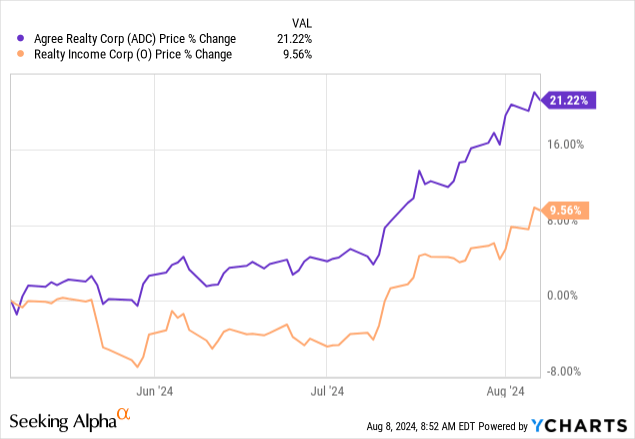

Adam Gault

Over the previous 12 months, I’ve posted a number of articles that have been essential of Realty Earnings (NYSE:O).

Briefly, I believe that Realty Earnings faces three foremost points:

- The REIT has turn into too large for its personal good and its large measurement is prone to decelerate its future development.

- The REIT is stepping away from its foremost circle of competence and now investing in all types of properties, together with casinos, information facilities, and even vertical farming.

- We expect that its common portfolio high quality has degraded over time following its many acquisitions of lower-quality web lease REITs (Vereit and Spirit Realty Capital).

However that doesn’t imply that I am bearish on the corporate. Quite the opposite, I gave it a Purchase ranking even in my final replace, which mentioned a few of its tenant points:

Searching for Alpha

I simply assume that it has been overhyped relative to lots of is lesser-known shut friends and that is why I’ve not invested in Realty Earnings.

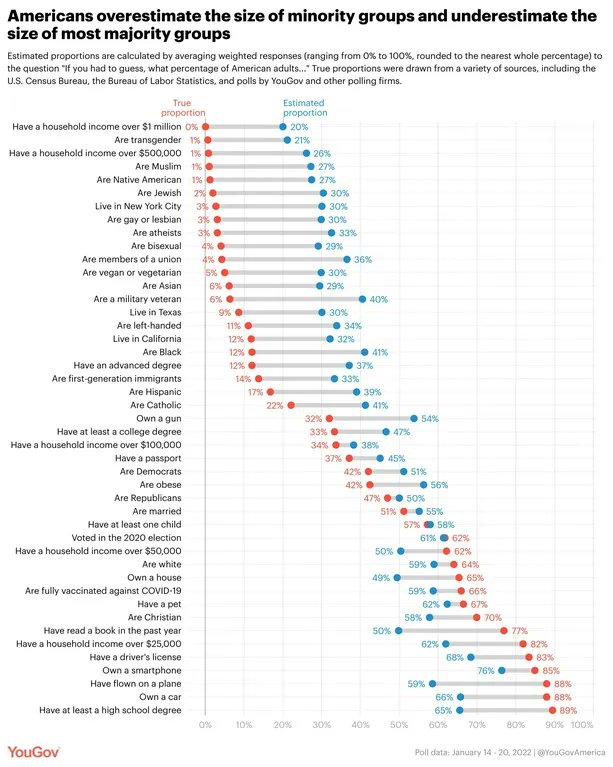

To date, I’ve been proper on that as my high decide, Agree Realty (ADC), has constantly outperformed Realty Earnings.

That is true in case you examine their outcomes over the previous decade…

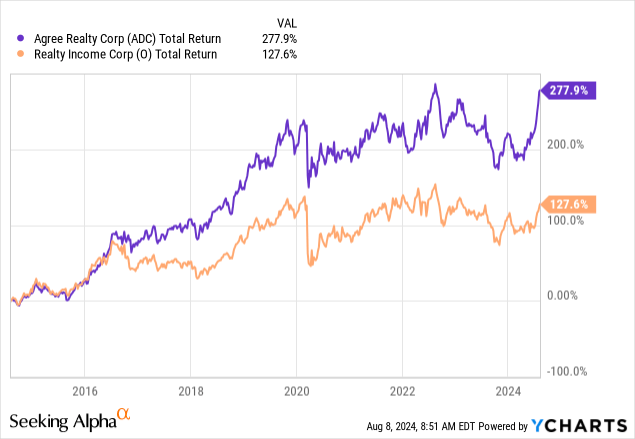

… and it has additionally been true on this latest restoration. Realty Earnings has lagged behind, leading to decrease returns for its shareholders:

However following all of this underperformance, Realty Earnings has now turn into fairly a bit cheaper than Agree Realty, which makes it extra fascinating. That is very true after Realty Earnings reported stronger than anticipated Q2 outcomes.

