GCapture/iStock via Getty Images

In the two and a half months since I announced to the world that I was locking in an 8.4% profit in Franklin Resources, Inc. (NYSE:BEN) in an article with the monumentally original title “Taking Profits in Franklin Resources Inc.” The shares have dropped about 18.26% against a loss of about 3% for the S&P 500. While this is gratifying on some level, I think it’s worth revisiting the name yet again. I’ve obviously been willing to own it in the past, and a stock trading at $22.88 is, by definition, a much less risky investment than the same stock when it’s trading at $28.34. I’m going to review the valuation and compare that to trends in AUM. Additionally, all of this is going to be set against the backdrop of the current risk-free rate. I think we need to remember that the risk-free rate has changed dramatically. We’re past the notion that “there is no alternative” because the risk-free rate is no longer 1% or lower.

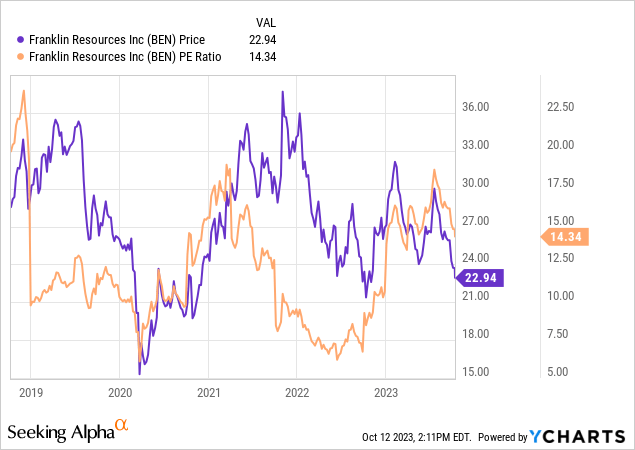

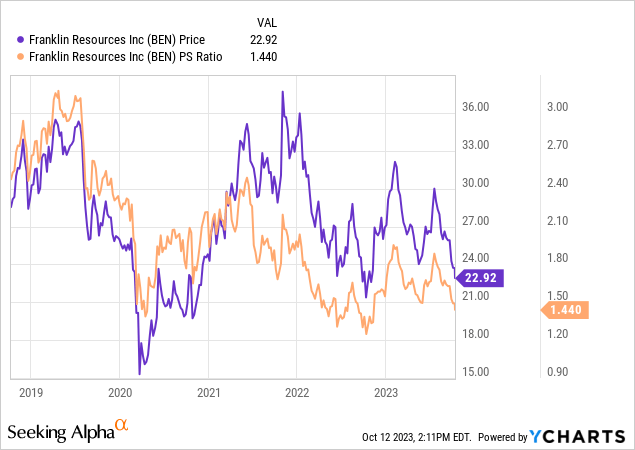

I put a “thesis statement” at the beginning of each of my articles. This gives my readers the chance to get in, get the “gist” of my thinking, and then get out again before they’re exposed to too much “Doyle mojo.” This paragraph is for people who want a bit more than they might get from a title and bullet points, but much less than they’re exposed to with a whole article. The shares are about 19% cheaper than they were on a PE and PS basis, and the dividend yield has spiked higher and is now another 10 basis points higher than the risk-free rate. The problem is that the extra 50 basis points of income isn’t worth the risk associated with owning this stock in my view. We’re no longer in a world dominated by “TINA”, so I think it’s much more prudent to accept slightly less income that is much more predictable than the returns an investor might get with this stock.

Trends in AUM

Since AUM is of critical importance to the financial health of this enterprise, I think it’s worth keeping track of it fairly closely. Although AUM was down 3.3% in September from August to $1.37 billion largely as a result of falling markets, it’s worth remembering that this is about $70 million higher than it was this time last year. So, year over year, AUM increased by about 5% from September 2022 to September 2023. In my previous article on this name, I forecasted a reduction in operating earnings of about $882 million for the year. Although I’m still not sanguine about the current fiscal year given how things have progressed over the past nine months, I have some faint hope that my earlier operating income forecast is a bit too pessimistic. After all, the company has been surprised by the upside in Q4 previously, and it may do so again. All of that aside, I think the dividend is well covered with its 60% payout ratio, and I would be very happy to buy the shares back at the right price.

The Stock

If you read my stuff regularly, you know that I consider the stock and the business to be distinctly different things and that I try to buy shares that are as cheaply priced as possible. This is because cheap shares offer a great combination of lower risk and higher potential rewards. They’re lower risk for the very obvious reason that they have much less far to fall than the high flyers that people are most excited about. Such shares offer the greatest potential reward in my view. So much bad news is already “baked into” the price, that any good news will offer the market a positive surprise, which would send shares higher.

In addition to knowing that I think the stock and business are different, and that cheap shares are generally superior investments, my regulars know that I measure the cheapness of shares in a few ways, ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, free cash flow, sales, and the like. I like to see shares trading at a discount to both the overall market and to their own history.

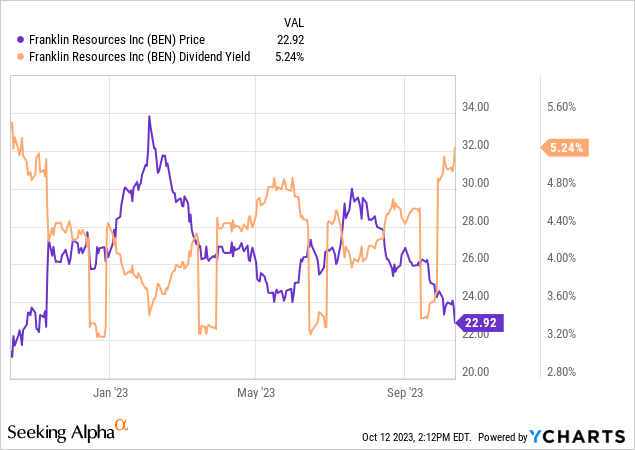

With that as a preamble, it’s time to write about Franklin Resources. When I took profits in this name earlier, the PE and PS ratios were 17.74 and 17.83 respectively, and the dividend yield was about 4.2%. The shares are about 19% cheaper today, and the dividend yield is now about 30% higher.

The dividend yield is now about 50 basis points higher than the 10-year Treasury Note. Last time I checked on this name, the risk-free premium was only about 40 basis points, so things have certainly improved on that front.

I also measure cheapness in a way that ignores price and focuses on the relationship between risk and return. An investor spends units of “risk” in order to achieve a return. In my view, at the moment, investors are still paying too much “risk” for too little “return.” Put another way, I’d rather be able to sleep at night earning 50 basis points less with a perfectly predictable government note, than stretch and take the risk of stock ownership to earn an extra half percent.

While I’ll agree that the shares are cheaper, they’re not near “screaming buy” lows, and for that reason, I feel compelled to continue to avoid this name. I will be watching the upcoming earnings release closely and will buy back aggressively if my pessimism is unwarranted. I may miss out on some financial upside from current levels, and the shares may skyrocket on “less bad” earnings, but the risk-reward doesn’t make sense to me at this point. Even if I’m pleasantly surprised in the final quarter of the year, I can’t evade the fact that both operating income and net income are down dramatically for the first nine months of the year so far.