The actual property market remains to be as sizzling as its ever been. Regardless of rising rates of interest over the previous few months, the market continues to set new information.

Many anecdotes level to it being a easy farce. For instance, houses have bought for one million {dollars} over asking worth in San Jose, Washington D.C., and San Francisco.

In Jackson County, Missouri (which holds most of Kansas Metropolis), solely 0.8 months of stock was left in March. In different phrases, for each 5 houses that bought in March, 4 remained available on the market going into April. For comparability’s sake, a “balanced” market that favors neither consumers nor sellers has six months of stock.

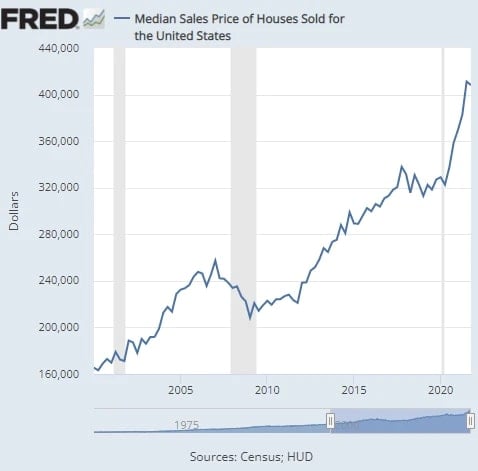

Total, costs are up 14% year-over-year and have nearly doubled for the reason that trough of the Nice Recession. However just a few different nationwide stats from Forbes paint a fair higher image:

- “Energetic listings (the variety of houses listed on the market at any level through the interval) fell 22% from 2020 and 41% from 2019.

- “45% of houses that went beneath contract had an accepted provide throughout the first two weeks available on the market.

- “32% of houses that went beneath contract had an accepted provide inside one week of hitting the market.

- “43% of houses bought above listing worth.”

Certainly, the common gross sales worth was 100.5 % of asking. When you take a look at house costs from 2000 to the current, even the Nice Recession seems to be like little greater than a minor setback:

And whereas the tempo of will increase has slowed with rising rates of interest, it’s nonetheless on an upward trajectory.

However why is that this taking place?

The proper solutions relate to COVID-19 and the Nice Recession itself. However let’s begin with what’s not inflicting the housing increase regardless of the infinite proclamations from numerous pundits.

Non-Trigger #1: Wall Road

Wall Road all the time makes for villain, and so they actually have had their share of scandals. For one, CEO of Gravity Funds, Dan Value, said that Wall Road companies owned over 15% of all single-family residences.

Luckily, he was off by an element of about 30. If Wall Road is making an attempt to make “a nation of renters,” they’re doing it at a snail’s tempo.

In 2018, there have been about 83.3 million single-family houses in the USA. As Gary Beasley notes in Forbes,

“Researchers at my firm, Roofstock, estimate that large-scale landlords at present personal roughly 450,000 of the roughly 20 million single-family leases within the U.S. Whereas this represents appreciable progress over the previous decade, it represents lower than 2.5% of all single-family leases and fewer than 0.5% of all single-family houses (together with owner-occupied).”

Whereas the added competitors Wall Road brings will technically have an effect on costs, the margin is negligible. Moreover, the share of single-family properties being purchased by traders of all types has truly been declining since 2013.

Wall Road’s impact on housing costs is tiny. So if it’s not Wall Road, what’s one other well-liked villain accountable?

Non-Trigger #2: The Battle in Ukraine

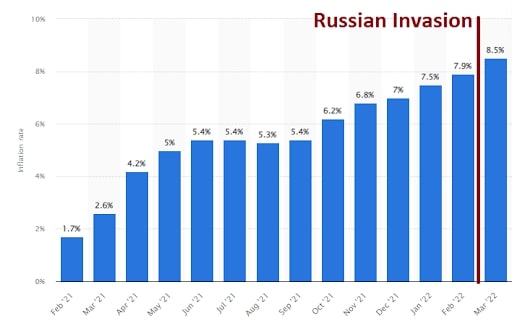

Russia’s invasion of Ukraine has actually exacerbated provide chain points globally. Nonetheless, it isn’t the reason for inflation typically and positively not the reason for worth will increase in housing. Certainly, inflation was already 7.5 % in January and seven.9 % in February. The invasion of Ukraine began on February 24.

