Printed on April eighth, 2022, by Quinn Mohammed

Washington Belief Bancorp has raised its dividend for eleven years straight, following a 2010 dividend development pause as a result of Nice Recession. Nonetheless, it didn’t slash its dividend as many different monetary establishments on the time.

Earnings development has led to first rate dividend development in recent times. Dependable dividend development has triggered Washington Belief to have a excessive dividend yield of 4.4%. And with current share value decreases, Washington Belief could also be a lovely alternative at this time.

Now we have created a spreadsheet of excessive dividend shares with dividend yields of 5% or extra…

You may obtain your free full listing of all securities with 5%+ yields (together with vital monetary metrics resembling dividend yield and payout ratio) by clicking on the hyperlink beneath:

On this article, we are going to analyze financial institution holding firm, Washington Belief Bancorp (WASH).

Enterprise Overview

Washington Belief Bancorp, Inc. operates as a financial institution holding firm, and owns The Washington Belief Firm. The corporate was based in 1800 and is the oldest group financial institution within the U.S.

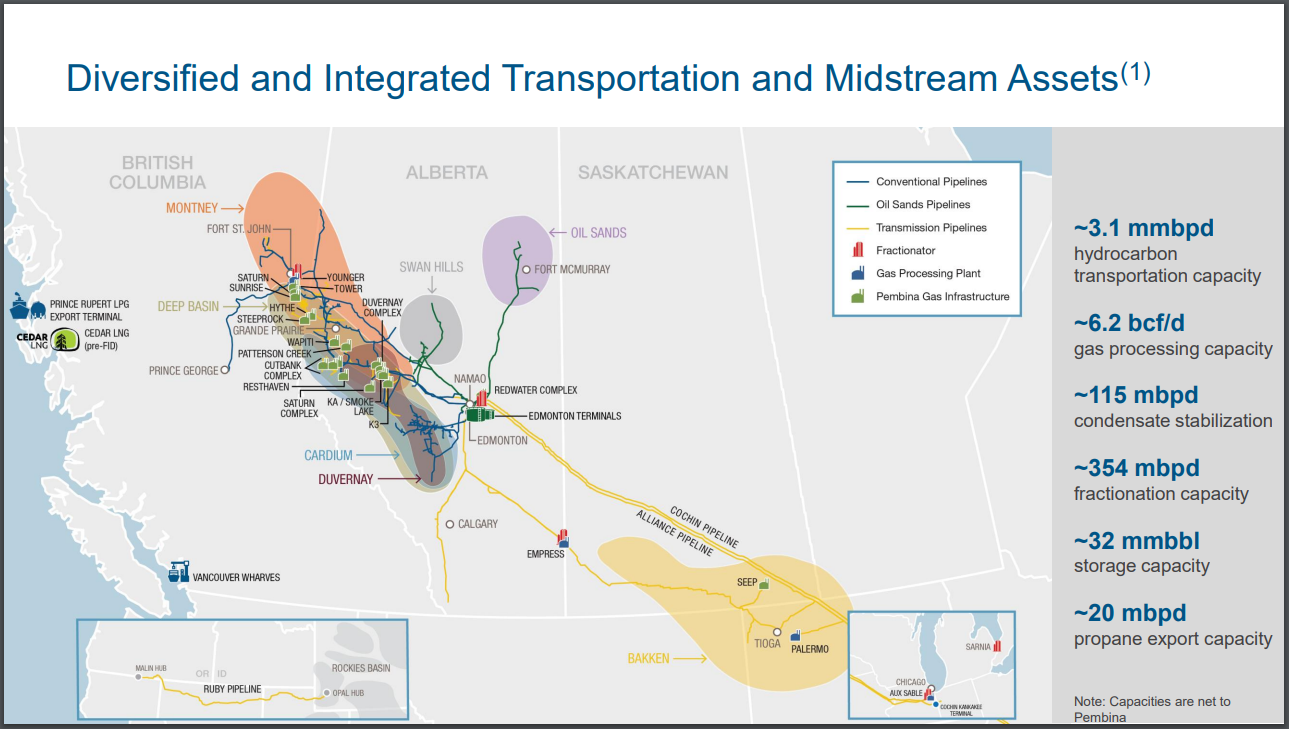

Washington Belief has 24 branches available in the market space of Rhode Island, japanese Massachusetts, and Connecticut. It boasts $5.9 billion property.

