Printed on July fifteenth, 2024 by Nathan Parsh

Excessive-yield shares pay out dividends which can be considerably greater than market common dividends. For instance, the S&P 500’s present yield is barely ~1.3%.

Excessive-yield shares might be very useful to shore up earnings after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

We’ve created a spreadsheet of shares (and carefully associated REITs and MLPs, and many others.) with dividend yields of 5% or extra.

You possibly can obtain your free full record of all securities with 5%+ yields (together with essential monetary metrics comparable to dividend yield and payout ratio) by clicking on the hyperlink under:

Truist Monetary Company (TFC) is a part of our ‘Excessive Dividend 50’ sequence, the place we analyze the 50 highest yielding shares within the Positive Evaluation Analysis Database.

This text will look at the corporate to see if Truist Monetary is worthy of funding.

Enterprise Overview

Truist is a holding firm within the U.S. that resulted from a merger of equals between BB&T and SunTrust Financial institution in late 2019.

Truist provides a large rage of monetary providers, together with retail and business banking, investments, wealth administration, asset administration, mortgage, company banking, capital markets, and specialised lending. The corporate is valued at $54 billion.

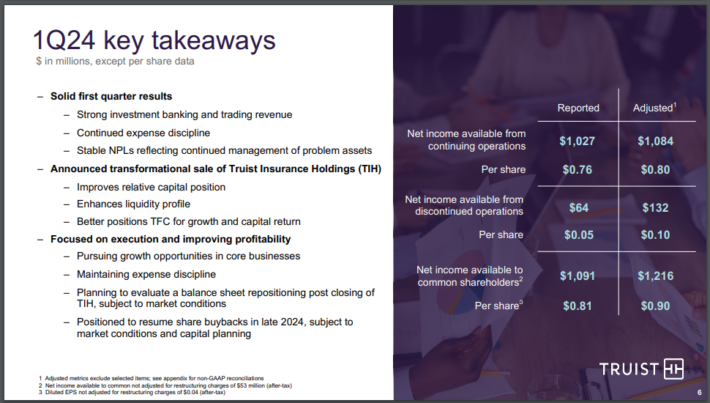

Truist reported first quarter outcomes on April twenty second, 2024.

Supply: Investor Relations

The corporate’s adjusted web earnings totaled $1.22 billion, or $0.90 per share, which in contrast unfavorably to adjusted web earnings of $1.4 billion, or $1.05 per share, within the prior 12 months.

Common property declined $29 billion, or 5.2%, to $531 billion year-over-year whereas common loans and leases had been down $19 billion, or 5.8%, to $3.09 billion. Deposits had been decrease by 5% to $389 billion.

Internet curiosity earnings of $3.425 billion, which was down from $3.918 billion within the prior 12 months. Because of this, the web curiosity margin contracted 28 foundation factors to 2.89%. This was the results of increased deposit prices coinciding with a decline in incomes property.

Truist recorded a $500 million provision for credit score losses, down barely from $502 million within the prior 12 months. As well as, web charge-offs totaled $490 million, or 0.64%, of common loans and leases, which was up from $297 million, or 0.37%, within the first quarter of 2023.

Truist is predicted to earn $3.37 per share in 2024, which might be a 6.1% lower from the prior 12 months. We anticipate that the corporate will develop earnings-per-share by 9% yearly over the subsequent 5 years.

Progress Prospects

Truist has struggled to supply progress in recent times. The financial institution’s earnings-per-share have compounded at a charge of three% over the past decade.

Nevertheless, earnings-per-share have declined by nearly 2% yearly over the past 5 years.

Truist does have some methods to enhance its bottom-line. This contains natural progress by way of business and retail mortgage progress.

Common loans did lower nearly 6% in the newest quarter on a year-over-year foundation, however had been down simply 1.3% on a sequential foundation, so the tempo of the declines has stabilized.

Additionally hindering outcomes has the been the elevated price of deposits given the excessive rate of interest surroundings that presently exists. This has weighed on web curiosity earnings as seen by the current declines.

Curiosity bills have surged, together with a 65% improve within the first quarter because it turns into extra pricey for banks to supply increased rates of interest on deposits.

There are some areas that Truist can leverage to enhance its enterprise efficiency.

