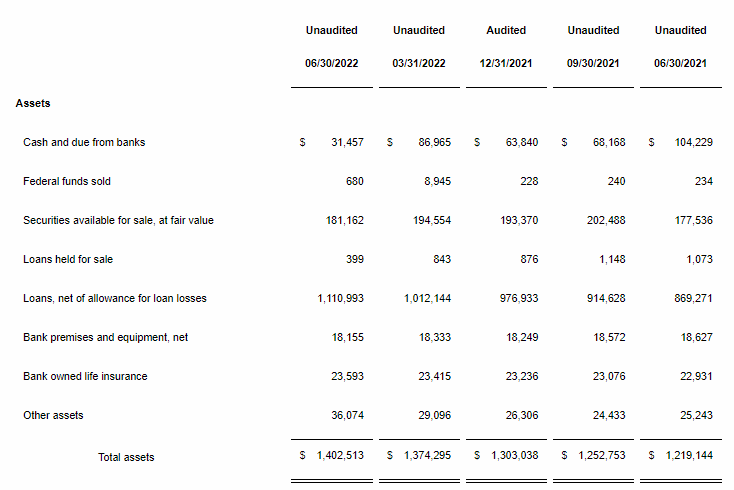

Unfortunately most brokerages gives you a simple ending balance over beginning balance (holding period return) to show you how much your account gain or lost. This is great if you did not contribute nor withdrew from the account. The question to be asking is “OK what about my investment decisions? How did I perform based on my choices with investments” to do this you need to do. “time weighted return – TWR” calculations. Holding period or money weighted can show you that you had a near 0 return or maybe positive especially if you DCA the Investments, however, TWR shows a different picture. It removes the effect of additional cash flow to show more closely to performances based on decisions.

https://www.investopedia.com/terms/t/time-weightedror.asp

The challenge is calculating requires data, time, and resource. Professionals pays for this kind of services or have a whole department dedicated to do this kind of measurements.

However you can do some kind of modified version to get a rough estimates by reviewing each monthly statements.

look at when the contributions takes place.

If it’s near month beginning the. Keep it there or prorated based on number of days.

if it’s near the end, then remove that amount from the ending number.

once you get a rough estimate monthly return then Aggregate it.

It’s a rough year, but knowing how the decisions made is important to your process and future.