The corporate offers banking companies resembling financial savings accounts, certificates of deposit and cash market accounts. Additionally they affords loans for residential, industrial, shopper and development prospects in addition to reverse mortgages. And eventually, the corporate additionally affords wealth administration companies, together with asset administration, monetary planning, and advisory companies.

Supply: Investor Relations

Washington Belief reported fourth quarter earnings and full 12 months 2021 outcomes on January 26th, 2022. Income elevated 25% year-over-year to $58.1 million for the quarter. GAAP earnings-per-share was $1.15, an $0.08 enchancment over the prior 12 months. For the complete 12 months, income was 1% increased to $229 million, and earnings-per-share rose 9.2% to $4.39.

Whole loans, excluding PPP loans, had been up 6% year-over-year to $4.2 billion. Whole in-market deposits reached a report $4.5 billion, an 18% improve from a 12 months in the past.

For the third consecutive quarter, there have been no provisions for credit score losses. Return on common fairness and common property was 14.03% and 1.32% for the 2021 12 months, respectively. Wealth administration revenues grew to a report excessive of $41.3 million and property underneath administration reached an all-time excessive of $7.8 billion. Internet curiosity earnings grew 11% year-over-year whereas web curiosity margin expanded 19 foundation factors to 2.59%.

In 2022, Washington Belief is anticipated to earn $3.79.

Progress Prospects

The corporate plans to develop enterprise improvement by rising its lending exercise in adjoining New England states and scale back its dependence on Rhode Island for producing property. Because the financial institution expands, it expects to capitalize on its model energy and its popularity for high quality service.

The corporate’s wealth administration enterprise is comprised of primarily excessive web value people, with a median consumer dimension of $2.8 million. Washington Belief will proceed to realize in property underneath administration and result in increased revenues. The corporate has a powerful stability sheet, and it’s fee-intensive enterprise mannequin will assist future earnings and dividend development.

The corporate may also develop its mortgage portfolio, which has grown by 5.7% per 12 months on common over the past 5 years. Residential makes up 40% of the mortgage portfolio, adopted by 38% in CRE, 15% in C&I and seven% in shopper. Moreover, 65% of the loans are variable.

The mortgage banking division additionally goals to develop banking relationships with prospects. It follows a versatile origination mannequin the place the corporate can place the loans on the market or to be put within the portfolio. In 2021, 55% of mortgage originations had been on the market, and 45% had been for the portfolio. Since 2018, nearly all of mortgage originations had been on the market.

Because the firm not often points fairness, outcomes on a per-share foundation can be reliant on improved enterprise efficiency and may stay unhampered by shareholder dilution.

Aggressive Benefits & Recession Efficiency

Washington Belief doesn’t seem to have any significant aggressive benefit, and it has a comparatively small footprint with solely 24 branches, primarily in Rhode Island. Nonetheless, the corporate does have a substantial wealth administration enterprise with practically $8 billion of property underneath administration.

Throughout the Nice Recession, Washington Belief noticed earnings-per-share decline 44% from 2007 to 2009. The corporate was badly affected through the Nice Recession, however it fared nicely all through the COVID-19 pandemic, with earnings development since 2017 as much as 2021.

