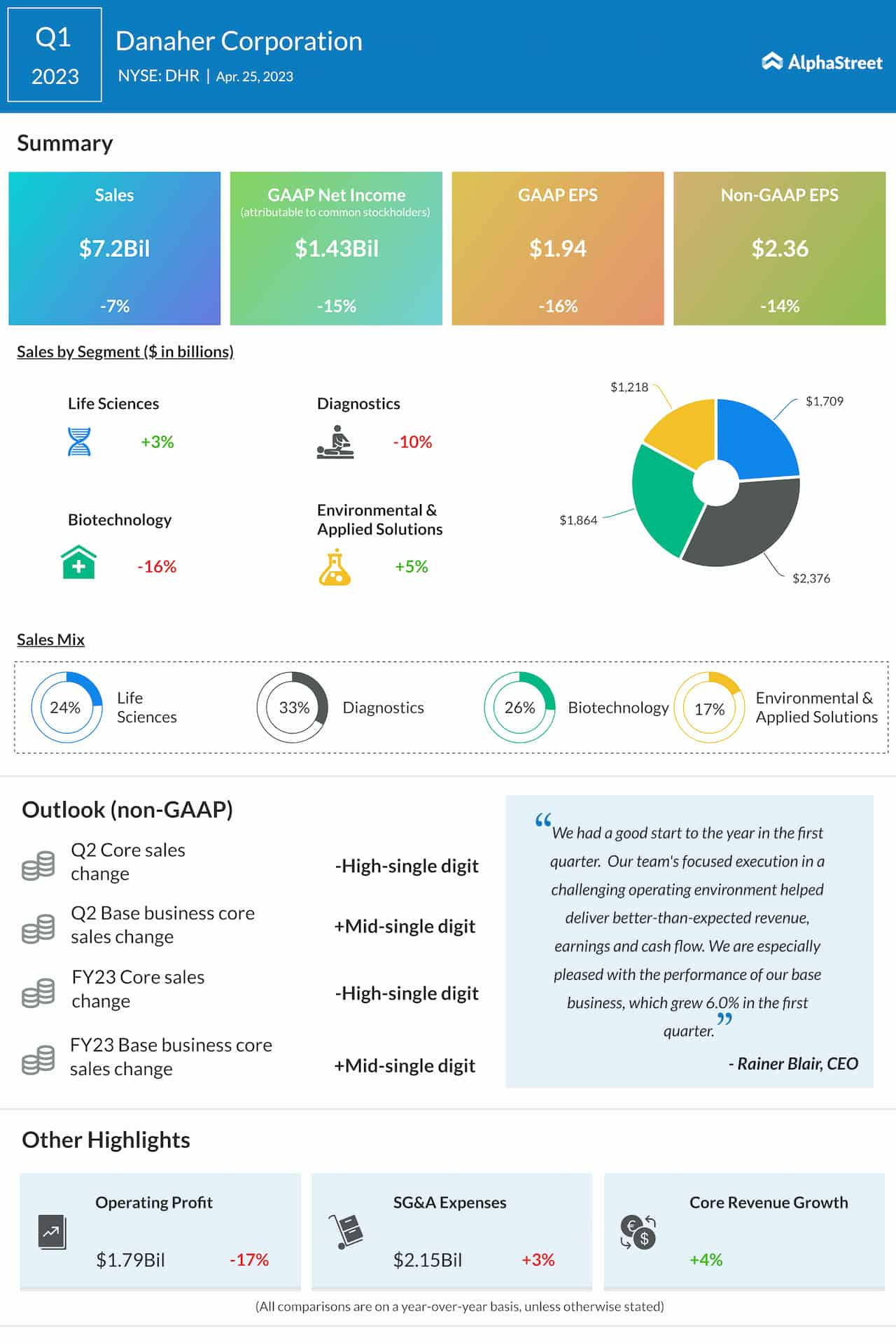

Net2phone’s revenue has been growing at a 33% CAGR between 2019 and 2022. Although it was not profitable in EBITDA during FY2022, we have observed a positive trend that eventually led to a profitable Q3 2023 with an Adjusted EBITDA Margin of 5.4%.

Author’s Representation

Boss Money

A Western Union-style international money transfer business that enables customers in the US to remit money to recipients in ~60 countries. Boss Money generates revenue through per-transaction fees charged to customers. While it may not have an extremely attractive business model, it is not a bad business by any means. This is because it can exhibit resilience during crises, given that many people rely on remittances for essential expenses in their home countries, such as food, housing, education, and healthcare. Consequently, there is often a steady demand for these services even during challenging economic times.

