JohnnyGreig

Investment Thesis

From my point of view, Hydrofarm (NASDAQ:HYFM) is in a catastrophic situation, and I think the stock market is about to price in the risk of bankruptcy. The debts are high; interest payments are rising sharply. Cash flow is negative and will remain so for at least another two years. Even the issuance of new shares would flush very little money into the coffers due to the low share price, and they do not even have as much cash left as they burned in the last quarter alone.

Company Overview

Since the 1970s, Hydrofarm has been a supplier of hydroponic equipment and supplies for controlled environment agriculture and a wide range of proprietary and innovative products. Hydrofarm offers grow lights, climate control solutions, growth media (hydroponics), nutrients, and a wide range of other products. The company’s mission is to provide growers and cultivators with products that enable them to achieve higher quality, more efficient, more consistent, and faster results in their growing projects. The IPO was in September 2021 at $20.

They describe themselves as a “pick and shovel” for the cannabis market, although their products are suitable for many crops. According to the company’s statements, the global market for agriculture under controlled conditions is currently worth $12B. It has a potential for $75B by 2025, mainly due to the growing global cannabis market.

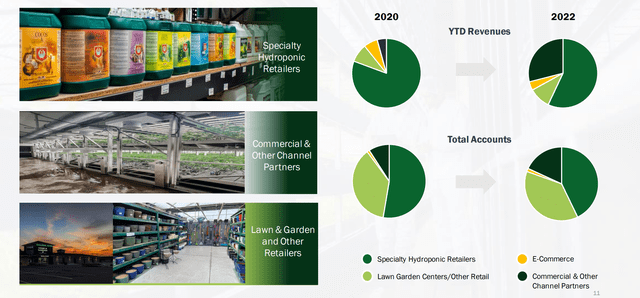

The company sells to companies (over 70) as well as to private end customers who, for example, want to cultivate cannabis themselves. However, in recent years, sales to commercial partners have become increasingly important, while sales to end customers via specialty hydroponic retailers have become relatively less important. However, these still account for over 50% of sales.

HYFM investors

Recent results & financials

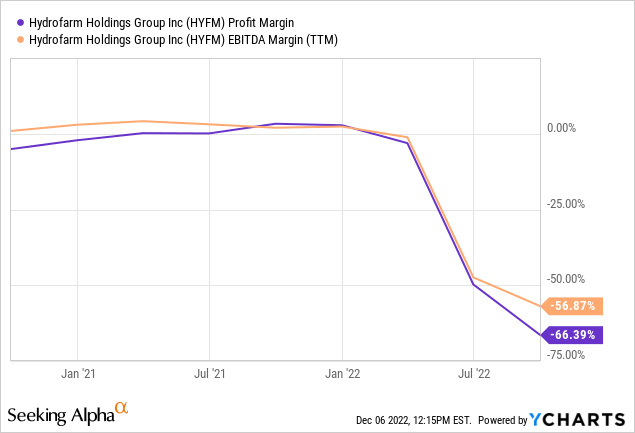

67% of the company’s sales come from consumables, i.e., things that are not reusable, such as soil, nutrients, grow media, etc. 33% of sales are durables such as lights and other equipment. Unfortunately, the company does not provide any information about the margins in these categories here. However, I strongly suspect that the consumables generate recurring revenues, but the margins are weaker. However, this is just my theory which I cannot prove. But it does not matter so much; overall, the development of profitability is terrible this year. The company explains it this way:

Pandemic over-production, demand pull-forward and shift from consumer hobbyists to commercial growers

Investor presentation page 15

Partly because of this demand pull-forward, revenue is also falling this year (the company was profitable in 2021). Revenue decreased to $74.2M from $123.8M in the prior year. Net loss was $23.5M, or $0.52 per diluted share, versus a net income of $17.3 million, or $0.37 per diluted share. The full-year revenue outlook is $330M to $347M. This compares to the total 2021 revenue of $480M.

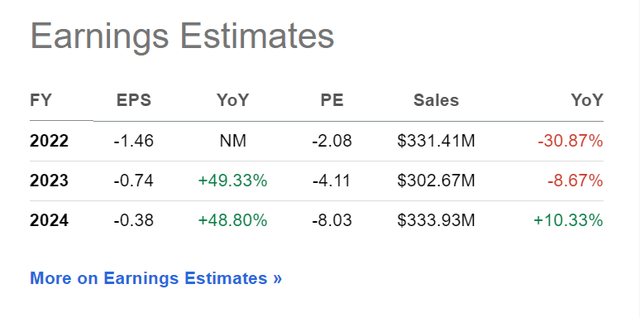

As of September 30, 2022, the company had only $16.5M in cash, less than the loss in the last quarter alone. That means another financing will be needed very soon. But issuing new shares is very unattractive due to the already very low price (see next section). And the debt is very high at $171M. In the TTM, the interest payments were already $9.7M. And at the same time, analysts expect the company to remain cash flow negative for at least two more years. All in all, this is a catastrophic situation for the company.

