Published on January 9th, 2023 by Quinn Mohammed

TELUS Corporation is one of the few companies publicly disclosing their annual dividend growth targets. The company has increased its dividend for nineteen years in its native currency and now has a high yield of 5.2%.

Telecommunications companies benefit from strong barriers to entry in their industry, which protects the current oligopoly shared among the Big Three Canadian telecoms.

As a result, TELUS can generate strong free cash flows from which it can pay and continuously increase its dividends. Income-oriented investors may be interested in TELUS and will find telecom companies generally offer high dividend yields.

We have created a spreadsheet of high dividend stocks with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

This article will analyze the Canadian telecom giant TELUS Corporation (TU).

Business Overview

TELUS Corporation is one of the ‘big three’ Canadian telecommunications companies, along with BCE, Inc. (BCE) and Rogers Communications (RCI).

The company provides a full range of communication products and services in wireline and wireless. TELUS reports revenues in two segments: TELUS technology solutions and Digitally-led customer experiences – TELUS International.

TELUS technology solutions include the company’s mobile and fixed products and services, health services through TELUS Health, and agriculture and consumer goods services.

Digitally-led customer experiences include the company’s majority stake in TELUS International, providing artificial intelligence and content management solutions. TELUS International operates in 28 countries across the globe.

TELUS produces about $17 billion in annual revenue and possesses roughly 17 million customer connections across all of its services.

Shares are listed on the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX), where TELUS trades under the tickers TU and T, respectively.

On November 4th, 2022, TELUS reported third-quarter financial results. The company saw consolidated operating revenues grow 10% year-over-year to C$4.7 billion. Adjusted EBITDA grew similarly by 11% to C$1.7 billion. The company also posted impressive adjusted earnings per share growth of 17% over the prior year to C$0.34.

Additionally, TELUS saw total mobile and fixed customer growth of 347,000, a quarterly record, and mobile net additions of 150,000, the highest since 2010.

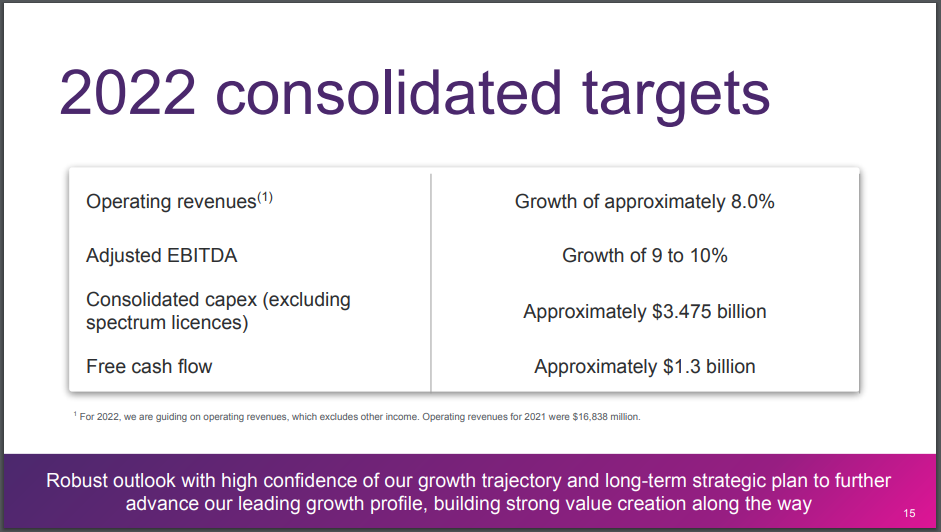

Source: Investor Presentation

Management updated its guidance for 2022 from 8% to 10% revenue growth to just 8% revenue growth. Adjusted EBITDA growth in 2022 is expected to be 9% to 10%, up from 8% to 10% previously. Capital expenditures and free cash flow guidance were also raised to roughly C$3.475 billion and C$1.3 billion, respectively.

Growth Prospects

TELUS will benefit from growing its subscriber base in wireless and wireline, as well as in its health services, agriculture, and consumer goods businesses.

The company has benefited from being the telecom company with the fewest complaints across the national carriers, as customers are satisfied with TELUS’ service. This is not new, as TELUS has boasted this top position for the last eleven consecutive years.

Furthermore, the company will benefit from its numerous significant capital investments over prior years. Beginning in 2023, TELUS expects a reduction in these costs, leading to free cash flow growth.

TELUS is also very active in growing by acquisition. The company acquired LifeWorks on September 1st, 2022, for $2.3 billion. This acquisition expanded TELUS Health’s coverage to over 160 countries and 50 million individuals internationally. This acquisition is paying off, with Health services revenues rising by 73% in the third quarter of 2022 compared to a year ago.

