Olivier Le Moal

Overview

With regards to funding an early retirement, coping with the tax penalties of early withdrawals or excessive dividend yielding funds is usually a burden. The John Hancock Tax-Advantaged Dividend Revenue Fund (NYSE:HTD) gives buyers a solution to mitigate this burden by distribution an 8.4% yield to buyers in a tax pleasant method. Only for some context, HTD operates as a closed finish fund that gives publicity to dividend paying corporations throughout completely different sectors. The fund is ready to present tax pleasant distributions due to its deal with most well-liked shares of holdings that qualify for favorable long-term capital features taxes.

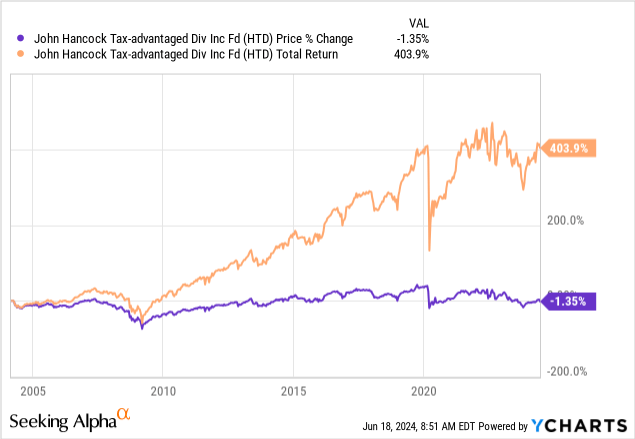

HTD has an inception courting again to 2004, and we will see that the worth has remained in a really constant buying and selling vary during the last 20 years. This value consistency makes it an important long-term revenue centered holding. We are able to see that by means of the continued excessive distributions, the whole return since inception sits above 403%. The present dividend yield sits at 8.4% and the distributions are paid out on a month-to-month foundation, which can be extra superb for buyers that rely upon the revenue generated from their portfolio to fund their bills.

This distinctive closed finish fund caught my consideration due to the present valuation. Since HTD operates as a closed finish fund, the worth can differ from the precise internet asset worth of the underlying belongings inside. Because of this, we have now the chance to start out a place whereas shares commerce at a relative low cost to their internet asset worth. HTD has complete internet belongings amounting to $771M and an expense ratio at 1.96%.

Technique & Holdings

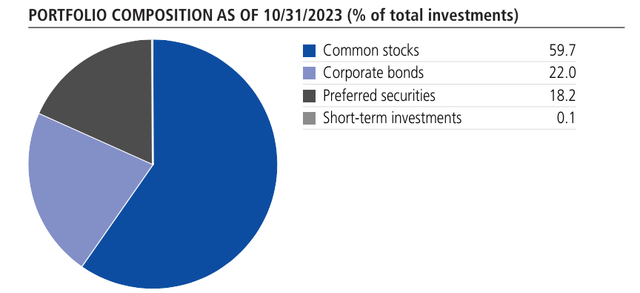

HTD’s clear technique is to deal with first producing excessive ranges of after tax revenue, adopted by additionally capturing capital appreciation when attainable. The fund is actively managed by Manu Funding Administration. They obtain this by investing no less than 80% of the fund’s belongings into dividend paying securities. In an effort to obtain the tax advantaged revenue, HTD additionally maintains publicity to securities which will qualify for extra favorable long-term capital features tax charges, similar to most well-liked shares. Whereas this can be outdated, we will confer with the newest 2023 annual report back to see the breakdown of its publicity to those sorts of securities.

HTD 2023 Annual Report

Publicity to most well-liked securities is useful with regards to revenue era due to the way in which tax therapy works. If a long-term place in a most well-liked safety is held for over a 12 months, any realized capital features are taxed at a lesser price than brief time period capital features. Moreover, the revenue obtained from most well-liked securities is often seen as much less dangerous as a result of most well-liked stockholders have the next declare on the dividends than widespread shareholders.

