BalkansCat

Investment Thesis: I continue to take a bullish view on Hilton Worldwide Holdings given continued growth in EBITDA and a reduction in the net debt to EBITDA ratio.

In a previous article back in July, I made the argument that Hilton Worldwide Holdings (NYSE:HLT) could continue to see upside from here, on the basis of strong revenue growth as well as an increasingly attractive Price/RevPAR ratio.

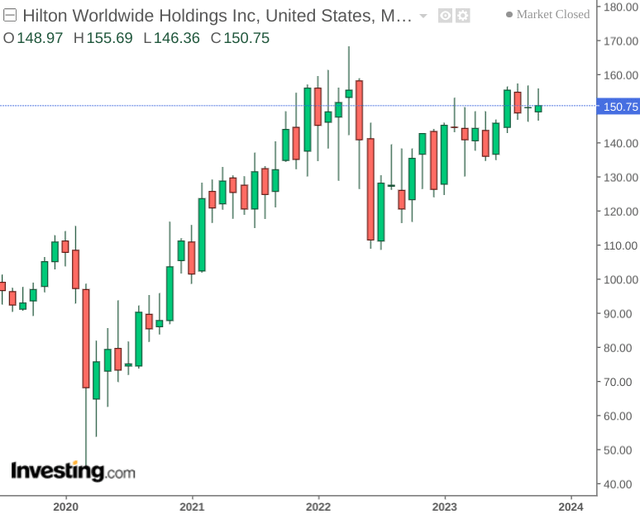

Since then, the stock has descended slightly to a price of $150.24 at the time of writing:

TradingView.com

The purpose of this article is to assess whether Hilton Worldwide Holdings has the ability to see continued growth from here taking recent performance into consideration.

Performance

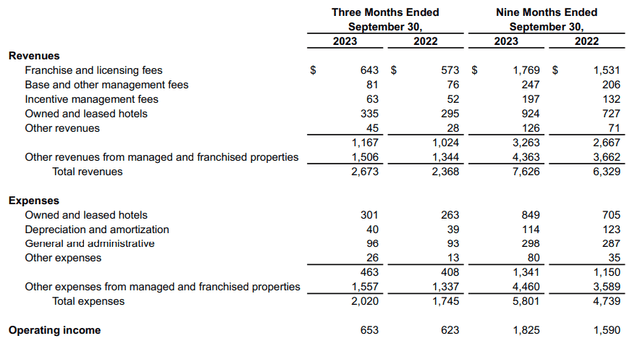

When looking at the Q3 2023 earnings results for Hilton Worldwide Holdings, we can see that both revenue and operating income saw continued growth – up by 12.8% and 4.8% respectively YoY.

Hilton Worldwide Holdings: Q3 2023 Earnings Release

Additionally, diluted earnings per share was up from $1.26 to $1.44 over the same period. In spite of welcoming performance over the last quarter, the stock price has not seen upside since July.

I had previously made the argument that signs of a plateau in revenue growth across more expensive brands might be a risk factor for further growth – even though revenue growth on the whole had continued to remain strong.

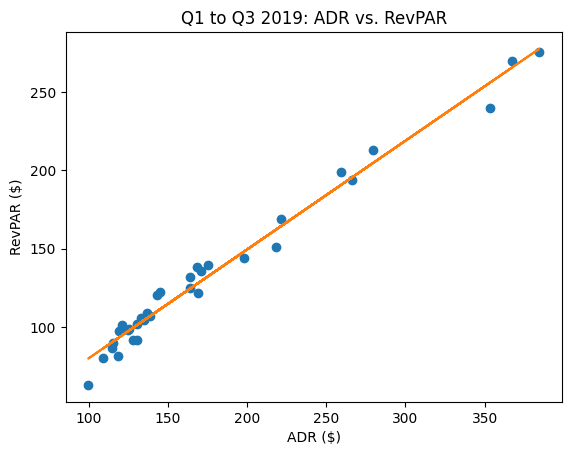

To investigate this in more detail, I decided to plot the relationship between ADR (average daily rate) and RevPAR (revenue per available room) across each brand for the periods Q1 to Q3 2019 and Q1 to Q3 2023.

Here are the plots below.

