jetcityimage/iStock Editorial through Getty Photographs

NEW YORK (August 21) – The shock ouster of Starbucks’ (NASDAQ:SBUX) CEO Laxman Narasimhan, and his alternative with Chipotle’s (CMG) CEO Brian Niccol, boosted the share value to ranges not seen since February. These hopes assume Niccol can impact the identical form of turnaround he led on the burrito chain. We’re skeptical about his capability to take action. We predict the markets are sanguine; displaying some, of what Alan Greenspan used to name, “irrational exuberance”.

OUSTER AND REPLACEMENT

SBUX had been below strain for a while, with the turning level coming with the 2024 Q1 earnings name on April thirtieth. There, Rachel Ruggeri, the SBUX CFO, downgraded practically all the 2024 outlook, to replicate the disappointing first quarter.

Based on the Monetary Occasions, the 2024 Q1 outcomes set off a series of occasions whereby the SBUX board and key traders, together with the blokes at “undergo no fools” Elliott Administration, moved quickly to oust Narasimhan, apparently supported by SBUX branding pioneer, Howard Schultz. Based on the FT, the board’s transfer to put in CMG’s Niccol was surreptitious, with not even Elliott Administration being given a heads-up in regards to the board’s plans. Niccol had been a potential CEO rent for SBUX earlier, however had not been accessible when the board had been trying.

The query for traders is: can Niccol replicate his CMG success with the espresso slinger? We predict these hopes are sanguine, however not out of the query.

Why We Assume Niccol Will Seemingly Fail

I do know CMG very nicely. My very first article for SA was within the quick aftermath of the Christmastime Norovirus outbreak at Boston Faculty in 2015. I adopted the corporate very intently till Steve Ells, the founder, and his government staff lastly left. I had referred to as for his or her ouster, together with a lot of the board, lower than two years after the Boston Faculty debacle, after their continued missteps. I felt strongly that the CMG senior administration may now not be tolerated on the helm of a publicly traded, nationwide, restaurant chain.

I ended following CMG so intently, as soon as Niccol, an skilled hospitality government from YUM’s “Taco Bell” chain, took the helm and the Steve Ells’ administration staff have been changed. I felt the chain was in good fingers, and, frankly, I misplaced curiosity.

Brian Niccol: “Previous Efficiency is No Indication of Future Success”

That lawyerly prospectus warning ought to be stapled to the resume of each CEO, each those that have been fired (Lee Iacocca & Mike Bloomberg come to thoughts) and people who succeed.

Niccol turned CMG into an SSS and AUV powerhouse, however listed below are 4 issues Niccol did, that enhanced CMG’s inventory value that he might not have the ability to replicate at SBUX and why he probably can’t do them.

1. Niccol Changed the CMG Founder’s Administration Group

The New England Patriots went from a Fifth Place end (5-11) in 2000 within the AFC, to First Place (11-5) in 2001 as a result of an unknown, sixth-round draft decide quarterback (No. 199 within the draft) changed Spherical 1 draft decide Drew Bledsoe at quarterback after an damage in Sport 2 of the 2000-2001 season. The little recognized alternative was named Tom Brady, now thought-about to be the GOAT.

Niccol is a proficient government; little doubt. However, like Tom Brady, he caught a extremely fortunate break changing the CMG founder’s administration, which had fared poorly managing a number of meals security crises. It made him look exceptionally good by comparability.

A few of the issues Niccol did have been “no-brainer” steps that anybody with a meals security certificates – not to mention a nationally acknowledged meals security knowledgeable on workers, as he had – would have carried out. (In truth, a few of the issues Niccol did have been issues we really helpful early on in our a number of SA articles in the course of the Ells reign at CMG.)

SBUX has gone via an array of CEOs within the final a number of years. It is uncertain any of them have been performing as poorly because the CMG founder was. And whereas Niccol additionally requested for, and acquired, the title of Chair at SBUX, along with CEO, it is uncertain that SBUX branding genius Howard Schultz will stay quiet if he sees a failure by Niccol.

2. Niccol Boosted Costs

For my cash, your neighborhood burrito slinger is miles above the CMG choices. A really Mexican restaurant just some doorways down from the CMG close to Boston Faculty that triggered the 2015 Norovirus outbreak was much better – each cheaper and with extra beneficiant with its servings of meat proteins – than the “rice bomb” burrito that’s the typical CMG providing.

I stay and work in Manhattan. I can consider at the very least three Mexican eating places inside a 10-minute stroll which might be higher than CMG’s; they’re cheaper, too.

However by some means, CMG appears to have a loyal following that permits them extremely elastic pricing; it is beautiful, given the standard of the fake “Mexican” choices. The corporate stories a staggeringly excessive 17%+ working margin! Niccol is unlikely to have that a lot value elasticity.

