Revealed on July nineteenth, 2024 by Bob Ciura

Many excessive dividend shares may be discovered throughout the utility sector. Utilities usually generate regular earnings, even throughout recessions, which permits them to pay constant dividends annually.

Northwest Pure Fuel (NWN) is a utility inventory with a excessive dividend yield of 4.9%.

Consequently, it’s a part of our ‘Excessive Dividend 50’ sequence, the place we cowl the 50 highest yielding shares within the Certain Evaluation Analysis Database.

You may obtain your free full checklist of all excessive dividend shares with 5%+ yields (together with vital monetary metrics comparable to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Not solely that, NWN has elevated its dividend for 68 consecutive years, giving it one of many longest dividend streaks within the inventory market.

This text will analyze the prospects of NWN in larger element.

Enterprise Overview

NW Pure was based in 1859 and has grown from a small utility to a big publicly traded utility in the present day. The utility’s mission is to ship pure gasoline to its prospects within the Pacific Northwest.

The corporate serves almost 3 million folks via its pure gasoline, water, and renewable vitality companies.

NWN inventory trades with a market capitalization of $1.5 billion.

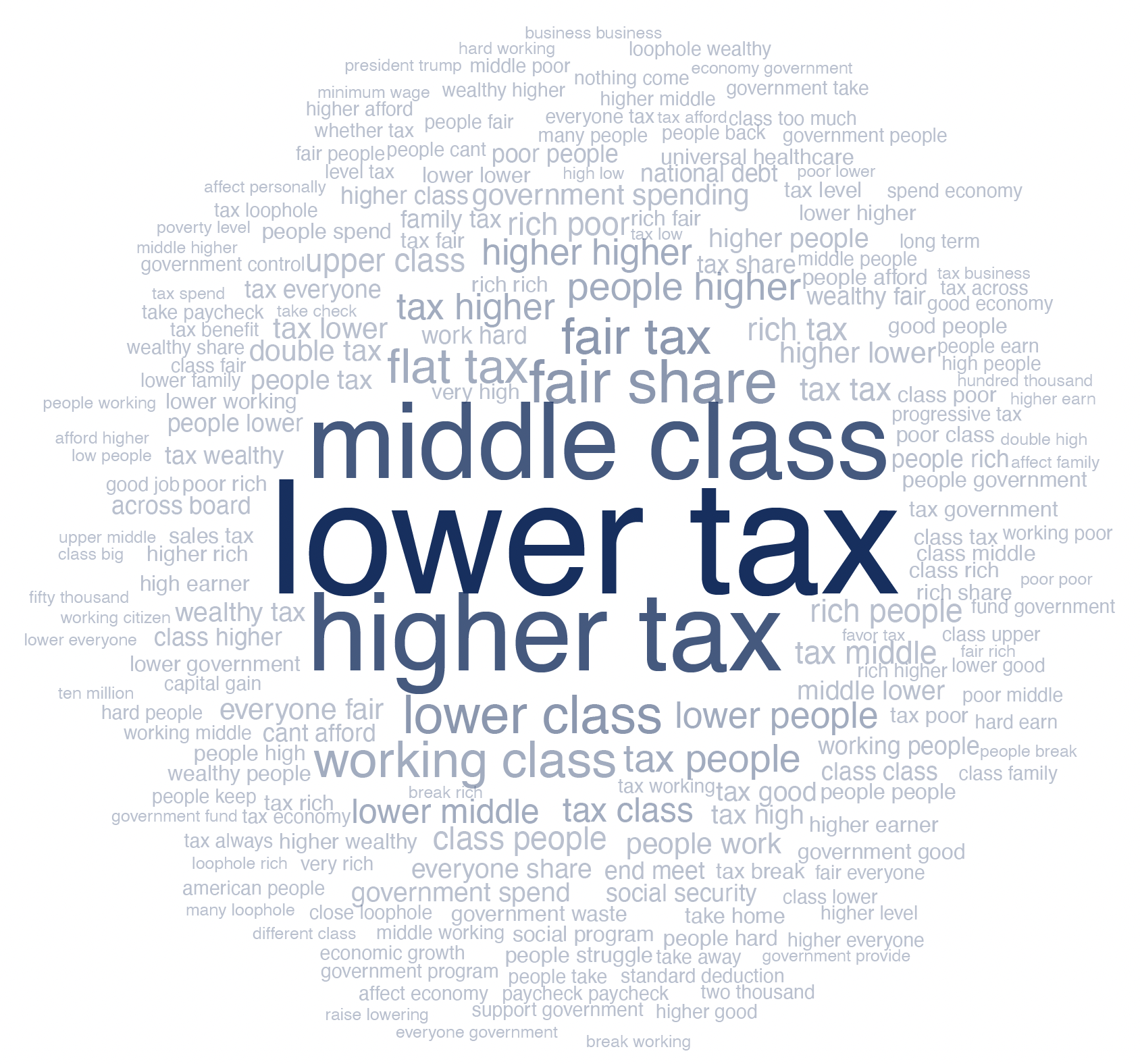

Supply: Investor Presentation

Northwest Pure Holding reported its monetary outcomes for the primary quarter of 2024, with internet earnings reaching $63.8 million ($1.69 per share), a lower from $71.7 million ($2.01 per share) in the identical interval of 2023.

