Sundry Photography

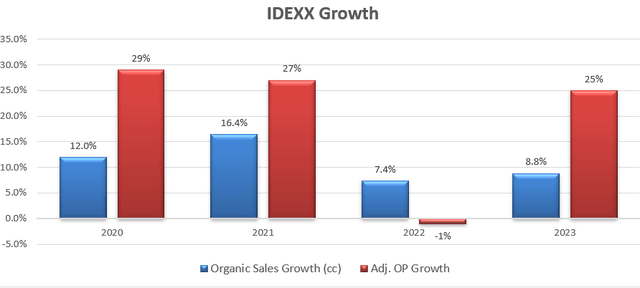

In my initiation report published in July 2023, I discussed IDEXX’s (NASDAQ:IDXX) recession resistant business model and their overpriced valuation. Since then, their stock price has underperformed compared to S&P 500 Index return. They finished FY23 with 8.8% organic revenue growth and 25% operating profit growth, maintaining strong growth momentum from both volume and net pricing. The double-digit growth in consumables, software, services, and diagnostic imaging drives the company’s recurring revenue growth. However, I still consider the stock price is overvalued, and I am downgrading to ‘Sell’ rating with a one-year price target of $420 per share.

Consumables and Veterinary Software and Diagnostic Imaging

IDEXX’s business model is quite simple: sell diagnostic equipment to veterinary professional, then sell rapid assay kits and consumables to generate recurring revenue. In addition, IDEXX offers veterinary software and diagnostic imaging system to help veterinary clinics manage their patient electronic health records, scheduling, client communication, billing, and inventory etc. The software is cloud-based SaaS products, generating monthly subscription revenue for IDEXX. IDEXX ImageVue DR50 and the IDEXX ImageVue DR30 provide radiographic images in digital form, replacing the traditional x-ray films, and IDEXX also sells related software to support their diagnostic imaging systems.

These products and services are generating recurring revenue streams for IDEXX, and most importantly, the business has been growing at double-digit, higher than the group level’s growth.

Based on my calculation, the recurring revenue from consumables, veterinary software and recurring part of diagnostic imaging account for approximately 38% of group revenue. In FY23, IDEXX VetLab consumables business grew by 12.7% organically in revenue and veterinary software and recurring part of diagnostic imaging grew by 18.8% year-over-year. The growth from recurring part is notably higher than the group revenue growth of 9.8%.

I anticipate the recurring business would continue strong double-digit growth momentum for the following reasons:

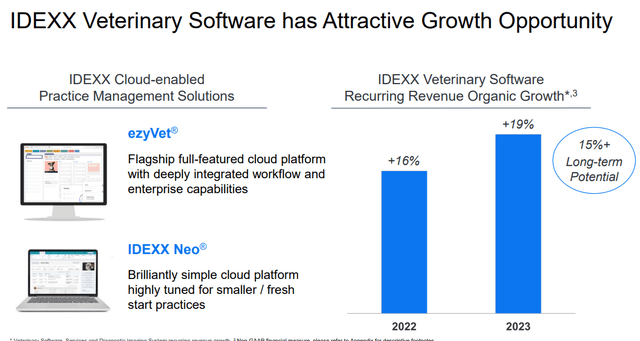

IDEXX Veterinary software comprises Patient management system, workflow optimization and client marketing and wellness plan management. As indicated by their management, the veterinary software could increase practise productivity, improve standard of care and enhance pet owner engagement. In addition, clinics can leverage the client marketing tool to provide customized services and promotions to pet owners, improving customer satisfaction. The veterinary software is a niche market, and IDEXX is primarily competing against Covetrus currently. IDEXX has a huge advantage in their massive customer base from their diagnostic business. IDEXX expects their software business to grow at 15% annually in the near future, as illustrated in the slide below.

IDEXX Investor Presentation

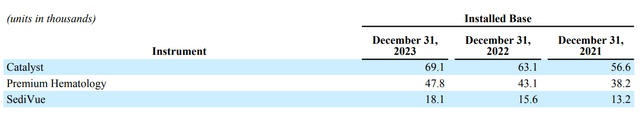

Consumable growth could be driven by two main factors: price and growing number of instrument install base. IDEXX grew their instrument install base by 11% in FY23, as detailed in the table below. Compared to other small competitors, IDEXX is focusing on premium and high-quality instruments, and they have been investing heavily on analyzer menus across urinalysis, hematology and chemistry.

IDEXX FY23 10K

In 2020, they launched ProCyte One Hematology Analyzer, simplifying the workflow and generating highly consistent results at the point of care. Since then, IDEXX has rapidly placed Premium Hematology, with 47.8 thousand installed base by the end of FY23. Considering their consistent product innovation and R&D investments, I foresee IDEXX maintaining their leadership in the diagnostic instrument market.

In Q4 FY23, IDEXX realized a global net price improvement of 6% to 7% in the CAG Diagnostic segment, and the company expects to realize another 5% in FY24. Why does IDEXX have such strong pricing power? Pet diagnostic market is a quite unique market, and IDEXX has a strong brand recognition. In my view, when a company holds a strong market share in a small niche market, the company is more likely to possess pricing power over their customers.