The corporate has made investments to enhance its digital capabilities. This has paid off considerably in a really brief time period.

Supply: Investor Relations

Clients throughout the banking trade are shifting in direction of using digital entry to finish a lot of their banking duties. First quarter digital transactions of 76 million represented a 13% improve from similar interval in 2023. Greater than three-quarters of deposit befell in self-service channels, a rise of 5 proportion factors over the previous 5 quarters.

The adoption of Zelle, a number one peer-to-peer cost service, has been particularly sturdy, with transactions up greater than 40% in the newest quarter.

Truist can also be taking steps to concentrate on its core enterprise by eliminating these not key to the corporate’s future. This contains the sale of its remaining stake in Truist Insurance coverage Holdings for $10.1 billion.

Moreover, Truist made the strategic resolution to promote almost $28 billion of its lower-yielding investments at an after-tax lack of $5.1 billion. The corporate then invested near $19 billion in shorter period investments that yield nearly 5.3%.

Aggressive Benefits & Recession Efficiency

Previous to merging, BB&T and SunTrust had been regional banks that lacked the dimensions and scale of the bigger names within the trade.

That modified following the tie up as Truist is now a top-10 financial institution business financial institution within the U.S. that instructions a bigger market share of high-growth areas across the nation.

This could assist the financial institution through the subsequent recessionary interval, one thing each banks struggled with through the Nice Recession:

BB&T’s efficiency through the 2007 to 2009 interval:

- 2007 earnings-per-share: $3.14

- 2008 earnings-per-share: $2.71 (14% decline)

- 2009 earnings-per-share: $1.15 (58% decline)

SunTrust’s efficiency through the 2007 to 2009 interval:

- 2007 earnings-per-share: $4.56

- 2008 earnings-per-share: $2.12 (54% decline)

- 2009 earnings-per-share: -$3.98 (288% decline)

Each firms noticed their earnings-per-share decline drastically throughout this era, with SunTrust performing a lot worse.

That mentioned, the mixed entities held up significantly better through the Covid-19 pandemic. Earnings-per-share did fall 13% in 2020, however rebounded to make a brand new excessive the very subsequent 12 months.

Given the corporate’s efficiency throughout financial downturns, it’s possible {that a} lower in profitability would happen within the subsequent recession.

Dividend Evaluation

Whereas the corporate’s long-term outcomes and recession efficiency have been underwhelming, Truist’s dividend progress has been fairly sturdy. During the last decade, the dividend has a CAGR of simply over 9% over the past decade.

It needs to be famous that Truist has maintained the identical quarterly cost for 8 consecutive quarters. If the corporate doesn’t improve its dividend this calendar 12 months then Truist’s 12 12 months dividend progress streak will finish.

Shares yield 5.1%, which is among the many highest yields that the inventory has provided within the final 10 years.

Usually, an unusually excessive yield coupled with a stagnant distribution may foretell that the dividend could possibly be in danger for being lower and even eradicated.

Whereas we don’t consider {that a} dividend lower is imminent, there may be the probability that dividend progress will stay muted within the near-term.

The corporate ought to distribute a minimum of $2.08 per share in 2024, leading to a payout ratio of 62%. Apart from final 12 months, the traditional payout vary has been 35% to 45% since 2014.

With firm’s payout ratio effectively exterior of its regular vary, shareholders mustn’t anticipate to see a lot in the way in which of dividend progress.

That mentioned, if our projected earnings progress materializes then the payout ratio may turn out to be way more affordable, resulting in the potential of future will increase.

Remaining Ideas

Truist has remodeled from two regional banks to one of many bigger business banks within the nation. Progress has been sporadic over the long-term and the recession efficiency leaves a lot to be desired.

Accompanying the slowdown in earnings has been a dividend pause. The heightened payout ratio and dividend yield implies the potential for a discount in shareholder funds, although we consider {that a} pause is the most certainly consequence.

Traders on the lookout for dividends from the banking trade may discover the yield engaging, however we warning that these on the lookout for dividend progress could possibly be upset by the title.

These on the lookout for earnings progress and earnings may do effectively proudly owning shares of the corporate.

If you’re focused on discovering high-quality dividend progress shares and/or different high-yield securities and earnings securities, the next Positive Dividend sources will likely be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].