Welcome to the “polycrisis” — a world in which, as historian Adam Tooze says, “economic and non-economic shocks” are entangled “all the way down”. We have an inflation shock that emanates from the disruptions caused by a pandemic, the policy responses to that pandemic and an energy shock caused by a war. That war in turn is related to the breakdown in relations among great powers. Slow growth, rising inequality and over-reliance on credit have undermined political stability in many high-income democracies. The credit boom led to a great financial crisis whose outcome included a decade of ultra-low interest rates and so even more financial fragility worldwide. Adding to these stresses is the threat of climate change.

It is indeed convenient to think about the world in intellectual silos, focusing in turn on macroeconomics, finance, politics, social change, politics, disease and the environment, to the exclusion of the others. In a reasonably stable world, this may even work well. The alternative of thinking about the interactions among these aspects of experience is also too hard. But sometimes, as now, it becomes inescapable.

It is not just theoretically true that everything depends on everything else. It is a truth we can no longer ignore in practice. As my colleague Gillian Tett often warns, silos are perilous. We have to think systemically. Economists have to recognise how the economy is interconnected with other forces. Navigating today’s storms compels us to develop a wider understanding.

This is not an argument against detailed analysis of individual elements in the picture. Economists should still look carefully at the things they know about, because they are both complex and important in themselves. Thus the data and analysis in the OECD’s latest Economic Outlook continue to be both invaluable and illuminating. But, inevitably, they also omit vital aspects.

Consider, then, what the report tells us about the economic situation.

First, the energy crisis itself is truly huge. The share of OECD members’ GDP spent on end-use of energy is close to 18 per cent, double what it was in 2020. In Europe, the increases must be far bigger than this. The last time the ratio was this high was in the early 1980s, during the oil shock caused by Saddam Hussein’s invasion of Iran.

Second, inflation pressures are both strong and widespread. Again, this has echoes of the inflation in the early 1980s, which followed the high and variable inflation of the 1970s. Today, the energy price shock caused by the war in Ukraine followed the negative shocks to supply and positive shocks to demand triggered by Covid. This combination of supply and demand shocks with big reductions in real wages and losses of national incomes in net energy-importing countries makes the job of central banks hugely difficult.

Third, there is likely to be a sharp slowdown in global economic growth between 2022 and 2023. The latter is forecast at 2.2 per cent. Moreover, the overwhelming bulk of that growth will be generated by Asian economies. The British and German economies are forecast to shrink a little, while the eurozone and US economies are forecast to grow by only 0.5 per cent.

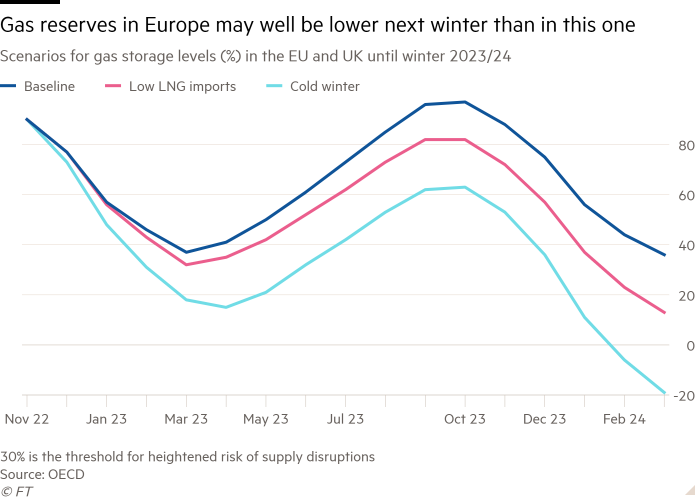

Fourth, although this is, unsurprisingly, an unhappy picture, it could turn out far worse. The energy outlook is itself highly uncertain, with a substantial risk that gas reserves in Europe will be smaller next winter than this one, especially if winters are cold or imports of liquefied natural gas too small. Rising interest rates might trigger more financial upheaval and deeper downturns than now foreseen. Food shortages might cause deeper distress in developing countries than expected, especially in a financially restrictive environment.

The OECD’s view, which I share, is that central banks must not take a peak in inflation as a sign their job is done. It is essential that inflation be brought firmly back under control. In this context, it is also vital that fiscal policy be targeted at supporting those worst hit by high energy prices. Just as important is a push on expanding supply of renewable energy and improving energy efficiency. That is the “home front” in Europe’s conflict with Russia.

Yet even this is an incomplete picture. Other elements are the possible developments in the Ukraine war itself and what is needed to bring it to a satisfactory end. Yet another is how China will escape the trap of its zero-Covid policy. Last but not least is finding ways to help developing countries through their looming financial woes, while supporting their climate transition.

The point is that we need to analyse within the silos, while also analysing systemically across them. The OECD, to its credit, created in 2012 a unit called the New Approaches to Economic Challenges in order to do that. As this unit’s most recent and apparently final report notes, we have to analyse interactions among social, economic, political, geopolitical, health and environmental developments in addressing the challenges we confront. Humanity has created a world so interdependent that no other approach is possible. Of course, such an approach is difficult. It is bound to irritate professional experts working comfortably in their silos. But ever since the financial crisis and quite particularly over the past three years, it has become clear that such narrowness is folly. It is to be precisely wrong rather than dare to be roughly right.

So what has the OECD done with this venture? Apparently, it is closing it. This is a mistake. If the NAEC is not good enough, make it better. The world we know now does not divide into neat silos. Our thinking must not remain stuck narrowly within them either.

Follow Martin Wolf with myFT and on Twitter