Cecilie_Arcurs/E+ via Getty Images

A few months ago, we wrote an article about Hims & Hers Health (NYSE:HIMS) titled: “Hims & Hers: 3 Reasons To Buy This Potential Growth Stock”.

In that article, we made the case that the stock was incredibly undervalued when compared to the company’s growth opportunity and TAM over the long term.

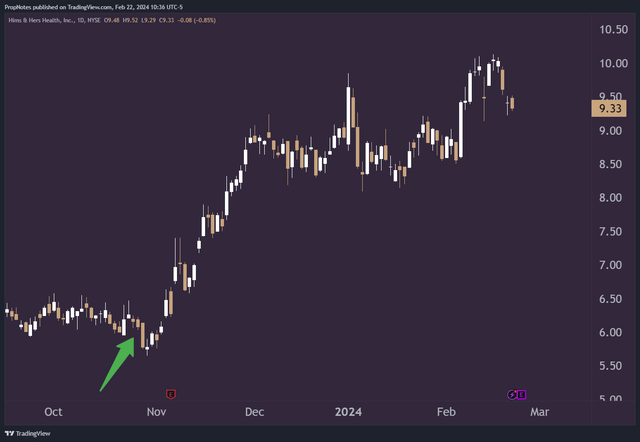

Since then, the stock has rallied more than 50%, as we were lucky enough to catch nearly the exact bottom with our article:

Seeking Alpha

However, while HIMS’s market opportunity remains robust and top line revenue continues to grow like clockwork, the company’s shares have potentially become a bit extended to the upside on a technical basis, and earnings are due out in only a few days.

Thus, while we think the stock is still a vigorous long-term buy, we thought we’d publish again on the company again and put forth a trade idea that might do a better job of balancing risk and reward at the present moment in time.

Today, we’ll explore recent developments with the company, dig into where the company’s Q4 results might come in, and lay out our trade idea in the stock – selling put options to generate cash-on-cash returns while laying off a significant amount of earnings risk.

Sound good? Let’s jump in.

Original Thesis

Before talking about recent updates and Q4 earnings for HIMS, it makes sense to quickly cover the main points of our original thesis when we wrote about the stock last year.

Here are the 3 key reasons we liked the stock back then:

- A Strong Subscription Model: HIMS’s subscription-based model on long-term treatment markets like Hair Loss, Erectile Dysfunction, and Birth Control produces long term sales visibility, and marketing payback periods remain under 1 year. With a successful land & expand strategy and low COGS, the economics of this model promise to produce high quality profits in the future.

- A Massive Market Opportunity: HIMS has begun to expand horizontally and vertically, both into new treatment markets as well as into supplements & telehealth. With the potential for all of these new markets to also leverage HIMS’s existing cost structure and subscription model, the potential here seems massive.

- A Potentially Undervalued Stock: HIMS traded at a low Price / Sales multiple compared to its level of growth, as well as peers in the same category. The negative sentiment around the company presented an opportunity, especially given HIMS’s recent TTM FCF pivot to profitability.

Updates

Since the article, the company has reported earnings once, and the report was excellent.

Revenue came in above expectations, and grew 55% YoY from Q3 of 2022:

Seeking Alpha

Additionally, while EPS did miss by 1 cent, the improving economics of the business are in full display when you zoom out a bit.

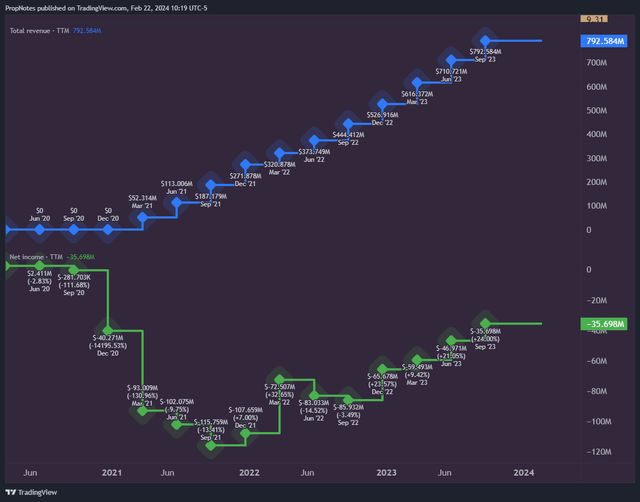

The company remains on track from a revenue perspective, and net income figures continue to make progress towards the breakeven mark:

TradingView

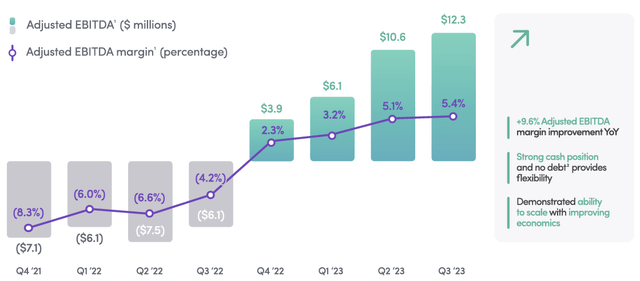

Additionally, if you want to strip out SBC and some other net income quirks, HIMS has continued to grow EBITDA quarter after quarter, which is now firmly into the black:

Investor Presentation

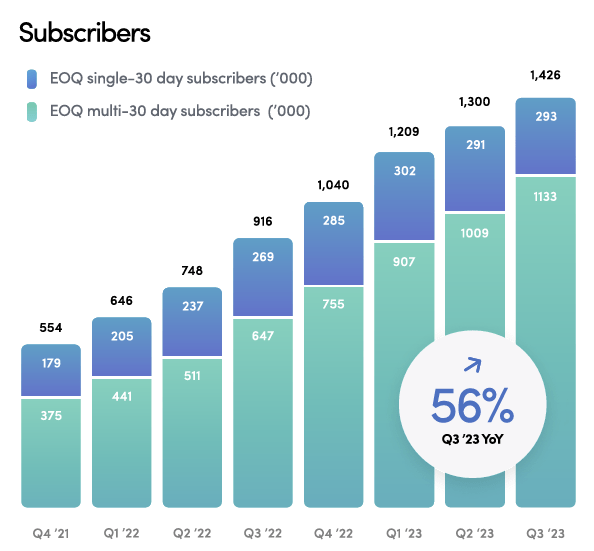

These results have been powered partly by the company’s improving operational profile, but mostly by the green columns on the chart below:

Investor Presentation

As you can see, the company’s ‘Land & Expand’ subscription model is working.

As customers come through the funnel and use the company’s products, trust is built, and they begin adding on additional treatments over time. Every quarter, a chunk of the blue ‘single’ subscribers become ‘multi’ subscribers, which helps shorten the company’s acquisition spend payback period.

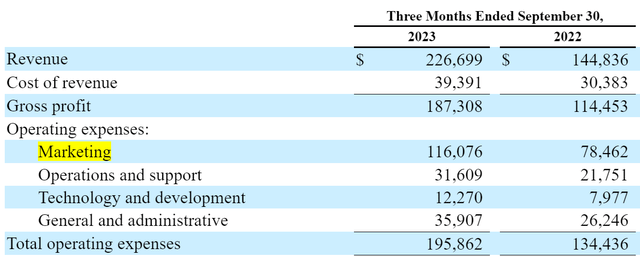

With gross margins of more than 75%, and with marketing being such a massive amount of spend for the company, if management were to shut off marketing tomorrow, HIMS would be wildly profitable on a go-forward basis:

10Q

It really is just a case of the company prioritizing growth over profitability, but make no mistake, HIMS has complete control over the lever in this case.

With no debt on the balance sheet and a manageable level of dilution, the company appears to be standing on very solid ground.

However, from a technical standpoint, the stock has also begun to reflect this reality.

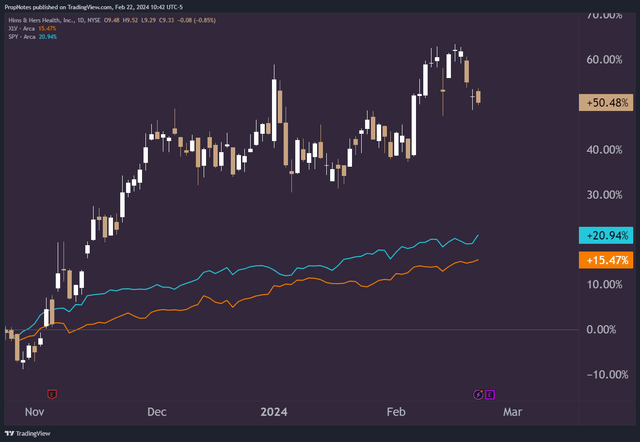

Since our last article, the stock has rallied more than 50%, which is a long way to go in less than a quarter:

TradingView

When compared to the market and the sector, this outperformance is significant:

TradingView

This has us somewhat concerned that the market’s expectations for the stock are now higher going into Q4 earnings, which could cause much more in the way of short-term volatility.

Q4 expectations

For its part, we expect that Q4 will be another strong quarter by the company.

