Revealed on March seventeenth, 2022, by Quinn Mohammed

Excessive-yield shares pay out dividends which can be considerably greater than market common dividends. For instance, the S&P 500’s present yield is only one.4%.

Excessive-yield shares could be very useful to shore up earnings after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

Now we have created a spreadsheet of shares (and carefully associated REITs and MLPs, and so forth.) with dividend yields of 5% or extra…

You’ll be able to obtain your free full checklist of all securities with 5%+ yields (together with vital monetary metrics reminiscent of dividend yield and payout ratio) by clicking on the hyperlink under:

Subsequent on our checklist of high-yield shares to evaluation is New York Neighborhood Bancorp (NYCB).

NYCB final lower its dividend by 32% in 2016, and it has maintained its $0.68 annual dividend since. Whereas the corporate’s dividend historical past is lower than stellar, the payout ratio is moderating as earnings have grown.

The long-term decline of the share value has induced NYCB to sport a excessive dividend yield of 6.2% presently, which can curiosity earnings buyers.

Enterprise Overview

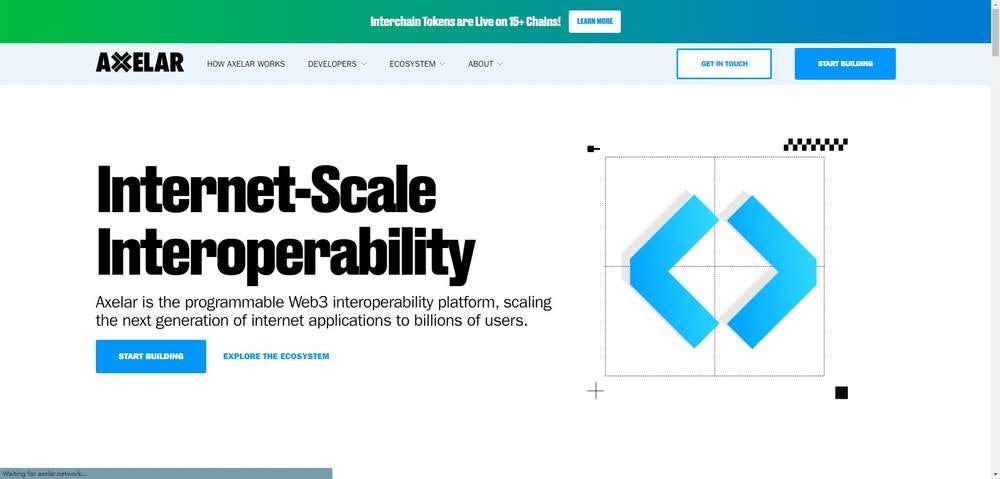

NYCB is a financial institution holding firm. The wholly owned subsidiary operates 236 branches in New York, New Jersey, Ohio, Florida, and Arizona. It operates two main entities, the New York Neighborhood Financial institution; a financial savings financial institution established in 1859, and the New York Business Financial institution, established in 2005.

NYCB operates a financial savings and loans enterprise mannequin. It has greater than $59 billion of whole belongings, $35.1 billion in deposits, and a $45.7 billion multi-family mortgage portfolio.

Supply: Investor Presentation

New York Neighborhood Bancorp reported This fall and FY 2021 outcomes on January twenty sixth, 2022. The financial institution achieved report quarterly mortgage progress within the closing quarter of the 12 months, in addition to deposit progress. Asset high quality additionally improved.

The corporate reported earnings-per-share of $0.31, up from $0.27 in the identical interval a 12 months in the past. Pre-provision web income was $203 million, up 7% year-over-year. After adjusting for merger-related bills, that quantity was up 11% year-over-year.

The financial institution originated $4.6 billion in new loans and leases, up 18% year-over-year, and 55% larger than the third quarter. Multifamily originations had been up 62% quarter-over-quarter, whereas specialty finance originations had been up 52% from Q3.

Internet curiosity margin was 2.44%, down three foundation factors year-over-year. Loans held for funding had been up $2.1 billion to $45.7 billion, up 19% from one 12 months in the past. Whole deposits had been up 5% to $35.1 billion.

Following wonderful 2021 outcomes, we estimate NYCB will generate $1.40 in earnings-per-share in 2022.

Development Prospects

New York Neighborhood Bancorp has chanced on progress from 2016 via 2020, after the company lower its dividend. Nonetheless, leads to 2021 had been nice, and we anticipate progress to proceed into 2022.