First, SBUX could also be on the higher restrict of value elasticity, limiting Niccol’s capability to lift costs and improve AUV. A cup of Starbucks has at all times been at the very least double or triple the value of “espresso cart espresso” that us “Boomers” got here to be accustomed to, earlier than Starbucks got here on the scene. It is uncertain that Starbucks could have a lot value elasticity past, maybe, a 500 bps value improve past inflation.

Second, SBUX now has loads of native, standalone and small chain espresso purveyors in city areas, a lot of that are superior. These choices are competitively priced with SBUX shops. Moreover, if SBUX pricing goes a lot above a 500 bps improve, it may run into extra severe competitors within the super-premium lane from Nestle-backed Blue Bottle Espresso cafés, to say nothing of a rising legion of at-home and Blue Bottle novice baristas who’re workplace colleagues.

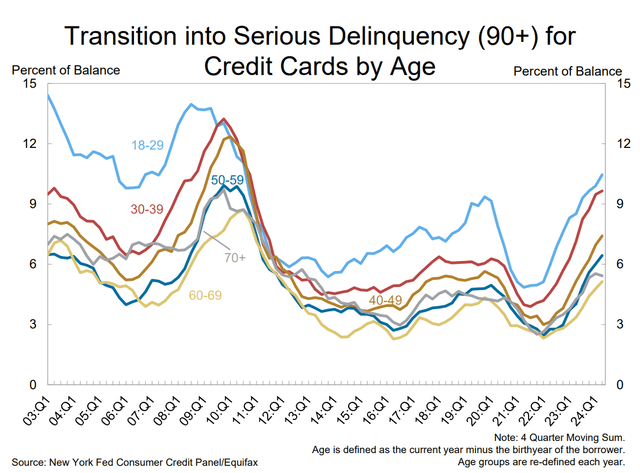

Lastly, on a macro degree, inflation has rocked the funds of most staff and, as illustrated on this chart from the New York Federal Reserve, discretionary spending on issues like Starbucks espresso would seem like below rising strain, given the extent of significant delinquencies in shopper credit score; the worst because the waning days of the Nice Recession.

Critical (90+ Days) Credit score Card Delinquency by Age (2024 Q2 NY Fed Report on Family Debt & Credit score)

3. Niccol Offered Extra Burritos by Innovation

Mealtime comes and goes within the restaurant enterprise. We have all handed by fast serve and informal eating eating places with traces that have been too lengthy that we handed by. Niccol was in a position to transfer that line quicker and likewise to create second make traces – “digital kitchens”, in CMG PR parlance – in most eating places that serve app and supply orders in the course of the pandemic that later advanced to additionally deal with “Chipotlanes” for drive-thru pick-ups. These improvements reportedly added practically 1,000,000 {dollars} a 12 months in restaurant AUVs.

SBUX claims someplace between 87,000 and 170,000 totally different espresso mixtures and a reported 250+ menu objects, at the very least the final time the Wall Avenue Journal reported on it a decade in the past. It is uncertain Niccol can expedite SBUX service or productiveness by a lot. SBUX already has pick-up apps and supply. Drive-thru and supply solely places are already within the works. With respect to supply, it is onerous to think about a lot additional progress in that space, particularly when Blue Bottle is coaching novice baristas to make their double latte grandes at dwelling and a few bigger corporations are putting in elaborate espresso stations as worker perks to attract workers again to the workplace.

4. Niccol Break up CMG inventory 50:1

CMG inventory had grown outdoors the technique of most retail traders to purchase a block. The board’s choice in March to impact a 50:1 inventory cut up – the most important in NYSE historical past – elevated its accessibility and enhanced liquidity, each of which enhanced demand and, thus, the inventory value.

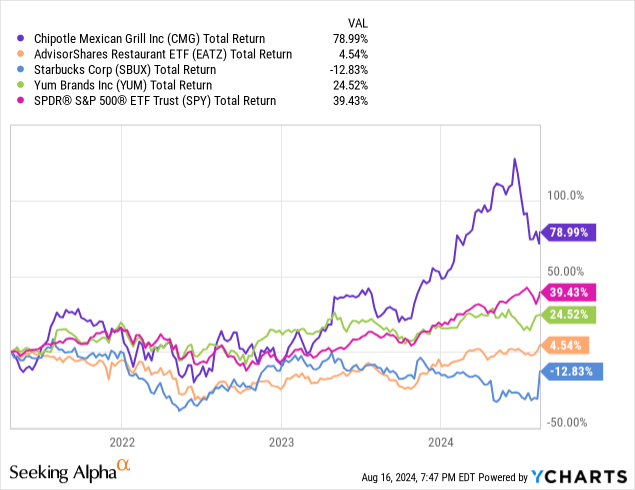

These two charts illustrate CMG proportion returns relative to opponents like EATZ and YUM, and the S&P 500 during the last 5 years, ending final week. SBUX can be included.

