Revealed on March thirtieth, 2022, by Prakash Kolli

Excessive yield shares with dividend yields above 5% are interesting for earnings buyers. Nevertheless, not all excessive dividend shares are created equal. Some have safe dividend payouts. Nevertheless, others are in questionable monetary situation, leaving shareholders susceptible to a dividend lower in a downturn.

With this in thoughts, we created a full listing of excessive dividend shares.

You possibly can obtain your free full listing of all excessive dividend shares with 5%+ yields (together with essential monetary metrics equivalent to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Northwest Bancshares (NWBI) has been a excessive dividend yield inventory since early 2020, when the COVID-19 pandemic impacted the US financial system. The financial institution has struggled with risky income and earnings. Nevertheless, the financial institution continues to pay and enhance its dividends. The dividend yield is now over 5.5%.

Enterprise Overview

Northwest Bancshares is a 100+ years outdated financial institution based in Pennsylvania and headquartered in Columbus, Ohio. Right now, the financial institution has about 162 branches and eight drive-through areas in Ohio, Pennsylvania, Western New York, and Indiana. The financial institution’s focus is private and enterprise banking and wealth administration.

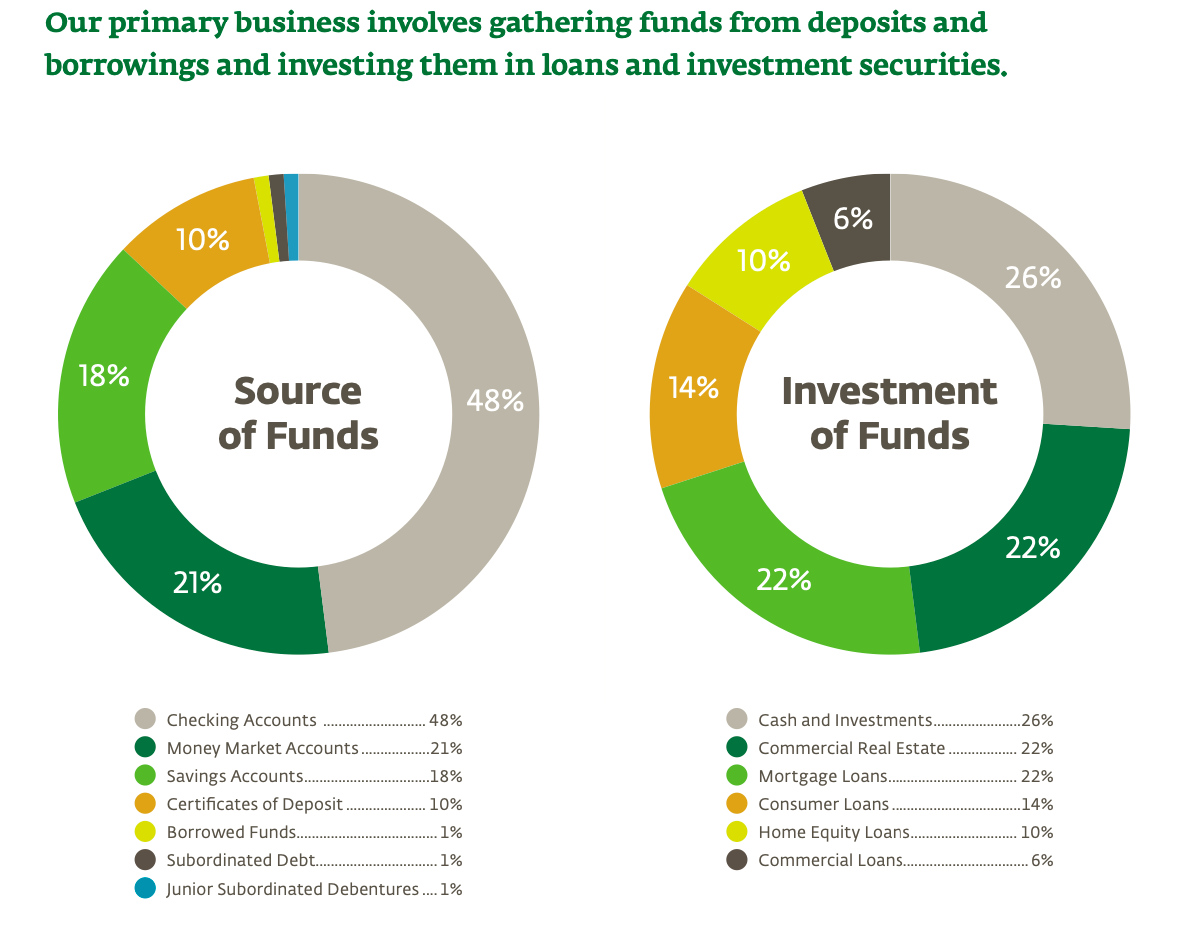

Northwest takes in deposits and loans out cash to customers and small-to-medium-sized companies like most group banks. Moreover loans, the financial institution invests deposits in money and money equivalents.

Therefore, the financial institution provides customers checking and financial savings accounts, mortgages, auto loans, private loans, and bank cards. For small companies, the financial institution provides enterprise checking and financial savings, bank cards, loans, payables and receivables, retirement plans, and many others. As well as, Northwest gives wealth administration, providing mutual funds, insurance coverage, and annuities.