We are able to see that the biggest bulk of the fund is inside widespread shares, accounting for almost 60% of the load. This the place we will find the highest ten holdings, together with a majority weight in BP (BP) sitting at 3.92%. That is carefully adopted by American Electrical Energy Firm (AEP) making up 3.73% in addition to Verizon (VZ) accounting for 3.58%.

| Holdings | % Of Internet Belongings |

| BP | 3.92% |

| American Electrical Energy Firm | 3.73% |

| Verizon | 3.58% |

| Kinder Morgan | 3.48% |

| Duke Power | 3.39% |

| AES Corp | 3.13% |

| Entergy Corp | 3.03% |

| AT&T | 2.93% |

| The Southern Firm | 2.87% |

| NiSource | 2.84% |

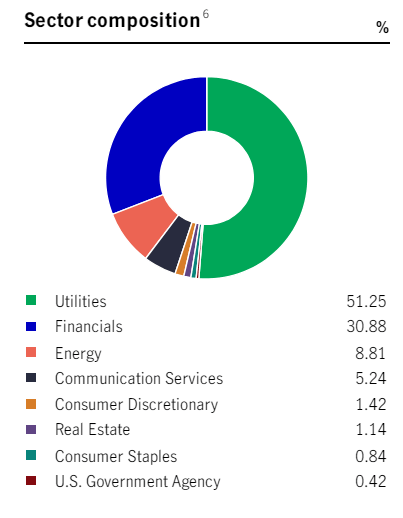

We are able to additionally see that quite a lot of these high tens lean in direction of the utilities sector. Utilities make up the biggest slice of the publicity, sitting above 51%. That is adopted by financials, making up almost 31%. HTD additionally has some minority publicity to different sectors similar to power, communication providers, client discretionary, actual property, and client staples. Whereas the intention right here was to take care of a weighting in direction of extra ‘dividend constant’ industries, I imagine this presents some vulnerabilities inside the present market circumstances.

HTD Factsheet

The thought round having a majority publicity to utilities is supported by the truth that these companies supply providers which can be thought-about important. Water, electrical energy, and fuel are one thing that all of us require in our private lives, but additionally one thing that many companies depend on. Subsequently, corporations on this sector sometimes have very predictable and regular streams of revenue that may translate to a dependable supply of dividends. Nonetheless, as we sit in the next rate of interest setting, it has offered some vulnerabilities.

Vulnerabilities

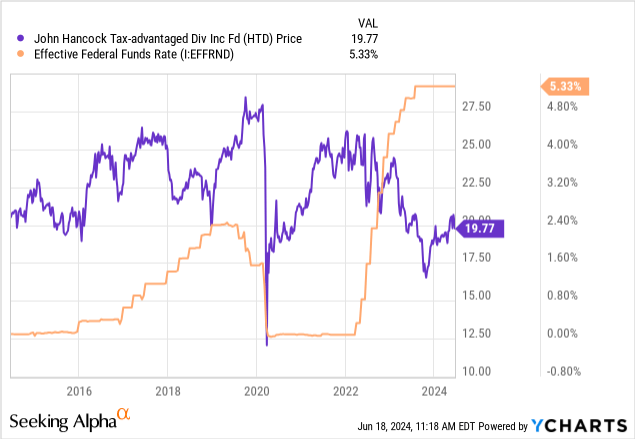

As seen under, the Fed began to aggressively hike rates of interest across the begin of 2022. Because the Federal Funds price continued to rise, the worth of HTD began to fall in the wrong way. Since HTD is made up of principally utility and monetary publicity, the identical inverse value relationship performed out when evaluating the utilities sector (XLU) or the monetary sector (XLF) towards the federal funds price. Conversely, we will see that the worth of HTD rose when charges have been minimize to close zero ranges in 2020.

The commonest cause that utilities are so affected by larger rate of interest is that this interprets to the next value of borrowing. For instance, American Electrical Energy at present has over $44B in debt, and that is sometimes used to fund completely different areas of enterprise operations. Utility corporations usually depend on entry to low-cost debt in order that they will fund enlargement efforts, new developments, capital expenditure, and different infrastructure associated enhancements that may gasoline progress.

