Federal Reserve Chairman Jerome Powell.

Andrew Harnik | Getty Photos

Federal Reserve chair Jerome Powell on Friday gave the clearest indication but that the central financial institution is prone to begin slicing rates of interest, that are at present at their highest degree in 20 years.

If a price reduce is available in September, as consultants count on, it could be the primary time officers have trimmed charges in over 4 years, once they slashed them to close zero at first of the Covid-19 pandemic.

Traders could also be questioning what to do on the precipice of this coverage shift.

Those that are already effectively diversified seemingly needn’t do a lot proper now, in line with monetary advisors on CNBC’s Advisor Council.

“For most individuals, that is welcome information, nevertheless it doesn’t suggest we make large modifications,” stated Winnie Solar, co-founder and managing director of Solar Group Wealth Companions, based mostly in Irvine, California.

“It is type of like getting a haircut: We’re doing small trims right here and there,” she stated.

Many long-term buyers might not have to do something in any respect — like these holding most or all of their property in a target-date fund by way of their 401(okay) plan, for instance, advisors stated.

Such funds are overseen by skilled asset managers outfitted to make the required tweaks for you.

“They’re doing it behind the scenes in your behalf,” stated Lee Baker, an authorized monetary planner and founding father of Claris Monetary Advisors, based mostly in Atlanta.

Extra from Private Finance:

Why distant work has endurance

This RMD technique will help keep away from IRS penalties

Some schools is now price almost $100,000 a 12 months

That stated, there are some changes that more-hands-on buyers can contemplate.

Largely, these tweaks would apply to money and glued revenue holdings, and maybe to the forms of shares in a single’s portfolio, advisors stated.

Decrease charges are ‘constructive’ for shares

In his keynote tackle on Friday on the Fed’s annual retreat in Jackson Gap, Wyoming, Powell stated that “the time has come” for interest-rate coverage to regulate.