In short, I think consumables, veterinary software and diagnostic imaging are valuable assets for IDEXX, making the overall business highly recurring.

Recent Result and FY24 Forecast

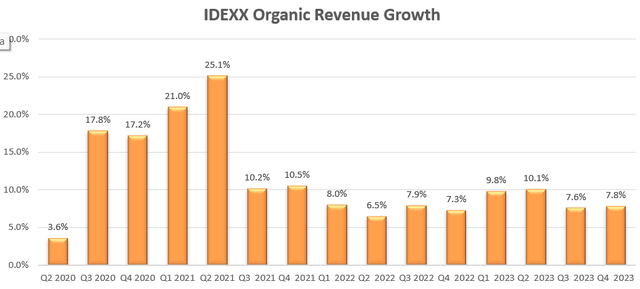

IDEXX published their Q4 FY23 result on February 5th, delivering 7.8% organic revenue growth and 7.2% adjusted operating profit growth. As shown in the chart below, their organic revenue growth has normalized from the overheated market during the global pandemic.

IDEXX Quarterly Results

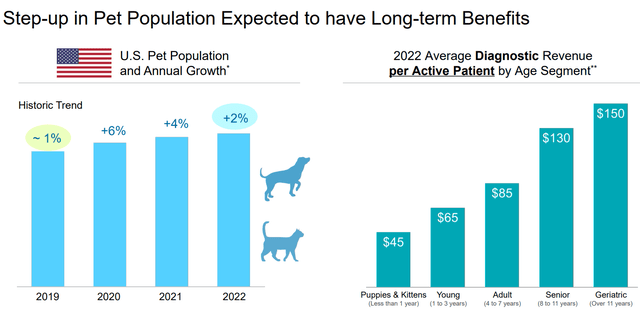

During the global pandemic, many families adopted pets due to work-from-home environment. The U.S. pet population experienced abnormal growth of 6% in 2020 and another 4% in 2021. The overheated market started to normalize when coming out of pandemic, as evidenced by IDEXX’s organic revenue growth. I think the normalization of market growth explains the weakness of IDEXX’s stock price in the past years.

IDEXX Investor Presentation

For the full year, IDEXX grew their revenue by 8.8% and operating profits by 25% year-over-year, driven by strong pricing growth and cost improvement. They generated $772 million of FCF, and repurchased $72 million of own shares.

IDEXX 10Ks

In terms of FY24 growth, I am considering these factors:

-Pricing growth: As discussed, IDEXX has strong pricing power for their consumables, software, and digital imaging systems. Historically, they have delivered 4%-5% net pricing growth. I don’t expect the trend changing in the near future.

-Pet Growth: According to Future Market Insights, the adoption of pets is expected to progress at a CAGR of 8% from 2023 to 2033, as pet owners increasingly treat pets as cherished family members. I think the 8% growth might be too optimistic, however, 3-4% of growth is quite possible, in my view. The rising adoption of pets is coupled with the declining global birth rate. According to CNN, the fertility rate has decreased from 4.84 in 1950 to 2.23 in 2021 and is expected to drop to 1.59 by 2100.

– Software and Services Penetration: IDEXX has a huge growth potential in their software/services by penetrating their extensive customer base. The higher revenue mix towards software/services could make IDEXX’s business more recurring.

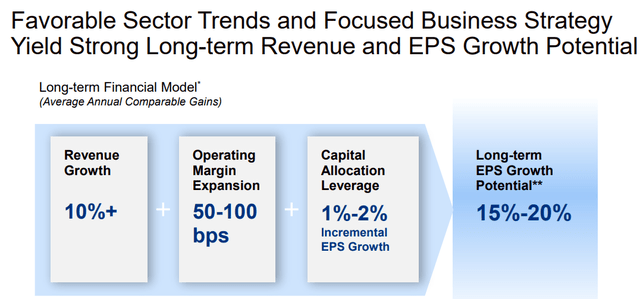

On the consolidated level, I forecast IDEXX to achieve 4%-5% net pricing growth, 3%-4% of pet volume growth, and additional 2% growth from software/services. Therefore, I think IDEXX can deliver at least 10% organic revenue growth in the near future.

The growth assumption is also aligned with their own long-term growth target, as shown in the slide below.

IDEXX Investor Presentation

Valuation Update

As discussed above, I forecast IDEXX to deliver 10% organic revenue growth in the DCF model, and frankly, I think it is a quite conservative assumption.

I assume 30bps annual margin expansion for IDEXX driven by the two main factors:

-Pricing Growth: IDEXX is more likely to achieve 4%-5% net pricing growth annually in my view. The net pricing growth will be driven by their innovated new product offerings and a shift in revenue mix towards consumable and software/services. As disclosed by their management, 70%-80% of their R&D resources have been allocated towards new products, including instrument platform, differentiated assay development, and consumer-facing software, data and connectivity. Additionally, consumables, software and services carry much higher gross margin, and these businesses are experiencing faster growth compared to the group level, as discussed previously. The increasing revenue mix towards consumables, software and services would further increase their gross margin. Based on my calculation, the gross margin will improve by 20bps per year.

