Revealed on July sixteenth, 2024 by Nathan Parsh

Excessive-yield shares pay out dividends which might be considerably greater than market common dividends. For instance, the S&P 500’s present yield is barely ~1.3%.

Excessive-yield shares will be very useful to shore up revenue after retirement. A $120,000 funding in shares with a mean dividend yield of 5% creates a mean of $500 a month in dividends.

Not all high-dividend shares are created equal. Some have safe dividend payouts whereas others are in questionable monetary situation, leaving shareholders susceptible to a dividend minimize in a downturn.

With this in thoughts, we created a full checklist of high-dividend shares.

You possibly can obtain your free full checklist of all excessive dividend shares with 5%+ yields (together with necessary monetary metrics equivalent to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Discovering shares paying excessive yields is less complicated to do in sure areas of the economic system than others. Utilities are one such sector as these shares typically payout out very beneficiant yields, making them enticing funding choices for these on the lookout for revenue.

NorthWestern Power Group Inc. (NWE) is at present yielding simply over 5%, which is among the inventory’s highest yields within the final 10 years, and has raised its dividend for practically twenty years.

NorthWestern is a part of our ‘Excessive Dividend 50’ collection, the place we cowl the 50 highest yielding shares within the Certain Evaluation Analysis Database. This text will look at the corporate and inventory as a possible funding.

Enterprise Overview

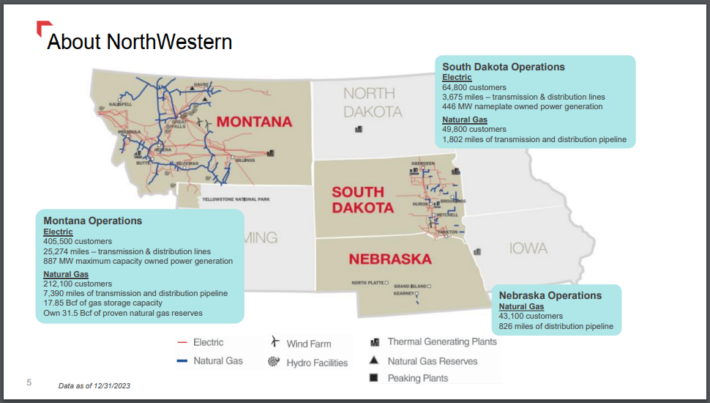

Primarily based in Sioux Falls, South Dakota, NorthWestern is an electrical energy and fuel utility that gives companies primarily to Montana and South Dakota. The corporate additionally supplies pure fuel to prospects in Nebraska.

NorthWestern is valued at simply over $3 billion right this moment.

Supply: Investor Relations

NorthWestern has greater than 470,000 electrical prospects and practically 29,000 miles of transmission and distribution traces. The corporate additionally has 305,000 pure fuel prospects and greater than 10,000 miles of pipelines.

NorthWestern reported first quarter earnings outcomes on April twenty fifth, 2024.

The corporate’s quarterly efficiency was combined. Income grew 4.6% to $475.3 million and was barely forward of what the market had anticipated. Adjusted earnings-per-share of $1.09 was decrease than final yr’s $1.13 and was $0.07 beneath estimates.

Charge bases will increase in Montana and South Dakota and positive factors from electrical transmission income aided outcomes in the course of the interval. Nevertheless, retail volumes for electrical and pure fuel had been down resulting from unfavorable climate in Montana and South Dakota. Increased bills additionally impacted outcomes.

NorthWestern reaffirmed steerage. Adjusted earnings-per-share are projected to be in a spread of $3.42 to $3.62, representing 9.3% development from 2023 on the midpoint.

Progress Prospects

NorthWestern has struggled to supply development over the long-term. Earnings-per-share had a compound annual development price of simply 0.8% yearly for the 2014 to 2023 interval.

Regardless of the weak historic monitor file, administration has guided in direction of earnings-per-share development of 4% to six% over the following 5 years off of the $3.22 that the corporate earned in 2022.

There are a number of causes that development is projected to be significantly increased going ahead than it was over the past decade.

First, price base will increase ought to play a significant function in future outcomes. The corporate has already seen the good thing about price will increase in its two major areas of operation. These occurred as a result of funding that it made in its infrastructure.