Complete income (web curiosity earnings and non-interest earnings) was roughly $546 million in 2021 and the previous 12 months.

Supply: Investor Relations

Progress Prospects

A group financial institution like Northwest generates income in 3 ways: curiosity on loans, charges on providers, and wealth administration charges.

Group banks earn income from the online curiosity margin (NIM), which is the unfold between the rate of interest they provide on deposits and the rate of interest they cost on loans. This earnings is the online curiosity earnings. As an example, banks acquire deposits providing the bottom rate of interest doable. They provide checking and financial savings accounts, cash market deposit accounts (MMDAs), and certificates of deposit (CDs) to gather deposits. Then, banks mortgage this cash out at a better price on mortgages, auto loans, business loans, residence fairness loans, and many others.

Banks organically develop their web curiosity earnings by including clients and increasing into new territory by including branches. Banks can develop web curiosity earnings quickly in excessive inhabitants development areas, equivalent to Florida or Texas. Nevertheless, Northwest operates in an space with low and even declining inhabitants development limiting natural development. Therefore, Northwest has been lively within the M&A entrance. In 2019, the financial institution merged with Donegal increasing in Pennsylvania. Extra just lately, in 2020, Northwest merged with MutualFirst Monetary attaining $12.3 billion in belongings and increasing into Indiana. The financial institution will possible proceed to merge with smaller banks in its territory. This technique has been carried out by the present CEO, who took over in 2017.

Northwest can even develop by including customers and companies who make the most of extra fee-based providers, like ATMs. As well as, the financial institution can develop by including clients for wealth administration. The financial institution receives commissions or charges for insurance coverage merchandise, trusts, brokerage accounts, and the sale of mortgages on the secondary market.

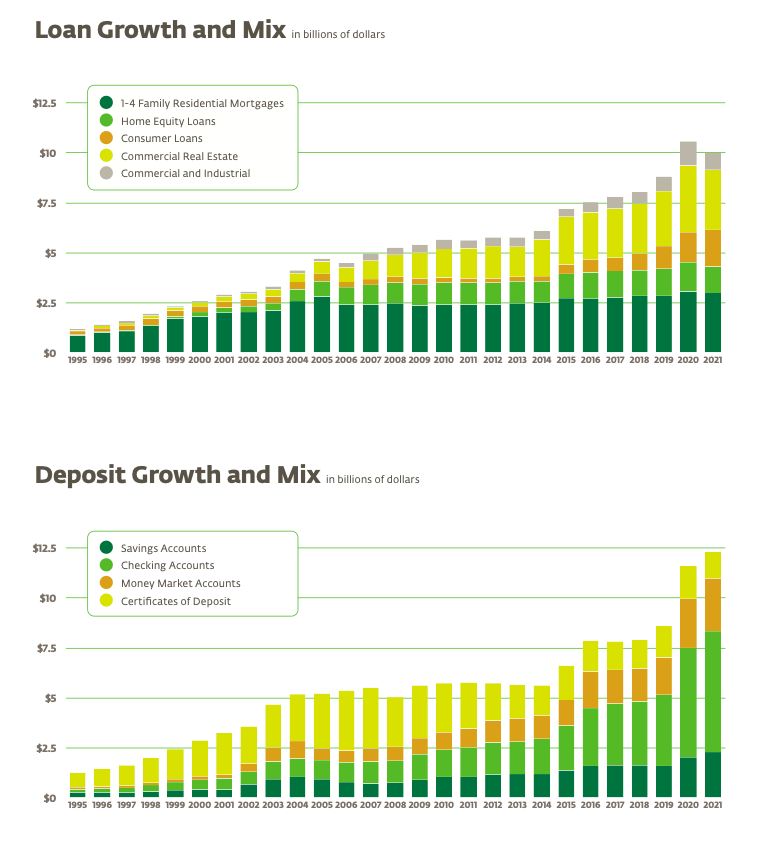

Since 1995, Northwest has efficiently grown its deposit base and loans. Furthermore, the latest acquisitions have resulted in a leap in each metrics.

Supply: Investor Relations

As well as, the rising rate of interest surroundings in 2022 ought to drive greater web curiosity earnings. This happens as a result of banks often enhance the rates of interest on loans sooner than the rate of interest on deposits in a rising rate of interest surroundings. Consequently, the NIM will increase, resulting in income development.

Aggressive Benefits

Northwest Bancshares’ aggressive benefit is its concentrate on group banking. Many customers and small-to-medium-sized companies favor banking at native banks because it retains cash locally and leads to a useful financial affect.

Subsequent, many bigger regional and nationwide banks are transferring extra features on-line and decreasing department depend. Northwest can be following this development, however a group financial institution can nonetheless construct a strong face-to-face relationship by way of higher service.

Dividend Evaluation

Northwest pays a superb dividend yield of roughly 5.6%. The ahead dividend price is $0.80 per share. The ahead dividend yield is larger than the 5-year common of 5.00%. It is usually greater than 3 times the common dividend yield of the S&P 500 Index.

The financial institution has delivered an growing dividend for 13 years, making the inventory a Dividend Contender. Northwest’s dividend development price has been about 6.27% previously decade and roughly 5.66% within the trailing 5-years. Nevertheless, the newest enhance was 5.3%, close to the long-term common however suggests the expansion price is slowing.

The corporate’s dividend is secure from the angle of earnings and free money circulation (FCF), however this security metric worth is regarding. The payout ratio is about 73% based mostly on the ahead dividend price and estimated 2022 earnings per share of $0.87. As well as, Northwest generated an FCF of roughly $188 million in 2021, and the dividend required solely $100.3 million. Subsequently, the dividend-to-FCF ratio is comparatively conservative at ~53%.

Northwest had $14,501.6 million in complete belongings, $9,914.1 million in complete loans, and $12,301.2 in complete deposits on the finish of 2021. The financial institution is nicely capitalized based mostly on US federal rules and Basel III regulatory capital ranges. The widespread fairness Tier 1 (CET 1) is 14.889%, greater than the requisite 7.000%. The Tier 1 risk-based capital ratio is 10.296%, greater than the regulatory requirement of 8.500%. The whole risk-based capital ratio is 15.738%, greater than the required 10.5%. Moreover, the present credit standing is BBB+, a decrease medium investment-grade credit standing by S&P International.

Last Ideas

Banks typically pay greater dividends, particularly when they’re well-capitalized. Many banks confronted web curiosity margin compression throughout COVID because the US Federal Reserve lowered rates of interest. However in March 2022, the Fed raised rates of interest and signaled additional will increase reversing the development.

Northwest is a group financial institution that ought to profit from rising rates of interest because it takes deposits at low-interest charges and loans or invests the cash at greater rates of interest. As well as, the excessive yield is great, however buyers ought to pay attention to the excessive payout ratio.

Northwest is a suitable inventory for buyers looking for a excessive dividend yield and earnings.

If you’re excited about discovering extra high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases will likely be helpful:

The main home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them usually:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].