For these causes, I now now not have a choice for its shut friends, and I am turning more and more bullish on Realty Earnings.

If something, I believe that Realty Earnings may outperform going ahead as a result of Agree Realty is now buying and selling at a traditionally massive valuation unfold relative to Realty Earnings.

Simply three months, the unfold was comparatively small with Agree Realty buying and selling at a 1-turn increased FFO a number of, nevertheless it has expanded to a 3-turn increased a number of:

Tikr

| Agree Realty | Realty Earnings | |

| FFO A number of 3-months in the past | 14x | 13x |

| FFO A number of right now | 17x | 14x |

Again when the unfold was small, it was a no brainer to favor Agree Realty as a result of it owns higher property, has much less leverage, and would not must take care of the dimensions situation.

Nevertheless it’s totally different right now.

Agree Realty has reached truthful worth and has little upside left on this restoration.

Nonetheless, Realty Earnings may nonetheless rise additional as rates of interest are reduce and more and more many fastened revenue buyers come again to the REIT market and bid up their valuations.

Actually, Realty Earnings is particularly properly positioned to profit from that as a result of it nonetheless affords a 5.2% dividend yield that is paid month-to-month and have been rising steadily for 30 years in a row:

Realty Earnings

Realty Earnings can be one of the well-known REITs on this planet, it is large in measurement, and has an A-rated steadiness sheet. Due to this fact, I count on Realty Earnings to be the primary selection for lots of fastened revenue buyers, whether or not it is sensible or not.

Not everybody follows REITs every day like me, and so we can’t count on the market is to be completely environment friendly always, and it would not shock if it bids Realty Earnings again to the identical a number of as Agree Realty.

It might result in 20% upside from right here, and that is why I am now more and more bullish on Realty Earnings and do not have a powerful choice for Agree Realty anymore.

It is primarily a query of valuation. Agree Realty was a greater deal so it made no sense to purchase Realty Earnings, however following its latest outperformance, this is not the case anymore.

Now, a fast phrase nonetheless on Realty Earnings’s second quarter outcomes.

There weren’t any main surprises. They barely beat their quarterly expectations and reaffirmed their full-year steerage.

Nonetheless, the excellent news is that administration addressed a number of the tenant points that I made in my most up-to-date replace. As a reminder, a few of Realty Earnings’s high tenants embrace Walgreens (WBA) and Greenback Tree (DLTR) they usually’re each closing shops proper now. Furthermore, additionally they personal Ceremony Assist and Pink Lobster properties, and people tenants are in chapter proper now.

Realty Earnings defined that whereas they count on to endure some retailer closures, the lack of revenue should not be important, they usually even shared their math.

This is what they mentioned:

“It is very important word that in whole, the lease in danger from Ceremony Assist, Pink Lobster, Walgreens, Greenback Tree, in addition to At Dwelling and Huge Heaps, which is 11 foundation factors of lease, represents in whole solely 2.3% of our whole portfolio annualized contractual lease via year-end 2026. And if we obtain the recapture fee in step with our long-term common for bankruptcies, which is 84%, this implies solely roughly 37 foundation factors of lease is vulnerable to ceasing, or an roughly $0.02 of AFFO per share affect.”

In order that’s very manageable.

It is nonetheless one thing to bear in mind as a result of the unfavourable headlines may affect its market sentiment, however as of proper now, I am not too involved by this.

One other piece of excellent information is that the REIT retains discovering excessive yielding offers in Europe with preliminary money cap charges in extra of 8%, leading to stable spreads over its value of capital. The unfold will solely develop bigger if and when rates of interest are reduce within the close to time period. Their inside development mixed with some unfold investing ought to permit them to develop at 4%-5% yearly going ahead, leading to double-digit whole returns, even ignoring any potential upside from a number of enlargement, and that is not too dangerous coming from an A-rated REIT.

Closing Observe

Lastly, to conclude, I need to remind buyers that valuations and fundamentals change over time, and subsequently, you must all the time be keen to rethink your investments.

No firm is ideal and every have distinctive professionals and cons.

Within the case of Realty Earnings, the principle situation in the previous few years was merely that its shut friends have been way more engaging. They provided higher return prospects with decrease danger and subsequently, it made no sense to purchase Realty Earnings. It resulted in robust outperformance and I profited from this.

However valuations have modified, and it’s now too late for this chance.

Realty Earnings is as soon as once more a superb decide within the web lease sector, and I am contemplating shopping for a place.