Justin Sullivan/Getty Images News

Investment Thesis

Company Overview

HP Inc. (NYSE:HPQ), founded in 1939 with a headquarters in Palo Alto, California, is a leading global provider of personal computing, imaging and printing products and related accessories and solutions products. It has three reportable segments: Personal Systems, Printing, and Corporate Investments.

Strength

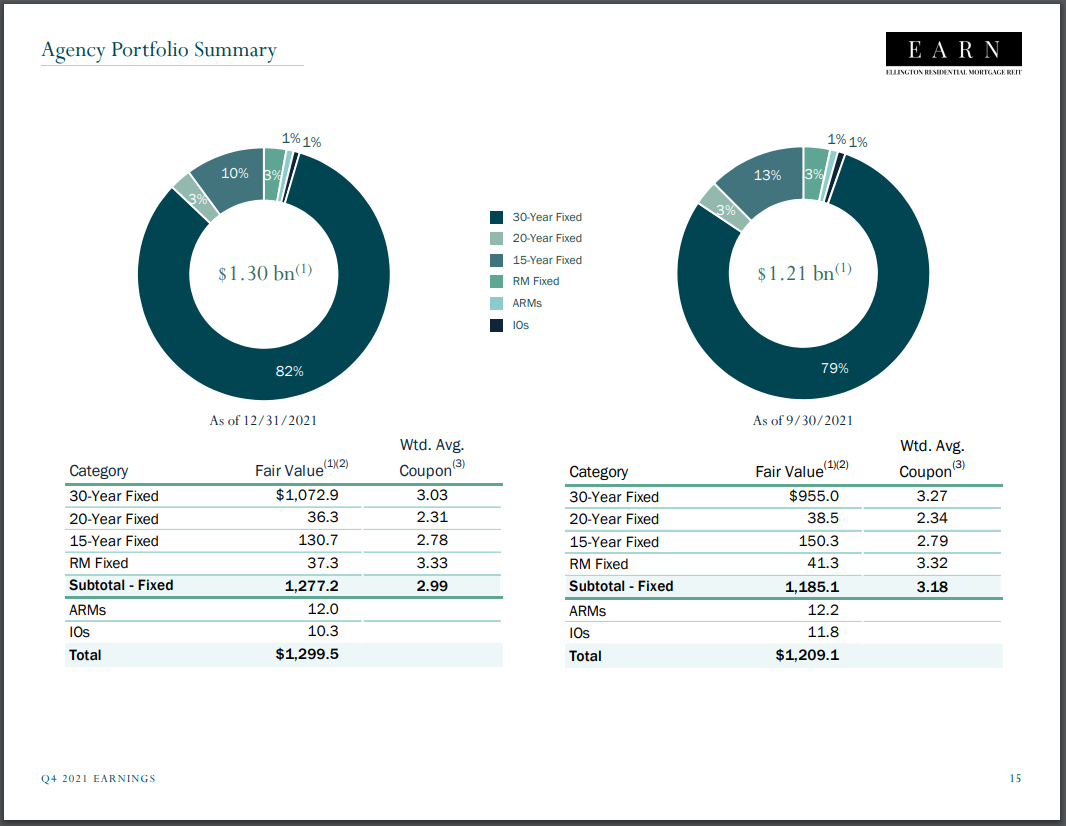

Since the separation from its former enterprise unit, Hewlett-Packard Enterprise Company, in 2015, HP has seen steady growth in its revenue. Its current composition of segments has the largest contribution from Personal Systems of Commercial users at 47%. Its printing supplies came in second at 21%, and its Personal Systems of consumer users at 20%. Overall, Personal Systems provide almost double what Printing contributed to the revenue, although printing is more synonymous with the brand in consumer perceptions.

