Published on January 6th, 2023 by Josh Arnold

Certain industries tend to produce good dividend-paying stocks more than others. For instance, technology is a tougher place from which to produce a great dividend stock given the ever-changing landscape, and the constant investment that requires to stay competitive. Other sectors, like financials, tend to produce more cash than they can profitably reinvest in the business, and, therefore, those companies tend to return that cash to shareholders instead. That means that historically, banks, insurance companies, and the like have generally been reliable in returning cash to shareholders.

One such financial is Lincoln National Corporation (LNC), an insurance company that has raised its dividend for 11 consecutive years. Not only that, but the recent decline in the share price means Lincoln now has a 5.8% dividend yield, which is well over triple the S&P 500’s yield. In fact, that 5.8% yield is good enough for Lincoln to claim a spot on our list of high-yield stocks.

This list contains about 200 stocks with yields of at least 5%, meaning that, like Lincoln, they all yield at least three times that of the S&P 500.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we’ll take a look at Lincoln’s prospects as a potential investment today.

Business Overview

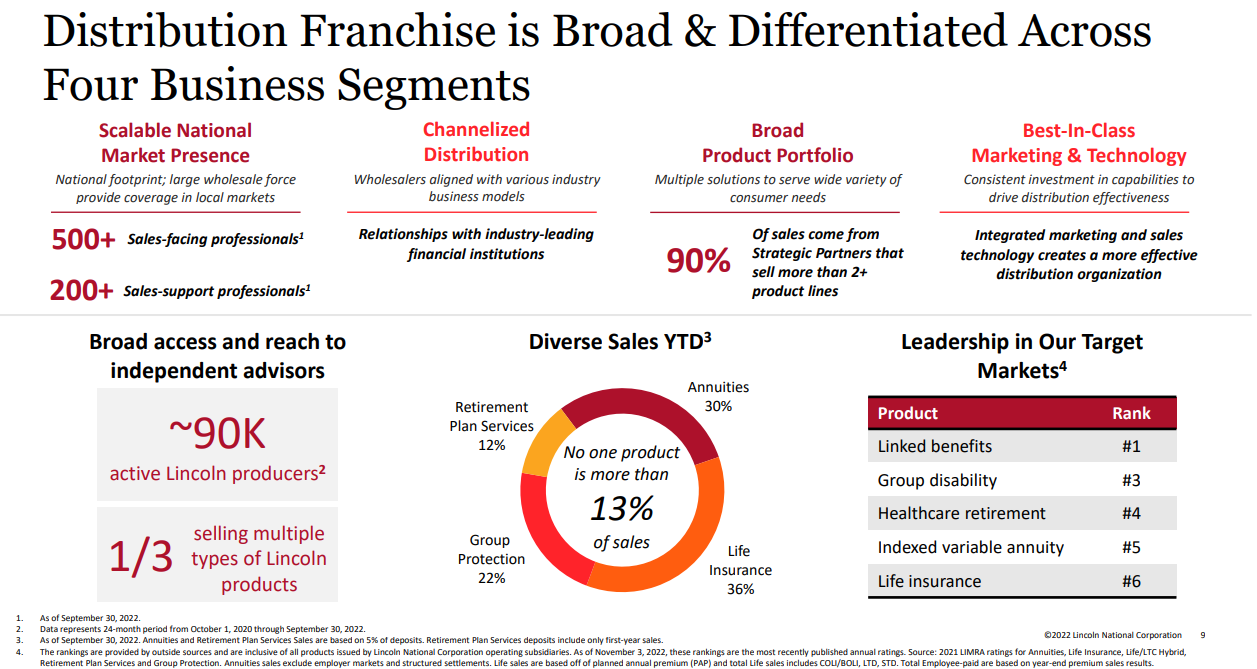

Lincoln is a diversified insurance and retirement business that operates in the US. The company has four segments: Annuities, Retirement Plan Services, Life Insurance, and Group Protection. Through these segments, the company offers various annuity products, defined contribution retirement plan products and services, trust and custodial services, various life insurance products, disability and medical leave insurance, and more. Lincoln distributes its products through a vast network of consultants, brokers, planners, agents, financial advisors, and other intermediaries.

Lincoln was founded in 1905, produces about $18.5 billion in annual revenue, and trades with a market cap of $5.3 billion.

Source: Investor presentation, page 9

Lincoln reported third quarter earnings on November 2nd, 2022, and results were very weak, causing a massive 30%+ decline in the share price following the report.

The big news in the report was a charge the company recorded of $2.2 billion that resulted from a review of policyholder lapsation assumptions. The charge was unexpected and therefore, the reaction from investors was sharply negative. The charge also called into question the company’s capital base given the size of the charge, although management did reassure investors the company would be able to replenish its capital back to the targeted level.

Revenue of $4.8 billion was also off 8.4% from the year-ago period, but, as a silver lining, did beat expectations by about $400 million. Still, the weakness was palpable for Lincoln in Q3. Annuities net flows were $319 million in Q3, down more than half from the $841 million a year ago. Retirement plan services total deposits were up 16% to $2.8 billion. Life insurance sales were up 3% to $171 million. Group protection premiums were $1.2 billion, up 8% year-over-year.

However, the charge the company took saw adjusted earnings-per-share plummet to -$10.23, which missed estimates of a profit of nearly $2 per share. Following the Q3 report, we now see a loss of $4.50 per share, although we estimate normalized earnings power at $4.50 per share going forward.

Growth Prospects

Like most insurance companies, Lincoln has a difficult time maintaining earnings growth for more than a couple of years at a time. Insurance companies tend to see profits ebb and flow based on claims, and Lincoln is no different.

