Editors’ word: This column is a part of the Vox debate on the financial penalties of conflict.

The seek for further sanctions is intensifying in view of the continuing struggling of the civilian inhabitants in Ukraine beneath Russian bombardment of cities. One thought which is usually mentioned is for the EU, or particular person Member States, to ban imports of Russian gasoline. The financial penalties of such a step could be very extreme within the brief run.1 However there may be one other, extra gradual method which might minimise financial disruptions and which might have a robust affect on the revenues flowing to Russia. The EU ought to merely impose a particular import tariff on Russian gasoline.

Such a transfer would in fact be towards WTO guidelines. However beneath these particular circumstances, it may be justified with the exemption beneath Article XXI for nationwide safety. Furthermore, Russia has imposed for a very long time an export tax of 30% on gasoline. The EU can declare that its import tariff simply compensates for this distortion.2

The important thing level of departure is that Russian gasoline is offered to Europe by one provider, Gazprom, with a close to monopoly on exports of gasoline.3 On the similar time, the EU accounts for about 70 % of general Russian pipeline gasoline exports (about 140 billion cubic metres). Different prospects are unlikely to have the ability to compensate absolutely for the EU market. China takes already substantial quantities of gasoline from Russia and won’t wish to turn into depending on Russia for its power. As the most important purchaser, the EU has appreciable ‘monopsony energy’, however this has to this point not been used.4

Commonplace financial evaluation implies that Gazprom, as a monopolist, is not going to merely cost its marginal value to European shoppers, however will prohibit its provides to the purpose the place its marginal value equals the marginal income from the final cubic meter offered. This provides Gazprom a substantial monopoly lease (which flows in the end into the coffers of the Russian authorities).