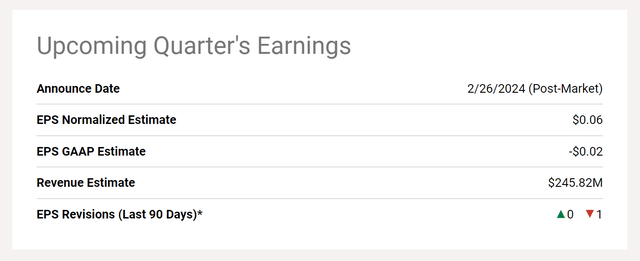

Analysts are projecting a 2-cent loss on revenue of $245 million, which is close to what the company is projecting for top and bottom-line results:

Seeking Alpha Investor Presentation

However, we think the company will outperform and come close to (or exceed) $250 million in top line sales. This belief is partially founded on the fact that the company’s longer-term guide is towards $1.2 billion in revenue run rate by the end of 2025, which is an aggressive target and would require continual incremental outperformance, in addition to the fact that the company has consistently beaten estimates going into this report, from anywhere between $3-$14 million.

As far as the market’s reaction to a potential beat, it’s anyone’s guess. While we’re certainly bullish on HIMS’s potential results, the run-up into earnings, combined with the increased multiple, puts more pressure on management to deliver.

The Trade

Thus, our trade idea.

While we love the underlying value of HIMS as a high gross margin subscription revenue platform, we’re also concerned about the potential of a poor reaction to what we expect will be a solid report, only due to the previous run-up as discussed.

Thus, selling put options might be the best way to expose oneself from a risk/reward standpoint over the coming earnings report and beyond.

If you’re unfamiliar with options trading, when you sell a put, you’re agreeing to purchase shares in a company at a pre-agreed price, if the stock price finishes beneath the pre-agreed price when the put expires. It’s as easy as that.

In return for this risk, put sellers are compensated with a cash payment called a ‘premium’.

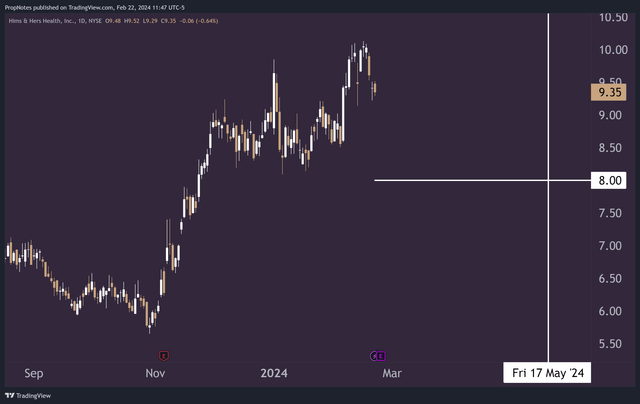

For this setup, we like the idea of selling the $8 strike options expiring May 17th, 2024:

TradingView

These options have a premium of $50 per contract, which works out to a 6.6% return over the next 85 days. This annualizes to a return of 28%.

If HIMS ends up finishing above $8 per share by mid-May, then a put seller would get to keep the cash returns and move on.

If HIMS ends up below $8 by mid-May, then a put seller would be assigned the shares at $8, but they would also get to keep the cash premium to offset this cost.

Earning a 28% annualized yield or acquiring the stock nearly 20% lower at 7.50 per share? Sounds like a win-win to us, especially when you consider the long-term potential we believe is still latent in the company.

Risks

There are some risks to this strategy.

The first risk is the fact that selling put options into earnings can be a risky endeavor. If done without leverage (which is always how you should short options, in our view), then it doesn’t hold any more risk than simply buying the stock and holding it through earnings anyway. However, you may be forced to buy shares at a price much higher than where the stock trades in an adverse scenario.

Something to think about.

The second risk is the idea of opportunity cost. If HIMS crushes earnings and the stock blasts higher, then a short put position’s profit is capped at 6.6% over the next 3 months. This is a consideration, especially given our overall view on the stock.

However, given how far the stock has gone in such a short period of time, we think the optimal thing to do in this case would be to gear down in terms of risk, accept the 6.6% yield, and buy in higher if shares do end up going on a run.

Summary

HIMS still looks like a great company going forward based on all of the available information out there, and we retain our “Strong Buy” rating on the stock.

However, gearing down for the time being with a risk / reward optimized trade – selling put options around earnings – appears to be a highly advantageous way to expose yourself right now to what could be a volatile earnings report.

If you’re ok with the risk, then feel free to stay long. But for those who want a more targeted option, or for those who simply want to earn a high level of yield in return for taking some risk in a high-growth name, our trade idea here seems like it could be the perfect fit.

Cheers!