HPQ: Net Revenue Composition (Company May ’23 Presentation)

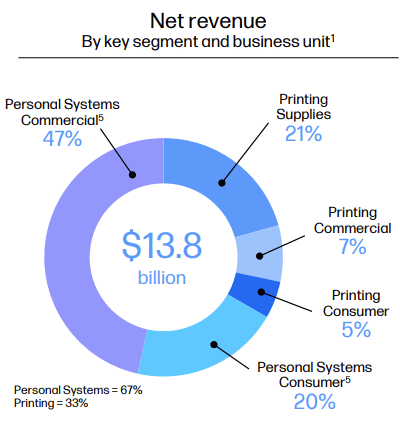

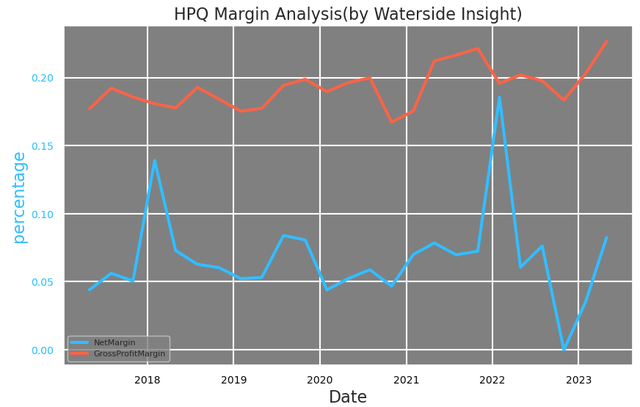

On a TTM basis, HP’s revenue has grown by over 50% since 2017. But in the last three quarters, the numbers have dropped back to just around the pre-pandemic levels. Despite the topline weakness, its margins have largely stayed within a normal range, with gross margin rising to levels of a 5-year-high.

HPQ: Margin Analysis (Calculated and Charted by Waterside Insight with Data from Company)

This is on the back of a reversal of revenue growth in the past two years. As explained by HP, the surge in FY 2021 was primarily driven by higher average selling prices and unit demand from the work-from-home and remote learning trends. While the reversal back down in FY2022 was mostly due to supply chain constraints and inflation-induced softness in demand. Under such macro circumstances, the steadiness in its margins shows the company’s management strategy’s resilience by both raising unit prices and controlling costs and expenses.

HPQ: Revenue (Calculated and Charted by Waterside Insight with Data from Company)

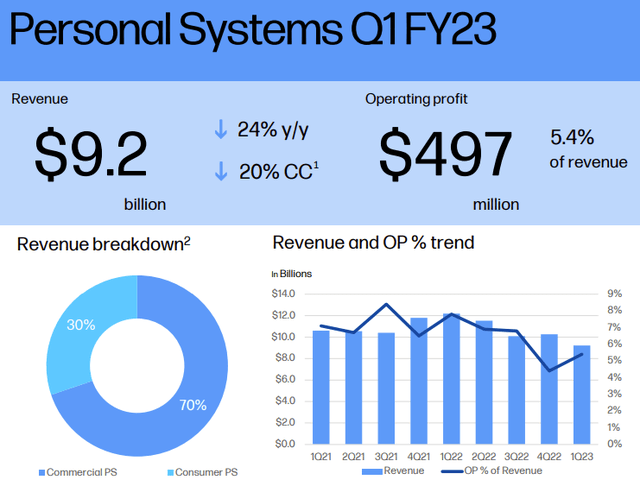

To break it down by its segment, we can see how the operating profits are still holding up, despite the drop in revenue. For its personal systems, the revenue has dropped 24% YoY, and its operating profit has increased by 5.4% in Q1 FY 2023.

HPQ: Personal System Segment Performance Q1 2023 (Company May ’23 Presentation)

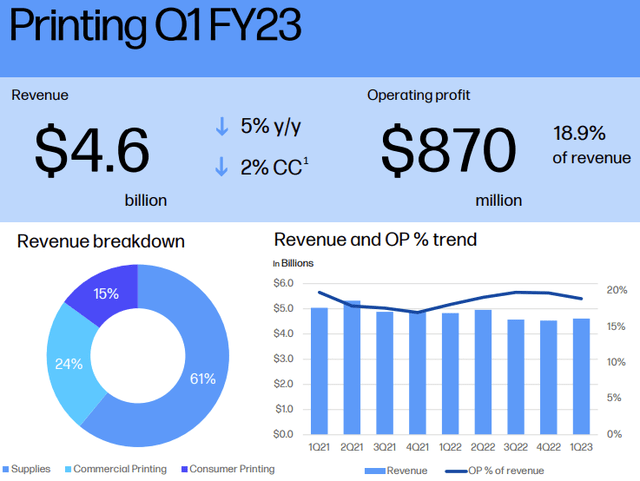

For its Printing segment, the revenue dropped slightly in the low single digits, and the operating profits have grown 18.9%.

