Updated on January 18th, 2023 by Felix Martinez

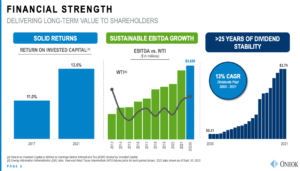

After a strong 18-year streak of dividend increases, ONEOK paid the same dividend in 2022 as it did in 2020 and 2021. This marks the end of its dividend increase streak, but the company has not cut its dividend in the last 25 years. However, the company just announced a 2.1% increase in its dividend.

And its high dividend yield of 5.3% is still attractive.

This high dividend yield is even more attractive given the recent spike in inflation. At times like this, high-yield stocks can help soften the inflation blow.

We have created a spreadsheet of high dividend stocks with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

This article will analyze the leading oil & gas midstream company ONEOK Inc. (OKE).

Business Overview

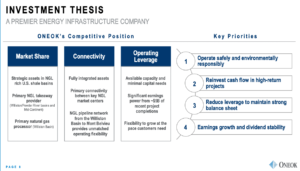

ONEOK is a midstream service provider and owner of significant natural gas liquids systems. The company is headquartered in Tulsa, Oklahoma, and was founded in 1906. The company has three major business segments.

First, the natural gas liquids segment links key NGL market centers through its gathering, fractionation, transportation, marketing, and storage services.

Second, the Natural Gas Gathering and Processing segment gathers, compresses, treats, and processes services for producers.

And lastly, the Natural Gas Pipelines segment provides transportation and storage services and direct connectivity to end-use markets.

Source: Investor Presentation

Most of the company’s earnings are generated from fee-based contracts, which have served the company well in the last few decades. This security in earnings has allowed the company to increase the dividend for eighteen consecutive years leading up to 2021.

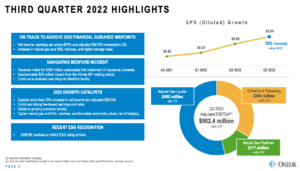

ONEOK reported Q3 and FY 2022 results on November 1st. The company reported revenues of $5.9 billion in 2022, which was 30.4% more than the revenues that ONEOK generated in 2021. This year-over-year revenue increase can be explained by commodity price movements, as natural gas and natural gas liquids moved significantly across the period.

However, the company’s bottom line could not fully capitalize on the significant commodity-related revenue increase due to the rise in input costs.

Leadership is forecasting a 10% EBITDA increase for 2023 compared to 2022, which could equal cash flow per share of roughly $7.27.

Growth Prospects

ONEOK struggled to grow earnings-per-share between 2010 and 2016. In 2018, the company grew strongly, primarily due to the roll-up of ONEOK’s Master Limited Partnership (MLP).

The company had a hiccup in 2020 as results were down year-over-year, but 2021 and 2022 saw significant growth, and we expected further growth in 2023. Despite fluctuating results, the company has been able to cover its dividend with distributable cash flow since 2017.

Source: Investor Presentation

The company’s cash flows are secure, and in 2023, the company expects 90% of earnings in the natural gas liquids segment to be fee-based exchange services.

It also expects 80% or more of the natural gas gathering and processing segment to be fee-based, with the other 20% of earnings to be commodity-based. Finally, natural gas pipelines are anticipated to generate more than 95% of earnings from fee-based contracts.

Leadership is guiding for the company to generate greater than 5% compound annual growth in EPS between 2022 and 2024.

In 2022, ONEOK counted on higher natural gas and NGL volumes in the Higher Rocky Mountain region. Additionally, higher NGL volumes for the Permian/Gulf Coast and rising gas-to-oil ratios in the Williston Basin. Projects completed in 2021 will also contribute a full year of operations to results in 2022.

Competitive Advantages & Recession Performance

Before 2017, there were multiple instances where ONEOK paid out more than the company earned. However, following 2017, the company has held a relatively safe payout ratio in the mid-70%. However, in 2020 it was nearly 90%. Based on our current estimated distributable cash flow per share of $5.50 in 2022, the company sports a solid 68% payout ratio, especially given the majority of its operations are fee-based contracts.

Due to the fee-based contracts, this earnings safety makes the company less sensitive to commodity price swings. This protection is a large part of why ONEOK can operate with significant leverage and not be considered dangerous since its cash flows are not very volatile, despite being somewhat impacted by the volumes they transport.

The company’s fee-based nature of its revenues and the non-cyclical demand for natural gas (such as for heating) has afforded ONEOK a degree of recession resilience in the past.

ONEOK has an investment-grade credit rating of BBB-/Baa3. The company has not cut its dividend in the last twenty-five years and more.

Dividend Analysis

ONEOK pays a $3.82 annual dividend. At the current share price, OKE is yielding 5.3%. This current yield is higher than the decade average of 5.3%.

Given expectations for $5.50 in distributable cash flow per share and the annual dividend of $3.74, the company is forecasted to pay out 68% of distributable cash flow in the form of dividends.

We anticipate a small growth rate in DCF per share will moderate the payout ratio in the medium term. We also expect the company to continue growing the dividend at some point in the next five years. While a dividend cut is not anticipated, it’s not out of the cards for ONEOK, as management may decide to focus on improving the balance sheet in the near term.

The company’s history is favorable to dividend growth, as they had grown the dividend for 18 consecutive years leading up to 2021. This marked the end of its dividend increase streak, but the company has not cut its dividend in the last 25 years. Its high dividend yield of 5.8% is attractive.

Source: Investor Presentation

Final Thoughts

ONEOK’s high dividend yield of 5.8% is slightly above its historical average of 5.3%. This strong dividend yield is secured by a majority of the company’s earnings coming from fee-based contracts.

The dividend payout ratio looks relatively healthy today, but the company chose not to raise the dividend in 2021 or in 2022. This stagnant year-over-year dividend eliminates the company’s 18-year consecutive dividend growth streak. However, as mentioned at the beginning of the article, the company recently announced a 2.1% dividend increase.

While shares are currently trading just above our estimated fair value, we find the dividend to be secure at this time. Given the company’s history of increasing dividends, we anticipate that they will pick this up again in the medium term.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].