Manufactured Dwelling parks will be a wonderful funding. At the moment, SUI is offered at a discount worth.

felixmizioznikov/iStock by way of Getty Pictures

Solar Communities (NYSE:SUI) is already one in all our bigger positions and is a poster youngster for what we wish to see in an fairness REIT. We responded to the very latest dip by elevating our place. When analyzing a REIT, it helps to take a look at the REIT from a number of angles. On one hand, we wish to have the ability to dig in deep to catch particulars. Nonetheless, we don’t wish to miss the forest for the timber. With SUI, once we dig in deep, it merely confirms that the forest matches our expectations. Consequently, I wish to concentrate on the large image components right now.

Temporary Overview

If you happen to’re not acquainted with SUI, it is a temporary historical past. SUI primarily owns MH (manufactured residence) parks, RV (leisure car) parks, and marinas. In addition they personal some vacation properties from a latest acquisition. They’ve delivered excellent progress in same-property NOI, AFFO per share, and NAV per share during the last twenty years. Consequently, additionally they delivered monumental returns to shareholders.

My Positions

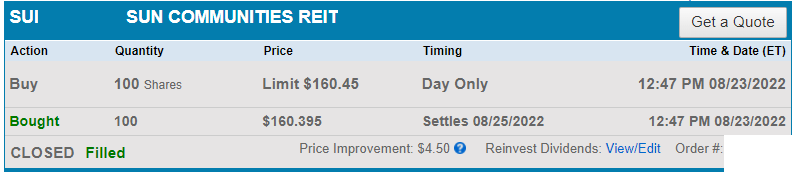

SUI is one in all our largest positions. Amongst our fairness REIT positions, it’s the third largest place. It solely lands behind American Tower (AMT) and Crown Citadel (CCI). We not too long ago elevated our place in SUI by shopping for one other 100 shares at $160.40, as proven beneath:

Charles Schwab

For anybody who wonders:

“Is the analyst actually bullish or simply writing an article?”

I’ve to ask:

“How would I justify that funding if I wasn’t assured in my name?”

This text will not usher in $16,040. Not even shut. Significantly, even a well-liked article will not do this and writing about SUI is just not a well-liked matter. The inventory simply delivers traders rising dividends, AFFO, and NAV 12 months after 12 months.

Who desires one thing that persistently performs after they may gamble on junk that might have them changing feasts in retirement with Fancy Feast in retirement? I am kidding, in fact. I would by no means counsel consuming Purina, it doesn’t matter what occurred to their portfolio. Shedding their retirement cash isn’t any purpose to purchase a model from Nestlé (OTCPK:NSRGF).

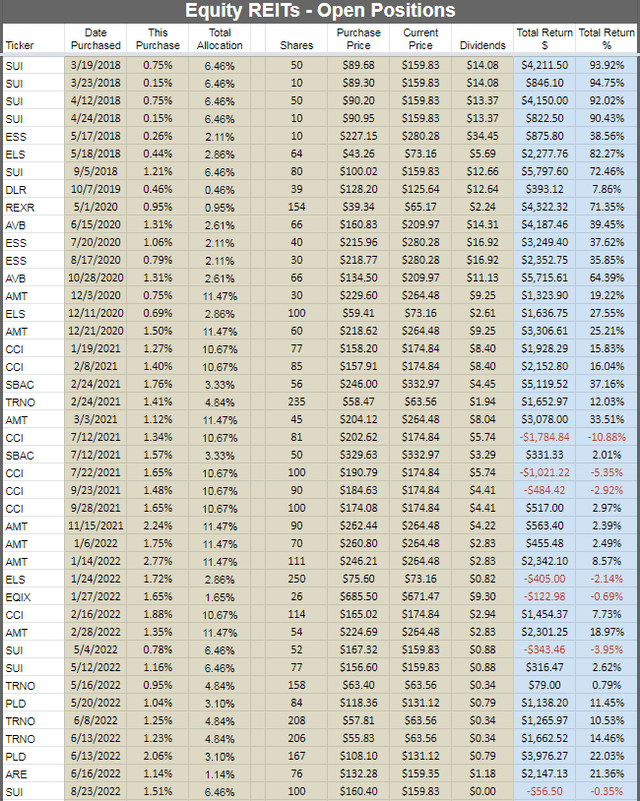

We have been investing in SUI for a number of years. Our oldest 4 open positions are all in SUI and we have purchased shares just a few different occasions over time. The next chart exhibits all of our open positions in fairness REITs:

