onurdongel

Investment Thesis: I expect modest growth for Host Hotels & Resorts, Inc. (NASDAQ:HST) in the short to medium-term.

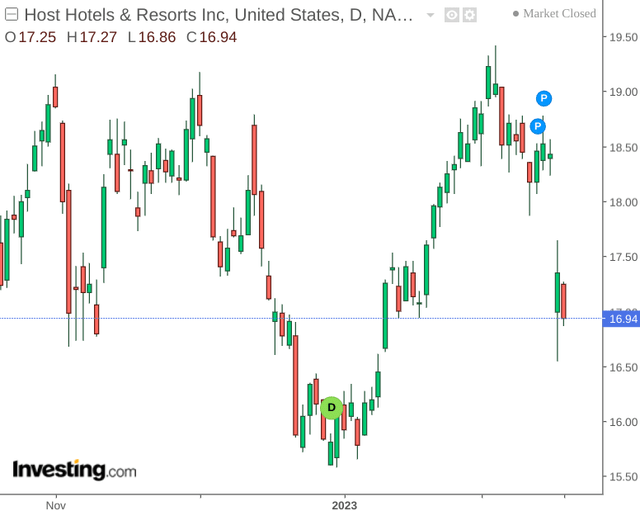

In a previous article back in December, I made the argument that Host Hotels & Resorts could be set to see further upside from there on the basis of continued growth in revenue as well as a reduction in total debt relative to total assets.

Since my last article, the stock is down by just over 5%:

investing.com

The purpose of this article is to assess whether my aforementioned reasons for taking a bullish view on the stock still holds, and whether Host Hotels & Resorts could see a rebound from here.

Performance

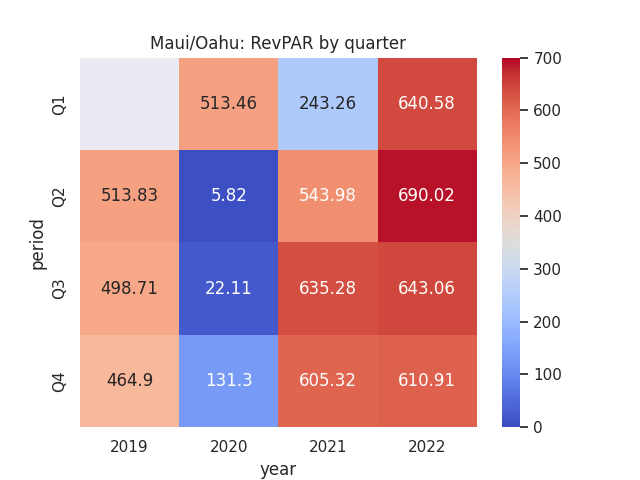

Previously, I had made the argument that Host Hotels & Resorts has demonstrated a capacity to sustain RevPAR growth across locations with a high average room rate – the Maui/Oahu properties being a case in point.

We can see that for the Maui/Oahu portfolio – RevPAR for Q4 2022 has dipped from that of Q2 2022 but still remains slightly higher than that of the same quarter last year:

Figures sourced from historical Host Hotels & Resorts quarterly financial reports. Heatmap generated by author using Python’s seaborn library.

The dip in RevPAR that we have seen from Q2 2022 is consistent with lower demand in the winter months. While we have continued to see overall growth in RevPAR – the fact that the same was only marginally higher than that of Q3 and Q4 in 2021 indicates that the recovery in demand post-COVID seems to be peaking.

Additionally, it is also notable that the average room rate for Maui/Oahu properties was $527.16 for Q4 2022, while it came in at $359.56 for Q4 2021. The fact that the average room rate has seen a strong increase but RevPAR has not followed suit suggests that the capacity to increase rates while continuing to bolster revenue growth seems to be decreasing.

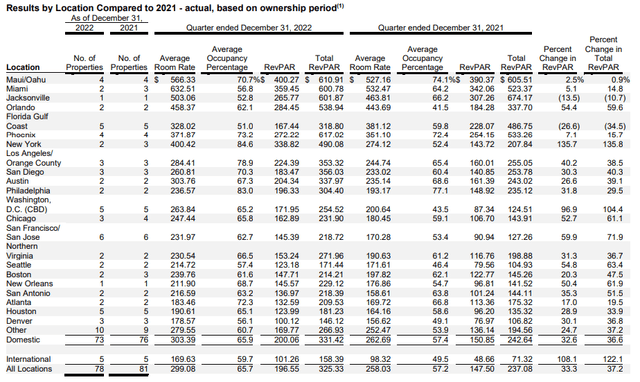

With that being said, total RevPAR across all locations has continued to see a significant increase – up from $237.98 in Q4 2021 to $325.33 in Q4 2022. This could be an indication that while revenue growth is plateauing across properties with a high average room rate – there is still scope for growth across lower-priced properties.

As one example, the San Antonio property portfolio saw a total RevPAR of $144.11 in Q4 2021, which had increased to $218.39 in Q4 2022 – where the average room rate for these two quarters was $123.70 and $158.61, respectively.

Host Hotels & Resorts: Q4 2022 Results

Overall, I take the view that while RevPAR has continued to see growth overall – signs are emerging that the ability of customers to absorb further price increases may be diminishing.

Risks

In my view, the main risk for Host Hotels & Resorts at this time is the possibility that revenue growth will increasingly reach a ceiling whereby demand will start to fall in the face of price increases – which we have seen some evidence of across higher-priced properties such as Maui/Oahu.

Moreover, as the largest lodging real estate investment trust globally – inflation places upward pressure on property prices – which in turn increases the cost of acquiring new properties to meet demand – or indeed to conduct repairs on properties that have needed to close temporarily as a result of the damage caused by Hurricane Ian.

Additionally, Host Hotels & Resorts also expects margins to decline relative to 2022 as a result of wage inflation as well as expected occupancy below 2019 levels and higher insurance and utility expenses.

Looking Forward

Going forward, my overall view on Host Hotels & Resorts, Inc. stock is that in spite of the strong rebound in revenue growth that we have seen to date – the stock could see modest growth in the short to medium-term as inflationary pressures continue to take hold and the effects of the post-COVID recovery starts to fizzle out.

Particularly, should we see RevPAR growth come in lower than expected during the summer months – then this could be a particular impediment to growth in Host Hotels & Resorts stock.

Conclusion

To conclude, Host Hotels & Resorts, Inc. has seen a strong recovery in RevPAR growth overall. However, signs are emerging that demand is starting to subside in the face of price increases. This, coupled with inflationary pressures, makes me of the view that growth for Host Hotels & Resorts, Inc. stock is expected to be modest in the short to medium-term.