Published on January 11th, 2023 by Jonathan Weber

LyondellBasell Industries (LYB) is a U.S.-based chemicals and refining company that offers a high dividend yield of more than 5% at current prices. Following recent gains, its valuation isn’t ultra-low any longer, but LyondellBasell still is pretty inexpensive.

It is one of the high-yield stocks in our database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze the prospects of LyondellBasell.

Business Overview

LyondellBasell Industries was incorporated in 2009 in its current form (following a previous bankruptcy) and is headquartered in Houston, Texas. The company is a chemicals and refining player that has organized its operations into six different business units: Olefins and Polyolefins—Americas; Olefins and Polyolefins—Europe, Asia, International; Intermediates and Derivatives; Advanced Polymer Solutions; Refining; and Technology.

LyondellBasell is active in a range of countries, including the United States, where it has expanded its asset base in recent years, Mexico, Germany, Italy, France, Japan, China, and several more. This geographic diversification helps protect LyondellBasell versus country- or area-specific issues such as Europe’s current energy crisis. While operations in countries such as Germany or France suffer from that, U.S.-based operations benefit from advantaged energy prices.

LyondellBasell has exhibited attractive business growth in recent years. Earnings-per-share have risen by 190% over the last decade, using the $14.60 analyst consensus estimate for fiscal 2022 (Q4 results have not been reported yet). There were ups and downs in LyondellBasell’s earnings-per-share, however. The company is thus not an overly steady grower, instead, its results can be cyclical, depending on factors such as crack spreads and demand for certain chemical products.

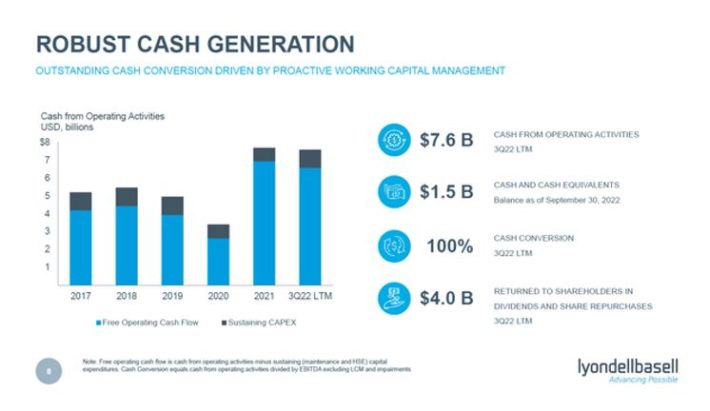

Source: LyondellBasell Presentation

During the most recent quarter, Q3 2022, LyondellBasell generated solid, but not spectacular results. Revenue was down by 3% year over year on soft demand for some of the products it manufactures, e.g. due to lockdowns in China. EBITDA and cash flow remained healthy, however, and LyondellBasell generated sufficient free cash flow to pay for dividends, buybacks, and net debt reduction at the same time.

Source: LyondellBasell Presentation

Distributable cash flow, or operating cash flow minus sustaining/maintenance capital expenditures, totaled around $6.5 billion, which makes for a hefty cash flow yield of more than 20% at current prices. It is expected that cash flows and profits will pull back this year due to an economic slowdown in the U.S. and some other countries, but that should be a temporary pullback only, as demand for LyondellBasell’s products should increase again once economic growth picks up.

Growth Prospects

LyondellBasell isn’t in the fastest-growing industry, but the company experiences solid growth, adjusting for ups and downs in the economic cycle.

Growth drivers, in the long run, include organic investments, such as the spending the company has pursued in its U.S. and China business units, as it seeks to expand where energy is cheap. Acquisitions also are a growth driver for LyondellBasell. The company acquired A. Schulman a couple of years ago in a deal worth $2.3 billion.

LyondellBasell also has been paying down debt in recent quarters, which results in declining interest expenses, all else equal. Last but not least, LyondellBasell has been an avid buyer of its own shares: Between 2012 and 2021, its share count declined from 570 million to 330 million, which resulted in a strong earnings-per-share growth tailwind. It is likely that LyondellBasell will continue to lower its share count over time.

2022, and especially 2021, were two strong years for the company thanks to the advantageous pricing environment for many of its products. It is expected that 2023’s earnings-per-share will decline to around $9.80. From that lower level, we believe that earnings-per-share will rise at a mid-single-digit rate to around $11.50 in 2027.

Competitive Advantages

The chemicals industry has high barriers to entry. Building out new chemical plants via greenfield projects is costly, and there are complicated and lengthy approval processes for that, at least in many of the markets LyondellBasell is active in, such as Europe and the U.S.

This means that few new plants are coming online in these markets. In the refining space, this is even more pronounced — no new refineries have been built in the United States for decades. Existing assets thus are valuable and hard to replace.

On top of that, LyondellBasell benefits from size and scale advantages. It is the largest polypropylene compound producer in the world, for example. Its large intellectual property portfolio also makes it an important polyolefin technologies licensor, allowing it to generate cash when peers produce certain products.

Dividend Analysis

LyondellBasell started to make dividend payments shortly after it emerged from bankruptcy a little more than a decade ago. Over that time frame, the company has increased its dividend regularly, including every year of the last decade.

In those ten years, the dividend went up from $1.45 per share to $4.76 per share, which pencils out to an annualized dividend growth rate of 13%, which is quite attractive. Dividend growth has been lower in the last couple of years, however. Especially in 2020, when there were major uncertainties due to the pandemic, LyondellBasell’s decision to hike the dividend only slightly in order to remain defensive made sense, which is why there was just a 1% dividend increase in that year.

With earnings-per-share being forecasted at $9.80 in 2023, the dividend payout ratio stands at 49% today. 2023 will likely be much closer to a bottom than a top profit-wise, and yet the dividend will should be easily covered. This makes us believe that there is little risk of a dividend cut when investing in LyondellBasell, although a dividend cut can’t be ruled out.

With LyondellBasell trading for $93 today, the dividend of $4.76 per share makes for a dividend yield of 5.1%, which is quite attractive. In combination with ongoing dividend growth, although larger in some years and smaller in others, and a reasonable dividend payout ratio, LyondellBasell looks like a solid high-yield income stock at current prices.

Final Thoughts

LyondellBasell’s shares have pulled back from the highs seen last summer, as they are currently trading around 20% below the 52-week high. This has made its dividend yield rise to a compelling level of more than 5%, although it should be said that LyondellBasell was even more attractive during the peak of the market selloff that we saw towards the end of 2022.

LyondellBasell is valued at around 9 to 10x this year’s expected profits right now. 2023 will be a down year, but we believe that there is a good chance that earnings-per-share will start to improve in 2024, as the economic picture should clear up again. Based on the fact that LyondellBasell trades at less than 10x this year’s earnings, despite 2023 likely being a trough year, LyondellBasell looks relatively attractively priced right here.

Due to the cyclical nature of the chemicals industry and the refining business, LyondellBasell is not an ultra-low-risk choice. But the dividend looks like it is well-covered for the foreseeable future, and the combination of a high starting yield and some growth potential is not unattractive.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].