Mustapha GUNNOUNI/iStock via Getty Images

Someone asked me yesterday:

“If you received $1 million, how would you invest it?”

It is not an easy question given that:

- Stocks (SPY) are today priced at historically high valuation multiples.

- Interest rates are expected to be cut substantially in the near term.

- Real estate cap rates remain quite low in most cases.

- Gold could suffer major capital flows to alternatives like Bitcoin.

- Bitcoin, on the other hand, has already risen a ton.

- We may be facing a recession in the near term.

- China could decide to invade Taiwan and we are much closer to a 3rd world war than what most people appear to understand.

With that in mind, here’s how I would invest the money in February 2024.

As you read this, keep in mind that what makes sense for me may not make sense for you. We all have different objectives, risk appetite, time horizons, and other personal circumstances.

Discounted Real Estate via REITs: $500,000

This would be my largest allocation.

I am biased, of course, because I am a professional real estate investment trust, or REIT, analyst and like to eat my own cooking.

But even if I wasn’t following REITs so closely, I would want to invest heavily in them today because they are historically cheap and essentially allow you to buy real estate at a discount to its fair value.

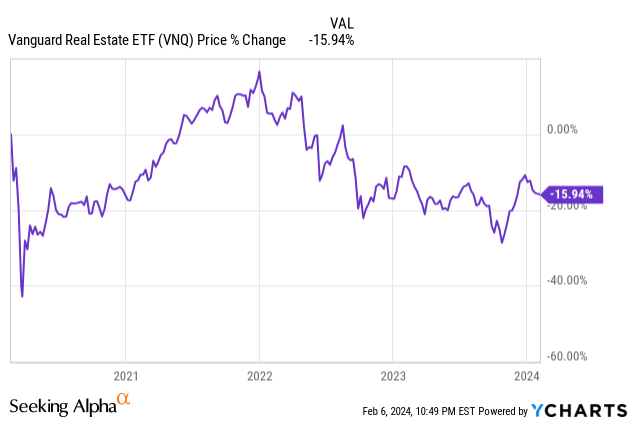

Consider this: over the past 4 years, REIT (VNQ) share prices have dropped by 16% on average, even as most properties gained substantial value and rents rose very significantly as well:

This disconnect in the share prices of REITs and the value of their properties has led to a historic opportunity to buy REITs at 30-50% discounts relative to the fair value of their properties.

Just to give you a quick example: Camden Property Trust (CPT) and Mid-America Apartment Communities (MAA) are today priced at a ~7% implied cap rate, which is way too high for high-quality sunbelt apartment communities. In the private market, you would be happy to get a 5% cap rate, you would consider it a great deal if you managed to a 5.5% cap.

And yet, in the public market, you can now buy shares of blue chips like CPT and MAA at a 7% cap rate and get the added benefits of diversification, liquidity, and cost-efficient professional management on top of that. This explains why private equity players like Blackstone (BX) are now buying REITs like Tricon (TCN) and are willing to pay large premiums for them.

Mid America Apartment Communities

Warren Buffett has famously said that you should be “greedy when others are fearful” and that “when it is raining gold, you should reach for a bucket, not a thimble.”

That is why I am investing so heavily in REITs.

I have followed them for about a decade, and I have not seen valuations this cheap in a long time. Typically, they are priced at a small premium to their net asset values to reflect the added benefits of liquidity, diversification, and professional management, but today it is the opposite. You get them at a large discount.

But I don’t expect this to last for much longer. The only reason why REITs ever got so cheap is because of the fears of rising interest rates and how a “higher for longer” environment would impact them. But now, long-term interest rates have already dropped quite a bit lower, and the Fed is expected to cut at least 3 times later this year.

I think that this is a strong catalyst that could push REIT share prices a lot higher, and therefore, now could be your last chance to buy investment-grade rated REITs like EPR Properties (EPR) at an 8% dividend yield and a large discount to their fair value.

International Equities: $300,000

Home bias is very strong among individual investors. Most of you reading this article may not have any exposure to foreign markets, but I think that this is a big mistake today because we live in a highly uncertain world and you don’t want to put all your eggs in one basket.

Russia is still waging the biggest war in Europe since the Second World War. Meanwhile, Russia is trying to prop up a bunch of pro-Kremlin propaganda agents all over the West and Russia’s closest partner, Iran, is now targeting U.S. troops via its own proxies – and the U.S. is starting to fire back. Russia recently also gave nuclear weapons to Belarus, which is another dictatorship and is working in close partnership with North Korea. China is telling us that they will invade Taiwan. Venezuela recently claimed a bunch of land in Guyana as their own. Tensions are also escalating between the pro-Kremlin government of Serbia and Kosovo.

The point that I am trying to make is that we are much closer to a Third World War than people seem to understand, and in that context, I want to own assets a bit all over the place.

As an example, I am quite heavily investing in Latin America at the moment. It has historically been a safe haven during times of geopolitical uncertainty and some of its equities are very cheap today. I like to invest in this region via Patria (PAX), which is the leading alternative asset manager in the region. Many call it the “Blackstone of Latin America.”

I am also investing in Africa by investing in the shares of Helios (OTCPK:HTWSF). It owns and operates a vast portfolio of cell towers across the continent and is expected to benefit from the booming demand for data in Africa.

Helios Towers

I also invest in the Baltics, where some banks and infrastructure assets are opportunistic if you have a long-term view.

And many other places.

Valuations are a lot lower abroad and including these investments as part of a diversified portfolio can help you to mitigate risks in case of a future black swan.

Farmland: $100,000

I recently posted an article on farmland, and you can read it by clicking here.

In short, some people like to invest in gold (GLD) or bitcoin (BTC-USD) to prepare for a black swan. I prefer to invest in farmland because it is far less volatile, has strong and predictable long-term prospects, and is a productive asset that’s essential to our society.

I don’t expect more than ~8% annual returns, but it helps me diversify my portfolio and serves as a form of insurance in case of a black swan.

I invest in farmland via crowdfunding platforms like FarmTogether and also via listed companies like Farmland Partners (FPI).

Farmland Partners

Fixed Income: $100,000

Finally, I would also put a little bit of it into bonds and private credit.

Today, interest rates are at a two-decade high, but this won’t last for much longer.

I don’t want to invest much into fixed income because it would expose me to significant reinvestment risk (= equities will likely rise higher as interest rates are cut), but I want some of it for diversification.

I have for many years invested in private credit via my company, Leonberg Capital, and have been able to earn an unleveraged ~9-10% annual total return. Today, the targeted returns are closer to 12%, which is still less than what I am targeting with REITs, but these investments help to further diversify my portfolio.

There are also some publicly listed bonds that now offer 6-7% yields with relatively little risk and liquidity. These bonds serve as a source of liquidity for me. If and when we get another stock market crash, I expect to sell them to buy more stocks at a discount.

Closing Note

Once again, we are all different so what makes sense for me may not make sense for you.

REITs are very opportunistic today, but I probably wouldn’t invest 50% of my portfolio in them if my full-time job wasn’t to follow them closely.

Similarly, I probably wouldn’t feel comfortable investing so much abroad if I had not had the chance to live and work in many of these countries.

How would you invest $1 million? Let me know in the comment section below.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.