Published on January 11th, 2023 by Nikolaos Sismanis

Utility small-cap VIA Renewables (VIA) has caught the eye of income investors looking for high yields these days.

Following the stock losing more than half of its value during 2022 and currently trading more than 66% lower from its all-time high levels, VIA Renewables now features a massive yield of 14.1%.

It’s also quite praiseworthy that the company has retained its $0.18 quarterly dividend for 32 consecutive quarters.

VIA Renewables is a high-risk stock amongst the high-yield stocks in our database.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

This article will analyze VIA Renewables.

Business Overview

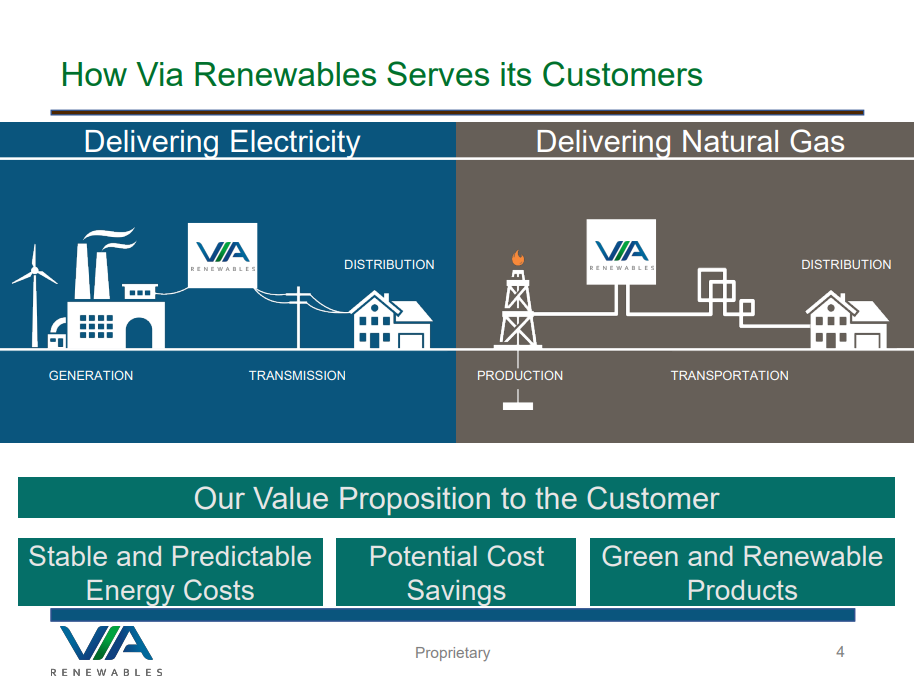

Once known as Spark Energy, Via Renewables is a small, Houston-based retail energy services company with a long-standing history dating back to 1999.

Operating across 19 states and the District of Columbia, it serves both residential and commercial customers through its unique asset-light model.

This approach enables the company to offer competitive prices as they source power and natural gas to meet the demands of their customers.

However, VIA Renewables is not your typical retail energy company as it doesn’t produce energy by itself. Instead, it manages risk and trades energy, which can result in its results being extremely volatile.

Source: Investor Presentation

Its most recent quarter wasn’t an exception to this theme, with performance reversing from a net income of $34.7 million in the prior year’s quarter to a net loss of -$4.9 million. This was due to hefty losses in its price hedges.

Accordingly, adjusted EBITDA fell -31%, as higher spending on customer acquisition and a tax benefit in last year’s period further weighed on results.

It’s worth noting that VIA Renewables has a complex and not easily understood business model. Management also does not provide any guidance.

Growth Prospects

VIA Renewables revenues peaked in 2018 when they reached $1.0 billion. The current revenue annualized run rate has declined massively to about $400 million.

Unfortunately, excluding customers gained through acquisitions (i.e., organically), the company has been losing customers for the past five years.

This is because its organic attrition rate exceeds its organic customer acquisition. Specifically, the company’s monthly attrition rate averaged 5.0% in 2019, 4.0% in 2020, and 3.3% in 2021.

In the future, VIA Renewables could post growing financials if it manages to expand its residential customer base and if it is able to accurately forecast its customers’ load needs in advance and hedge their power requirements.