Lincoln is different in that it is a diversified financial services company, so it has other revenue streams. However, it hasn’t been enough for the company to be able to sustain earnings growth over time. In fact, earnings peaked in 2018 at $8.48 per share, and we believe it may be many years before that number is reached again, if ever.

We see 3% growth from the estimated $4.50 per share in earnings power going forward, which we believe can be driven by a handful of factors.

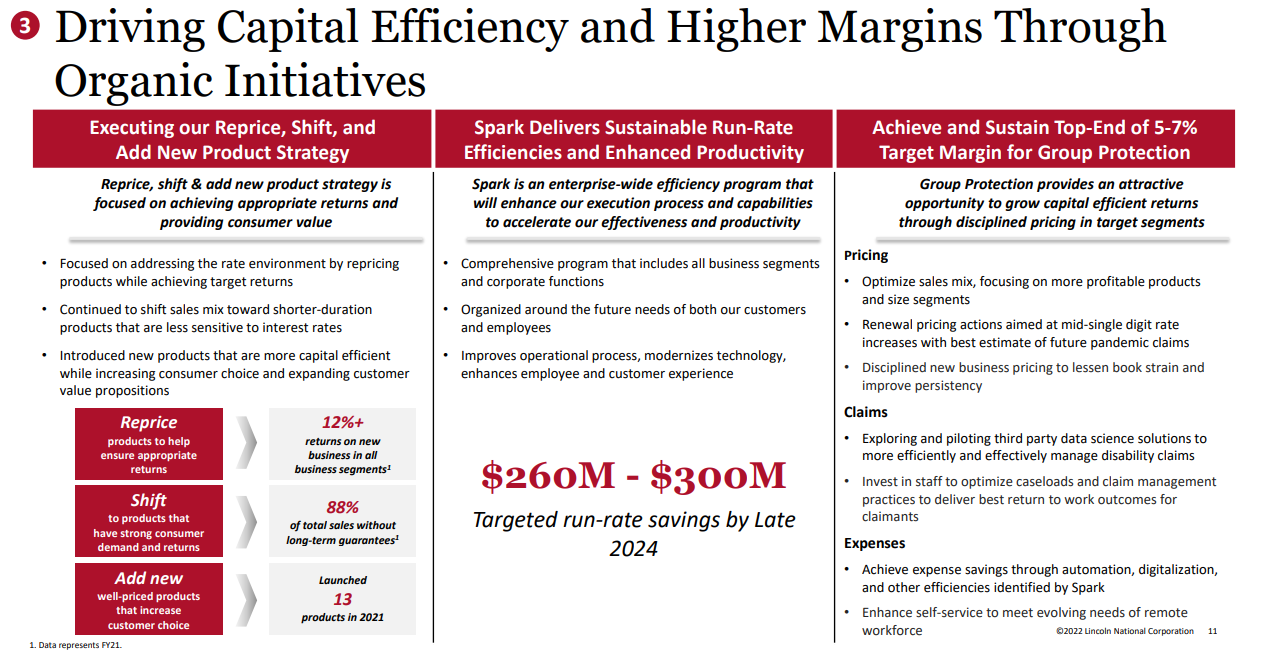

Source: Investor presentation, page 11

Lincoln’s stated strategy includes its Reprice, Shift, and Add New Product strategy that is focused on ensuring the company offers the right products to the right customers at the right price. It’s a portfolio review of sorts and should help drive additional revenue, with higher margins as well. In addition to that, the company is looking at saving roughly $300 million annually with cost savings that should help offset some of the declines in revenue it has faced. And finally, it is focusing on increasing the profitability of the Group Protection segment, which should help grow margins as well.

Lincoln also buys back stock at times, but we note those will be more challenging for the foreseeable future given it now needs to replenish its capital base following the Q3 charge. In all, we see 3% growth for Lincoln moving forward as we put all of these factors together.

Competitive Advantages

Lincoln, like other insurance companies, doesn’t possess much of a competitive advantage. Insurance products are highly commoditized, so it is difficult for entrants to create and sustain any sort of advantage, given customers are generally shopping on price.

We don’t see that changing in the years ahead, as Lincoln fights for market share while trying to maintain its pricing and margin structure. Lincoln has built out certain automation and technology platforms to make it easier for customers to buy and use their coverages, but we don’t believe this is strong enough for a true competitive advantage in what is a highly contested industry.

Dividend Analysis

Lincoln has paid dividends to shareholders for more than 30 years consecutively, but the dividend was cut to almost nothing in the wake of the financial crisis. In the decade-plus since then, the company has raised its dividend each year and recently eclipsed the pre-crisis level of 42 cents per share quarterly; the current payout is 45 cents per share quarterly, or $1.80 per share annually.

The company’s earnings are going to be negative this year, but we do expect a rebound into 2023. We note the capital base charge of Q3 is putting the company’s ability to raise the dividend in jeopardy, although we do not believe a cut is necessary just yet. The risk has risen, however, following Q3 results.

Our base case is the company’s earnings rebound and it continues raising the dividend, but we note the risks have risen because of the Q3 charge, but also the prospect of a recession in 2023.

Final Thoughts

Lincoln has a nice double-digit streak of dividend increases, but the company’s performance in 2022 simply wasn’t good enough. Earnings for the full-year will be negative once the company reports fourth quarter earnings, and its capital base took a big hit.

We think the company can probably continue to raise its dividend in the years to come, and it sports a nearly-6% yield. The stock is fairly priced, in our view, so we see it as modestly attractive despite the big yield.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].