Regardless of this decline, the corporate noticed notable achievements, together with including almost 15,000 gasoline and water utility connections within the final 12 months, pushed primarily by strong water acquisitions, and offering invoice credit totaling almost $30 million to Oregon gasoline prospects in early 2024.

The corporate additionally skilled a big demand for its gasoline system throughout the winter storm in January, setting a brand new peak day file for therms delivered.

Progress Prospects

We’re forecasting a median earnings-per-share development charge of seven.5% for the subsequent 5 years as NW Pure pushes via authorized pricing will increase and continues to amass prospects at low-single-digit charges, because it did with the brand new Oregon charge case.

NW Pure additionally has its water utilities enterprise that may present a small quantity of development, however larger earnings will primarily come from buyer and pricing development whereas the corporate invests in its water enterprise for longer-term development.

The corporate’s dividend has been raised for 68 consecutive years, so the payout is of nice significance to shareholders. The dividend has grown very slowly lately as an absence of earnings development has capped the amount of money NW Pure can return to shareholders.

We’re forecasting dividend development going ahead to proceed that development. The payout ratio has gotten too excessive to permit for larger charges of development.

Aggressive Benefits

Its apparent aggressive benefit is in its monopoly in its service areas. This allowed it to carry out extraordinarily nicely throughout the Nice Recession as discretionary use of pure gasoline and water may be very low.

The corporate additionally carried out comparatively nicely throughout the coronavirus pandemic. NW Pure remained worthwhile in 2020 and 2021, experiencing solely a gentle EPS decline in 2020.

This regular profitability, even via financial downturns, exhibits the energy of NWN’s enterprise mannequin.

On the identical time, its regulatory nature prevents it from driving sturdy profitability development throughout financial booms. Total, whereas NW Pure shouldn’t be a high-growth inventory, it’s a constant dividend payer.

Dividend Evaluation

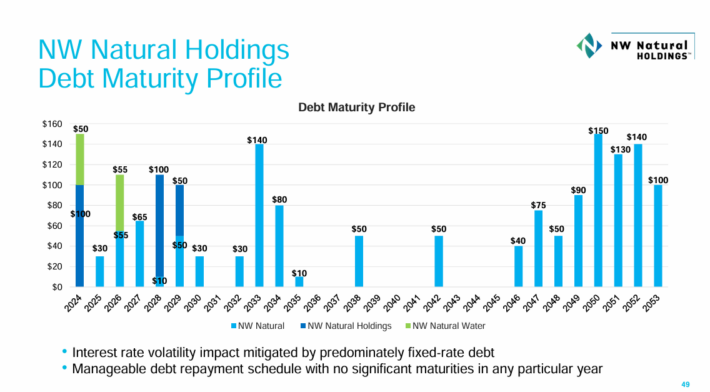

NW Pure’s high quality metrics have been very regular up to now decade. Roughly 76% p.c of its complete belongings are encumbered by debt, which is totally acceptable for a utility.

Its curiosity protection is pretty sturdy at 3.6x, so there are definitely no financing considerations shifting ahead.

Supply: Investor Presentation

NWN presently pays a quarterly dividend of $0.4875 per share. The annualized dividend charge of $1.95 per share represents a present yield of 4.9%.

NWN is predicted to generate earnings-per-share of $2.30 for 2024. Subsequently, the dividend payout ratio for this yr is projected to be 85%, which is on the excessive facet.

The dividend has grown very slowly lately as an absence of earnings development has capped the amount of money NW Pure can return to shareholders.

We’re forecasting dividend development going ahead to proceed that development. The payout ratio has gotten too excessive to permit for larger charges of development.

Last Ideas

Northwest Pure is a pure gasoline utility. Consequently, its regular enterprise mannequin generates sufficient income annually to pay a excessive dividend, and lift the payout annually.

NWN has elevated its dividend for 68 consecutive years, an extended time frame that has included a number of recessions. It has one of many longest dividend enhance streaks within the inventory market.

Whereas it isn’t a high-growth dividend inventory, NWN’s present payout is safe. And, the corporate ought to proceed to supply modest dividend will increase annually going ahead.

Total, NWN is a gorgeous dividend inventory for earnings buyers.

In case you are involved in discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Certain Dividend sources shall be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].