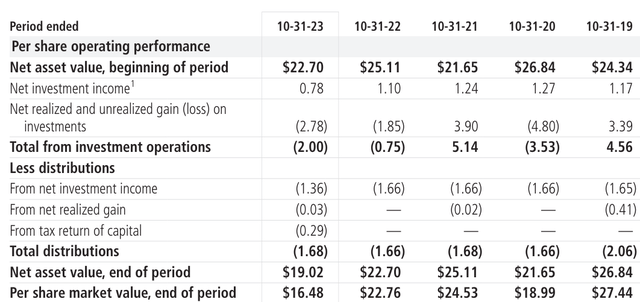

If we proceed to navigate by means of a ‘larger for longer’ rate of interest setting, we may even see the worth of HTD proceed to stay suppressed. Because of this vulnerability, I may also see some weak spot when taking a look at the newest annual report for 2023. Looking at 2023, we will see that internet funding revenue amounted to $0.78 per share whereas there was a internet realized loss on investments of ($2.78) per share. The full distribution for the 12 months was $1.68 per share, which signifies that HTD’s funding efficiency was unable to effectively cowl the total distribution quantity. If we glance again at 2022, we will see that the distribution was not capable of be absolutely coated as nicely, however the one distinction was that the sturdy efficiency of 2021 resulted in left over money that might make up the distinction wanted.

HTD 2023 Annual Report

In 2023, there was not a surplus of money that might be tapped to cowl the distinction. Because of this, HTD applied the usage of return of capital to assist fund the distribution. It is a regular observe for closed finish funds, however there may be points with prolonged use of return of capital. The return of capital classification can imply that buyers are fairly actually getting their principal returned to them out of the fund’s internet belongings.

Prolonged use of this may deteriorate the fund’s internet belongings over time whether it is unable to extend its worth by means of realized features and internet funding revenue. We see this play out during the last 12 months with 2022’s NAV amounting to $22.70 per share, whereas 2023’s NAV decreased right down to $19.02 per share.

Dividends

As of the most recent declared month-to-month dividend of $0.138 per share, the present dividend yield sits at about 8.4%. The dividend right here has been very dependable when you think about that the present month-to-month price has not been decreased since 2016. On the flip aspect of that, HTD has additionally not elevated the dividend since 2016 so if you’re an investor that’s on the lookout for a steadily rising distribution, you must in all probability look elsewhere. Particularly once we think about the beforehand talked about use of return of capital, I imagine there’s a minimal probability of seeing the dividend being elevated any time quickly.

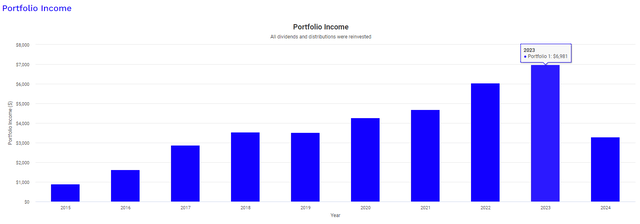

Nonetheless, the shortage of dividend progress would not essentially imply you could’t expertise dividend progress. With a long-term outlook and constant contributions, the regular distribution obtained can truly develop over time. In an effort to visualize this, I made a decision to run a again take a look at utilizing Portfolio Visualizer. This graph assumes an preliminary funding of $10,000 again in 2015 and a hard and fast month-to-month contribution of $500 monthly all through all the holding interval. It additionally assumes that every one dividends obtained have been reinvested again into HTD.

