Published on January 8th, 2023 by Josh Arnold

Utility stocks tend to be great sources of dividends for shareholders. Their predictable revenue and margins generally produce stable earnings over time, irrespective of economic conditions, and capital expenditure needs are often met several times over by earnings. That leaves ample room for high dividend yields, and one such stock that meets these criteria is lesser-known mobile phone service provider Telephone & Data Systems (TDS).

TDS has boosted its dividend for a staggering 48 consecutive years, putting it in elite company on the measure of dividend longevity. In addition, the stock is down more than 40% in the past year, so its current dividend yield is better than 6%. That means TDS is on our list of high-yield stocks.

This list contains about 200 stocks with yields of at least 5%, meaning that they all yield at least three times that of the S&P 500.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Below, we’ll take a look at one of the smaller wireless and broadband providers, including its growth prospects and dividend outlook.

Business Overview

TDS is a telecommunications company that is based and operates in the US. It operates two segments: UScellular and TDS Telecom. The company offers a wide variety of wireless solutions to consumers, businesses, and government clients, including software, automation, communication, fleet management, private networks, wireless services, hardware, and more. The company has about 5 million wireless retail connections through its UScellular business, and about 1.2 million wireline and cable connections.

TDS was founded in 1968, generates about $5.5 billion in yearly revenue, and trades with a market cap of $1.3 billion. For comparison, both AT&T (T) and Verizon (VZ), which operates similar businesses, both trade with market caps of at least $140 billion, so TDS is quite small.

TDS posted third quarter earnings on November 3rd, and results were very weak. Earnings-per-share missed estimates badly, coming in at a loss of 15 cents against expectations of a profit of a nickel. Revenue was up almost 7% year-over-year to $1.08 billion, but missed estimates by $270 million.

Total operating expenses weighed on profitability, rising 5% year-over-year to $1.392 billion. Earnings fell from a profit of $28 million a year ago to a loss of $25 million as expenses exceeded revenue.

Higher postpaid average revenue per user at UScellular drove service revenue growth as customers traded up to higher-priced plans. Postpaid average revenue per user was up 4% to just over $50. Total broadband connections were up 4% to 506,500, and residential revenue per connection grew 4.5% to just over $60. The company is investing in fiber infrastructure to help grow the broadband business in the years to come.