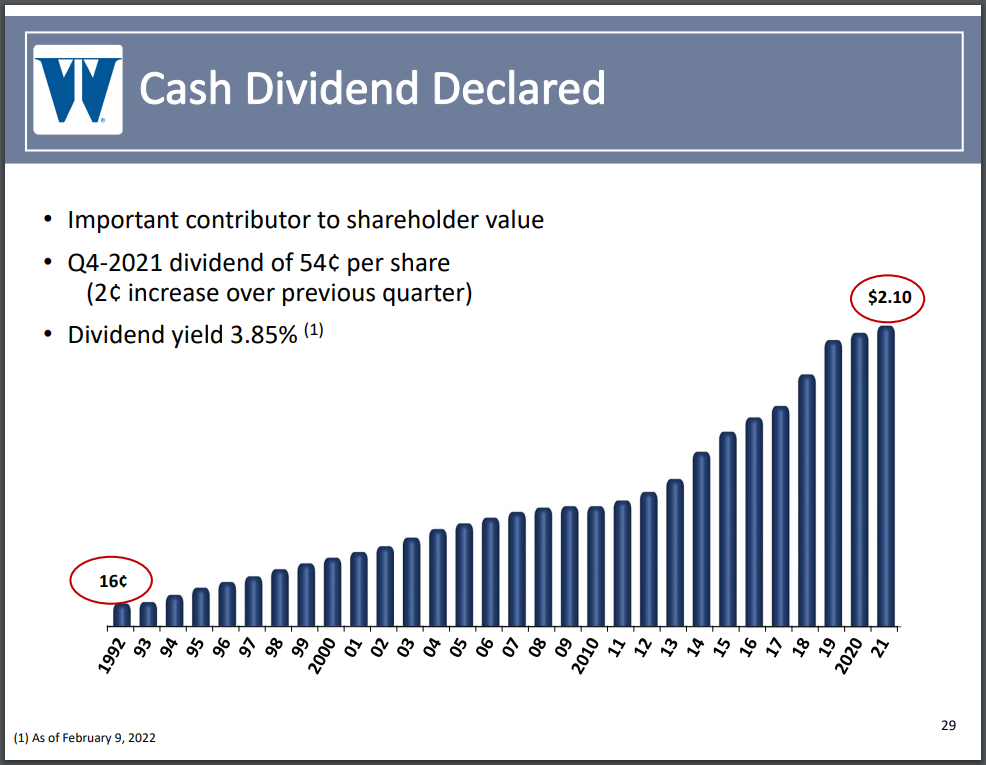

Whereas quite a lot of monetary establishments slashed their dividend through the Nice Recession, Washington Belief merely paused their dividend development. Previous to 2010, Washington had a 16-year dividend development streak. It was paused in 2010, after which grew one other 11 years to-date.

Dividend Evaluation

Washington Belief has elevated their annual dividend for 11 consecutive years. The corporate paused its dividend development in 2010, which ended a previous 16-year streak. So, the corporate has a demonstrated historical past of rising the dividend for a few years.

Supply: Investor Relations

The dividend has grown pretty nicely, with a compound annual development fee of 8.7% within the final decade. Even within the final 5 years, the dividend grew at a median tempo of seven% per 12 months.

Washington’s at the moment quarterly dividend payout of $0.54 equates to an annual dividend of $2.16 in 2022. On the present WASH share value, the corporate has a excessive dividend yield of 4.4%. The present dividend yield is 70 foundation factors above the trailing decade common, which signifies some degree of low cost on a dividend yield foundation.

With anticipated earnings per share of about $3.79 for the 12 months, the corporate has a protected and manageable payout ratio of 57%. The corporate’s dividend development could come extra cautiously within the medium time period, as the newest improve of three.8% was a good bit lower than the typical. Nonetheless, we see no speedy menace to the continuation of the dividend development streak right now.

Moreover, the corporate’s share rely has remained steady over the past decade, which makes it simpler for the corporate to develop on a per share foundation. The enterprise has carried out nicely to generate such development with out continuously issuing fairness.

Ultimate Ideas

Washington Belief Bancorp has carried out nicely as a easy regional financial institution holding firm. It has elevated its dividend for 11 years straight. Much more, the corporate beforehand had a sizeable dividend development streak which was placed on pause through the Nice Recession. Nonetheless, the corporate’s upkeep of its dividend at the moment was favorable to the various monetary establishments which slashed their payout.

Given current declines in share value, the above common yield, and a mid single digit incomes development expectation, Washington Belief Bancorp seems to be a lovely whole return alternative right now.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].