New York Neighborhood Bancorp will profit from growing charges, with a number of will increase at the moment anticipated in 2022. Rising charges typically widen the revenue margins of banks. And earnings from loans are likely to rise at a quicker tempo than curiosity paid on deposits.

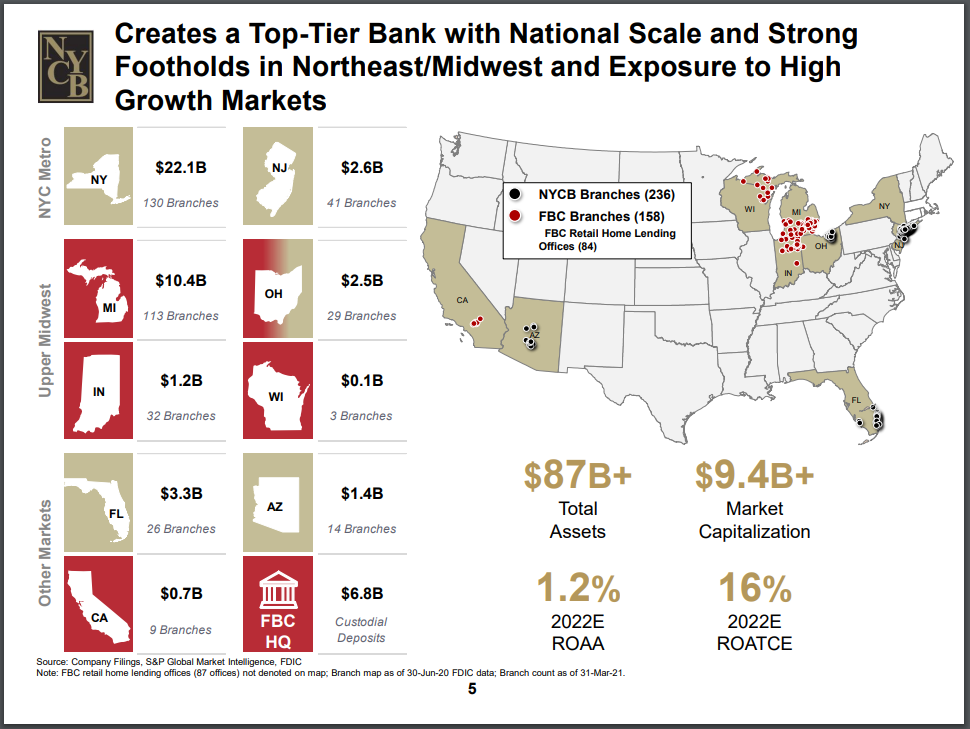

Additionally, the corporate will develop as its loans and deposits enhance. It has a prudent mortgage technique, which is to give attention to multi-family loans. Multi-family loans are notably enticing, and the corporate is aiming for progress particularly on this space.

Multi-family loans symbolize 76% of NYCB’s whole mortgage portfolio. Nonetheless, New York Metropolis handed stricter rules, making it more difficult for landlords to boost rents on rent-controlled models, which might negatively have an effect on the financial institution’s prospects, and by extension, their capacity to service their loans.

Supply: Investor Presentation

The vast majority of multi-family models in New York have lease management options. Of NYCB’s multi-family loans in New York Metropolis, greater than 50% are collateralized by buildings with rent-regulated models.

Lease-regulated models usually have below-market rents. Based on NYCB, these buildings usually tend to retain their tenants in downward credit score cycles. Thus, they could be a dependable supply of earnings throughout gentle recessions.

This helps clarify NYCB’s extraordinarily low losses on multi-family loans.

Moreover, multi-family loans are cheaper to provide and repair than different kinds of loans, which permits for NYCB to generate excessive ranges of effectivity.

NYCB’s effectivity ratio improved to 38.4% for 2021, in comparison with 44.0% in 2020. Moreover, the corporate’s effectivity ratio is much superior to that of its peer group, at over 50.0%.