Q1 to Q3 2019: ADR vs. RevPAR

For this period, we see a strongly positive relationship between ADR and RevPAR – i.e. as ADR rises so does RevPAR. This is expected, as RevPAR is simply ADR multiplied by the occupancy rate.

Specifically, for every $1 increase in ADR – RevPAR saw an increase of $0.69.

ADR and RevPAR figures sourced from historical earnings releases for Hilton Worldwide Holdings. Plot generated by author using Python.

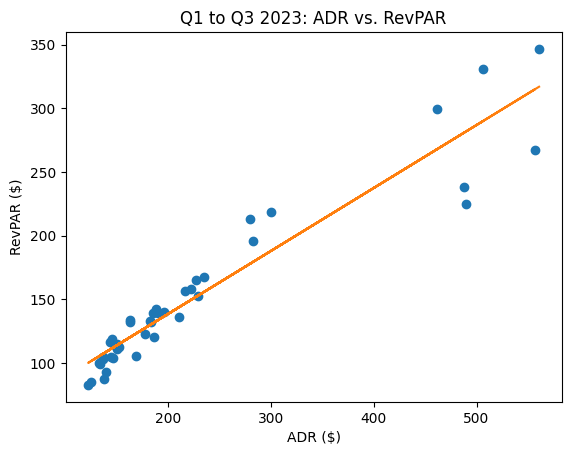

Q1 to Q3 2023: ADR vs. RevPAR

When analysing the period Q1 to Q3 2023, we can see that the relationship between ADR and RevPAR (as expected) continues to remain positive. However, it is notable that for every $1 increase in ADR – RevPAR only saw an increase of $0.49.

ADR and RevPAR figures sourced from historical earnings releases for Hilton Worldwide Holdings. Plot generated by author using Python.

Moreover, it is also worth noting that the highest ADR across any brand from Q1 to Q3 2019 was $384.45, whereas it was $560.91 from the period Q1 to Q3 2023.

In this regard, we can see that on the whole – revenue growth has been less responsive to price increases for this year as compared to the same period in 2019. This may be a reason for sluggishness in the stock price – investors might be concerned that customers have become more sensitive to price increases than in previous years – and the boom in booking demand that we saw post-COVID has now largely evaporated.

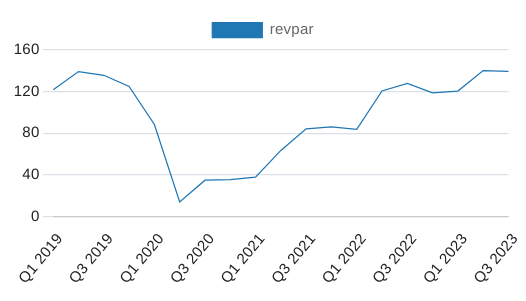

Moreover, I had previously made the argument that in spite of a plateau in demand among more expensive brands – revenue growth across more mainstream-priced brands such as Hilton Hotels & Resorts (among the largest brands for Hilton by number of rooms) – we can see that RevPAR by quarter also seems to be plateauing out near that of 2019 levels.

Quarterly RevPAR: Hilton Hotels & Resorts

Figures sourced from historical earnings releases for Hilton Worldwide Holdings. Graph generated by author.

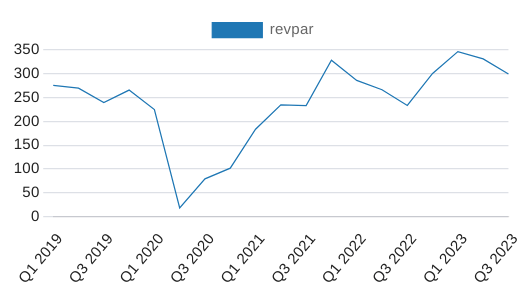

In the case of Waldorf Astoria Hotels & Resorts (the brand with the second-highest ADR for Q3 2023), we can see that RevPAR has only been seeing growth slightly above that seen in 2021 when booking demand recovered post-COVID.

Quarterly RevPAR: Waldorf Astoria Hotels & Resorts

Figures sourced from historical earnings releases for Hilton Worldwide Holdings. Graph generated by author.

In this regard, while revenue and operating income have continued to see growth – signs of a plateau in RevPAR are being observed across both luxury and mainstream brands.

My Perspective and Risks

As regards my take on the above results and the implications for the growth trajectory of the stock going forward, while it is still possible for Hilton to grow revenue through increasing volume and room capacity – there is a limit to the extent to which this can bolster growth overall.