-Sales & Marketing Leverage: IDEXX spent 17.4% of revenue in sales & marketing in FY19, and the ratio dropped to 15.5% in FY23, as the company began to control their costs and improve sales productivities via more innovative and premium products offerings. I expect a 10bps leverage from sales & marketing going forward.

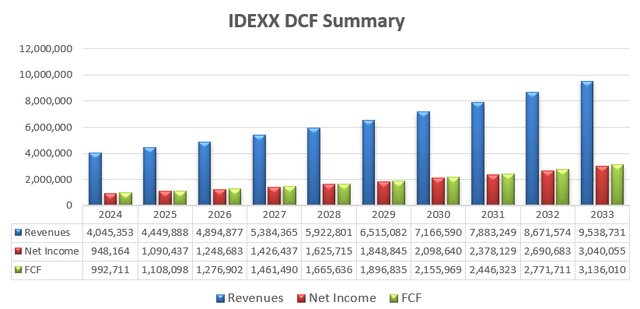

With these assumptions and a 22% tax rate, the revenue and profit are projected as follows:

IDEXX DCF – Author’s Calculation

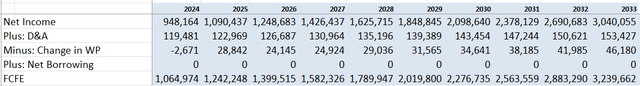

The detailed calculation of free cash flow to equity can be found below:

IDEXX DCF – Author’s Calculation

IDEXX’s cost of equity is calculated to be 14.4% assuming: risk-free 4.22% ((U.S. 10-Year Treasury Yield); equity risk premium 7%; beta 1.46 (SA’s DATA)). Discounting all the future FCFE, the one-year price target of IDEXX’s stock is calculated to be $420 per share.

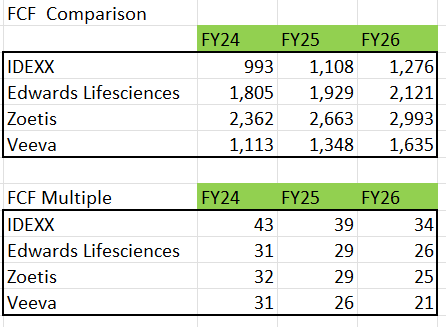

In addition, I compare IDEXX’s valuation to other fast-growing healthcare stocks including Edwards Lifesciences (EW), Zoetis (ZTS), and Veeva (VEEV). The table below presents a comparison of their projected free cash flow over the next three years, and the corresponding free cash flow multiples. It is clearly that IDEXX has the highest FCF multiple among these growth stocks, as per my calculation.

Author’s Calculations

Key Risks

Livestock, Poultry and Dairy: IDEXX holds some non-core assets including Livestock, Poultry and Dairy (LPD). They provide provides diagnostic tests tools to livestock and poultry. The whole business only represents 3.3% of group revenue, and IDEXX has not invested enough in this non-core business. As a result, the organic revenue growth has been negative for three fiscal years in a row, accompanied by declining operating profits. I don’t anticipate IDEXX could turnaround this small business anytime soon.

Discretionary Spending: Although IDEXX’s business is highly recurring, the overall pets diagnostic market depends on the financial situation of pet owners. If households income starts to worsen, the pet care market might be negatively impacted, and pet adoption growth might turn negative as well.

Rating: Hold or Sell?

I acknowledge that IDEXX is a quite unique franchise in the healthcare sector, and the market and institutional investors might favor the following characteristics about IDEXX:

-High Recurring Business Model: as mentioned earlier, the recurring revenue accounts for approximately 38% of group revenue. More importantly, these recurring businesses including consumables, digital imaging and software have been growing faster than other parts of the business. Similar to SaaS companies in the tech sector, highly recurring businesses are more likely to be assigned a higher multiple.

-IDEXX’s business is less sensitive to the macroeconomics. For instance, their organic revenue grew 0.7% in 2009 with 1.1% of revenue growth in the Companion Animal Group. IDEXX has not experienced any negative revenue growth over the past 15 years.

As such, I can understand why the market assigns a quite high multiple to the stock. I choose the ‘Sell’ rating here, as the stock price is 19% overvalued according to my calculation. I’d prefer to divest IDEXX position and allocate the funds to other growth healthcare stocks like Veeva and Edwards Lifesciences with better valuations.

Conclusion

The double-digit growth in consumables, software, services, and diagnostic imaging has made IDEXX’s business more attractive to investors, partially explaining their high stock multiple in my view. I acknowledge the high-quality of IDEXX’s business and superior management team. However, I worry about their overpriced stock price, thus I am downgrading to ‘Sell’ rating with a one-year price target of $420 per share.