Revealed on March 21th, 2022, by Felix Martinez

Excessive-yield shares pay out dividends which might be considerably in extra of market common dividends. For instance, the S&P 500’s present yield is just one.4%.

Excessive-yield shares will be very useful to shore up revenue after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

We’ve got created a spreadsheet of shares (and carefully associated REITs and MLPs, and many others.) with dividend yields of 5% or extra…

You may obtain your free full record of all securities with 5%+ yields (together with vital monetary metrics corresponding to dividend yield and payout ratio) by clicking on the hyperlink under:

For the subsequent high-yield shares on this sequence, we are going to overview a multinational know-how firm Lumen Applied sciences, Inc. (LUMN), which presently has a dividend yield of 9.3%.

Enterprise Overview

Lumen Applied sciences traces its roots to 1930 when the Oak Ridge Phone Firm was bought by the Williams household. They’d finally broaden exponentially into what has turn out to be Lumen, which serves clients in over 60 totally different international locations as we speak. It has an $11.4 billion market capitalization and produced $19.7 billion in income in 2021. The title Lumen was led to in September 2020 to rebrand and reposition the corporate as a crucial companion in main enterprises by means of the 4th Industrial Revolution – or the good know-how revolution.

The corporate integrates community belongings, cloud connectivity, safety options, voice, and collaboration instruments into one platform that allows companies to leverage their knowledge and undertake next-generation applied sciences. Lumen brings collectively the expertise, expertise, infrastructure, and capabilities of CenturyLink, Degree 3, and 25+ different know-how corporations to create Lumen Applied sciences, Inc. The corporate is designed particularly to deal with the dynamic knowledge and software wants of the 4th Industrial Revolution.

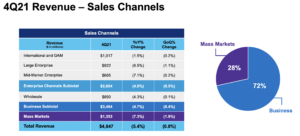

The corporate reported fourth-quarter and full-year outcomes for Fiscal Yr (FY)2021 on February ninth, 2022. The corporate reported whole gross sales for the quarter of $4,847 million in comparison with whole gross sales of $5,125 million, which is a lower of 5.4% year-over-year. Internet revenue was significantly better than 4Q2021. For the quarter, internet revenue was $508 million, in comparison with a reported internet lack of $2.289 billion for the fourth quarter of 2020. General for the quarter, the corporate had adjusted earnings per share (EPS) of $0.51 was a 21.4% improve over $0.42 earned in the identical prior-year interval.

Supply: Investor Presentation

For the complete 12 months, the overall income was $19,687 million. This was decrease than the $20,712 million the corporate reported in FY2020, a lower of 4.9%. Nevertheless, the corporate did make a revenue final 12 months in comparison with a internet loss for 2020. Internet revenue for the 12 months was $2,033 million versus a internet lack of $1,232 million in FY2020. For the 12 months, EPS reported $1.91 per share for 2021, in comparison with $1.51 per share for the complete 12 months 2020. This represented a rise of 26.5% year-over-year progress.

Development Prospects

The largest progress driver for Lumen would come from acquisitions and mergers. For instance, in 2017, the corporate accomplished a merger with Degree 3 Communications. Due to this merger, the corporate now derives about 75% of its income from enterprise clients, with the rest from residential customers. The corporate additionally has two divestitures pending, which can assist with margins. Thus, these two divestitures will in the end develop earnings.

One other progress driver, for the corporate, can be the Quantum Filber rollout. If the corporate can full the Quantum fiber rollout, it generate about 20% of Lumen’s whole income, maybe in 5 years.

Supply: Investor Presentation

Aggressive Benefits & Recession Efficiency

We predict its greatest benefit is that, in contrast to a few of its rivals, it could possibly present companies with a number of providers on a worldwide scale, and its in depth fiber community limits the variety of rivals who might try to duplicate all its providers.

The bottom of Lumen’s enterprise is its in depth long-haul fiber community. With over 450,000 route miles in its terrestrial and subsea transcontinental community, it is without doubt one of the worldwide leaders in serving the information transportation wants of enterprises. The corporate is without doubt one of the few Tier 1 networks worldwide, Lumen is a key contributor in making up the spine of the Web, which is important for the Web to operate. Enterprises corporations use Lumen’s providers to move knowledge, each for inside functions and to succeed in the general public.

As for recession efficiency, the corporate did very nicely through the 2008-2009 Nice Recession.

LUMN’s earnings-per-share all through the Nice Recession:

- 2007 earnings-per-share of $3.16

- 2008 earnings-per-share of $3.37 (7% improve)

- 2009 earnings-per-share of $3.60 (7% improve)

- 2010 earnings-per-share of $3.39 (6% lower)

As you see, the corporate did very nicely through the 2008-2009 Nice recession. Nevertheless, through the COVID-19 pandemic, the corporate elevated earnings from $1.32 per share in 2019 to $1.67 per share in 2020, however the firm minimize its dividend from $2.16 per share for 2019 to $1.00 per share in 2020. This leads us to consider that the corporate will minimize its dividend in one other recession.

Dividend Evaluation

The corporate has a really excessive present dividend yield of 9.3%. Nevertheless, the dividend seems to be unsafe. For instance, in 2013, the corporate minimize its dividend from $2.90 per share for 2012 to $2.16 per share in 2013. This can be a dividend minimize of 25.5%. This minimize was as a consequence of an earnings lower from 2010 to 2013. Since 2010, earnings have been reducing placing much more dangers to the corporate dividend.

As talked about above, earnings grew through the COVID-19 pandemic, however the dividend payout ratio was very excessive. This prompted the corporate to chop its dividend. Analytics expects earnings to proceed to say no within the foreseeable future. This may make the present dividend in danger as earnings decline.

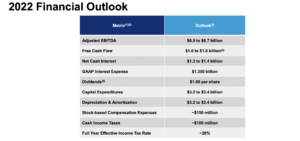

The corporate pays a $0.25 per share quarterly dividend for a complete of $1.00 per share per 12 months. Analytics expects earnings to be $1.35 per share in 2022, $1.01 per share in 2023, and $0.91 per share in 2024. As you may see, this may put heavy stress on the dividend payout.

Supply: Investor Presentation

As well as, the corporate has a poor stability sheet, with an curiosity protection ratio of two.8, a debt-to-equity ratio of two.5. That is at regarding ranges. Additionally, the corporate has an S&P credit standing of BB, which isn’t an funding grade.

In consequence, we view the dividend of Lumen as unsafe for the foreseeable future. Thus, traders shouldn’t anticipate a lot larger dividend progress and solely settle for the present excessive yield.

Ultimate Ideas

Lumen Applied sciences’ excessive dividend yield of 9.3% is unsafe. Earnings are on a downtrend, thus placing extra stress on the dividend payout. This, along with the frequent dividend cuts in its current previous, leads us to price the dividend at a excessive threat of being minimize in a recession or trade downturn. Thus, the corporate is a purchase for aggressive traders, however we warning conservative dividend progress traders that it stays a high-risk, high-reward state of affairs, notably contemplating the current dividend minimize and declining income.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].