Rising electricity costs could also help boost profitability.

Nevertheless, the company’s overall growth prospects are entirely speculative and almost impossible to predict accurately.

Competitive Advantages

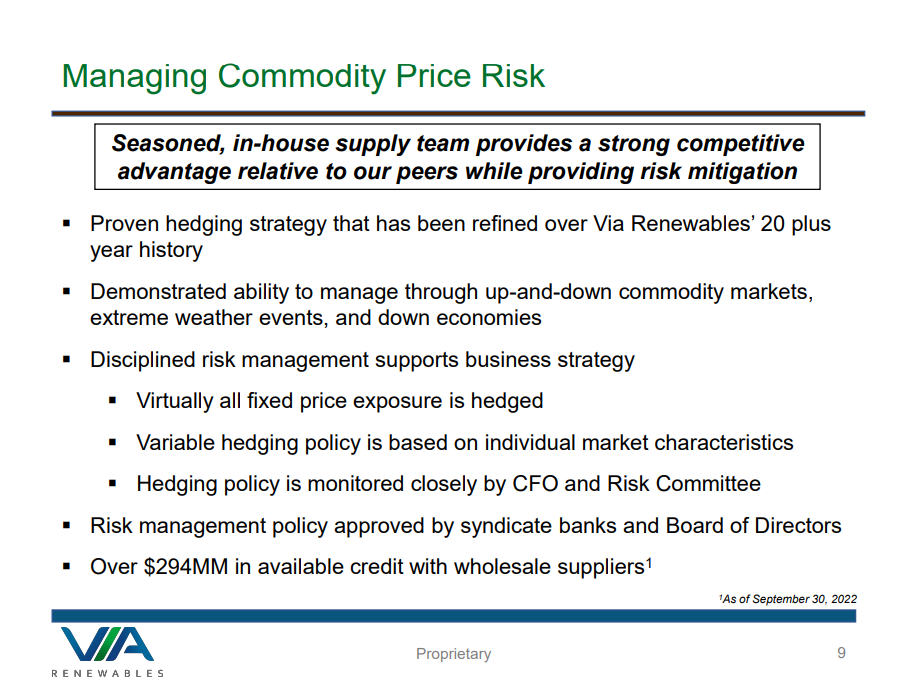

We don’t believe VIA Renewables has any noteworthy competitive advantages. The industry is highly competitive, with players such as MGE Energy (MGEE) and Otter Tail Corporation (OTTR) fighting for market share and advantageous electricity prices.

VIA Renewables’ business model bears considerable commodity price risks, which doesn’t help management execute with more control as well.

Source: Investor Presentation

It’s also worth noting that the company has cash reserves of just $40.4 million, which suggests management has little margin for error.

Fortunately, the company does not have any immediate debt to be prepared due in the next year.

However, if VIA Renewables does not resume generating positive and increasing cash flow, it may need to issue more shares or debt to raise capital. This would destroy shareholder value and apply further pressure on future results.

As a small-cap player in the space, the stock also tends to be more volatile than most large-cap stocks. It is thus likely to underperform the market during sell-off periods as a result.

Dividend Analysis

VIA Renewables has maintained the same $0.18 dividend per quarter for 32 consecutive quarters. This may give the impression to some investors that the company is stable and consistent in its performance.

Contrary to appearances, the company’s performance has been anything but stable and consistent and is expected to continue to be quite variable moving forward.

Based on its current performance, the dividends for fiscal year 2022 will just about be covered by the profits. Still, since 2018, when revenue started to decrease, the dividends have generally not been covered by the profits.

If revenues were to continue to decline, or the company doesn’t competently manage its electricity hedges, a dividend cut is quite likely. The massive 14.1% yield reflects the high probability of such a scenario.

Final Thoughts

VIA Renewables’ 14.1% dividend yield may appear attractive to some investors and the company’s long-term consistency in paying dividends may appear reassuring.

Nevertheless, we believe that the stock’s massive dividend should not be trusted. The company’s results should continue to be highly unpredictable due to the nature of its business model, which could result in multiple consecutive unprofitable years.

With a small cash position, one or more unprofitable years should be a fair basis for the company to cut its dividend.

That’s why investors require such a massive yield to be compensated for all the underlying risks attached.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].