And to kick off the new year, TELUS and TELUS International acquired WillowTree on January 4th, 2023. WillowTree employs over 1,000 digital strategists, designers, engineers, and project managers who have shipped more than 700 mobile applications, websites, and other digital products for its clients. These clients included FOX, CBC, PepsiCo, Anheuser-Busch InBev, Manulife, and others. This represented the company’s tenth acquisition since 2005.

Based on the low comparison base for 2022 EPS, we expect TELUS to deliver 8.0% annual EPS growth over the next five years. Results will likely fluctuate widely, though, as a result of currency effects.

Competitive Advantages & Recession Performance

TELUS Corporation is one of the Big Three Canadian telecoms; as such, it operates in a protected oligopoly. The Canadian telecom industry possesses massive barriers to entry, and significant regulation, which new entrants would find extremely difficult or near impossible to enter today, as things are.

The company offers essential products and services which are necessary in today’s world. TELUS’ wireless and wireline services and its health services are essential to clients year-round.

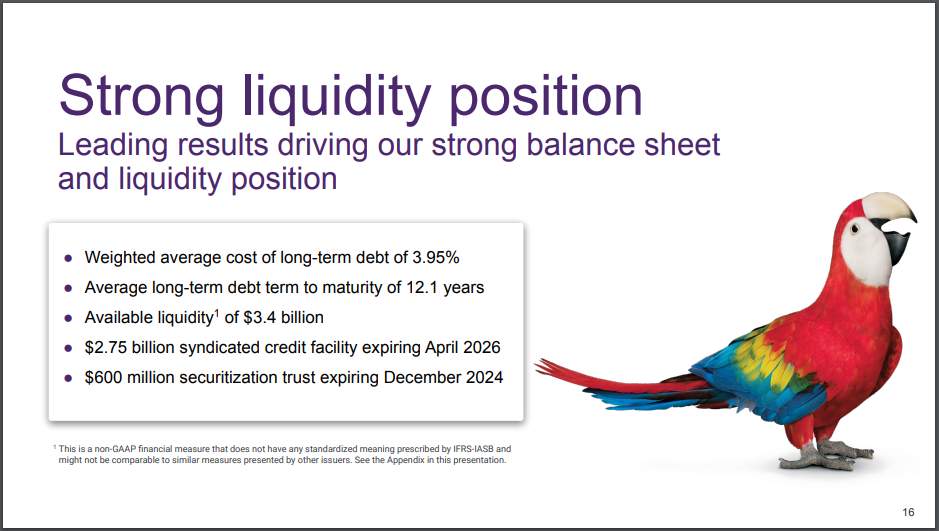

Source: Investor Presentation

At the end of the third quarter, TELUS had C$3.4 billion of available liquidity. The company also held $25.1 billion in long-term debt, with a weighted average cost of 3.95%.

Dividend Analysis

TELUS Corporation pays a C$1.40 annual dividend. The company last increased its dividend in November 2022, representing a 7.2% year-over-year increase. The company has raised its dividend for nineteen consecutive years.

At the current share price, TU has a high dividend yield of 5.2%, which is 90 basis points above its ten-year average yield of 4.3%.

Based on our EPS estimate of US$1.00 for 2022, the company is forecasted to pay out about 105% of earnings in dividends. This is a risky payout ratio, which indicates that the dividend could be in danger.

On the other hand, telecommunications companies often make massive capital investments and experience depreciation and amortization for their aging infrastructure, which impacts the company’s posted earnings. Due to this, the dividend may appear more manageable when compared to free cash flow.

Free cash flow in 2022 is still heavily impacted by capital investments, but this should be tapering off going into 2023 as the company is nearly completed its accelerated broadband build.

We currently anticipate relatively strong earnings growth from this low comparison base and coupled with a conservative dividend growth rate of 3% over the next five years, the payout ratio should moderate a fair bit.

Source: Investor Presentation

TELUS has been a company that has been vocal about its dividend growth prospects, as it has publicized its target dividend growth rate a majority of the time. While TELUS targets 7% to 10% annual dividend growth through 2025, currency fluctuations will likely impact the final dividend paid in US$.

The company has long focused on returning capital to shareholders, so the dividend will likely continue to grow for years to come. TELUS has increased the dividend 23 times in the last 11 years and paid $17 billion in dividends since 2004.

Final Thoughts

TELUS has diversified the company in a different way compared to the other Big Three Canadian telecom. While the company’s health services, agriculture, and consumer goods services still make up only a small part of overall revenue, they are growing rapidly.

The company expects strong growth in free cash flow to commence in 2023 due to growth in its business lines and a large decrease in capital expenditures. The company’s strong cash flow has enabled it to grow its dividend for nineteen years in its native Canadian dollar.

As a result of many dividend increases over the last near-twenty years, TELUS now boasts a high dividend yield of 5.2%. While the dividend is above its historic average, and the company appears to have a strong runway of growth ahead of it, shares are still trading at somewhat frothy valuations.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].