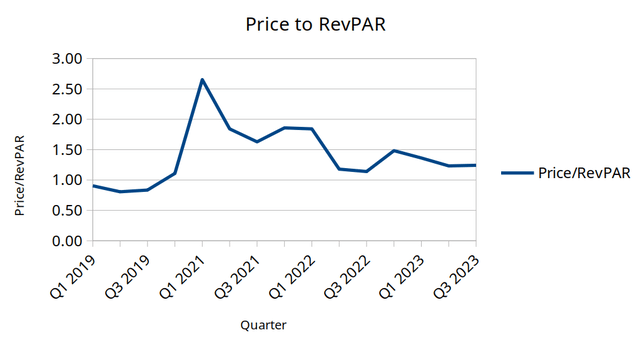

When using system-wide RevPAR in place of earnings as a valuation metric relative to price (excluding 2020 due to the effects of COVID-19), price to RevPAR has decreased since 2020 and seems to be plateauing at levels slightly above that seen in 2019.

Prices (as recorded on day of quarterly earnings release) sourced from nasdaq.com and system-wide RevPAR sourced from historical quarterly reports for Hilton Worldwide Holdings. Price to RevPAR ratio calculated by author.

Heading into the winter months, RevPAR is expected to be lower than that of the summer months owing to a drop in seasonal demand.

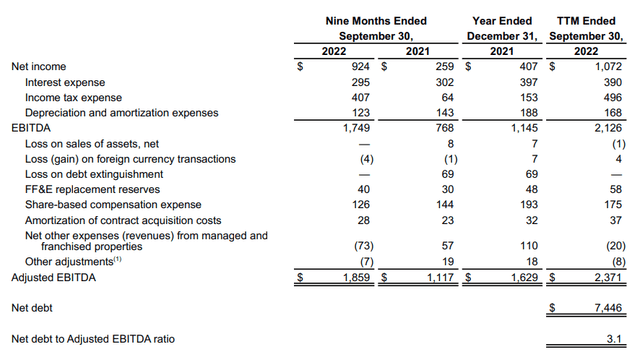

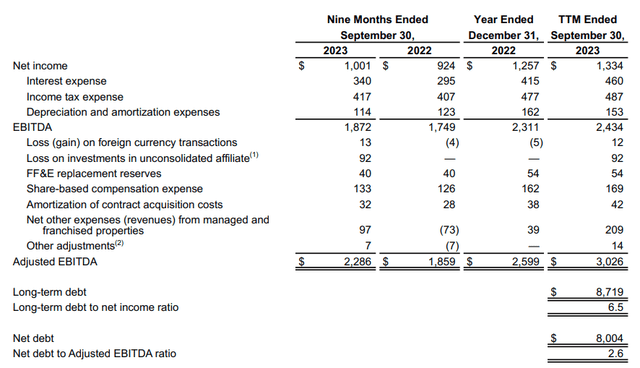

From a balance sheet standpoint, we can also see that while net debt has seen an increase over the past year – the net debt to adjusted EBITDA ratio has decreased from 3.1x to 2.6x over this period.

Net Debt to Adjusted EBITDA: September 2022

Hilton Worldwide Holdings: Q3 2022 Earnings Release

Net Debt to Adjusted EBITDA: September 2023

Hilton Worldwide Holdings: Q3 2023 Earnings Release

In spite of a slowdown in RevPAR growth – the fact that EBITDA has continued to see upside in addition to a fall in net debt to adjusted EBITDA continues to make me bullish on the stock.

I take the view that – depending on broader macroeconomic conditions – when we see RevPAR growth start to accelerate once again, then the stock is in a good place to see upside from here.

investing.com

Particularly, given that we saw the stock reach a high of near $170 in 2022, I take the view that Hilton Worldwide Holdings has the capacity to reach this level once again – particularly in light of the fact that Hilton has continued to comfortably grow EBITDA in spite of pressure on RevPAR growth.

Conclusion

To conclude, Hilton Worldwide Holdings has seen some pressure on RevPAR growth but the stock has remained resilient overall. Given continued growth in EBITDA and a reduction in the net debt to EBITDA ratio, I continue to take a bullish view on Hilton Worldwide Holdings.