NorthWestern has a five-year capital funding plan of $2.5 billion. The corporate doesn’t count on to should situation shares to fund the funding plan, as a substitute utilizing money from operations and secured debt. This can be a departure from the previous.

Subsequent, the corporate’s major areas of operation are small population-wise, however they mission to have a better development price than the nationwide common over the following 5 years.

Supply: Investor Relations

All three states that the corporate operates are forecasted to develop above the nationwide common via the top of the last decade. Montana, crucial state for the corporate, ought to see nearly double the typical inhabitants development for the nation.

This can supply NorthWestern the chance to accumulate extra prospects, one thing it has been extra profitable at than most utilities. Moreover, the corporate’s buyer base has an unemployment price beneath that of the nation as a complete, which means that utility payments are prone to be paid.

Lastly, NorthWestern has dramatically modified its vitality technology fleet. Whereas the corporate had lengthy relied on coal for almost all of its energy manufacturing, that has now shifted to renewable vitality. Roughly 55% of whole mixed energy technology comes from wind, photo voltaic, and hydroelectric sources.

One space of concern is the corporate’s web debt on its steadiness sheet, which totaled $2.76 billion as of the latest quarter. Contemplating the market capitalization of the corporate, it is a appreciable quantity of debt.

Increased rates of interest additionally imply that servicing that debt has grow to be costlier. NorthWestern has acknowledged that its accomplished its debt financing wanted for 2024, so the entire ought to be secure for the rest of the yr.

Regardless of this, we imagine that the corporate’s tailwinds ought to allow NorthWestern to develop its earnings-per-share at 6% per yr via 2029, which is the high-end of the corporate’s projection vary.

Aggressive Benefits & Recession Efficiency

Utility corporations typically act as close to monopolies within the areas that they function. Coupled with the flexibility to recoup funding capital via price base will increase, these corporations sometimes produce regular earnings development.

As seen above, this has not all the time been the case for NorthWestern, although the corporate does have a number of constructive components working in its favor that would imply strong positive factors within the coming years.

NorthWestern has confirmed to carry out fairly properly beneath antagonistic financial situations. The corporate produced robust outcomes over the past main financial downturn, the Nice Recession of 2007 to 2009.

- 2007 earnings-per-share: $1.45

- 2008 earnings-per-share: $1.78 (23% improve)

- 2009 earnings-per-share: $2.03 (14% improve)

NorthWestern had double-digit earnings development each years in the course of the worst of this era. The corporate did see earnings decline greater than 13% in 2020 in the course of the worst of the Covid-19 pandemic, however outcomes rapidly rebounded to determine a brand new excessive for earnings-per-share the very subsequent yr.

The corporate’s outcomes throughout this troublesome intervals speaks to the general power of its enterprise and the continued demand for companies.

Dividend Evaluation

NorthWestern’s earnings development has been lackluster prior to now, however the dividend has grown at nearly 5% yearly because the finish of the Nice Recession.

Supply: Investor Relations

The corporate’s dividend development streak is nineteen years, although the scale of the annual elevate has slowed lately as earnings development has stagnated. For instance, traders obtained only a 1.6% improve earlier this yr.

Smaller dividend raises are prone to be the case till the payout ratio returns to NorthWestern’s focused vary of 60% to 70%. For context, the corporate’s anticipated payout ratio if 74% for 2024, so we mission that earnings development will outpace dividend development within the near-term.

Offsetting this weak development price is the inventory’s present yield of 5.1%. NorthWestern’s common dividend yield since 2014 has been the in low 3.0% to low 4.0% vary, so right this moment’s yield is significantly increased than traditional.

We discover that the dividend is probably going secure as the corporate has guided in direction of mid-single-digit earnings development shifting ahead and the payout ratio is edging nearer to the focused vary.

Remaining Ideas

Utility corporations are sometimes owned for his or her regular development and beneficiant yields. Earnings haven’t moved all that a lot over the long-term, however NorthWestern has a number of levers it could pull to generate development above what it has traditionally produced.

NorthWestern additionally yields near 4 instances the typical yield of the S&P 500 Index and has a dividend that we imagine is secure. Subsequently, we price shares of the corporate as a purchase for revenue traders on the lookout for publicity from the utility sector.

In case you are interested by discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Certain Dividend assets can be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].