The REIT Discussion board

We do not merely “promote the losers to cover them”. Nonetheless, I do not wish to derail the article by simply posting a protracted commerce historical past. The purpose is that SUI now stands at over 6.4% of our whole portfolio.

Clearly, a few of my positions are extra concentrated than most traders needs to be. Nonetheless, as a REIT analyst, I needs to be consuming my very own cooking. I needs to be keen to stake my very own portfolio on my calls. Most individuals following my analysis will not be placing 100% of their portfolio into REITs, however this methodology makes it simple to match my calls and efficiency with the indexes for the sector.

That is sufficient about me. It is time to get again to SUI.

AFFO Progress

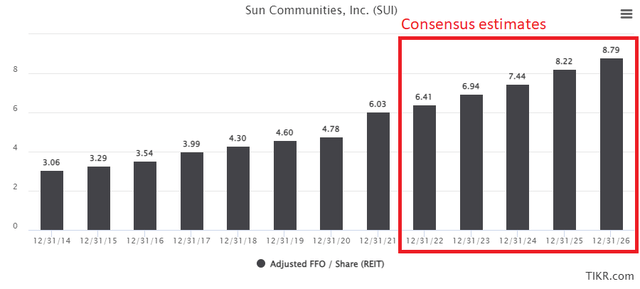

The primary trait we wish to see is constant progress in AFFO per share. It’s okay for the expansion to be lumpy, however unfavourable values needs to be uncommon and require a deep understanding of exactly what went improper. With SUI, actually nothing has gone improper in a decade. You possibly can inform that simply by trying on the AFFO per share:

TIKR

AFFO per share grew quickly with the very best progress coming in 2021. That is sensible when you think about that outcomes for 2020 had been restricted by the pandemic. The excessive bar set in 2021 additionally made the year-over-year comparability for 2022 a bit tougher.

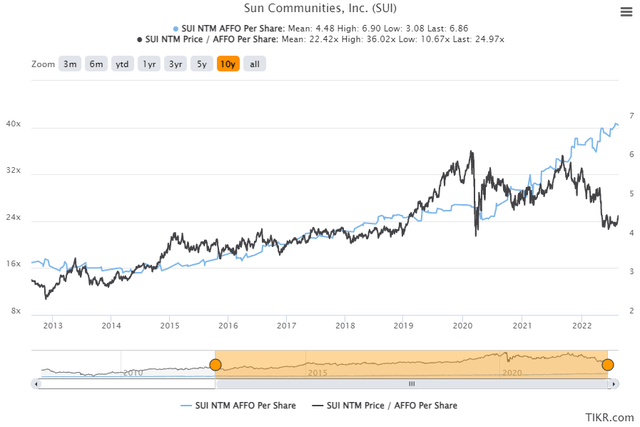

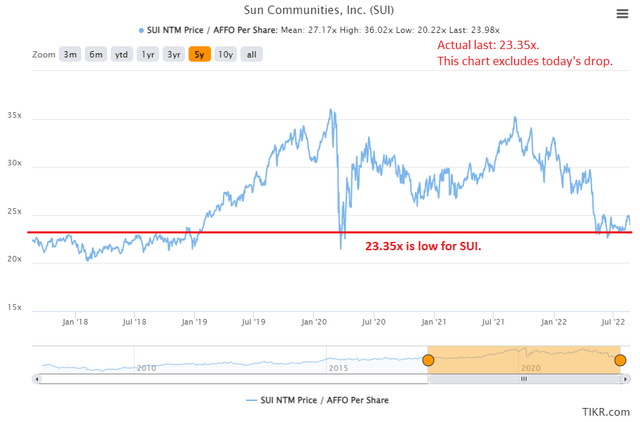

To take a look at valuation, we will swap over to utilizing a chart for NTM (Subsequent Twelve Months) AFFO per share. We mix that with the AFFO a number of, and we will see how the share worth is shifting relative to the money flows (as represented by AFFO):

