If you’re like most investors I know, you probably hold the following beliefs, even if subconsciously:

- Buying stocks is noble because it funds innovation, growth and prosperity, and…

- “Shorting” stocks is evil.

I agree with #1 … but am here today to dispute the misconception in #2.

Look, I get why “shorting” stocks appears less than noble. The optics of some high-powered Wall Street trader taking home billions in profits while grandma loses 50% of her 401(k)… It feels icky.

But it’s not the whole story.

Consider this…

In 2015, Harvard Law grad and Wall Street insider Steve Eisman found himself the subject of a lead role in the blockbuster film The Big Short.

(Source: The Big Short – 2015 via The Wall Street Journal.)

If you saw the movie, you might’ve got an icky feeling as you watch Steve Eisman rake it in during the 2008 great financial crisis — which, indeed, chopped 50% off the value of grandma’s retirement savings.

Looking deeper, though, you’ll learn that Steve didn’t cause the great financial crisis. (Short sellers rarely, if ever, cause stocks to crash.)

He was, in fact, trying to expose the ones that did!

See, in January 2007, Steve Eisman was invited to meet with a man named Wing Chau. Chau was prominently involved in packaging subprime mortgage debt into collateralized debt obligations (aka “CDOs”).

Essentially, Chau was able to take a bunch of high-risk subprime mortgage debt and package them into CDOs, which somehow were slapped with “low risk” labels by trusted ratings agencies like Moody’s.

Then he sold them by the billions to unsuspecting investors.

And these unsuspecting investors were not greedy hedge funds for which you’d have little sympathy. Many were pension funds that managed millions of Americans’ retirements … including “grandma’s.”

Long story short, after meeting with Chau and hearing what he was doing … Steve called the CDOs “dog crap” and vowed to short them.

The rest is history. Steve Eisman and a small handful of others — John Paulson, Michael Burry and James Mai — all shorted the toxic CDOs that Wing had been pedaling as “safe” investments.

Soon the façade of those “safe” investments crumbled … the short sellers made billions of dollars … and the entire U.S. financial system — the system that allowed Wing and other bad actors to push toxic investments into grandma’s retirement fund — came under intense scrutiny.

That, my friends, is why you should be able to see Steve Eisman and his short seller colleagues as the heroes of this story … not the “evil” villains that short sellers are lazily portrayed to be.

These short sellers catalyzed one of the most impactful Wall Street reforms of the 21st century.

Unfortunately, 15 years on from the great financial crisis, the system has found a workaround.

Once again, toxic assets have made their way into the retirement funds of everyday Americans — whether they like it or not.

I can confirm with 99% certainty that you’re exposed to assets like these right now.

Worse, there’s almost nothing you can do to avoid it.

However, there is something you can do to fight back.

But before I tell you that, we have to understand how Wall Street changed after 2008, and why that still can’t protect us from this problem.

The Dodd-Frank Act

The Dodd-Frank Wall Street Reform and Consumer Protection Act was the U.S. Congress’ answer to Wall Street’s greed and reckless behavior.

It was meant to protect grandma from the likes of Wing Chau and everyone else who was willing to sell “dog crap” to unsuspecting investors.

If it worked, it would prevent a systemic calamity like the great financial crisis from ever happening again. And, for the most part, it seems to be working.

Yes, there are criticisms of Dodd-Frank. Some argue it’s too strict and makes it more difficult for U.S. financial institutions to be competitive.

But few will argue the U.S. financial system is less safe than it was in 2007. Most agree it’s far, far safer.

For instance, Steve Eisman himself recently spoke on the state of the U.S. banking system in 2023, relative to how it looked in 2007.

Back then, the major U.S. banks were highly levered. That means they borrowed a lot of money to invest and didn’t have nearly enough capital to cover themselves in case of emergency.