This excuse appears weird to me. Whereas the timing is off with inflation, it’s wildly off with housing costs.

Like Wall Road, it could be enjoyable accountable Putin for all the pieces, however this one isn’t on him.

So allow us to flip to what is de facto driving house costs via the roof.

Trigger 1: Extra Cash, Extra Inflation

“Inflation is all the time and all over the place a financial phenomenon,” the well-known economist Milton Friedman as soon as stated. I feel this can be a little simplistic, but it surely’s actually true that each one issues being equal, extra money will equal extra inflation.

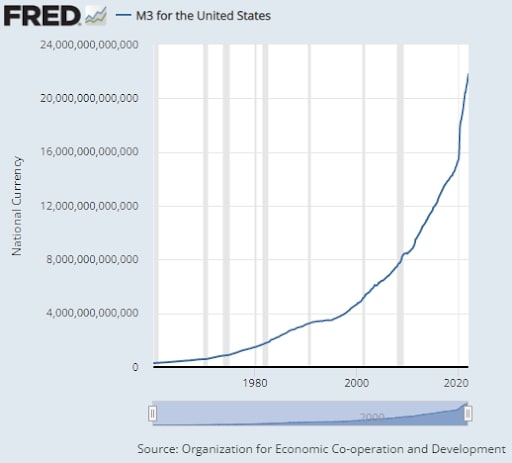

And there’s undoubtedly much more cash within the financial system lately. Based on Tech Startups, about 80% of all {dollars} in circulation have been printed for the reason that starting of 2020! Whereas these numbers have been challenged to various levels, there isn’t a query that some huge cash was pumped into the financial system as Covid threw the whole world right into a tailspin.

For instance, right here is the Fed’s chart for the cash provide:

Milton Friedman, as talked about earlier, additionally launched us to the Quantitative Concept of Cash. The equation seems to be like this:

M (cash provide) x V (velocity) = P (worth stage) x T (Quantity of Transactions)

In different phrases, the sum of money multiplied by how briskly it’s spent equals the costs multiplied by the quantity of stuff being purchased.

Throughout the top of Covid, the cash provide dramatically elevated on the identical time the financial system took a nosedive. In some ways, these two issues counteracted one another because the financial system’s slowdown in 2020 lowered the “velocity” of cash. To place it merely, the variety of instances every greenback was spent decreased. That is what stored inflation in test throughout 2020 and for many of 2021.

So, for instance, if I’ve one greenback and purchase a widget from you, and then you definitely flip round and purchase a chunk of sweet from John, that greenback has been utilized in two transactions. The rate of that greenback stands at two, and there would possibly as properly have been $2 within the financial system. Then again, if I had two {dollars} after which purchased a widget from you and a chunk of sweet from John and each of you held that greenback, the speed of every greenback is one.

Within the second situation, the cash provide is twice as massive, however the inflationary impact is identical as within the first situation since every greenback is spent solely as soon as.

Each time there’s a recession, velocity is lowered. However now that the financial system has picked up once more as COVID has waned, velocity is accelerating, however with many extra {dollars} in circulation. Thus, we’ve got a better cash provide (M) and better velocity (V).

Thus, inflation.

In the long run, what we name “appreciation” in actual property is de facto simply housing inflation. However that doesn’t sound as good, so we made up a unique phrase for it.

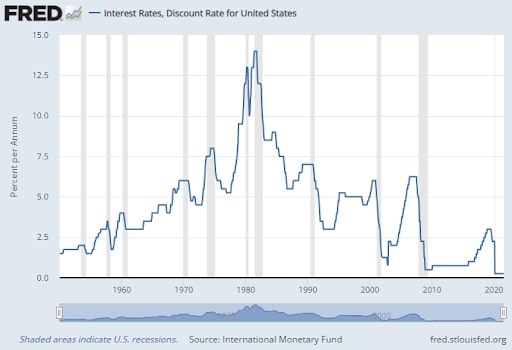

In fact, housing inflation is especially spurred on by rates of interest, which regardless of latest will increase, are nonetheless at historic lows.

The low cost charge is the speed that the Federal Reserve lends to different banks. Traditionally talking, it has largely hovered between 2%-6% however has climbed as excessive as 13% when Paul Volcker determined to “break the again of inflation” within the early Eighties.

The low cost charge has been beneath 3% for the reason that Nice Recession of 2008 and has remained round one. It dropped to zero after COVID, and the Fed solely raised it once more in March 2022.

Even the Fed’s introduced plan of elevating the low cost charge to 1.9% by the tip of 2022 and to 2.8% by the tip of 2023 would preserve the low cost charge beneath the historic common.

Rates of interest are additionally low in actual phrases (versus nominal). Provided that inflation is at 8.5% round late April 2022 and the common 30-year mortgage is simply over 5%, that also means the price of borrowing is lower than inflation, which actually shouldn’t be a factor. And, after all, rates of interest a yr in the past have been even decrease, with some folks getting mortgages beneath 3%, by some means.

Low-interest charges clearly encourage house purchases. Along with that, there are nonetheless a ton of presidency incentives to buy a house. For instance, FHA loans enable consumers to get in for as little as 3.5% down.

Based on Economics 101: More cash chasing fewer items (fewer homes, on this case) means costs go up.

Put together for a market shift

Modify your investing ways—not solely to outlive an financial downturn, however to additionally thrive! Take any recession in stride and by no means be intimidated by a market shift once more with Recession-Proof Actual Property Investing.

Trigger #2: A Historic Housing Scarcity

Whereas among the housing worth explosion has its roots in 2020, a lot of it goes again to 2008. As is typical, we over-corrected for the true estate-driven monetary disaster of 2008.

I keep in mind driving via empty subdivisions that littered the nation within the years following the Nice Recession. It was surreal.

These days, nonetheless, are lengthy gone. The shell shock of that disaster triggered the federal government, banks, and builders to all, implicitly not less than, cease constructing.

However the inhabitants of the USA didn’t cease rising.

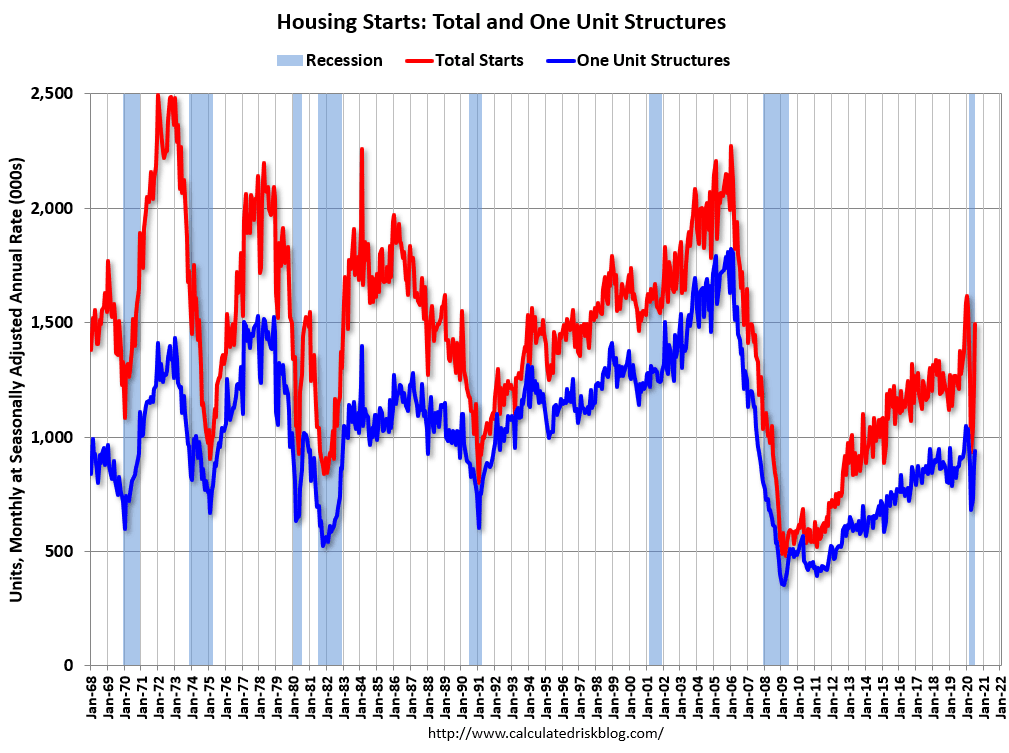

From 2000 to 2007, there have been not less than one million housing begins annually. From 2005 to 2007, there have been over two million. Then the disaster hit, and housing begins fell via the ground. They didn’t break a million once more till 2020, after which Covid occurred, and the lockdowns shut down and delayed each new development venture.

Just about everybody predicted the true property market would collapse when COVID hit. Weirdly, nobody appeared to understand it might merely exacerbate the housing scarcity that was already acute.

Freddie Mac launched a research purporting to indicate a 3.8-million-unit housing scarcity in the USA in 2020. That is up from 2.5 million simply two years earlier.

Provide and demand are undefeated. When demand outpaces provide by that a lot, you’ll be able to count on just a few upper-end houses in coastal cities to go for one million over asking. Moreover, homes and flats take time to construct, particularly since strict allowing and zoning laws usually impede growth. This isn’t a shortfall that may be rapidly resolved.

Supplemental Causes

Whereas will increase within the cash provide and a nationwide housing scarcity are the principle drivers of housing costs, just a few different supplemental causes might be thrown in with Wall Road and the warfare in Ukraine as minor accelerants.

For one, there have been a number of provide chain problems with late which have triggered all types of prices to extend. Probably the most noteworthy in the true property world has been lumber, but it surely’s additionally a systemic drawback.

Provide chain points have exacerbated inflation, triggered growth and rehab tasks to be delayed, and compelled housing suppliers to go costs onto customers. However to consider that all the pieces will return to regular when these points are resolved is, sadly, wishful pondering.

As well as, Airbnb has been accused of choking provide as properly. Presumably, as extra owners determined to make use of their home as a short-term rental, this could have damage the resort trade and triggered a boon in house development to fill the hole. However, there was no boon to growth, so the housing scarcity was exacerbated.

One research, for instance, discovered “{that a} 1% improve in Airbnb listings results in a 0.018% improve in rents and a 0.026% improve in home costs.” Whereas that does rely as an impact, like Wall Road, it’s negligible. There are some 660,000 Airbnb listings in the USA. A few of these are for a spare bed room or solely used as a short-term rental a part of the time. However even in the event you assumed all 660,000 have been single-family residences, it might be lower than 1% of the entire housing inventory.

Conclusion

There are numerous causes housing costs are skyrocketing. By far, the 2 most important have been low-interest charges and the corresponding improve within the cash provide together with a historic nationwide housing scarcity.

Moreover, whereas rates of interest are rising, they’re nonetheless properly behind inflation, and the housing scarcity isn’t going away any time quickly. Total, we will count on costs to proceed to rise, though most likely at a slower charge, as rates of interest climb and we attain affordability limits.

We are able to count on housing costs to stay excessive for the foreseeable future.