Portfolio Visualizer

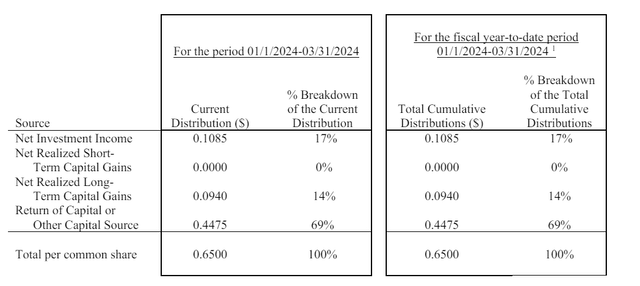

We are able to see that in 2015 your dividend revenue would have solely totaled $900 for the 12 months. Quick forwarding to 2023, we will see that the dividend revenue quantity would have grown to just about $7,000 yearly. Based on the most recent 19-a discover, it seems to be like 69% of the distributions issued YTD as much as March have been return of capital. This offers a little bit of a sign that HTD is struggling to cowl the distribution by means of its inside efficiency of holdings by means of internet funding revenue and realized features.

HTD 19a-Discover

Because of this, there is definitely a risk that extended use of return of capital can lead to each a lowered distribution in addition to the share value of HTD falling because the NAV continues to lower. On a extra optimistic be aware, nonetheless, the usage of return of capital signifies that the revenue obtained has extra favorable tax therapy since return of capital sometimes is not taxed the identical as peculiar and even certified dividends.

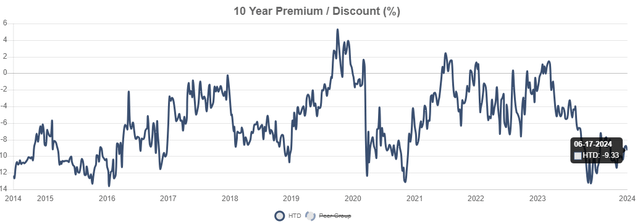

Valuation

Since HTD has been topic to the vulnerabilities of upper rates of interest, this has opened the door for a sexy entry level. HTD has traditionally traded at a really constant vary however because it operates as a closed finish fund, the worth can differ from the precise NAV. In the mean time, HTD trades at a reduction to NAV of 9.33%. For reference, HTD has traded at a mean low cost of 4.5% during the last three-year interval, which signifies that the present low cost is twice as engaging than regular. Because of this, we get the possibility to provoke a place at a sexy low cost that we have now not seen for the reason that begin of 2021. Wanting on the graph, we will see that HTD fairly steadily traded at a smaller low cost than this.

CEF Knowledge

HTD nonetheless trades under its pre-pandemic value degree nearer to $25 per share. I feel that when rates of interest lastly do start to get minimize, this might function a catalyst for a value restoration again to those ranges. As rates of interest get minimize to decrease ranges, this may make the borrowing setting extra favorable. Moreover, this will likely additionally cut back the rate of interest bills inside utilities which might enhance margins and profitability. This serves as prime circumstances for corporations to start out allocating extra funds to completely different progress initiatives that may enhance revenues by means of acquisitions, expansions, and new developments.

It looks as if price cuts are on the horizon too. The Fed left charges unchanged at their final assembly as they await extra financial information to roll in round inflation, client spending, and the employment market. Nonetheless, I imagine that the tide is beginning to flip as inflation begins to chill, and the unemployment price slowly begins to creep above the 4% mark. With these financial elements beginning to align, there’s an elevated chance that we see HTD’s value begin to enhance.

Takeaway

In conclusion, I feel that HTD presents a singular alternative to lock in some high-yielding revenue from an utilities-based fund. Whereas efficiency has been a bit missing during the last two years, that is comprehensible once we consider how HTD is delicate to rate of interest modifications on account of its holdings make-up and sector publicity to industries which can be weak to price modifications. Nonetheless, this presents a chance to acquire shares at the next low cost to NAV than typical and lock in the next revenue degree because the share value stays suppressed under its pre-pandemic ranges. Future rate of interest cuts can function a catalyst to a value restoration, and the constant value vary of HTD instills confidence that they’ll be capable to enhance efficiency as soon as macro circumstances grow to be extra superb. Subsequently, I price HTD as a purchase.