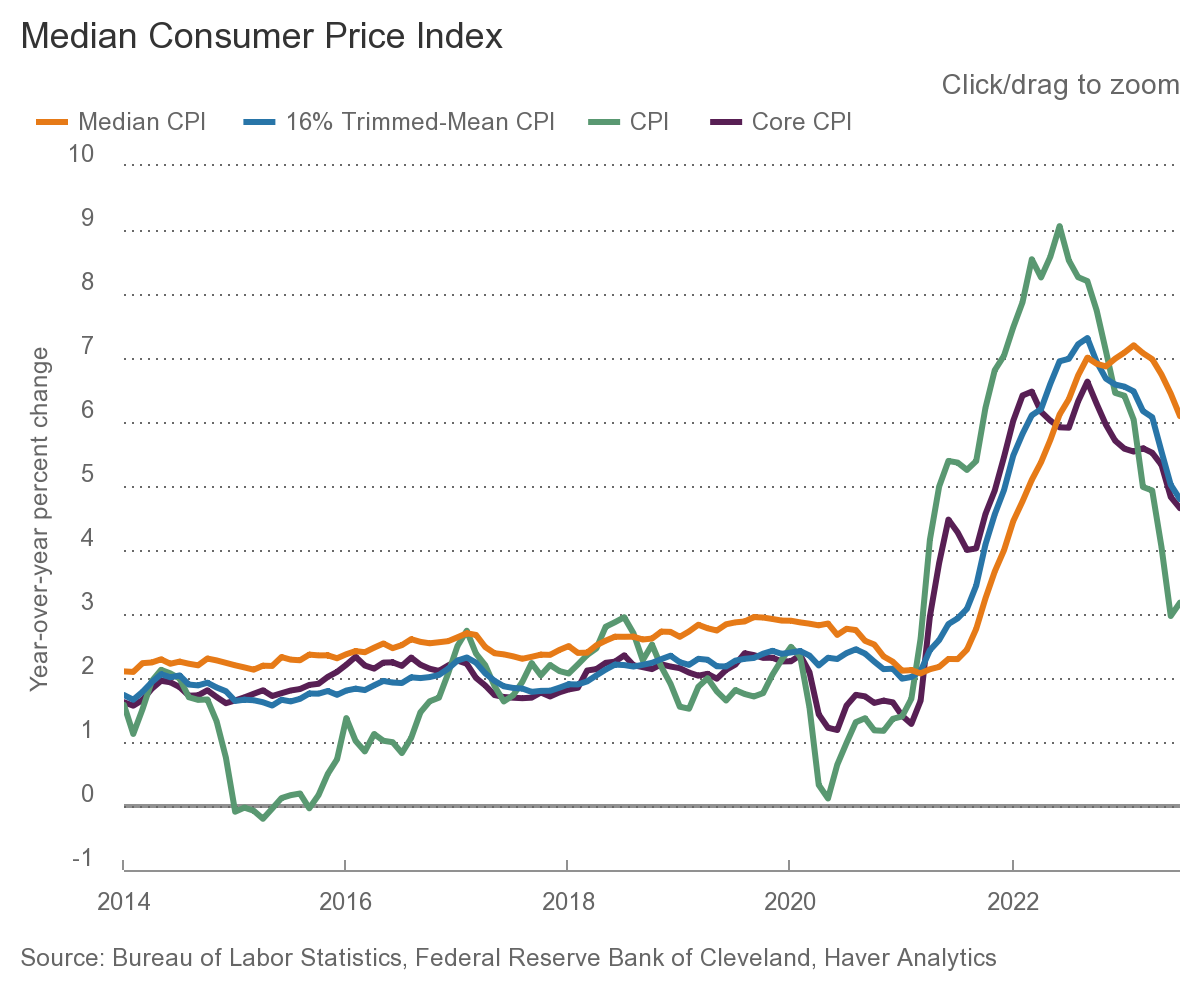

That proclamation comes as inflation has fallen considerably from its pandemic-era peak in mid-2022. And the labor market, although nonetheless comparatively wholesome, has hinted at indicators of weak point. Decreasing charges would take some strain off the U.S. economic system.

The Fed will seemingly be selecting between a 0.25 and 0.50 percentage-point reduce at its subsequent coverage assembly in September, Stephen Brown, deputy chief North America economist at Capital Economics wrote in a observe Friday.

Decrease rates of interest are “usually constructive for shares,” stated Marguerita Cheng, a CFP and chief government of Blue Ocean World Wealth, based mostly in Gaithersburg, Maryland. Companies might really feel extra snug increasing if borrowing prices are decrease, for instance, she stated.

However uncertainty across the variety of future price cuts, in addition to their dimension and tempo, imply buyers should not make wholesale modifications to their portfolios as a knee-jerk response to Powell’s proclamation, advisors stated.

“Issues can change,” Solar stated.

Importantly, Powell did not decide to decreasing charges, saying the trajectory will depend on “incoming knowledge, the evolving outlook, and the steadiness of dangers.”

Concerns for money, bonds and shares

Falling rates of interest usually means buyers can count on decrease returns on their “safer” cash, advisors stated.

This would come with holdings with comparatively low threat, like money held in financial savings accounts, cash market funds or certificates of deposit, and cash in shorter-term bonds.

Excessive rates of interest have meant buyers loved pretty lofty returns on these lower-risk holdings.

It is type of like getting a haircut: We’re doing small trims right here and there.

Winnie Solar

co-founder and managing director of Solar Group Wealth Companions

Nonetheless, such returns are anticipated to fall alongside declining rates of interest, advisors stated. They often suggest locking in excessive assured charges on money now whereas they’re nonetheless obtainable.

“It is in all probability a very good time for people who find themselves enthusiastic about shopping for CDs on the financial institution to lock within the greater charges for the following 12 months,” stated Ted Jenkin, a CFP and the CEO and founding father of oXYGen Monetary, based mostly in Atlanta.

“A 12 months from now you in all probability will not be capable of renew at those self same charges,” he stated.

Others might want to park extra money — sums that buyers do not want for short-term spending — in higher-paying fixed-income investments like longer-duration bonds, stated Carolyn McClanahan, a CFP and founding father of Life Planning Companions in Jacksonville, Florida.

“We’re actually being aggressive about ensuring shoppers perceive the interest-rate threat they’re taking by staying in money,” she stated. “Too many individuals aren’t enthusiastic about it.”

“They’re going to be crying in six months when rates of interest are rather a lot decrease,” she stated.

Bond length is a measure of a bond’s sensitivity to rate of interest modifications. Period is expressed in years, and elements within the coupon, time to maturity and yield paid by the time period.

Quick-duration bonds — with a time period of maybe a couple of years or much less — usually pay decrease returns however carry much less threat.

Traders may have to boost their length (and threat) to maintain yield in the identical ballpark because it has been for the previous two or so years, advisors stated. Period of 5 to 10 years might be OK for a lot of buyers proper now, Solar stated.

Advisors usually do not suggest tweaking stock-bond allocations, nonetheless.

However buyers might want to allocate extra future contributions to several types of shares, Solar stated.

For instance, shares of utility and home-improvement firms are likely to carry out higher when rates of interest fall, she stated.

Asset classes like actual property funding trusts, most popular inventory and small-cap shares additionally are likely to do effectively in such an setting, Jenkin stated.