Seeking Alpha

Valuation

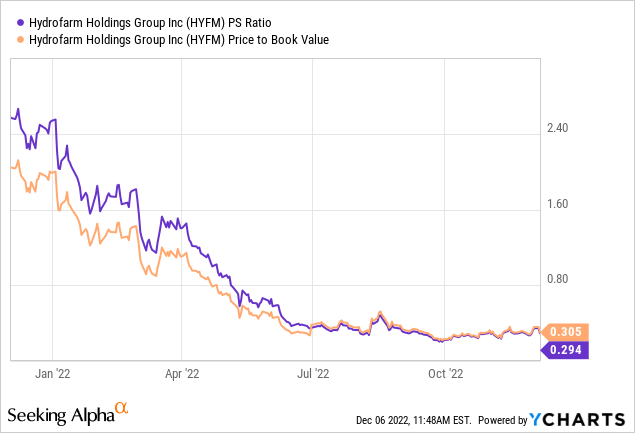

The company is currently valued at an enterprise value of $292M. The market cap is $137M, and the total debt is $171M. Since Hydrofarm has neither positive cash flow nor earnings, making a fundamental share valuation is difficult. But P/S (price-sales ratio) can be used for valuation purposes. We can see the price-sales and price-book ratios are extremely low.

I think there is nothing more to say about the valuation. The valuation is so low that the market is basically pricing in the company’s risk of bankruptcy. If you believe in a long-term turnaround of the company, you can get in at a very low valuation.

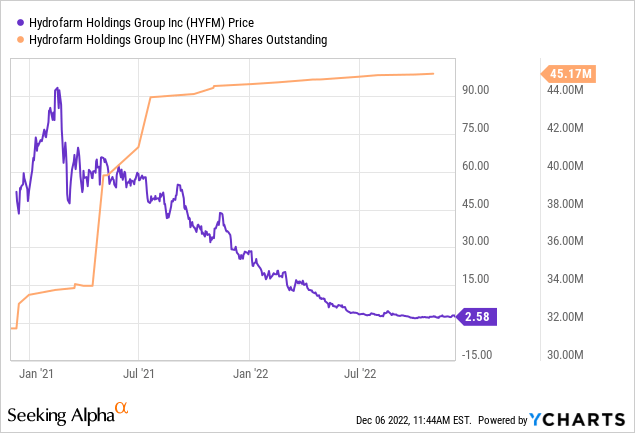

Share dilution and insider selling

One thing I always want to look at, especially with companies that are not yet profitable, is stock dilution and whether there is insider selling. 2021, the company issued shares to fund an acquisition, and only a little has happened since July 2021. The CEO bought shares for $93,000 in August this year.

Risks to my thesis

As written earlier, overproduction during the pandemic period was one of the reasons for the current decline in margins. The margin pressure might ease and improve when the company’s inventories are reduced again. As mentioned, the company had a profitable year in 2021 with a $0.31 profit.

Suppose the company manages to get over the current financial situation and be profitable again. In that case, the share price could rise very strongly, and the low valuation may become more decisive again. In this context, the company could also benefit from a possible interest rate cut next year. Since the company supplies more and more to commercial customers and the cannabis market is generally growing strongly, it could be that the company is not so much affected by a possible recession but reaps the benefits of it, namely falling interest rates.

Short selling of shares theoretically involves unlimited risk. Especially with such a low valuation, a single announcement could be enough to cause the share price to explode. In this case, a short seller would quickly suffer high losses. Especially with smaller illiquid stocks, you may also be unable to limit your losses (i.e., buy back the shares) as quickly as you would like.

Conclusion

I suspect the company’s management has significantly misjudged in assessing the situation. In 2021, they made a takeover and issued cash and shares for it, and also overproduced. Now the economy and the Fed’s policy have turned around, and they are looking at high debt and problems getting new money. The share price was at its high point at $90 and is now at $3. It would probably have been wiser to issue significantly more shares at these high prices to build up a cash cushion, but now it is too late.

Furthermore, you have competition that doesn’t have all these problems, for example, Scotts Miracle-Gro Company (SMG). As far as I can see, Hydrofarm has no unique selling proposition that would make it irreplaceable. For all these reasons, I would not invest here. If I did anything, it would be shorting the stock. I am surprised that the short interest is only 8%, maybe due to the already very low valuation, but a complete default is also within the realm of possibility.