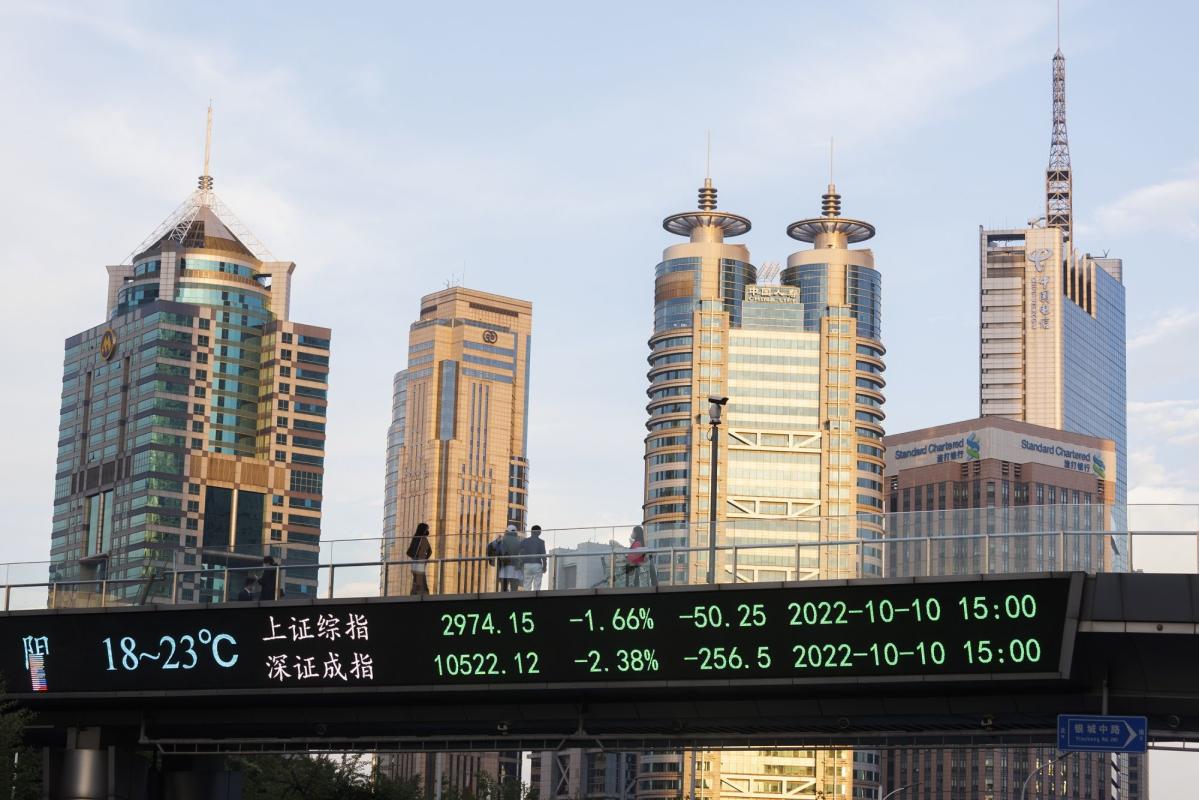

On average, banks were levered between 30-to-1 and 40-to-1. Now, thanks in large part to Dodd-Frank reforms, they’re back down into the 10-to-1 range.

I like how Eisman put these numbers into context. He said: “These are just numbers … a better way to think about it is: If you’re levered 30-to-1 or 40-to-1, all it takes to destroy you is a ‘pebble.’ When you’re only levered 10-to-1 … it would take a meteor.”

So, think about all this for a minute…

Here in 2023, we’re muddling through a bear market in stocks and bonds … we’re facing a 90%-odds recession … and inflation is throwing a curve ball we haven’t seen in over 40 years.

My point is, it’s by no means an easy environment to be an investor.

But, it could be worse. We could be questioning the toxicity and fragility of the entire U.S. financial system like we were in 2008. Yet, we aren’t, thanks to Dodd-Frank and those misunderstood short sellers who “called foul” on one of the most unjust and unsustainable situations in modern financial history.

For that, we should all be thankful!

But unfortunately, I see a similar scenario playing out right now…

Is History Repeating Itself?

One of the saddest parts of the 2008 great financial crisis was how those toxic CDOs were more or less forced into grandma’s retirement portfolio.

And while I realize saying so will be controversial, I’m concerned the very same thing is happening today, with a single stock that I’m willing to bet 100% of grandmas — and you — already own.

Do you own anything that tracks the S&P 500? A mutual fund, exchange-traded fund or even a “target-date” fund through your 401(k) provider?

If you answered “yes,” then you’re exposed to the company I’m referring to.

The committee that decides which stocks are to be included in the S&P 500 added this company to the index in 2020, in a move that’s been called “controversial” by many.

In short, the stock was (and still is) grossly overvalued. It traded at a price-to-earnings ratio more than 20 times the S&P 500’s the month before it was added to the index.

I don’t know about you, but to me that sounds about as reckless as the ratings agencies slapping “low risk” labels on toxic mortgage CDOs in 2007!

At any rate, because of that nosebleed valuation, the stock instantly became a top 10 holding for the index.

And whether you or grandma realized or agreed to it … you began owning shares of this company from December 2020 onward — that is, assuming you have any of your money in an S&P 500 fund.