TIKR

As an AFFO a number of, shares had been buying and selling barely above the degrees seen from 2015 to early 2019 after they had been $171.36 (we simply purchased extra at $160.395). Nonetheless, they’re far beneath the degrees seen from mid-2019 to early 2022. Even throughout the pandemic, the a number of was solely barely decrease. The share worth was materially, however money stream was decrease.

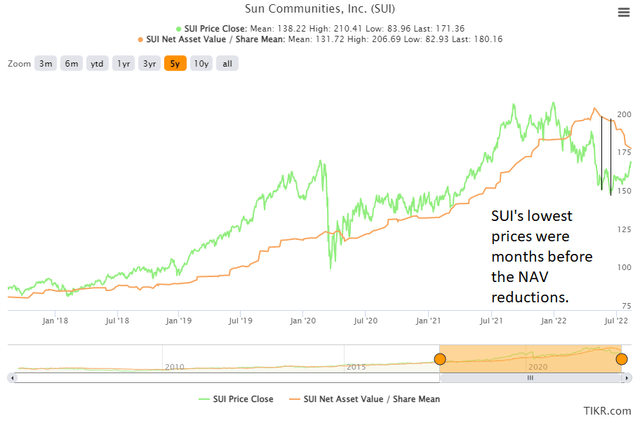

So, what’s dragging SUI decrease? The “simple” reply may be to say that cap charges moved up and meaning NAV (internet asset worth) is decrease. That’s a easy clarification, nevertheless it’s not a very good one. Whenever you actually drill in on the 2 values, you’ll see a difficulty:

TIKR

For SUI, the consensus NAV estimate dropped by 12.9% from $206.69 to $180.16.

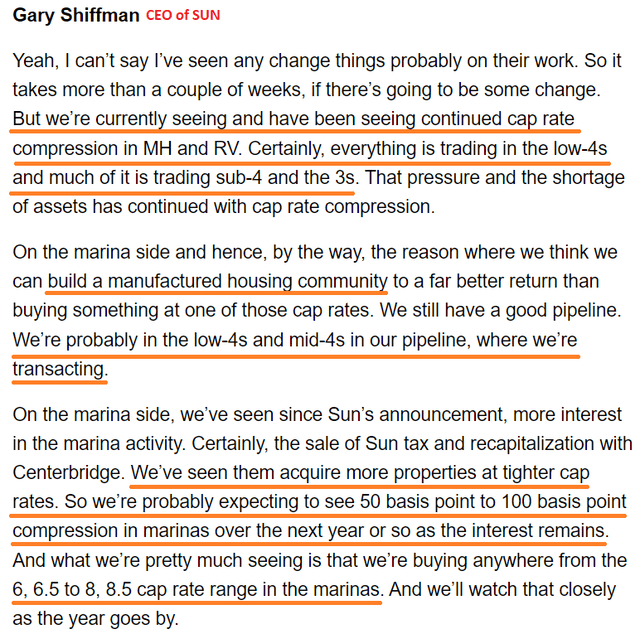

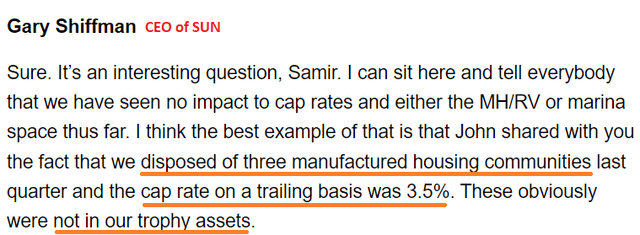

So why are NAV estimates going decrease? Administration for SUI is kind of clear, and so they’ve indicated that cap charges on MH parks moved a bit larger. We will see that improvement throughout the earnings calls. We are going to begin with the This fall 2021 earnings name:

Looking for Alpha

After that commentary, NAV estimates bumped a little bit bit larger.

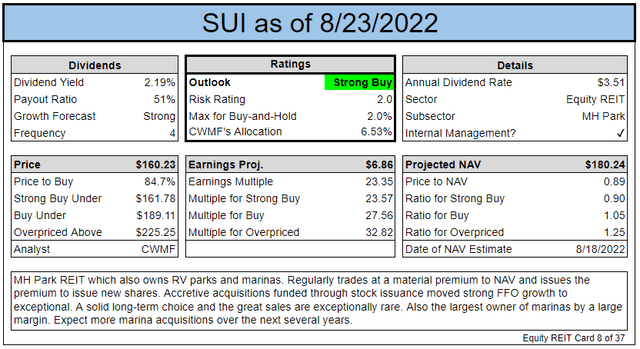

That is from the commentary on the Q1 2022 earnings name:

Looking for Alpha

Following the decision, consensus NAV estimates topped out about two days later at $206.59. NAV estimates slide decrease by about 10% previous to the Q2 2022 earnings name:

Looking for Alpha

Within the Q2 name, we will see marinas are nonetheless within the 6% to eight% vary, which is a bit decrease than the 6% to eight.5% vary referenced in Q1. Nonetheless, the cap charges on MH park and RV transactions moved a bit larger. That brings NAV down, nevertheless it hasn’t lowered money stream in any respect. A few of the affect from larger cap charges needs to be offset simply by the rise in NOI (Web Working Revenue). On condition that SUI makes use of comparatively little debt, there isn’t a lot leverage to swing NAV values.

Ought to Cap Charges Be Rising?

Clearly, there’s a problem for traders wanting to make use of debt leverage to juice returns. When these traders can solely borrow at charges above the cap price on the property, it turns into a problem for leverage. That reduces the pool of patrons and might negatively affect NAV.

Nonetheless, SUI doesn’t use a lot debt and our curiosity in SUI goes deeper than NAV. Larger rates of interest needs to be a reasonably small headwind for his or her potential to generate money flows for shareholders. When money owed are rolled over it has a unfavourable affect on financing prices, however larger charges are additionally lowering demand for single-family housing. As building of recent housing is inadequate to fulfill demand, it maintains an imbalance between provide and demand. That helps landlords proceed to lift rents.

Given the sturdy progress in rental charges, we must always count on AFFO per share to proceed rising considerably. This can be a main a part of our valuation course of for SUI, so we see shares providing a fantastic alternative for traders.

The Cap Fee Downside

If cap charges on MH parks are rising, it is sensible for the cap charges on flats and single-family leases to be rising additionally. Are they? We will actually argue that with costs regular, cap charges must be barely larger. Web Working Revenue is growing. If costs are regular with larger internet working earnings, the cap charges should be larger. That’s basic math:

Web Working Revenue / Cap Fee = Actual Property Value

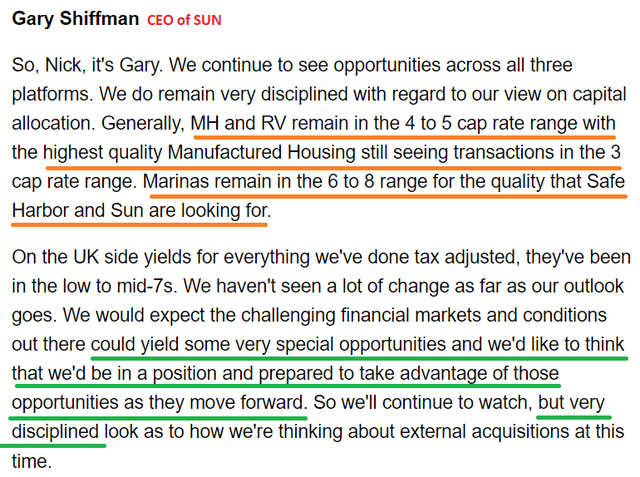

The query is why analysts are making use of larger cap charges extra aggressively to SUI than to different housing REITs. It may possibly’t be a discount in Web Working Revenue, as a result of NTM consensus AFFO estimates are very near report highs. But SUI noticed consensus NAV estimates hammered whereas different housing REITs, together with Fairness LifeStyle (ELS) (comparable belongings), noticed solely modest reductions:

Chart by The REIT Discussion board, Information from TIKR

On condition that future money flows for SUI stay sturdy, I’m inclined to ignore the change in consensus NAV estimates. Because it stands there are solely 5 analysts feeding in estimates and the quantity has diversified between 5 and seven during the last 12 months, which may distort the typical.

I believe the estimates for the opposite housing REITs are fairly affordable on common. SUI is the outlier.

This can be a advantage of protecting a number of REITs with comparable property sorts. An analyst who tries to cowl shares from each sector simply to “have protection” of their service may simply neglect to run comparisons on a number of of the opposite REITs.

Conclusion

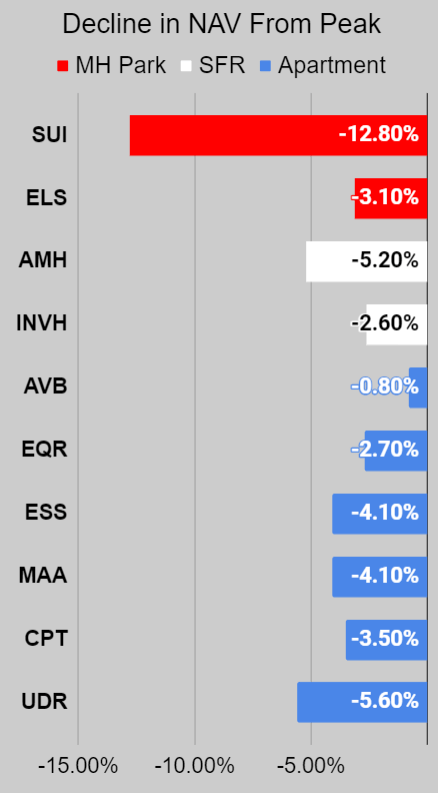

With shares of SUI dipping all the way down to about $160, shares look nice. We purchased extra to reap the benefits of the autumn into the Sturdy Purchase vary:

The REIT Discussion board

They carry a cloth low cost to the consensus NAV, which seems to be a bit low anyway. On an AFFO foundation, SUI is buying and selling at solely 23.35x ahead consensus AFFO. That’s unusually low cost:

TIKR

With AFFO progress projected to common about 8% over the subsequent a number of years, traders are returns pushed by a mix of:

- Dividend yield (2.2%)

- AFFO progress (8% common)

- A number of adjustment

Even when the a number of solely remained at 23.35x, the mixture of dividend yield and AFFO progress would counsel returns above 10%. That’s glorious.

In fact, we may all the time say that 8% progress plus over 2% in yield can be above 10%. When the worth falls, it doesn’t transfer the yield that a lot. Nonetheless, it does present a extra enticing beginning a number of and that offers us a better margin for security as long as we’re getting the identical high-quality REIT. SUI is actually a high-quality REIT.

Shopping for weak REITs at a low a number of is just not even remotely secure. Weak REITs are likely to exhibit declines in AFFO per share or inflate AFFO per share with low-quality changes. We don’t need these.

Nonetheless, shopping for high-quality REITs at a below-average a number of (27.17x common vs. 23.35 right now) has been a fantastic approach. If the AFFO a number of will increase within the subsequent few years, it could additional improve returns to traders.

Be aware: I consider the consensus estimates for AFFO per share progress are affordable on common. In follow, there’ll most likely be some volatility. Clearly, 2021 is an instance of maximum volatility throughout the progress price. If the estimates had been materially completely different from our expectations, it could be necessary to handle.