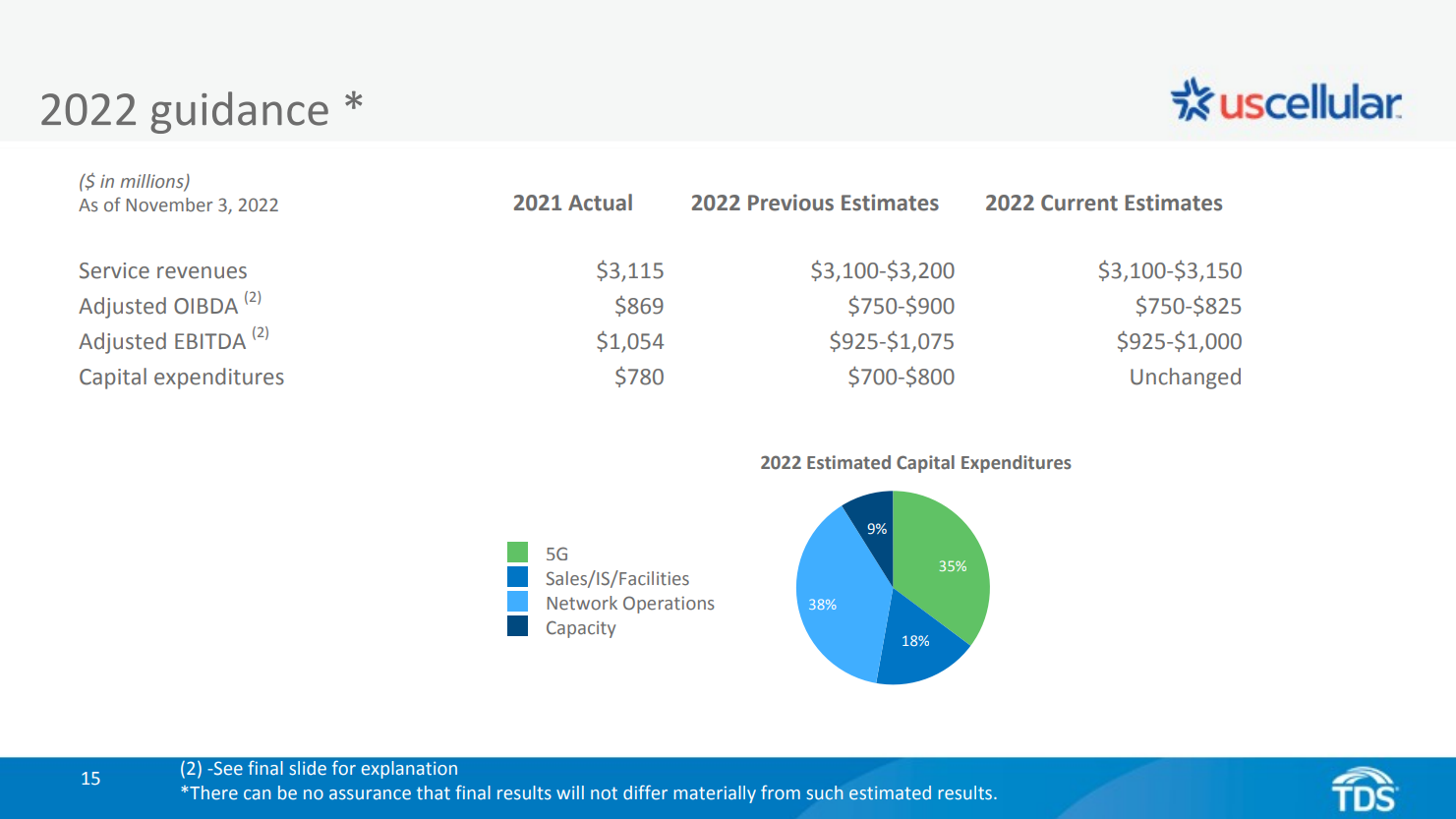

Source: Investor presentation, page 15

The company reduced guidance for the full year, with service revenue estimates being narrowed to a slightly lower midpoint of $3.125 billion, and adjusted profits coming down more sharply due to deleveraging of the top line. Capital expenditures are now expected to be nearly all of the company’s adjusted EBITDA for 2022. Following a weak third quarter report, we expect earnings to be just three cents per share for fiscal 2022.

Growth Prospects

TDS operates a very low-growth business, as it is a very small player in a highly competitive industry that is dominated by Verizon and AT&T. That has led to repeated years of negative earnings growth, such as 2022, and we think the company will struggle to grow in the years to come at just 0.5% annually. TDS’ strategy is highly dependent upon the UScellular business, and to its credit, the number of users and the average revenue per user are gradually drifting higher.

However, soaring operating expenses are taking some of that advantage away over time, as we saw with Q3 2022 results. In addition to that, the company is trying to build out its offerings in broadband service through its fiber infrastructure, which helps deliver faster and more reliable internet to residences in its service area.

Source: Investor presentation, page 11

We can see that operating revenue has been roughly flat for some time, and we expect it will remain as such for the foreseeable future. The company’s retail service revenue is the most profitable, so while the top line can show growth, investors must keep an eye on where it’s coming from.

Equipment sales, for instance, can see peaks around new product launches, but that revenue is lower-margin and tends to be more volatile than service revenue. While TDS is trying to invest for growth, we believe the company is facing an uphill battle when it comes to growing earnings in the years to come.

Competitive Advantages

TDS’ competitive advantage, if it has one, is that it has a captive audience of sorts in its service areas. Broadband operators tend to have service areas analogous to power utilities in that choice for consumers is usually limited. That can help protect TDS’ internet-based revenue over time, but we see less of a value proposition for consumers on wireless revenue.

Consumers have much more choice when it comes to wireless revenue, and while TDS hasn’t faced a user exodus, growth is low and we attribute that to the intense competition in the wireless service space. The fact is that Verizon and AT&T have scale advantages that TDS does not, and we think that its competitive position is potentially at risk as a result.

To its credit, TDS has weathered recession after recession in the past five decades, raising its dividend through all of them. Thus, even if we get a recession in 2023, we don’t think that alone would put the dividend at risk as the company’s revenue and earnings aren’t necessarily beholden to economic conditions. Rather, TDS is more susceptible to other factors, as discussed above.

Dividend Analysis

TDS’ dividend streak is outstanding by any measure, but we believe that the dividend is under more threat of being cut than it has been at perhaps any other time in the past 48 years. The company is slated to produce essentially no earnings for 2022, which means the entirety of the 72 cents per share in common share dividends must be paid from sources other than earnings. That’s a completely unsustainable situation, although we do see earnings rebounding in five years’ time to 95 cents per share annually.

We also see the dividend around 83 cents per share in five years, so it will remain tight in terms of the payout ratio for TDS. In other words, we aren’t necessarily sure TDS will be able to continue its dividend increase streak indefinitely given its weak earnings situation.

Final Thoughts

While we like TDS’ impressive streak of dividend increases, as well as its ample 6.1% current yield, we have concerns about its ability to continue to pay the dividend, let alone raise it, in the years to come. The company will need a sharp rebound in earnings to make that happen, and we are cautious as a result.

The stock is down over 40% in the past year, and the yield is extremely high as a result, but TDS is too speculative at the moment, in our view, to warrant it as a good choice for those seeking dividend safety.

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].