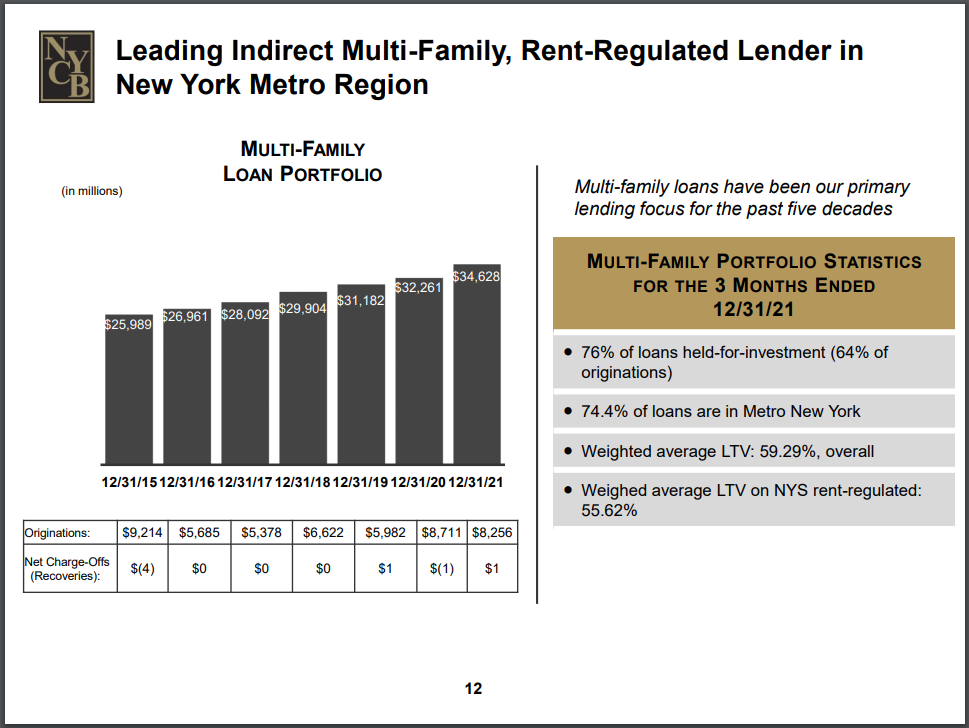

Aggressive Benefits & Recession Efficiency

NYCB’s high-quality belongings persistently outperformed its banking friends throughout varied trade downturns, together with the Nice Recession and the COVID-19 pandemic. In 2021, non-performing belongings had been solely 0.07% of whole belongings.

Supply: Investor Presentation

New York Neighborhood Bancorp’s earnings-per-share all through the Nice Recession of 2007-2010 are listed under:

- 2007 earnings-per-share: $0.90

- 2008 earnings-per-share: $0.83

- 2009 earnings-per-share: $1.13

- 2010 earnings-per-share: $1.24

The corporate remained worthwhile via your entire stretch. Earnings dropped in 2008, however NYCB recovered and surpassed their 2007 outcomes instantly after. Its earnings reached a brand new excessive by 2010.

This sturdy and environment friendly efficiency allowed NYCB to take care of its dividend through the recession, at $1.00 per share. On the identical time, many U.S. banks had been reducing their dividends and posting huge losses.

Despite the fact that the dividend held up through the nice recession, it was nonetheless slashed later in 2016.

Dividend Evaluation

The company’s present annual dividend stays $0.68 per share. Shares of NYCB at the moment commerce at $10.97, thus yielding 6.2%. It is a excessive yield for NYCB, even when accounting for its trailing ten-year common of 6.0%.

With 2022 earnings-per-share expectations of $1.40, and the annual dividend of $0.68, the corporate is anticipated to pay out 49% of EPS in dividends. This payout ratio is kind of protected and sustainable for NYCB. The truth is, the payout ratio at present is more healthy than it has been within the final decade.

With additional earnings progress, the payout ratio ought to average even additional. We aren’t anticipating the corporate to extend the dividend within the near-term, as they seem like investing in progress.

Nonetheless, buyers might not view NYCB’s dividend favorably, given it doesn’t have a wonderful historical past. The corporate went via a dividend lower in 2016. On the time, NYCB tried to accumulate Astoria Monetary, the same New York-based firm.

NY Neighborhood Bancorp lower the dividend in anticipation of this acquisition, which was going to extend compliance and regulation prices. Ultimately, nonetheless, the merger settlement was terminated as a consequence of a low expectation for regulatory approval.

Last Ideas

New York Neighborhood Bancorp has a excessive dividend yield of 6.2%, even compared to its historic common. The corporate doesn’t have a historical past of dividend will increase, and final lower its dividend by 32% in 2016.

As we speak its dividend is effectively coated by earnings. Moreover, the company ought to profit from rising rates of interest in 2022. This earnings progress will additional average the payout ratio within the subsequent few years.

It’s attainable, although not anticipated, that NYCB will increase the dividend sooner or later. At present, they seem like extra targeted on earnings progress and acquisitions.

NYCB’s 6.2% yield appears to be safe, and the inventory may very well be a strong financial institution choose for earnings buyers.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].