Mat Szwajkos

Icahn Enterprises (NASDAQ:IEP) is an interesting recession hedge especially for those seeking higher quarterly cash payments to make ends meet. The yield of close to 15% is really not directly dependent on current income in the partnership so it really does not matter if the recession is mild or severe because the quarterly $2.00 distribution mostly will not be decreased. Even if the market value of their securities portfolio drops because of a recession, the high distribution yield will keep the market price of IEP units from dropping significantly. Because of the complexities of the limited partnership and the U.S. income tax code, IEP units may not, however, be suitable for all investors.

High Distribution Yield Protects Against a Recession

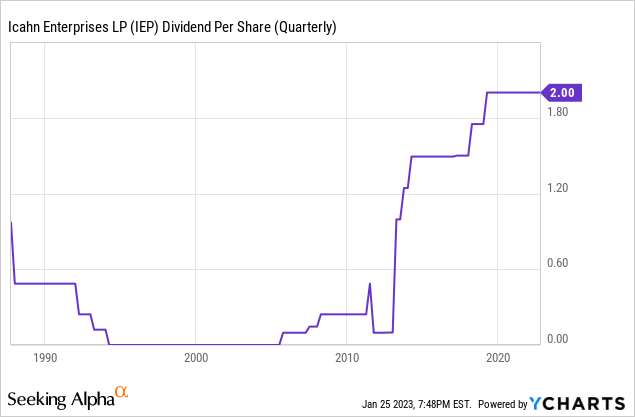

IEP is currently trading at a yield close to 15%. This high yield is based on a quarterly distribution of $2.00 per unit. This is a limited partnership distribution – it is NOT a dividend. There is a huge difference. Too often SA authors and SA editors use the word dividend when describing IEP’s distribution. It is taxed differently than a dividend for one thing. Often dividends are fairly highly related to current income and there is also discussion of “dividend payout” percentage. There is no direct strong correlation between IEP’s quarterly distributions and their current income, which is a major reason why IEP is an attractive investment during a recession. Many years ago, there were some decreases in the annual payments, but over the last 11 years the payments have remained the same or even increased.

Quarterly Distribution Per Unit

(Note: the incorrect usage of “dividend” by YCharts)

Most of their $2.00 quarterly distributions are really just bookkeeping entries because Carl Icahn and his associates elect to get IEP units. This causes a significant increase in units outstanding. For the first nine months of 2022 units outstanding increased by 33,364,320 and as of November 3 there were 337,473,951 units outstanding. Only $158 million cash was used to pay the distributions for the first nine months of 2022. This compares to $2.4 billion cash on their books as of September 30. This figure does not even include $4.8 billion cash held at consolidated affiliated partnerships and restricted cash. This is why, in my opinion, their distribution of $2.00 per unit is fairly safe during a recession because not much cash is used to actually pay it. There is, however, a very high level of long-term debt of $5.3 billion at the holding company level, which does not include a total of $1.8 billion long-term debt at the operating level. This debt compares to a balance sheet total equity of close to $9.9 billion.

To repeat again, even if there is a recession it is unlikely the distribution will be decreased. Since IEP unit price is supported by the very high yield, it is unlikely IEP will have a major price drop during a recession. In addition, while the market pricing of IEP is somewhat influenced by the market value of their securities portfolio, units do not trade based on net current asset value. IEP is not some mutual fund/investment company that trades on current asset values.

Dilution Issue

One could assert that there is a serious dilution problem because of the constant increase in the number of units each quarter caused by almost all of the distributions being paid in additional IEP units. For those electing to receive cash distributions the issues associated with potential dilution is lessoned because they are taking a significant amount of “cash off the table” each quarter.

In addition, IEP signed a $400 million ATM agreement with Jefferies last November to raise additional cash to make potential new stock purchases and/or other partnership uses.

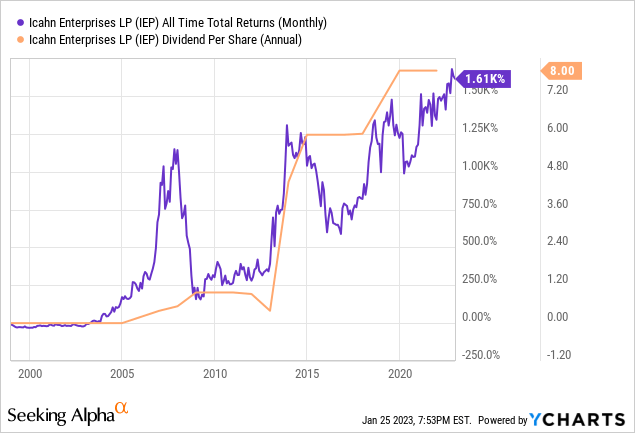

A rational way to look at the potential dilution issue is to look at total returns over a long period of time, in my opinion. A 1,610% total return since January 1999 is a very impressive return. Of course, the past may not indicate what future total returns will actually look like.

