LeoPatrizi/E+ through Getty Photos

In October 2023, I lined Honeywell and assigned a maintain ranking to the inventory. The inventory returned 20.2% in comparison with 29.3% for the S&P 500. So, a maintain ranking, in my opinion, has been truthful. Honeywell will likely be reporting earnings on the July 25 and on this report, I would like to shortly present an earnings preview earlier than shifting my concentrate on the latest M&A momentum and valuation of Honeywell inventory.

What Are Analysts Anticipating For The Second Quarter Earnings?

For the second quarter, analysts count on between $9.3 billion and $9.47 billion in revenues, with a mid-point estimate of $9.42 billion offering 3% development. The rationale gross sales development shouldn’t be extraordinarily excessive is as a result of the comp is changing into tougher and a few enterprise segments are usually not anticipated to carry out as strongly. One instance is the PPE unit that surged in the course of the pandemic however is not performing as strongly, and Honeywell is even exploring promoting the unit that might be valued in extra of $2 billion. Equally, warehouse automation options are additionally seeing off-peak demand. So, income development shouldn’t be as easy as one would assume, additionally as a result of manufacturing will increase within the airplane manufacturing trade are underneath strain.

Estimates for earnings per share for Honeywell are anticipated to be $2.41 on the mid-point, indicating 8.1% development with an EPS vary of $2.29 to $2.45. It ought to be famous that to some extent the expansion is pushed by share repurchases. Over the previous two years, Honeywell has overwhelmed estimates on EPS each quarter, whereas it missed income estimates 5 occasions and beat estimates 3 times. So, on EPS, the observe report is stronger than on the highest line.

Honeywell Acquisitions In Help Of Three Megatrends

In 2023, Honeywell introduced that it could be realigning its portfolio with three megatrends. These developments are the way forward for aviation, power transition and automation. Taking a look at that realignment, it additionally is smart that the corporate is exploring the sale of its PPE enterprise. Nevertheless, extra importantly, we see that there are acquisitions that align with the three megatrends.

In June 2023, Honeywell accomplished the acquisition of Compressor Controls Company for a money consideration of $673 million and in August 2023, the corporate acquired SCADAfense which offers cybersecurity options. In December 2023, there was an enormous acquisition as Honeywell acquired Service World Company’s World Entry Options enterprise for $4.95 billion. The transaction was finalized in June 2024 and was additionally included within the steering replace for 2024 outcomes. The acquired enterprise will report as a part of the Constructing Automation section.

In March 2024, there was an acquisition intention introduced to strengthen the Aerospace Applied sciences enterprise with further autonomous capabilities through a $200 million acquisition of Civitanavi. Towards anticipated EBITDA for 2024, it could indicate 12.35x EBITDA.

In June 2024, there was an settlement to amass CAES Programs Holdings for $1.9 billion, valuing the corporate at 14x estimated 2024 EBITDA. The acquisition permits Honeywell to boost its protection portfolio.

The most recent acquisition is that of Air Product’s Liquefied Pure Gasoline Course of know-how and tools for 13x 2024 EBITDA or $1.81 billion. This clearly feathers into the power transition megatrend. Whether or not it’s a good acquisition stays to be seen. LNG appears to be like promising, however I consider that all the technique of liquifying the gasoline is an energy-consuming course of and that might additionally clarify why Air Merchandise is specializing in power transition through scaling inexperienced hydrogen manufacturing.

What Is Honeywell Inventory Value?

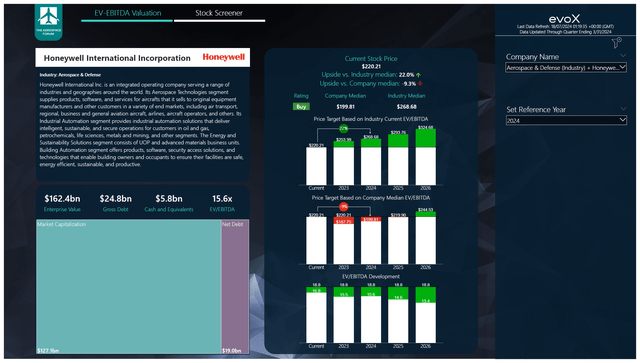

The Aerospace Discussion board

With all of the acquisitions, it may be a little bit of a problem to worth Honeywell inventory. There are a number of causes for that, the primary one is that we don’t know what belongings and liabilities Honeywell brings on the books with the acquisition, and since the timing of the transactions shouldn’t be recognized we don’t know the contributions and the timing of the money outflow to amass the enterprise. Nevertheless, I’m assuming the Civitanavia acquisition so as to add to the outcomes for at the very least one quarter this yr and for the CAES and LNG acquisitions to be finalized subsequent yr.

In comparison with my earlier report, EBITDA estimates have elevated by 2.7% between 2023 and 2025. Towards the corporate’s median EV/EBITDA, the inventory appears to be pretty valued with 2025 earnings in thoughts. So, Honeywell shouldn’t be a reputation which I feel you can purchase as a result of it’s discounted, taking a look at its median EV/EBITDA it’s clearly not discounted. Nevertheless, towards the median EV/EBITDA and 2026 projections, there may be already 11% upside and if we had been to permit some margin growth towards 2024 earnings, we get to a $234 goal representing 6% upside. That’s not an enormous upside, however I consider that the continued acquisitions and the concentrate on three key developments are going to repay, and I feel this can be a inventory to purchase and maintain for the long term.

Conclusion: Honeywell Inventory Is A Strong Inventory To Personal

From a valuation perspective, Honeywell inventory shouldn’t be a screaming purchase. Towards the present yr’s earnings, it’s 9% overvalued and pretty valued for 2025 earnings. So, that isn’t one thing that screams “purchase” to me. If Honeywell inventory drops greater than 9% then it most positively turns into a stronger purchase. The rationale why I’ve assigned a purchase ranking reasonably than a maintain ranking is as a result of there may be nonetheless upside to the peer group valuation and the important thing subjects round which Honeywell builds its enterprise and acquisitions, particularly aerospace, power transition and automation, are developments that can drive enterprise for years if not many years to come back. So, this isn’t a inventory that I view via a short-term lens.