Summary Aerial Artwork/DigitalVision by way of Getty Pictures

Funding Thesis: Hilton Grand Holidays may see short-term draw back because of the scenario in Ukraine and broad-based inflation considerations. Nonetheless, the Diamond Resorts acquisition may enable for vital upside as demand for trip possession rebounds over the longer-term.

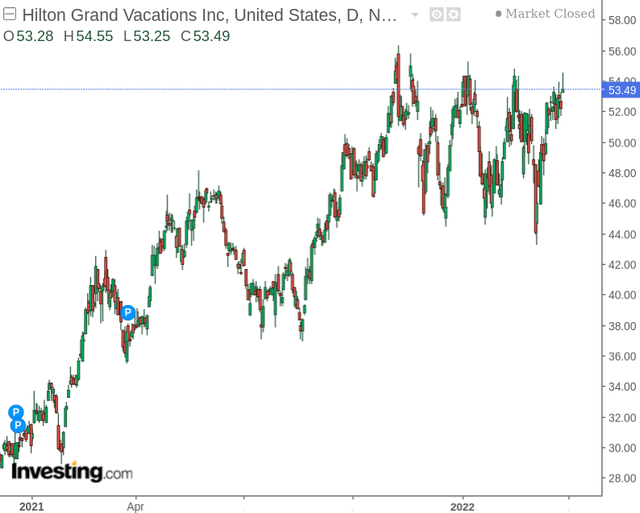

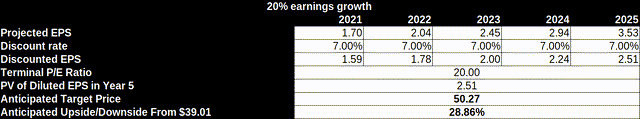

In a earlier article, I made the argument that Hilton Grand Holidays (NYSE:HGV) may see upside to a goal worth of $50 on the idea of 20% yearly development in EPS per 12 months over the subsequent 5 years.

The inventory noticed sturdy development previous this degree since July:

investing.com

The aim of this text is to evaluate whether or not Hilton Grand Holidays may nonetheless see vital upside in gentle of latest efficiency.

Efficiency

When earnings development over the previous 12 months, we are able to see that the corporate has made a powerful rebound during the last 5 quarters:

| Quarter | This autumn 2020 | Q1 2021 | Q2 2021 | Q3 2021 | This autumn 2021 |

| Diluted earnings per share | (1.81) | (0.08) | 0.10 | 0.90 | 0.62 |

Supply: Figures sourced from Hilton Grand Holidays Quarterly Reviews

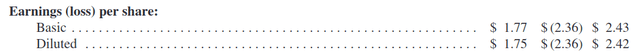

Whereas earnings have seen a restoration, the earnings determine of $1.75 for 2021 nonetheless stays under the 2019 determine of $2.42.

Hilton Grand Holidays: 2021 Annual Report

Based mostly on the earlier assumption of 20% earnings development per 12 months – Hilton Grand Holidays can be anticipated to succeed in this degree of earnings as soon as once more by 2023:

Creator’s Calculations

On this regard, whereas the corporate noticed an earnings determine of simply barely larger than my projected determine of $1.70 for 2021 – this does imply that the corporate is probably going going to wish to proceed to point out vital earnings development to justify the present worth.

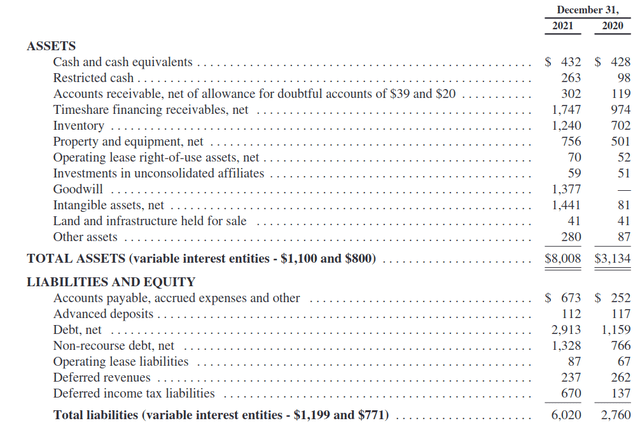

From a stability sheet standpoint, we are able to see that the corporate’s web debt has elevated considerably in 2021 as the corporate has needed to enhance expenditure to finance the rebound in reserving demand. We are able to see that money and money equivalents have remained just about fixed – that means that the money to web debt ratio has decreased from 0.36 in 2020 to 0.14 in 2021.

