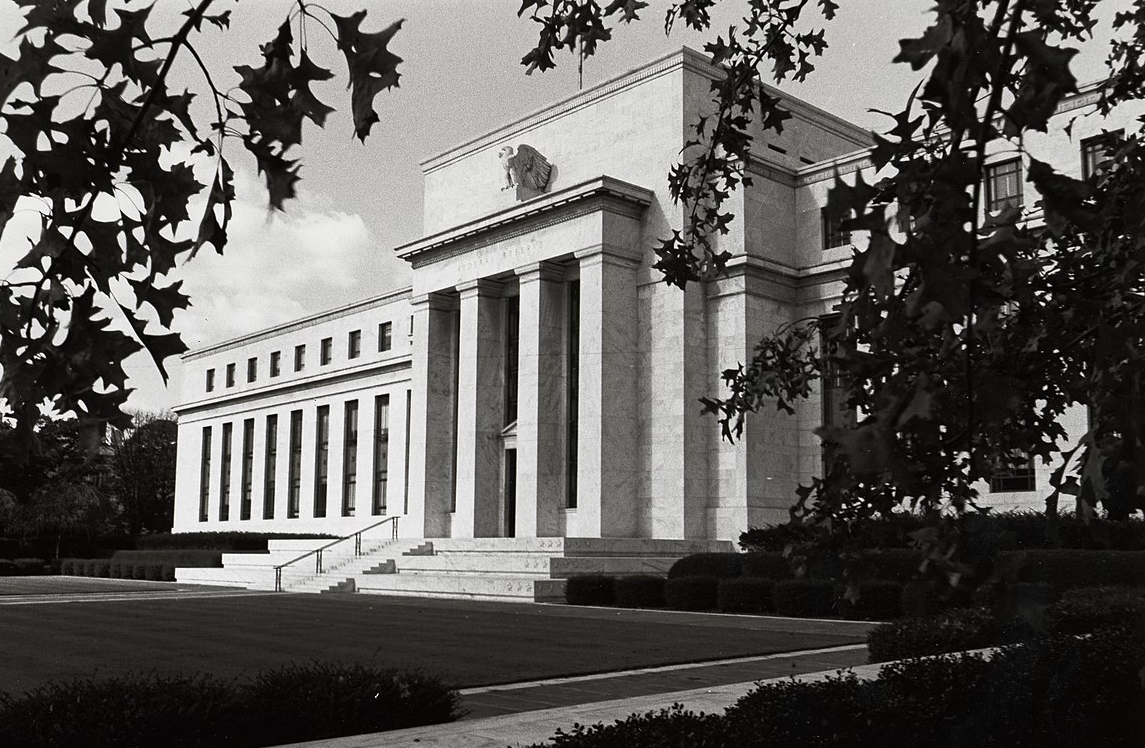

Valentinrussanov | E+ | Getty Photographs

The Federal Reserve is poised to make the primary rate of interest minimize in years this fall, which may affect mortgage charges to go down.

Even small cuts in charges may make a significant distinction in what a homebuyer pays. To that time, individuals available in the market to purchase a house have been eagerly ready for the central financial institution to chop charges.

The Fed is assembly this week, however specialists say it appears extra doubtless the primary charge minimize will are available in September. That might be the primary charge minimize since 2020 on the onset of the Covid-19 pandemic.

Whereas there’s a lower than 6% likelihood of a charge minimize within the upcoming Federal Open Market Committee assembly, in response to the CME’s FedWatch measure of futures market pricing, there’s a a lot larger probability of quarter-point reductions in September, November and December.

That together with additional cuts in 2025 would deliver the the Fed’s benchmark fed funds charge to under 4% by the tip of subsequent 12 months, in response to some specialists.

Whereas mortgage charges are fastened and principally tied to Treasury yields and the economic system, they’re partly influenced by the Fed’s coverage. House mortgage charges have already began to come back down, partially induced by the Fed placing the brakes on charge will increase.

Here is what owners and patrons have to know.

Price cuts are already priced into the market

The primary charge minimize is nearly fully priced into monetary markets already, particularly bond markets, mentioned Chen Zhao, the financial analysis lead at Redfin, a web based actual property brokerage agency. In different phrases, mortgage charges aren’t going to vary a lot as soon as the Fed really begins to chop again, she mentioned.

“A number of these charge cuts are already priced in,” she mentioned.

The 30-year fastened charge mortgage declined to six.78% on July 25, down from 7.22% on Might 2, in response to Freddie Mac knowledge by way of the Fed.

Refinance now or later?

“Refinancings are beginning to tick up, it is not an enormous wave but, however they’re beginning to decide up a bit bit as charges begin coming down,” Zhao mentioned.

Refinance exercise on current residence loans was up 15% from the earlier week, reaching the very best degree since August 2022, in response to the Mortgage Bankers Affiliation. It was 37% larger than a 12 months in the past, MBA discovered.

Whether or not owners ought to refinance relies upon partially on their current charge, mentioned Selma Hepp, chief economist at CoreLogic.

“There are those that originated when mortgages peaked at 8% within the fall of final 12 months,” Hepp mentioned. For these patrons, “there may be some alternative there.”

Extra from Private Finance:

House insurance coverage premiums rose 21% final 12 months

Easy methods to know if you happen to’re a homebuyer pleasant market

1 million individuals now owe greater than $200,000 in federal scholar loans

To be “within the cash,” or when it is smart to refinance, owners have to see a notable drop in mortgage charges as a way to profit, specialists say. The prevailing charge ought to be at the least 50 foundation factors under your present charge. A foundation level is one-hundredth of a share level.

Whereas that may be a great technique, it is not a “onerous and quick rule,” mentioned Jacob Channel, senior economist at LendingTree.

Timing the refinance of your private home will depend upon components like your month-to-month mortgage fee and if you happen to pays closing prices, he mentioned: “There’s a number of variability.” (Whenever you refinance a mortgage, you might be more likely to incur closing prices, in addition to an appraisal and title insurance coverage; and the full price ticket will rely in your space.)

“The saving has to outweigh your upfront prices,” Zhao defined.

Even when your current mortgage has a excessive charge, you may wish to contemplate ready till the central financial institution is additional alongside in its cuts, with the expectation that charges are to steadily decline all year long and into 2025, Zhao mentioned.

In case you are fascinated by it, attain out to lenders and see if refinancing now or within the close to future makes probably the most sense for you, Channel mentioned.

Purchase now or later?

Whereas decrease charges can come as a aid for cost-constrained homebuyers, the true results of decrease borrowing prices are nonetheless up within the air, in response to Zhao.

For example: If borrowing prices for residence loans come down, there’s an opportunity extra patrons will soar available in the market. And if demand outpaces provide, costs may go up much more, she mentioned. It might probably “offset the aid you get from mortgage charges.”

However what precisely will occur within the housing market “is up within the air” relying on how a lot mortgage charges decline within the latter half of the 12 months and the extent of provide, Channel mentioned.

“Timing the market is principally unimaginable,” Channel mentioned. “If you happen to’re at all times ready for good market situations, you are going to be ready perpetually. Purchase now provided that it is a good suggestion for you.”