Annual Distributions and Total Return Since Jan. 1999

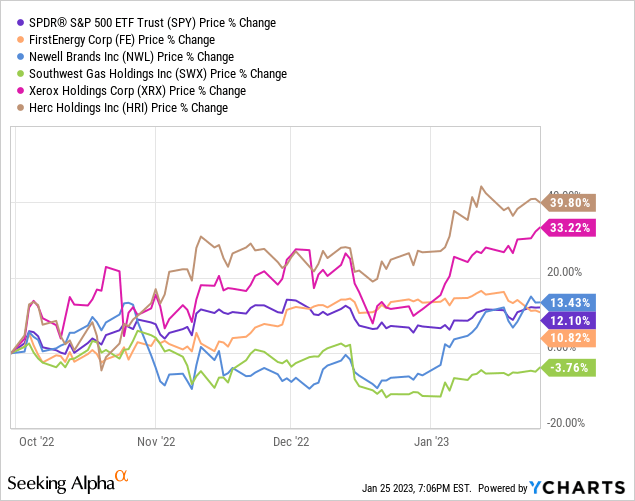

Performance Since End of 3Q

In order for IEP to avoid being regulated as an investment company under the Investment Company Act of 1940, less than 40% of their assets are investment securities. The 60% or more are operating companies, such as Icahn Automotive. Since their 3Q report, their largest securities holdings have performed relatively well. We don’t know, however, how well their massive short positions have performed. As of September 30, they had a net short notional exposure of 54% (66% long and 120% short). The S&P 500 index is up about 12% since the end of the 3Q.

Major Securities Holdings Changes Since End of 3Q

Besides the securities in the above table, IEP bought Crown Holdings (CCK) shares in 4Q for an average price of $79.80 that compares to a current price of $88.13 or a 10.4% gain on their 10.2 million shares. They sold some Herc Holdings (HRI) shares in 4Q and have continued to sell the stock. On January 20, for example, they sold a total of 113,456 HRI shares at prices from $142.42 to $145.42. IEP also made on nice profit of $250 million on their Twitter trade (TWTR) of 15 million shares.

In their operational area, their 71% owned CVR Energy (CVI) is up 21.5% since the end of 3Q, but their 37% owned CVR Partners (UAN) is down 10.4%. There is no trading in their 100% owned Icahn Automotive business or in most of their other operating sectors.

Income Tax Problem – Lending for Short Sales

There are a number of critical income tax implications that could impact IEP investors. Seeking Alpha is an investment website and not an income tax website, so I am limiting my income tax comments to only one per article. I have read many incorrect statements on taxes in the comment sections of my prior articles. With the IRS greatly increasing the number of agents some of those who have not been properly following the tax code when filing their tax returns may need to adjust how they file their tax returns.

Because some brokers, such as Robinhood, are finally beginning to pay their clients when they allow the lending of their securities for short sales, I decided it would be important to cover this issue. The best way to avoid any inaccuracies is to quote IEP’s latest prospectuses regarding those who lend their IEP units for short selling:

A unitholder whose units are loaned to a “short seller” to cover a short sale of units may be considered as having disposed of those units. If so, he would no longer be treated for tax purposes as a partner with respect to those units during the period of the loan and may recognize gain or loss from the disposition. As a result, during this period:

- any of our income, gain, loss, or deduction with respect to those units would not be reportable by the unitholder;

- any cash distributions received by the unitholder as to those units would be fully taxable; and

- all of these distributions would appear to be ordinary income.

Those IEP unitholders in a no tax/low tax bracket may not mind having their $2.00 current distribution taxed as ordinary income and may want the additional income from lending their IEP units for short sales. The latest borrow rate for IEP securities is a low 3.9-4.1% depending upon the broker. A broker does not pay the full amount to their clients, so I don’t think it is rational to currently lend IEP units. Even those who have not actually told their brokers that they can lend all the securities in their accounts need to instruct their broker not to lend their IEP units for short selling, in my opinion. It is a very murky tax issue that is best avoided completely by not lending IEP units.

(Note: this is not income tax advice, and each IEP unitholder should consult with their own income tax CPA/advisor.)

Conclusion

This is an update to my prior IEP articles. Icahn Enterprises is a very complex limited partnership that pays a very attractive current quarterly distribution of $2.00 that unitholders can elect to receive as a cash payment or in additional IEP units. The current yield of about 15% makes IEP a very interesting hedge against a recession especially for those who elect to take cash. Even if the economy goes into a recession, I consider it highly unlikely the $2.00 quarterly distribution would be reduced because it is really not based on current results.

All IEP unitholders should instruct their brokers not to lend their units for selling short. For U.S. investors needing higher cash payments I consider IEP units a buy, but absolutely not in IRA accounts because of tax issues. Because of the complexities of owning/trading IEP units I am maintaining my neutral/hold recommendation – it is not appropriate for every investor.