Hilton Grand Holidays Annual Report 2021

This might need the potential to hinder earnings development as a good portion of these earnings might want to go in the direction of servicing such debt, and income might want to proceed rising strongly to compensate for this.

Trying Ahead

Taking the corporate’s latest monetary efficiency into consideration, buyers are more likely to more and more search for additional earnings development to justify a worth vary above $50.

When it comes to potential development prospects going ahead, journey shares have typically seen downward strain because of the continued scenario in Ukraine. Certainly, this will place brief to medium-term strain on demand for timeshares throughout Europe as potential prospects could keep away from the continent till the scenario turns into extra steady.

With that being mentioned, the North American market nonetheless accounts for a big portion of the corporate’s total enterprise and on this regard I anticipate that any strain on revenues because of decrease European enterprise is more likely to be restricted.

So far as what may have the potential to drive earnings development additional, Hilton Grand Holidays’ acquisition of Diamond Resorts permits the corporate entry to twenty new markets together with offering an anticipated $125 million in run-rate price synergies within the first two years. Hilton Grand Holidays additionally good points entry to Diamond Resorts’ 92 leisure resorts to enhance the corporate’s personal current 62 upscale properties.

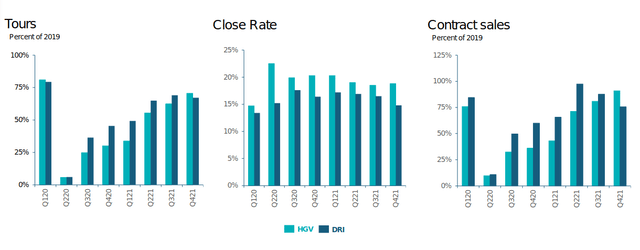

Now we have already seen a powerful rebound within the firm’s total gross sales developments by way of HGV development:

Hilton Grand Holidays This autumn 2021 Investor Replace

From this standpoint, the acquisition of Diamond Resorts has allowed Hilton Grand Holidays to turn out to be the main trip possession firm worldwide. Ought to we see demand proceed to rebound, then this provides Hilton Grand Holidays an important alternative to scale income development which might in flip increase earnings development.

The primary danger to Hilton Grand Holidays right now is the potential for COVID to disrupt journey plans as soon as once more – though the business has been exhibiting sluggish however positive indicators of restoration over the previous two years. Furthermore, it stays to be seen whether or not the anticipated price synergies from the Diamond Resorts acquisition will in the end materialize. Nonetheless, there may be more likely to be upside within the occasion of a continued rebound in demand.

Conclusion

To conclude, Hilton Grand Holidays might want to present proof of additional earnings development to justify continued upside previous the $50 mark. With the scenario in Ukraine having introduced some uncertainty again to the business together with broader inflation considerations, the inventory itself may see some downward strain within the short-to-medium time period.

Nonetheless, the acquisition of Diamond Resorts has the potential to solidify the corporate’s place as a number one trip possession firm, which is more likely to result in larger upside over the longer-term assuming additional rebounds in demand.

Further disclosure: This text is written on an “as is” foundation and with out guarantee. The content material represents my opinion solely and on no account constitutes skilled funding recommendation. It’s the duty of the reader to conduct their due diligence and search funding recommendation from a licensed skilled earlier than making any funding choices. The creator disclaims all legal responsibility for any actions taken based mostly on the data contained on this article.