As you’ll be able to see, CMG largely outperformed its restaurant opponents, however probably not excessively so till late 2023, when the chattering courses have been all speculating a few inventory cut up. (The Motley Idiot alone had a minimum of three articles about an SBUX inventory cut up in December 2023.) When it was lastly accepted in 2024, improved earnings and hypothesis in regards to the cut up and boosted the inventory nicely above its friends.

Sanguine Hopes a New CEO Can “Repair” SBUX

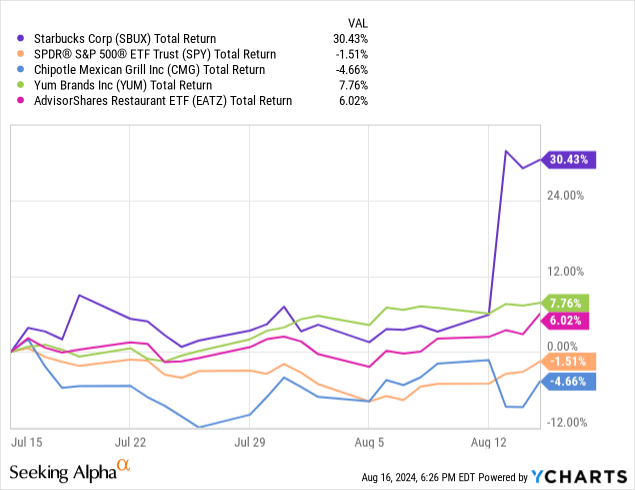

The charts beneath present what a major change Niccol’s hiring, introduced August 13, has had on its inventory value.

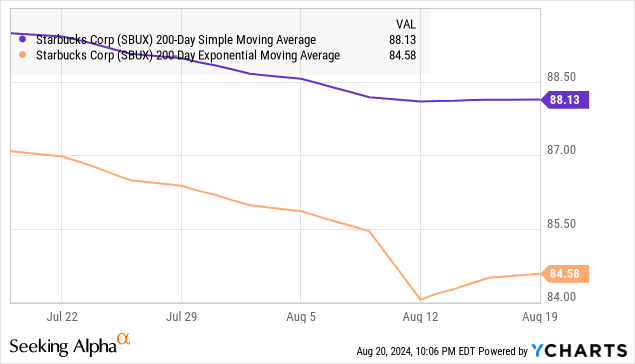

That’s very true with its exponential 200-day shifting common, which displays more moderen occasions greater than the easy common.

SUMMARY:

Our funding thesis is that markets are sanguine about Niccol with the ability to replicate his CMG success, for the explanations mentioned above. We provide a “maintain” analysis at this level, as a result of we’ve got little foundation to evaluate how Niccol will fare in Starbucks’ hope to increase in China, though we’re not hopeful.

That mentioned, we predict there are a number of issues Niccol may do to enhance SBUX revenues and operations. However, as with all our suggestions to corporations we point out in our evaluation (SEE: NOTE, beneath), our funding thesis for SBUX presumes our suggestions is not going to be adopted.

Issues we might advocate are:

1. Allotting “primary” drinks (like plain “espresso cart” espresso, which is my choice) in cafés by shelling out espresso cups from a merchandising machine and permitting clients to attract their very own beverage from a espresso dispenser. Maybe add different machines that enable extra customization with espresso pictures, foamed milk, and so on.

2. Do a broader market take a look at of bubble tea or, maybe, even take into account buying or doing a three way partnership with a bubble tea chain and develop it below a unique model identify. We “boomers” are the most important espresso drinkers, adopted by the Millennials (i.e., these aged 25 to 40). Getting youthful individuals – who’re the most important customers of bubble tea – into the behavior of ordering a morning beverage can solely profit Starbucks.

3. Dispense espresso (cold and warm brew) in cans, in merchandising machines. These machines are throughout Japan, the third-largest espresso consuming nation on the earth, in practice stations, airports, purchasing areas, filling stations, and the likes. (It should clearly take a while for Individuals to adapt to the notion, a step Niccol’s advertising abilities may help.)

4. A lot of SBUX hopes are pinned on progress in China, a hope we consider is probably going misplaced. As Niccol has little expertise there (Taco Bell was solely in China since 2016; Niccol joined CMG in 2018 and CMG by no means operated there.), we predict CMG ought to convey at the very least one – possibly two – native Chinese language from the hospitality business on to the SBUX board.

_____________________________________

NOTE:

Our commentaries most frequently are usually event-driven and lean towards basic evaluation, though we additionally take into account technical evaluation in our evaluation if we deem it applicable. They’re largely written from a public coverage, financial, or political/geopolitical perspective. Some are written from a administration consulting perspective for corporations that we consider to be under-performing, and embody methods that we might advocate have been the businesses of our shoppers. Others talk about new administration methods we consider will fail. This method lends particular worth to contrarian traders to uncover potential alternatives in corporations which might be in any other case in a downturn. (Opinions concerning such corporations right here, nevertheless, assume the corporate is not going to change or undertake our suggestions). In the event you like our perspective, please take into account following us by clicking the “Comply with” hyperlink above.