HPQ: Printing Segment Performance Q1 2023 (Company May ’23 Presentation)

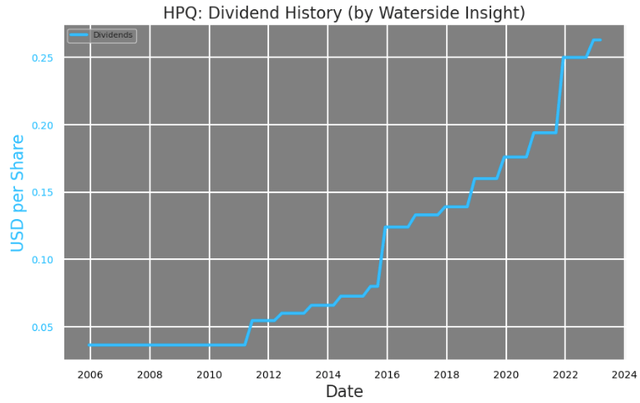

Last but not least, HP has maintained its dividend payout at $0.2625 per share, the same level as Q4 last year. This is on the heels of a steep ascend from 2021 to 2022. The company’s stock repurchase has slowed down in the past two years, so the increasing dividend is another way of maintaining its strong tradition of giving back to shareholders.

HPQ: Dividend History (Calculated and Charted by Waterside Insight with Data from Company)

Weakness/Risks

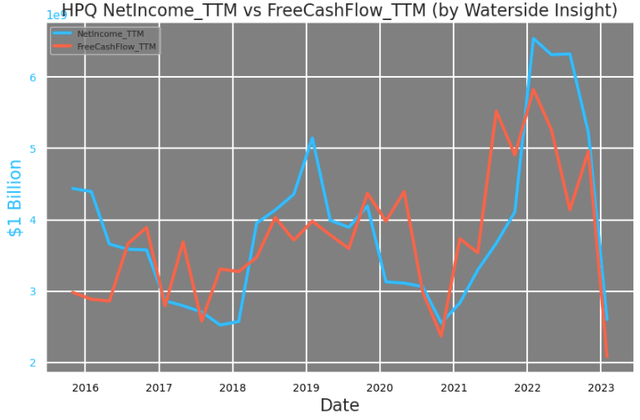

However, this reversal of topline growth still broke some cracks in HP’s financials. The company’s net income and free cash flow have dropped in the latest quarters after almost doubling in late ’21 to early ’22. The recent low levels are the lowest since the spun-off on a TTM basis.

HPQ: Net Income vs Free Cash Flow (Calculated and Charted by Waterside Insight with Data from Company)

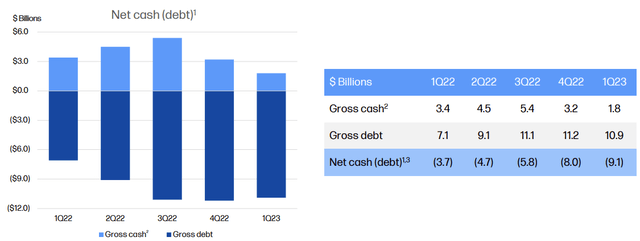

The company’s cash position has been decreasing while its debt load has been stagnant.