The Next Big Short

You must realize, more than $7 trillion worth of retirement savings is tied to the S&P 500 Index. That’s a ton of money. And a ton of losses for unsuspecting investors, considering the stock has already fallen in half from its highs!

That of course means that the “nosebleed” valuations this stock carried with it have come down some since its addition to the S&P 500 Index.

Yet my analysis shows the stock is still between five and seven times more expensive than its peers — a valuation gap that I’m convinced will close this year as the stock tumbles lower still.

As you can probably tell, I’ve done a lot of research and due diligence on this company. And you can also likely tell that I’m targeting it for a big short of my own.

In fact, my team and I have put together a presentation we’ll release this coming Tuesday, February 14, at 1 p.m. with all the details…

I’m calling it “The Next Big Short” because the amount of money at stake actually exceeds the size of the CDO market in 2007.

Thankfully, I believe the damage won’t have the same “systemic” impact CDOs had during the great financial crisis.

But considering this stock is one of the largest holdings in all S&P 500 funds, I at least feel obligated to warn you of this situation.

Already a number of successful Wall Street “short sellers” are betting against this stock, as are my subscribers.

Whether or not you still believe shorting a stock is “evil,” the recommendation I’ll share next Tuesday could help you hedge the exposure you likely have to this grossly overpriced stock.

You do not have to fall victim to Wall Street’s latest scheme. There are sensible ways to profit as stocks like this unwind.

Right now, I’m using such a method to make even bigger percentage gains than the short sellers did in 2008 … with none of the unlimited risk that comes with shorting stocks.

And if making a risk-limited trade that could net you a gain of 20-times your initial investment sounds appealing to you … attending my Next Big Short presentation is a must.

Regards,

Adam O’DellChief Investment Strategist, Money & Markets

Adam O’DellChief Investment Strategist, Money & Markets

I was just starting my career when the 1990s dot-com bubble finally burst. I still remember being amazed by things that simply didn’t make sense.

You remember the Palm Pilot?

Before there were iPhones … or even BlackBerries … there was the Palm Pilot personal digital assistant, or PDA.

It didn’t really do much… It was basically a glorified digital address book and calendar. But it was the hot technology of the day, and everyone wanted a piece of it.

Palm was a publicly traded stock, but only about 5% of its shares were freely traded. The rest were owned by its parent company … stodgy “old tech” equipment maker — 3Com Corporation.

It was the 1990s … no one wanted to own a dinosaur company like 3Com that made legacy technology equipment. It was new tech or bust!

And this is where it got weird.

Palm’s market value in early 2000 was $53 billion, making it larger at the time than General Motors, Chevron or even McDonalds. 3Com’s market value was just $28 billion … despite the fact that it owned 95% of Palm.

The market was essentially pricing 3Com at a value of negative $22 billion.

That might be remembered as the most asinine pricing in the entire multi-century history of the stock market.

On Palm’s IPO, shares soared as high as $165 on the first day from an initial listing price of $38. It made zero sense.

But the rally was short-lived. By that afternoon, PALM was down to $95 and change.

Anyone who could see that situation for what it was would’ve made an absolute killing shorting the stock … while exposing the insanity all at once.

Like Adam, I’m not naturally bearish. But I do take advantage of opportunities to short from time to time.

There is absolutely nothing wrong with shorting. It’s not mean-spirited … it’s not unpatriotic… It’s certainly nothing sinister.

As Adam points out, the real damage to investors usually comes from unscrupulous hucksters on the long side, not the short side. Short sellers actually play a vital role in the market.

To start, they provide liquidity. If you want to buy a stock, you need someone to sell it to you. It doesn’t just magically appear. You have to have a counterparty. Short sellers take that other side of the trade.

They also help to expose fraud. Hindenburg Research just claimed to have found evidence of massive fraud in the businesses controlled by Indian billionaire Gautam Adani. If true, they will have potentially saved future investors from falling into a trap.

But perhaps more than anything, short sellers can help inject a voice of reason into the conversation. When prices simply don’t make sense, short-sellers can profit by simply correcting a market that has lost its mind. Palm’s IPO is one of countless examples of insanity correcting itself.

That’s what Adam is aiming to do for his subscribers with his Next Big Short.

As Adam told you today, he’s set his sights on a troubled company that has no business carrying the valuation it does.

He’s already made his subscribers plenty of money shorting it … but he believes there’s far more profits to come.

You can learn which stock it is, and how you can join in on the short side with far less risk and much bigger rewards, when Adam reveals it in his brand-new presentation next Tuesday. Be sure to sign up here and make sure you have a seat.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge