Justin Paget

Housing affordability in the U.S. would have worsened if the Federal Reserve had not hiked interest rates in 2022 and 2023 because home prices would have risen more, according to a study from the Federal Reserve Bank of Dallas.

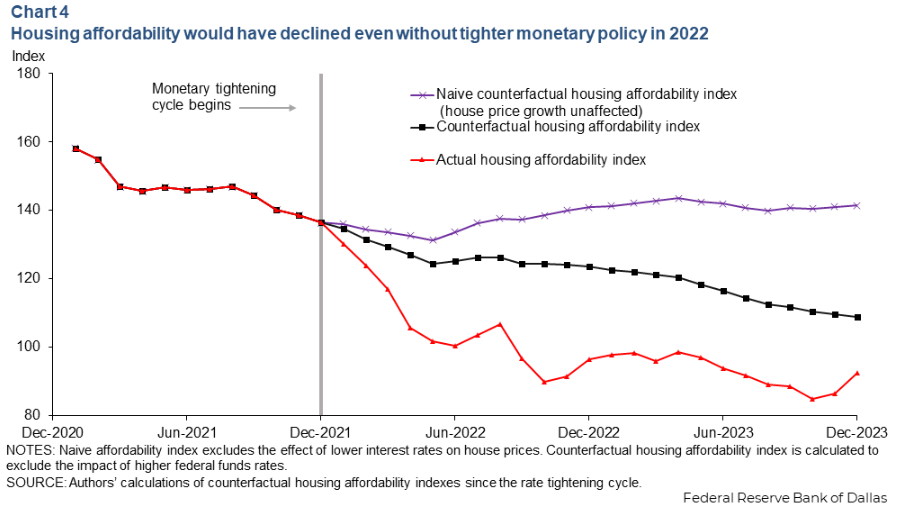

Since March 2022, when the central bank embarked on its most aggressive tightening cycle in decades to lower inflation, housing affordability deteriorated significantly as higher mortgage payments dealt a blow to prospective homebuyers. Specifically, the National Association of Realtors’ housing affordability index dropped nearly 30% since December 2021, the Dallas Fed paper noted, eyeing levels last seen in the late 1980s.

Bear in mind, though, that a great deal of homeowners have been largely unaffected by current elevated mortgage rates. Indeed, the average homeowner paid a rate of only 3.9% as of September 2023. That’s far lower than the 6.82% average 30-year fixed-rate mortgage as of April 4, 2024. Importantly, “the fraction of homebuyers is small relative to the population of homeowners,” the study said.

Home prices, too, saw a big run-up in the face of low supply, though new listings have started to rise and home-price growth is returning to the prepandemic norm. When looking at previous housing cycles, by comparison, home prices usually decline when interest rates increase given an increased lack of demand.

Homebuilding companies (ITB) generally responded to the housing affordability issue by cutting prices or offering mortgage rate buydowns. Sure, that translated to lower margins, but single-family homebuilders had the breathing room after achieving strong profit margins during the pandemic housing boom.

Dallas Fed researchers Alexander Richter and Xiaoqing Zhou noted that house prices experienced such a large increase in the postpandemic era “that housing affordability would have declined even if mortgage rates stayed at their average.”

The chart below shows that Fed rate hikes worsen housing affordability. Excluding rate increases, however, affordability would have still declined after 2022 (black line). The purple line excludes the impact of lower interest rates on house prices. The red line is the actual housing affordability index.

“When monetary policy is easier, mortgage rates tend to fall, while house prices tend to rise due to higher demand,” the authors wrote. Interestingly, “these opposing channels imply that the net effect on affordability is ambiguous and potentially the opposite of what intuition based solely on mortgage rates would suggest.”

Real estate broker stocks: Anywhere Real Estate (HOUS), Re/Max Holdings (RMAX), Redfin (RDFN), Zillow (Z) (ZG), Compass (COMP), Opendoor Technologies (OPEN), Offerpad Solutions (OPAD), eXp World Holdings (EXPI).