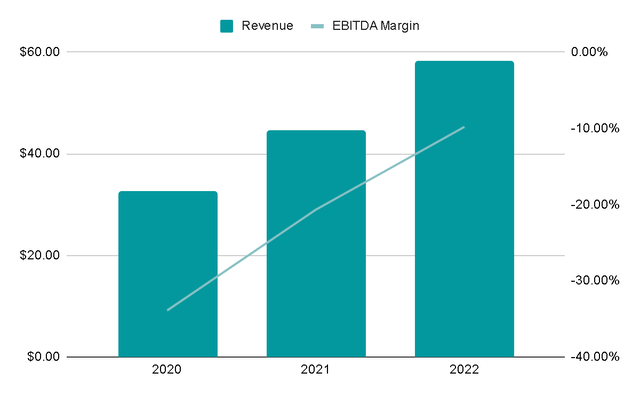

The company doubled between 2019 and 2020, but in FY2022 it had a non-depreciable growth rate of 15% and in Q3 2023 it grew 29% YoY and the volume increased by 38% to 3.28 million transactions, which is very positive. This business is not yet profitable in EBITDA, but comparable companies such as Western Union, International Money Express or MoneyGram usually have EBITDA margins of around 15 to 20%, so we could get an idea of how profitable the business can be and why the management is betting on this investment.

Author’s Representation

National Retail Solutions (NRS)

NRS is a point-of-sale platform catering to independent, niche-focused retailers such as convenience stores, liquor and tobacco stores, and bodegas. IDT sells terminals to these retailers, with nearly 24,000 active terminals in over 21,000 independent retail stores. Over the past year, they’ve added 6,000 terminals.

The hardware terminal sales offer growth but involve one-time payments. The real value comes from recurring revenues, driven by software subscriptions that include features like Employee Time Clock, inventory management, customer loyalty programs, and store performance statistics. These subscriptions typically cost between $25 and $65 per month, depending on the functionalities required.

Additionally, NRS processes credit and debit card payments for a commission on each transaction, adding to its income. Leveraging relationships built through the traditional communications business, NRS has room to grow, given the presence of over 150,000 independent convenience stores, as well as the potential to increase the average revenue per customer.

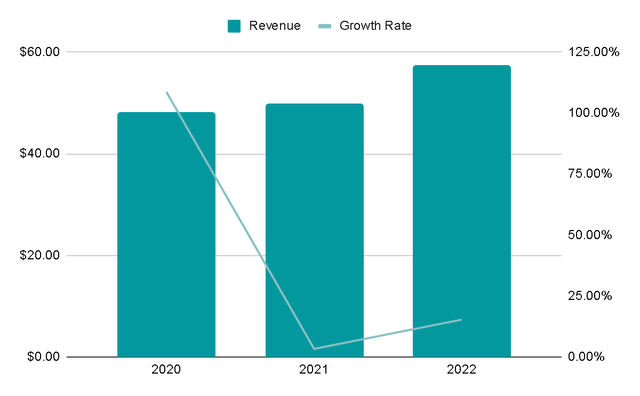

NRS has achieved triple-digit growth over the past three years, with a 60% growth in Q3 2023. Notably, it reached adjusted EBITDA margins of 23% in FY2022, which is in line with the expected performance of software businesses that typically generate EBITDA margins between 30% and 40%.

Author’s Representation

Straight Path Litigation

In 2013 IDT spun off a company called Straight Path Communications. It was listed at around $6 USD and was later sold to Verizon at $184 per share, a sign of how highly capable management is of generating value for its shareholders.

During this purchase process, legal problems arose between the companies involved. By way of summary, the accusation was as follows:

The lawsuit, filed by the plaintiffs in 2017, alleged that the Company aided and abetted Straight Path’s Chairman of the Board and Chief Executive Officer Davidi Jonas, and Howard S. Jonas in his capacity as controlling stockholder of Straight Path, in forcing an unfair settlement of claims between Straight Path and the Company at the time of the sale of Straight Path. The Court found that the settlement in fact exceeded the value of those claims, and that there was no harm to Straight Path stockholders as plaintiffs alleged.

However, on October 3, 2023 IDT announced that the Court dismissed the claims against IDT and found that the Class suffered no damages, to which the market reacted with a large rise of almost 22% thanks to the fact that this great risk was finally removed from the equation.