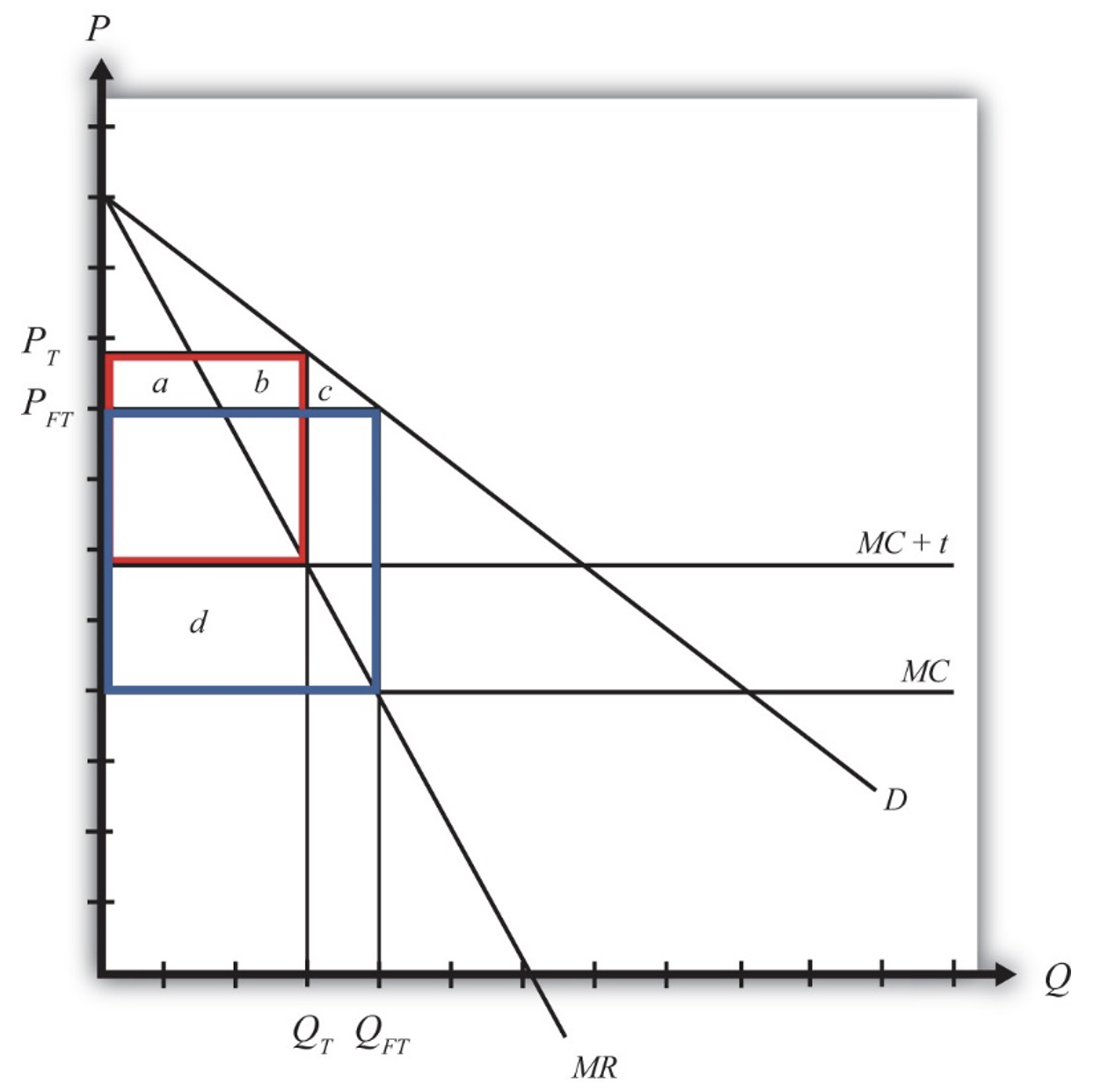

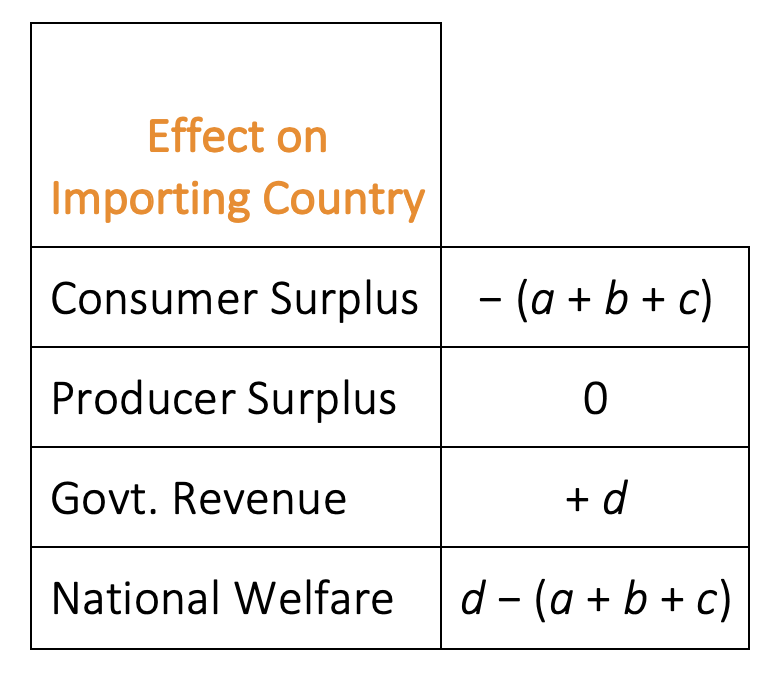

If the EU imposes a tariff, Gazprom will enhance its worth, however solely by a fraction of the tariff as a result of in any other case it will lose an excessive amount of income. The tariff thus eats into the lease of Gazprom. Determine 1 within the annex reveals the equilibrium ensuing from a tariff. The welfare of European shoppers thus suffers from greater costs, however the tariff income could be greater than their loss, at the least as much as a sure stage of the tariff.

In Gros (2022b), I develop this normal formal evaluation5 additional and present that there’s a tariff charge which is perfect for the EU as a result of it will maximise the distinction between the tariff income and the losses of European shoppers. In a easy linear mannequin, the optimum tariff seems to be roughly 30% (of immediately’s worth) – by likelihood equal to the Russian export tariff. Furthermore, this tariff would reduce Gazprom’s revenues from gross sales to Europe by one half.