HPQ: Net Cash (Company May ’23 Presentation)

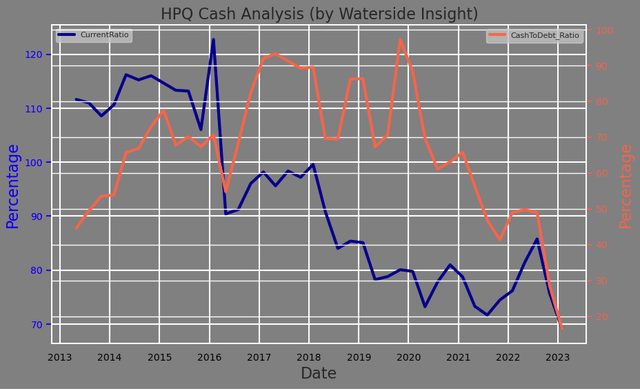

As a result, it has a weak cash position with a low cash-to-debt ratio and a low current ratio.

HPQ (Calculated and Charted by Waterside Insight with Data from Company)

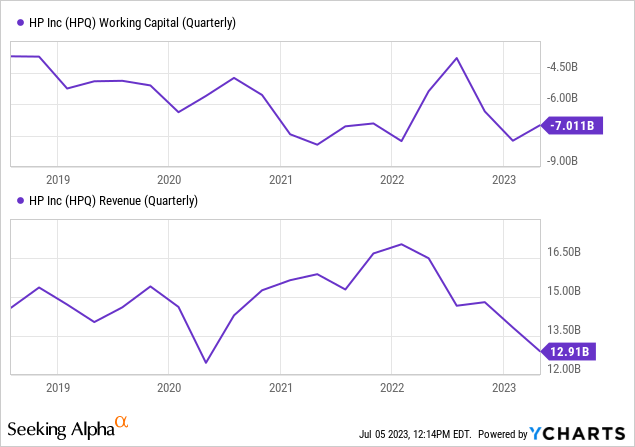

HP’s working capital is also at its lowest level, almost 60% less than five years ago, contrasting with its latest revenue, which was less than 10% weaker within the same time frame. With weakening cash flow and low cash position, its recent ability to implement its strategic expansion could be constrained.

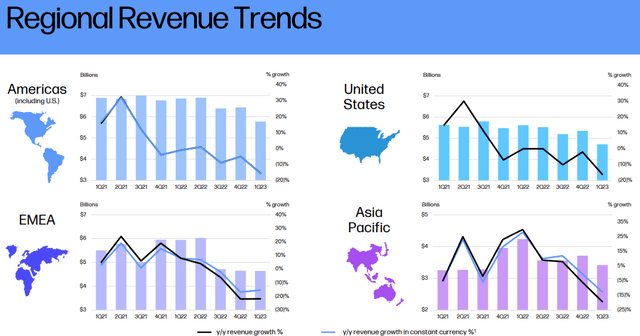

Geographically, HP has seen a slowdown in growth across four regions in its worldwide markets. All found major regions have been experiencing a contraction in revenue growth. The strengthening of the USD has impacted its EMEA and Asia Pacific regions’ growth, but not to a large degree. The slowdown started in Q1 of 2021 for most of the regions and was more acute in the last quarter. This indicated a secular trend had been formed. The return-to-office calling has been uneven in certain regions or cities, which will inevitably impact the company’s commercial clients’ office system supply demands. It is important to keep an eye on whether it will become a new normal for the company’s topline growth.

HPQ: Regional Revenue Trends (Company May ’23 Presentation)

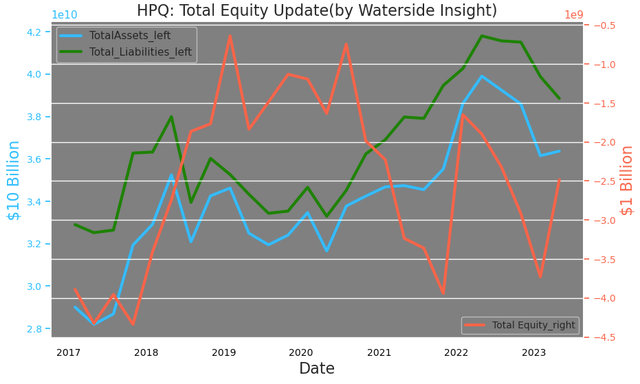

On top of these recent weaknesses, HP also has a legacy issue: a high debt load. Its total liabilities have exceeded total assets since its spin-off. The company’s debt-to-equity ratio is at a negative 429% lately, which is already riding on an improved total equity level, albeit still negative. This hasn’t stopped the market from heavily discounting its future growth for a good reason: a higher interest environment will directly impact its future cash flow.

HPQ: Total Equity (Calculated and Charted by Waterside Insight with Data from Company)

Overall, we see HP inevitably continued being affected by soft demand in the near term and, what’s more, an unenviable constrained cash position in coping with the slowdown in sales and revenue. Raising unit prices can still work in the near term to offset some weakness, but if the company’s strategic spending capacity to catch up with the long-term booming trend in AI is compromised, then the discount to its intrinsic value would be larger than expected. Instead of expecting more near-term shareholder returns, long-term investors perhaps would be more inclined to see how the company would capitalize on this trend. So far, the latest AI frantic doesn’t seem to have any impact on HP, if one sees Nvidia’s (NVDA) stock price as any indicator of this latest trend. Although, it is hard to imagine consumers enjoying a booming AI application in daily life in the absence of robust personal computing systems at hand.

HPQ vs NVDA (TradingView)

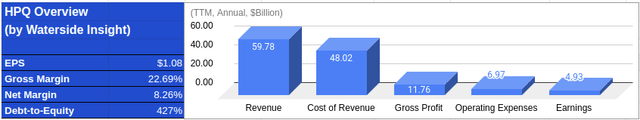

Financial Overview

HPQ: Financial Overview (Calculated and Charted by Waterside Insight with Data from Company)

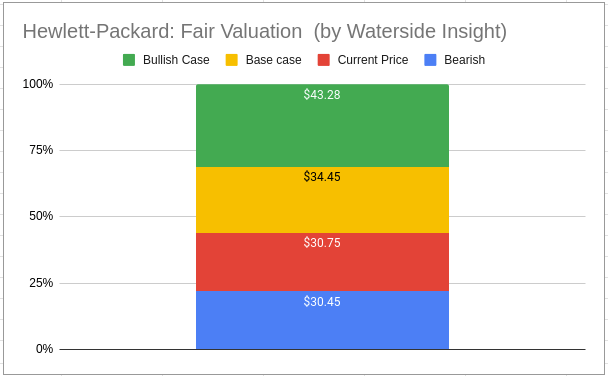

Valuation

Combining all our analysis above, we use our proprietary models to assess the fair value of HP’s stock with a ten-year projection forward. We use 6.55% as the cost of equity and 9.71% as WACC. In our bullish case, although slower growth in ’23 seems more likely than not, a rosier scenario was expected for ’24, accompanied by a steady growth path forward, the company was priced at $43.28. In our base case, anemic growth in the ’23 and ’24, basically when a higher interests environment still persists, has been priced in as constraints for it, with somehow higher discount factor set in up to five years forward, it is priced at $34.45. In our bearish case, not only near-term anemic growth stay, but future growth is also less than impressive; it is priced at $30.45.

HPQ: Fair Valuation (Calculated and Charted by Waterside Insight with Data from Company)

It’s hard to say whether the market is penalizing HP for its heavy debt load, pessimistic about its ability to grow by riding the recent AI boom, or both. The current stock price is largely discounting a near-term strength in the company’s growth with a bearish view, which we echo that HP is not out of the woods to stay in such bearish growth prospects yet.

Conclusion

In the past three years, despite the aftermath of enterprise unit spinoff, stay-at-home and remote access boost, and the latest supply chain constraint and higher inflationary environment, HP has been riding the tides with steady earnings margin levels. But the higher debt load compounded with the recent weakening cash flow position makes the market, in general, bearish about the company’s prospect of turning it around quickly in the near term. The bearish scenario could extend into next year without major shifts in HP’s growth dynamics. Although the stock is inexpensive at the moment, we recommend a hold.