Anyway, I would like to mention that despite this enormous increase, the share price is still too attractive, as we’ll see next in the Valuation section.

Valuation

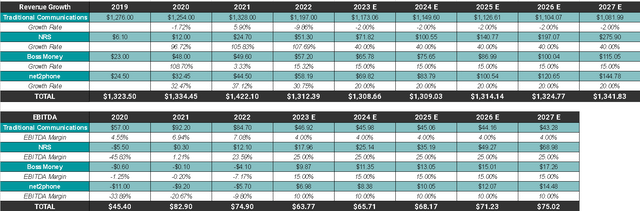

For the valuation I will do a sum of the parts, where I will calculate the EBITDA margins that each part of IDT can generate, I will assign a multiple according to what the market usually assigns to similar businesses and thus we can get a better idea of how much it should be worth. the company if each component were evaluated individually.

The image below displays the growth and margins for Traditional Communications, NRS, Boss Money, and net2phone, along with my forward guidance. It’s important to note that these figures represent the average growth and margins I anticipate over the next 5 years and does not imply the exact growth and margins that I expect each year. Actual performance may vary from year to year, but it should closely align with the averages shown.

- Traditional Communications: This segment of the business has decreased in previous years and it would make sense for it to continue doing so in coming years at rates of 2% CAGR. I will also consider that EBITDA margins are reduced to 4% on average.

- NRS: Estimating the growth of a high-growth business is challenging, but I consider a 40% CAGR to be a reasonable average for the next 5 years, and it might even be somewhat conservative. As for EBITDA margins, I believe they can reach around 25%, which is also a conservative considering that it is a business with a large part of its revenue comes from subscription, like a SaaS business.

- Boss Money: This business achieved a remarkable 35% CAGR over the past four years. I anticipate it can maintain a 15% annual growth rate in the future. Additionally, I’ve considered margins that are slightly below the average for comparable businesses.

- net2phone: I believe this business has significant potential for continued 20% annual growth, despite achieving 33% growth in recent years. As for future EBITDA margins, I will use the margins of companies like Crexendo, Five9, or 8×8, which have previously had margins close to 10%.

Valuation Assumptions (Author’s Representation)

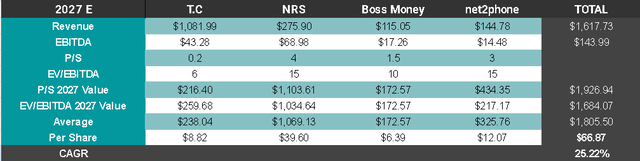

Subsequently, I opted to value it based on both sales and EBITDA, aiming for more precise calculations. The valuation multiples were determined by averaging those of comparable businesses listed on the stock market, with a conservative approach to the multiples assigned.

In the P/S and EV/EBITDA value lines, you can see the calculated values for each segment. The total value for the year 2027 averages about $1,800 million. On a per-share basis, this would amount to $70 USD, considering the 25.6 million diluted shares in circulation. This represents a potential annual return of 26% from the current price of $27 USD. This expected return seems excellent to me considering that we made conservative and reasonable projections at all moment.

Sum of the Parts (Author’s Representation)

Risks

While I find the businesses within IDT to be solid and profitable, it’s important to consider potential risks:

- The acceleration of the decline in the traditional business, which may affect its ability to finance new projects.

- Competitive pressures in the UCaaS market for net2phone and NRS’s sector, as other businesses like Thryv Holdings are exploring similar markets, potentially impacting growth.

- Delays in the Spin-Off’s release, which could lead to the market undervaluing IDT.

However, there are also positive factors worth noting, such as the company’s negative net debt of $132 million, indicating its ability to pay off debt with available cash. Additionally, IDT boasts a competent board of directors capable of adjusting the business’s direction as needed and determining the ideal time for independent listings.

Final Thoughts

It seems to me that after the excellent news that the lawsuit will not proceed, IDT is a much more solid and attractive company than it was before. Even so, the current valuation is extremely interesting considering that the businesses in incubation are quality and highly profitable when we see other peers that are listed on the stock market. Although the traditional business is in decline, the company is debt-free, so the risk of bankruptcy is minimal.

All this means that even considering the great rise the stock price had in recent days, IDT for me is still a ‘buy’ and a great company to keep in the long term as long as the board continues to generate value through the creation of new businesses.