To start out with among the large numbers, the early January fires within the Los Angeles area—probably the most damaging ones in U.S. historical past—induced not less than an estimated $250 billion, solely roughly $30 billion to $45 billion of which will probably be lined by insurance coverage.

Put one other approach, even that conservative estimate of the financial injury provides as much as about 4 % of California’s GDP.

That’s the start of the context for Rising from the Ashes: Assessments on the Impacts to CRE Put up the LA Wildfires, a brand new report from JLL Analysis.

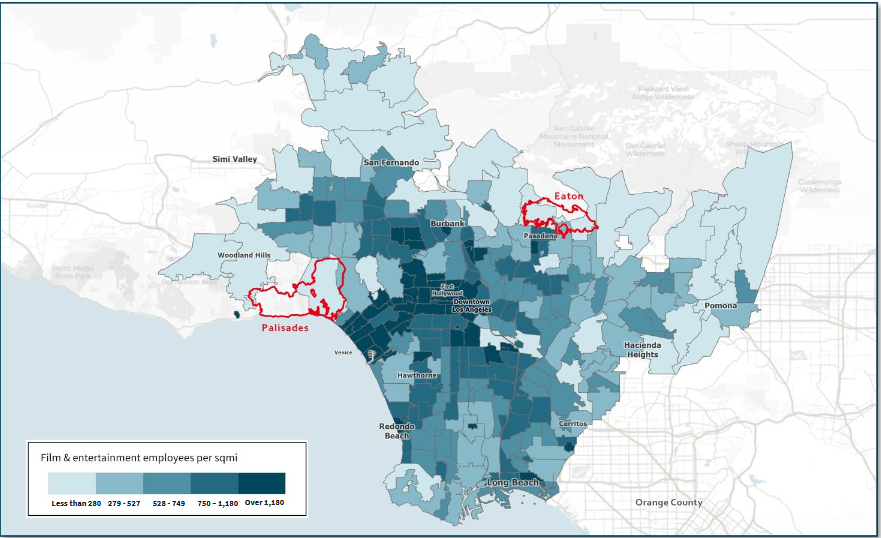

As day after day of reports video footage from the hearth zones confirmed, the heaviest property injury was to single-family residences, practically 11,000 of which had been destroyed, representing greater than half of the SFR inventory within the two fireplace zones (Palisades and Eaton). As well as, greater than 300 multi-housing constructions had been destroyed.

On one hand, the 11,000-odd housing models destroyed or considerably broken signify simply 0.4 % of the market’s housing inventory, but the estimated 24,000 households displaced by the fires must stay someplace.

READ ALSO: 5 Neglected Insurance coverage Gaps That May Hit Your Backside Line

And JLL reminds us that Southern California was already a long-term supply-constrained market. As higher-income households relocate to single-family leases, others will spill over into the multifamily sector. “Already the exacerbation of Los Angeles’ multi-housing provide scarcity will end in elevated hire development within the medium time period,” in accordance with the report.

Influence to retail, workplace, industrial

Although much less publicized, the area’s retail, workplace and industrial business actual property sectors had been additionally hit. About 200 business buildings, predominantly retail properties and food-and-beverage institutions, had been destroyed. They signify, JLL acknowledged, practically half of the retail institutions and about one-third of the full retail area within the fireplace zones.

Within the close to time period, dwelling facilities and {hardware} retailers may benefit. “Long term,” JLL added, “mixed-use developments could also be a technique to deal with each the housing scarcity exacerbated by the hearth in addition to exchange the misplaced retail area, which has not been rising for a very long time.”

The fires’ results on workplace area are anticipated to be oblique, probably by displacing workplace employees, particularly within the skilled and know-how companies sector and the media and leisure sector.

The impacts on industrial actual property may very well be extra direct, with rebuilding efforts boosting the demand for warehouse area and IOS properties.

Moreover, JLL reported, dwelling home equipment, furnishing and day-to-day requirements should be changed, additional bolstering the necessity for warehousing. “This may assist decrease industrial vacancies in and across the affected areas, notably within the San Fernando Valley and San Gabriel Valley markets the place whole emptiness at present stands at 4.2 % and 5.8 %, respectively.”

Given the efforts by the state authorities to streamline rebuilding, JLL famous, the true challenges lie in bodily development. “Attributable to important demand, labor and supplies will probably be costly, additional complicating rebuilding efforts.”

Lastly, these usually greater substitute prices for business actual property have the potential to make present buildings extra engaging for buyers.