The optimum tariff argument thus implies {that a} tariff on imports of Russian gasoline could be applicable even with out having any intent to sanction. Such a tariff would thus have been applicable already prior to now. At current, the EU is trying to find methods to scale back Russia’s export revenues. This intent will be added to the evaluation by assuming that the EU is prepared to forego one euro of advantages for itself if this cuts Russia’s export revenues by one euro. The result’s then that the EU ought to impose a tariff of roughly 60% on imports of Russian gasoline.6 This is able to then reduce Gazprom’s revenues to lower than one fourth of immediately’s stage.

European shoppers would in fact endure extra beneath the upper, sanctioning tariff. However the mannequin means that the tariff revenues would nonetheless be adequate to compensate them as a result of the upper tariff would additionally take away a bigger proportion of the (remaining) rents of Gazprom.7

Sanctioning Russia through a excessive tariff on Gazprom’s exports to the EU would thus signify the last word ‘sensible’: it will severely diminish Russia’s revenues and would impose no financial burden on the EU.

The political benefits of a tax on imports of gasoline from Russia are additionally clear.

Initially, it will counter, at the least partly, the ethical argument that, by importing gasoline from Russia, we’re financing Russia’s conflict of aggression. Those that nonetheless purchase Russian gasoline would then additionally contribute to financing our response to this conflict and the tariff would supply them with a robust worth sign to diversify over time. Those that have alternate options will accomplish that instantly. The demand for Russian gasoline in Europe will fall, slowly at first, however at an accelerating charge.

Second, it will yield substantial revenues (which additionally play a key function within the financial evaluation). At present excessive world pure gasoline costs, a 30% tariff on the worth of Russian gasoline may simply attain €30–50 billion (on an annual foundation) on the stage of the EU. This is able to enable the EU to offer help to susceptible teams being hit by greater gasoline costs, additional help to the Ukrainian authorities, and assist to Member States to defray the prices of caring for the hundreds of thousands of refugees we should count on. If, as now sadly appears probably, 3–5 million Ukrainian have to hunt shelter within the EU, the general prices may be within the order of dozens of billions of euros (counting over €10,000 per refugee for housing and residing bills).8

An additional benefit of this strategy is that it supplies a robust long-term incentive for the non-public sector to hunt different provides. And these provides could be forthcoming. If the EU makes it clear that the tariff goes to remain so long as Russia’s aggression towards Ukraine continues, different potential suppliers of gasoline world wide will take discover and begin investing find new sources or exploit higher present ones. In Gros (2022b), I argue that in Asia there may be appreciable potential for power financial savings and switching from gasoline to coal, thus liberating vital portions of LNG provides for Europe.

One may in fact object that Russia may react to the European import tariff by growing its personal export tariff. This would possibly very nicely be the case. However Russia’s export tariff is of little significance. It determines solely the home worth stage for gasoline (see Tarr 2004 on the explanation why Russia desires to maintain twin pricing). The decrease that stage, the extra gasoline will probably be wasted inside Russia. Anyway, the home worth stage for gasoline inside Russia is mounted in roubles and has thus already gone down relative to the world market worth stage. The Russian export tariff has thus de facto already elevated.

As an alternative choice to a tariff, it has been proposed to easily put a cap on the value European importers could be allowed to pay to Gazprom. However this may increase a number of points.

Initially, it will not resolve the issue that, for the European shopper, Russian gasoline must be dearer than different gasoline. Furthermore, even assuming that Russia accepts to ship at a worth mounted by the EU, at what worth would/ought to the importers resell the gasoline to shoppers?

Second, at what stage ought to the value be mounted? At marginal value, attempting to applicable your complete producer surplus? On this case, Russia would not have an incentive to ship.

Third, if Russia continues to ship (if the value has been mounted sufficiently above marginal value), what amount ought to the EU import?

A worth cap doesn’t resolve the elemental drawback that Russian gasoline has turn into politically poisonous in Europe; it ought to now even be made costly.

Lastly, one has to ask how Europe would obtain the purpose of lowering gasoline imports from Russia with out resorting to a tariff. The one various could be quantitative restrictions or outright orders to power distribution corporations to not purchase Russian gasoline. The latter could be tough to maintain from a authorized viewpoint and the previous could be equal to a tariff if the rights to import Russian gasoline are auctioned. If they’re simply distributed on political grounds this may outcome a large distribution of rents. The European Fee has lately introduced concepts how the EU may substitute about two-thirds of immediately’s Russian gasoline imports ‘nicely earlier than 2030’. However the Fee doc (European Fee 2022) describes solely what sources may substitute Russian gasoline, not how or why non-public sector gasoline customers ought to cut back their purchases of Russian gasoline.

At any charge, one has to remember the fact that any discount in Russian gasoline imports – whether or not achieved by quantitative restrictions, licensing or a tariff – implies the identical enhance in gasoline costs (except gasoline is rationed). The primary distinction a tariff makes is that the hyperlink between the discount of gasoline imports and better costs turns into extra clear.

Annex

Diagrammatical textbook exposition

The determine beneath illustrates the linear case used within the textual content. MC denotes the marginal value, D demand and MR is marginal income. QFT denotes the amount imported beneath free commerce, and QT the amount imported with a tariff (or charge t).

Determine A1

Supply: Worldwide Commerce: Idea and Coverage, part 9.6

The importing nation positive aspects if d > a+b+c, which can at all times be the case for a small tariff.

References

Bachmann, R, D Baqaee, C Bayer et al. (2022), “What if? The financial results for Germany of a cease of power imports from Russia”, ECONtribute Coverage Transient No. 028 (see additionally the Vox column right here).

Brander, J A and B J Spencer (1984), “Commerce warfare: tariffs and cartels”, Journal of worldwide Economics 16(3-4): 227-242.

Gros, D (2022a), “When the faucets are turned off: The right way to get Europe by the following winter with out Russian gasoline”, CEPS Coverage Perception No. 2022-07.

Gros, D (2022b), “Optimum tariff versus optimum sanction: The case of European gasoline imports from Russia”, forthcoming EUI Coverage Transient 2022/19..

Hausmann, R (2022), “The Case for a Punitive Tax on Russian Oil”, Venture Syndicate, 26 Feb February.

Johnson, H G (1968), “The Acquire from Exploiting Monopoly or Monopsony Energy in Worldwide Commerce”, Economica 35(138): 151-156.

Jones, R W and S Takemori (1989), “International monopoly and optimum tariffs for the small open economic system”, European Financial Overview 33(9): 1691-1707.

OECD (2017), “Who bears the price of integrating refugees?”, Migration Coverage Debates No. 13, January.

Sturm, J (2022), “A Word on Designing Financial Sanctions”, manuscript, 16 March. https://drive.google.com/file/d/1DGY7BRJd8op4KvCx0-uw5cU7r7lQ4j2X/view

Tarr, D G and P D Thomson (2004), “The deserves of twin pricing of Russian pure gasoline”, World Financial system 27(8): 1173-1194.

Endnotes

1 For an estimate see Baqaee et al. (2022).

2 See Tarr (2004) for an financial evaluation of Russia’s twin pricing within the WTO context.

3 For Russian gasoline one thus can’t apply the standard fashions which assume that international provide is offered by aggressive companies (e.g. Sturm 2022).

4 For the basic reference on monopsony energy, see Johnson (1968) and Brander and Spencer (1984). Russia has some LNG export amenities, however they’re near being absolutely used and may thus not represent a security valve.

5 The mannequin relies on Jones and Takemori (1989), who additionally focus on intimately what constellation of market segmentation could be required for a tariff to be attainable. [1] This is able to be considerably decrease than the ‘punitive’ charge of 90% recommended by Hausman (2022).

6 It’s assumed right here all through that there’s one built-in European market on this mannequin. The value is similar for all international locations, independently of whether or not they import their gasoline from Russia or sources (piped from Norway or Algeria, LNG from the Center East). The affect of a better gasoline worth or a tariff on any particular person member state thus doesn’t rely on the quantity of gasoline imported from Russia by that nation, however solely on its general imports of gasoline.

7 See OECD (2017) for estimates of the per capita value of refugees in OECD international locations between $10,000 and $20,000.